Need help with these questions. Thank you!

Need help with these questions. Thank you!

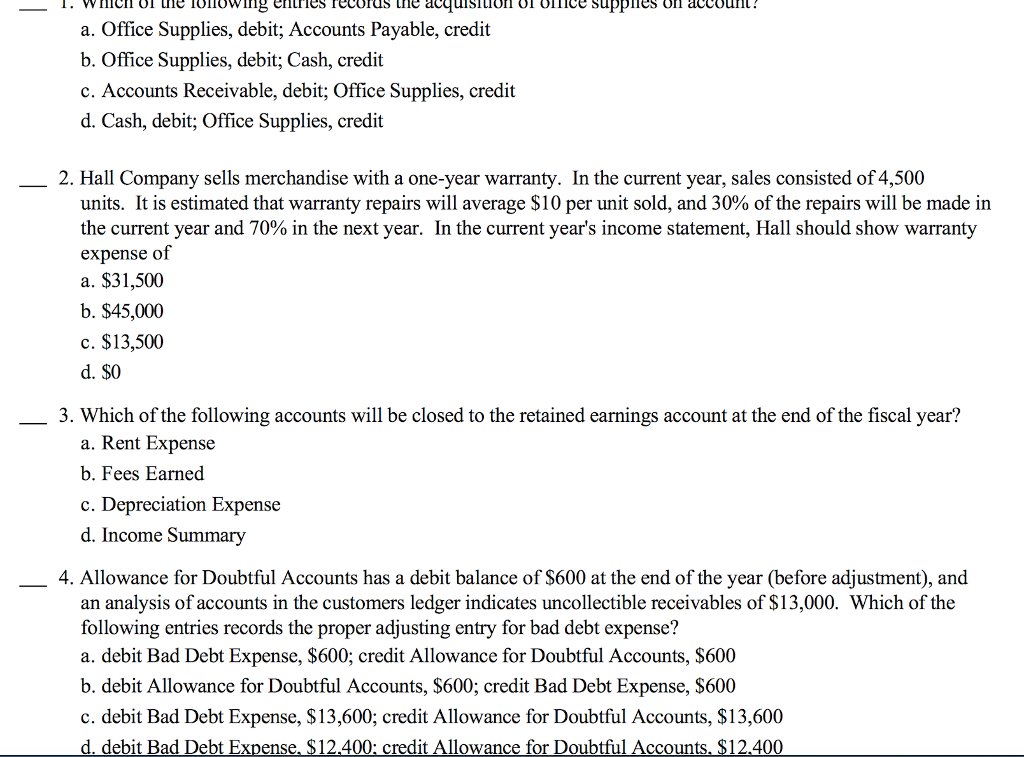

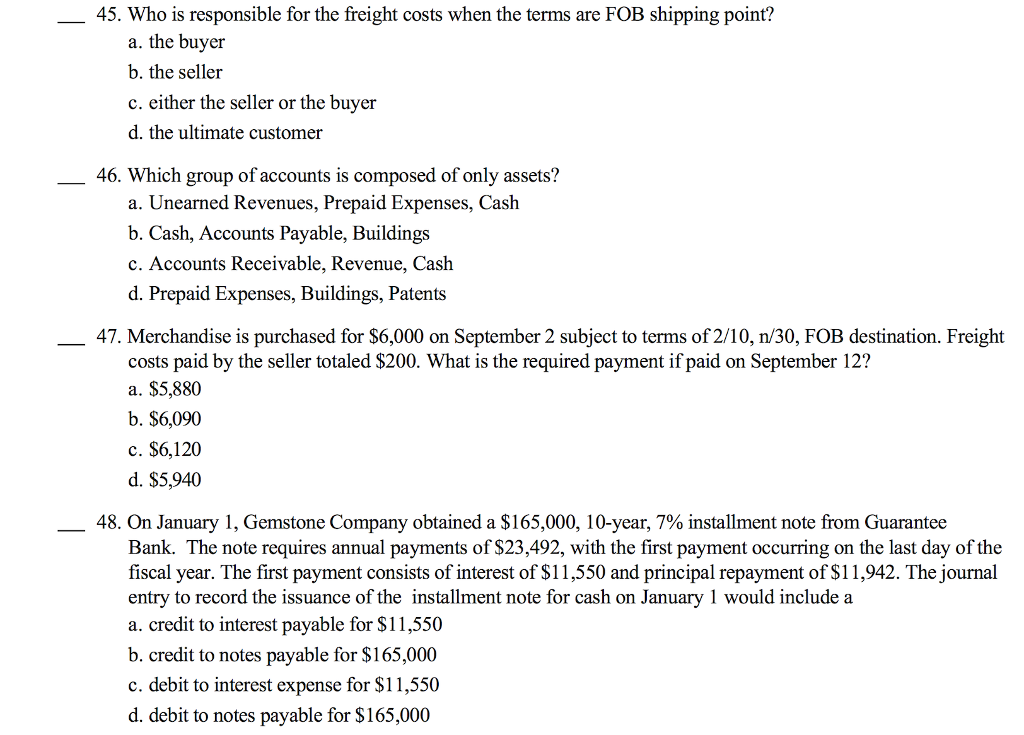

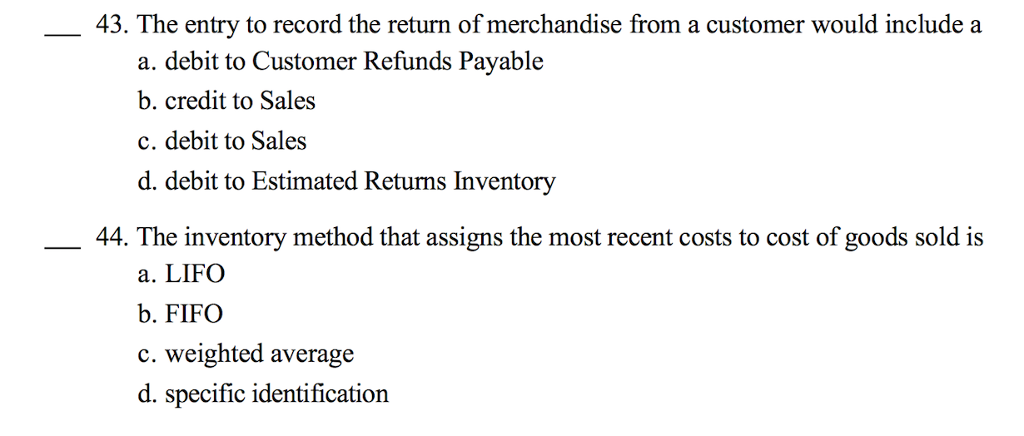

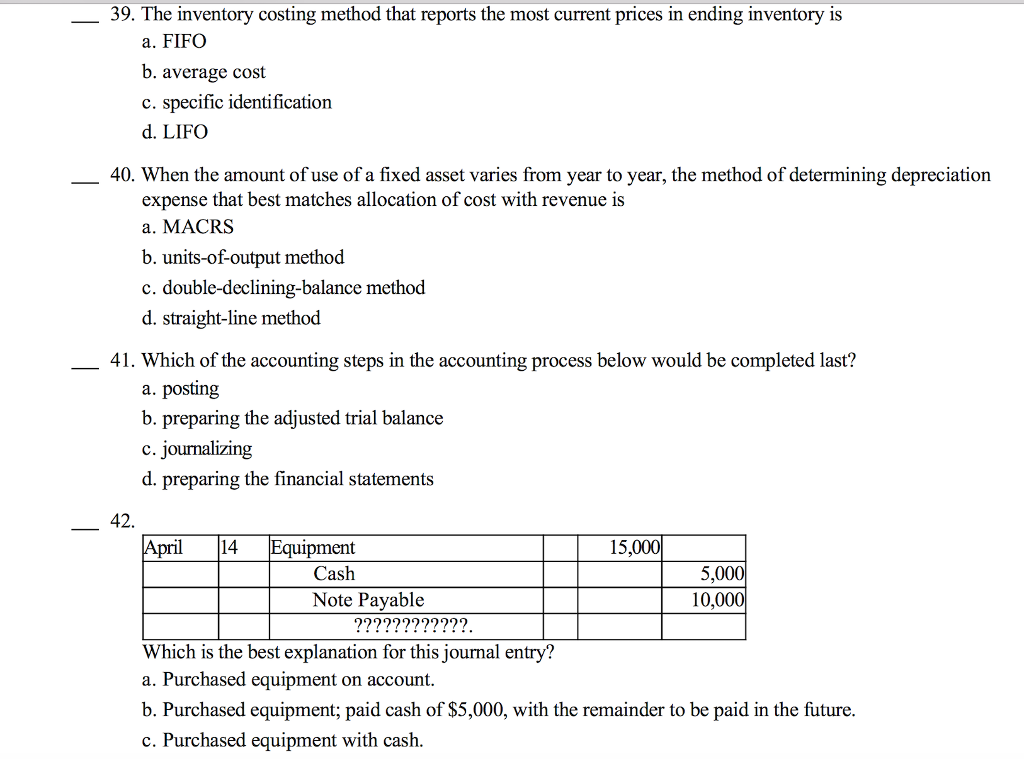

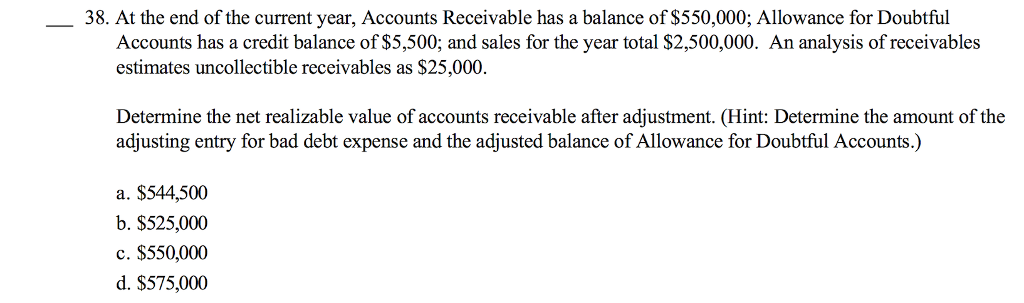

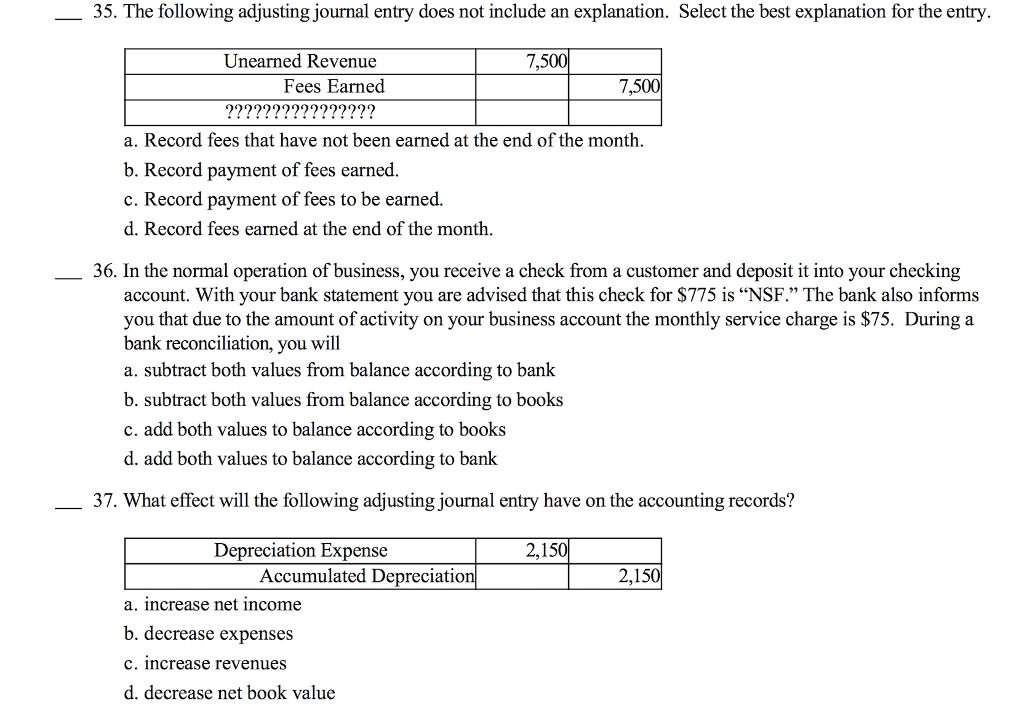

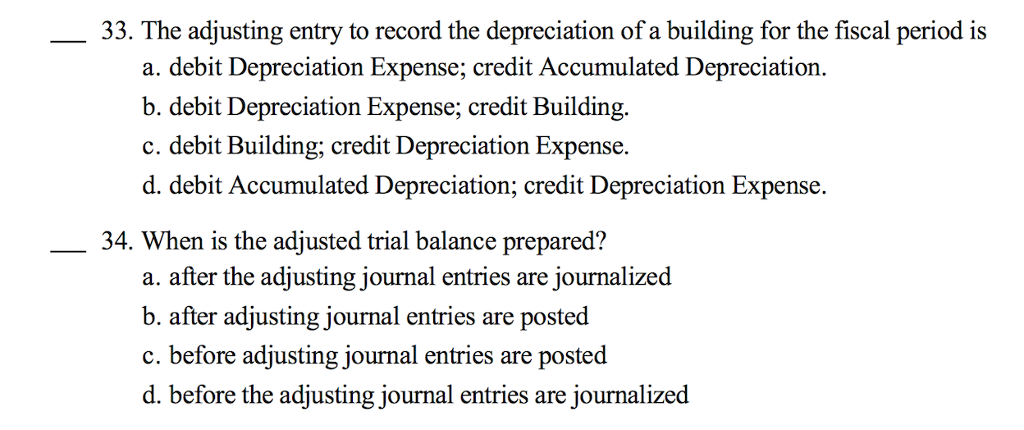

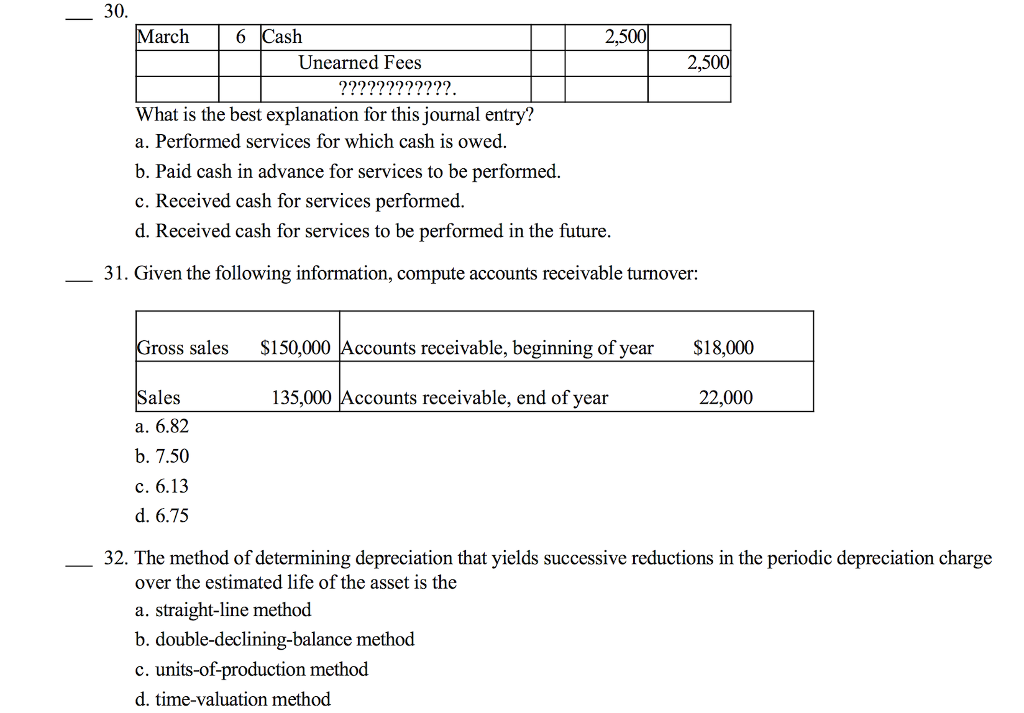

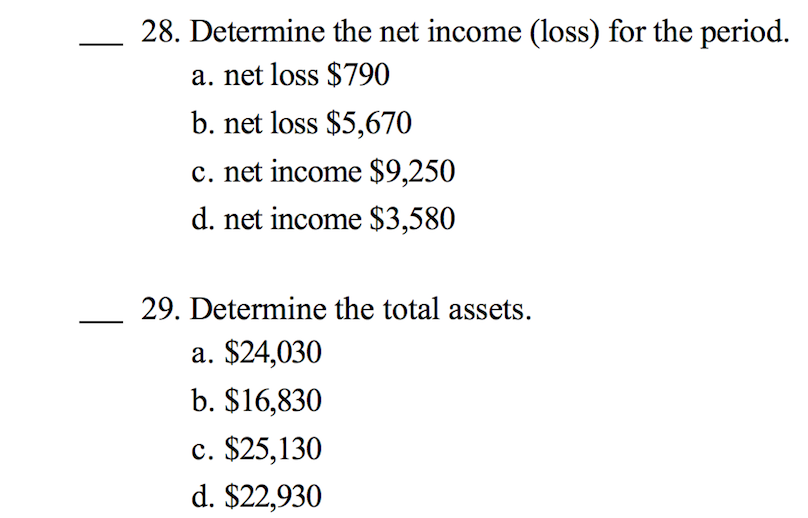

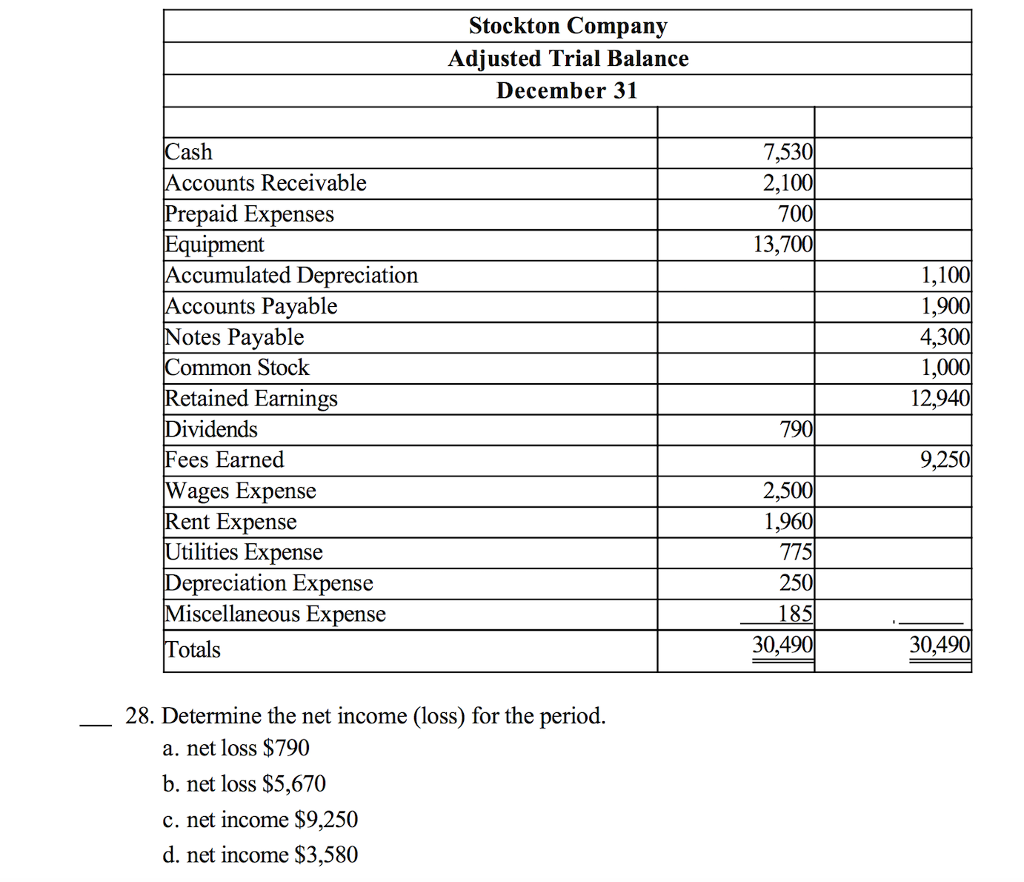

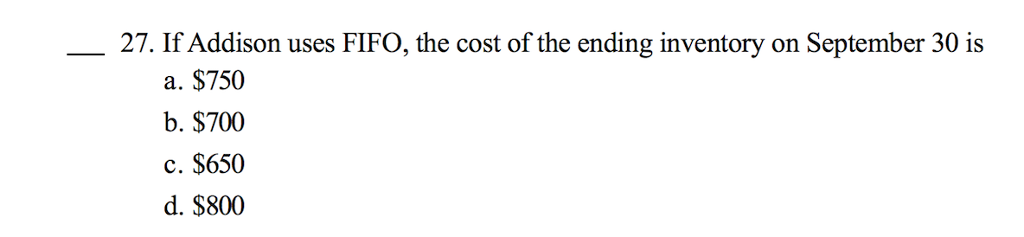

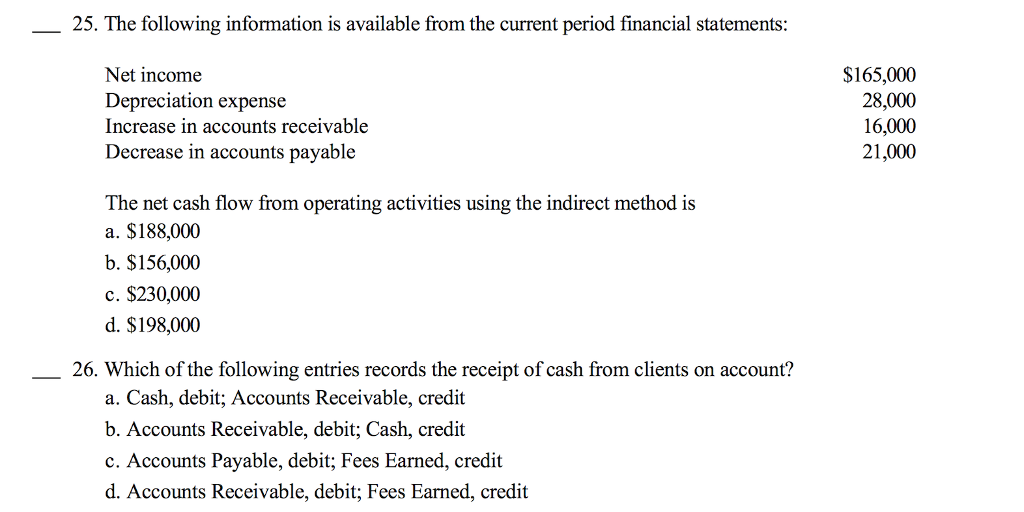

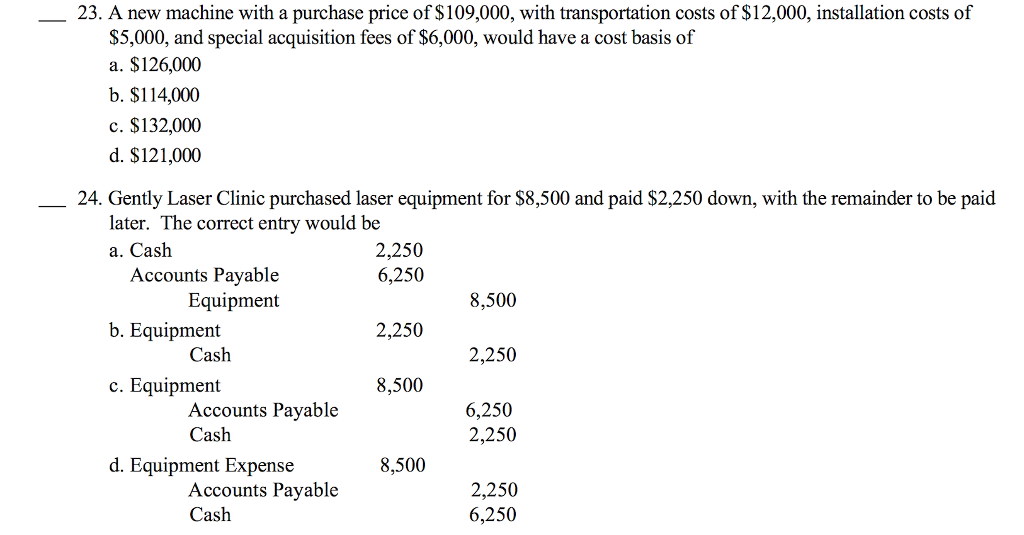

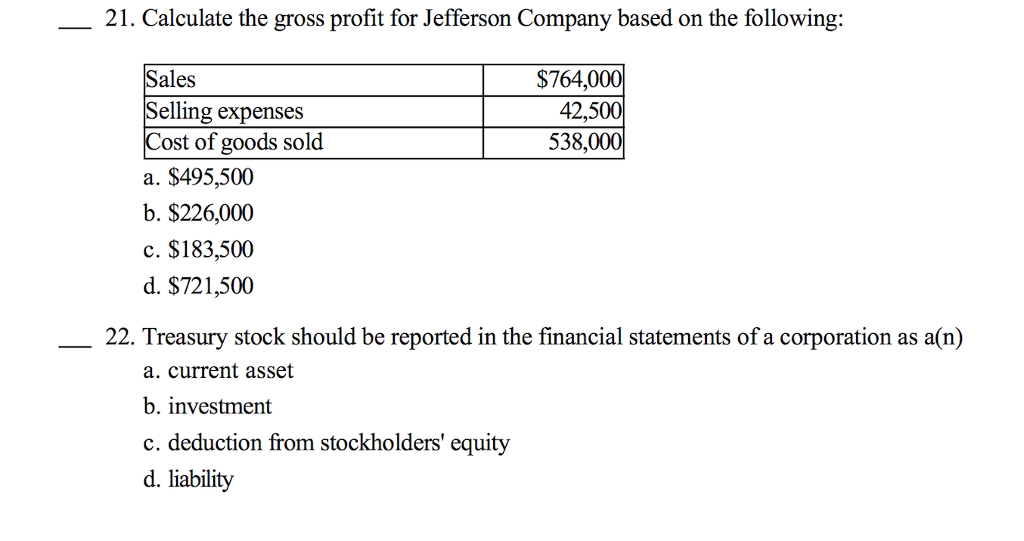

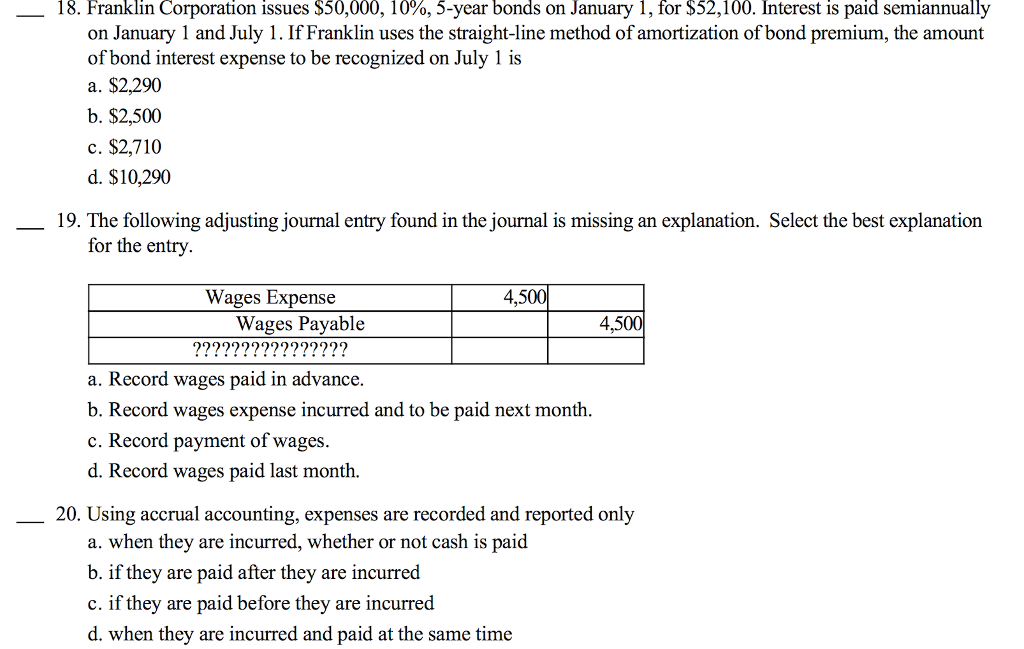

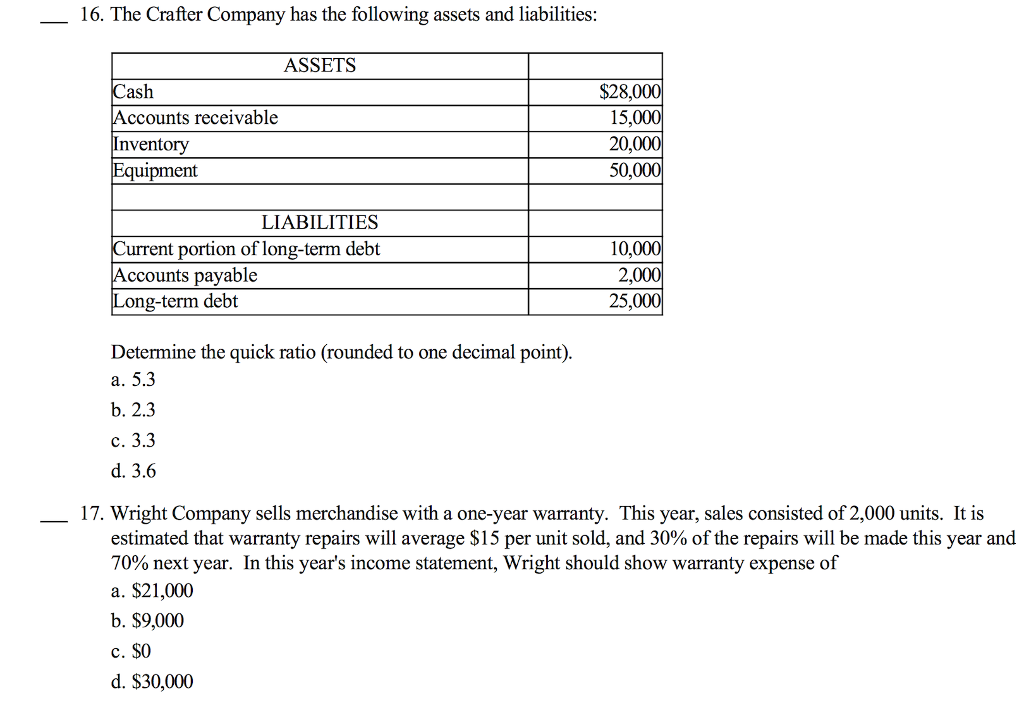

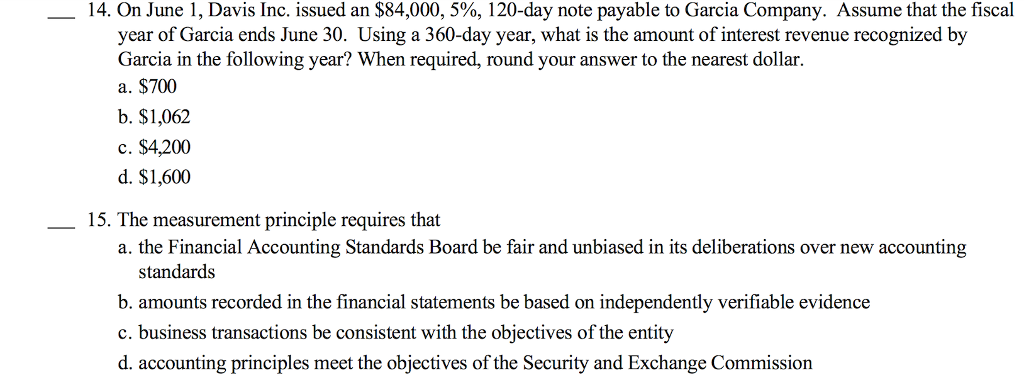

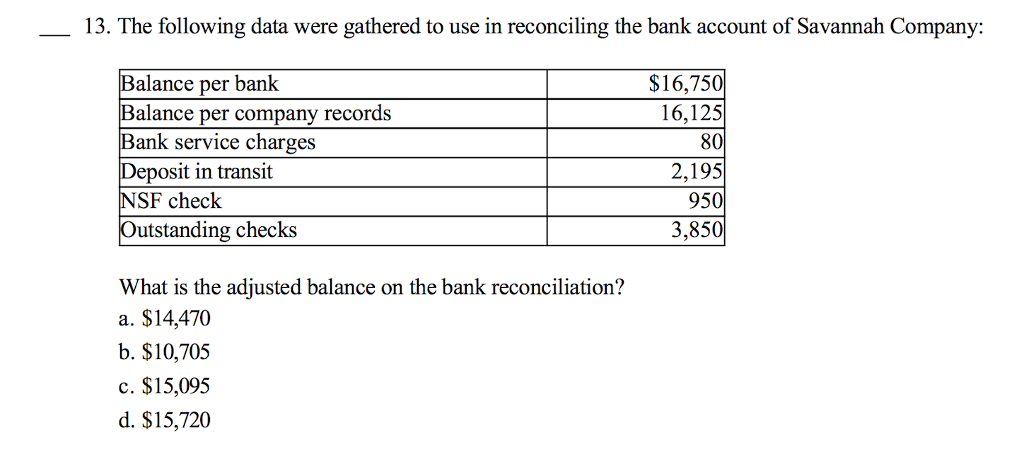

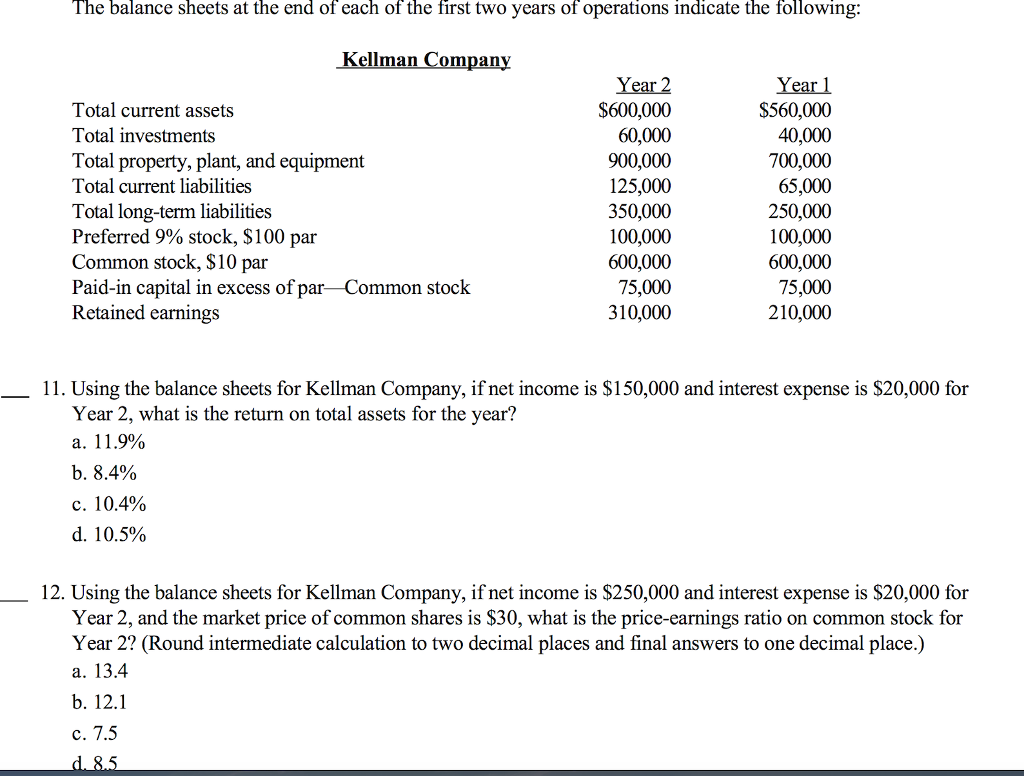

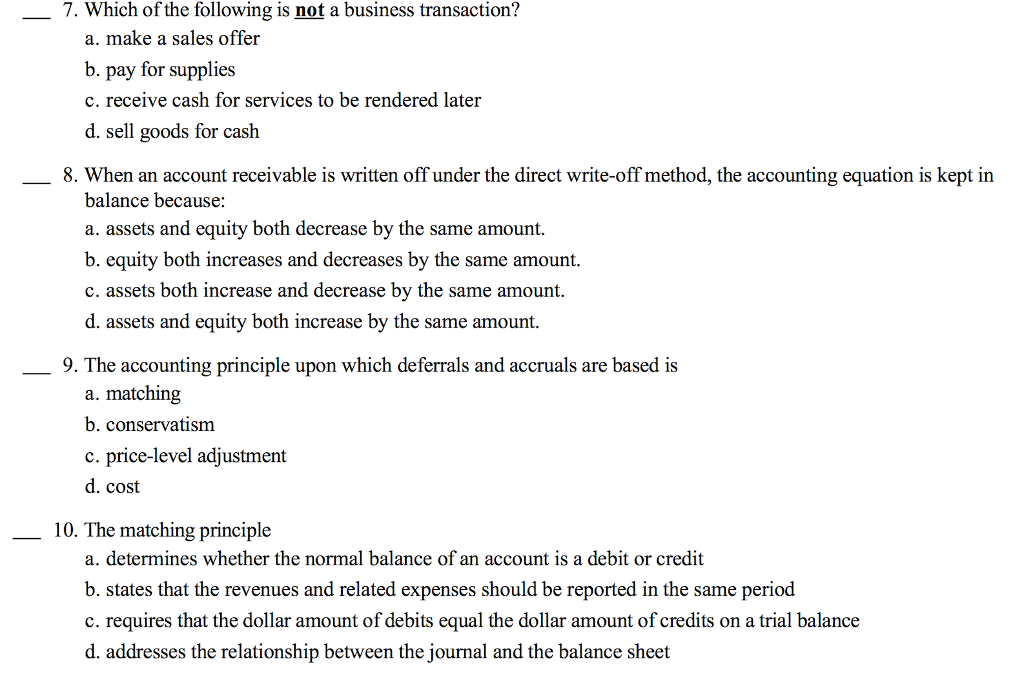

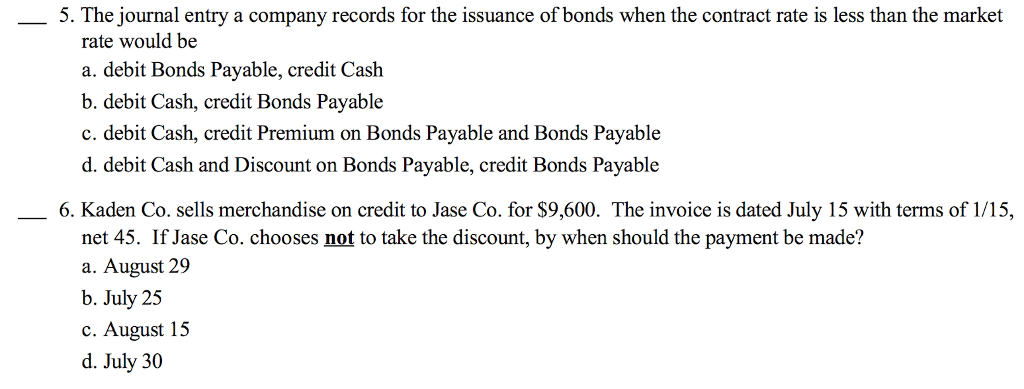

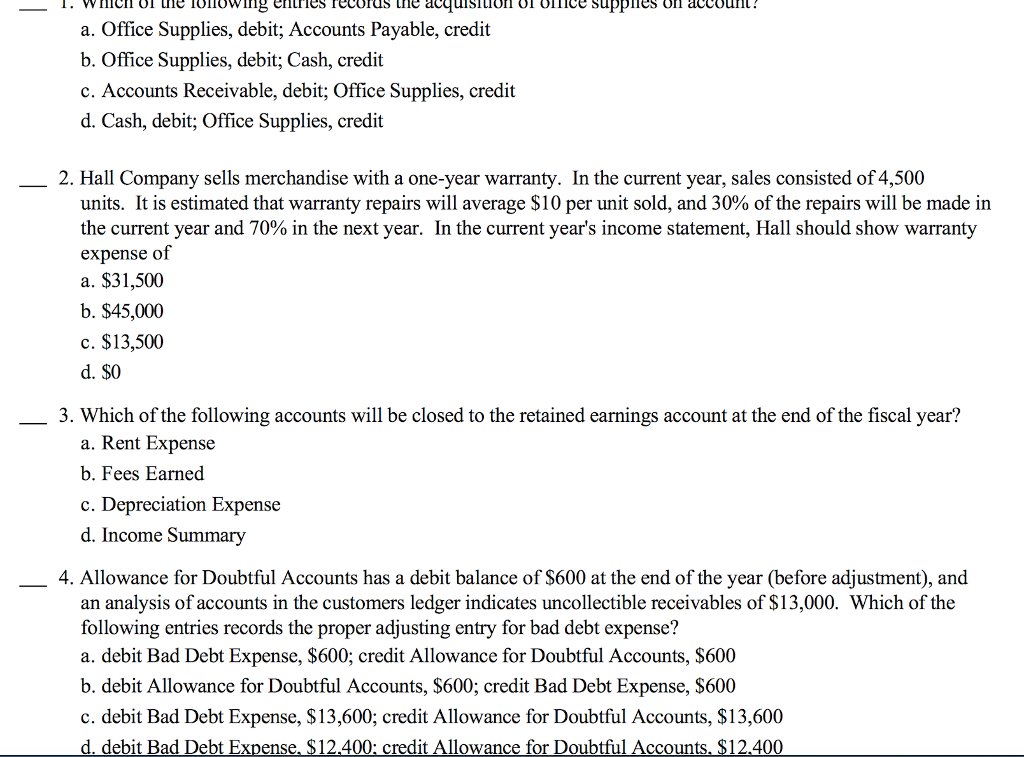

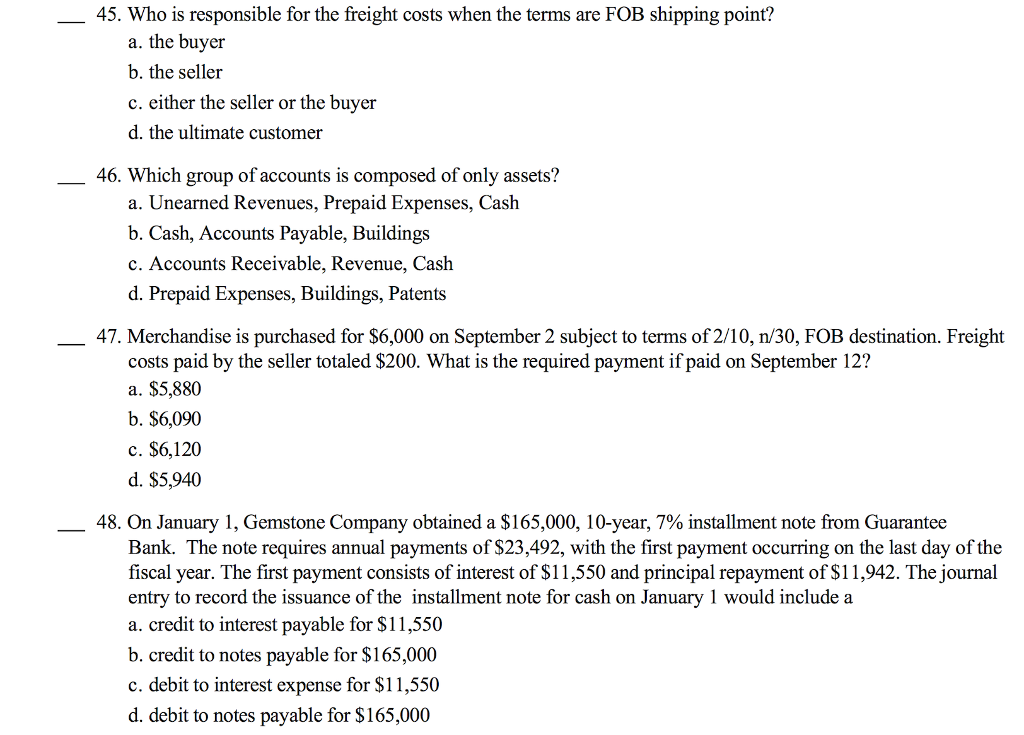

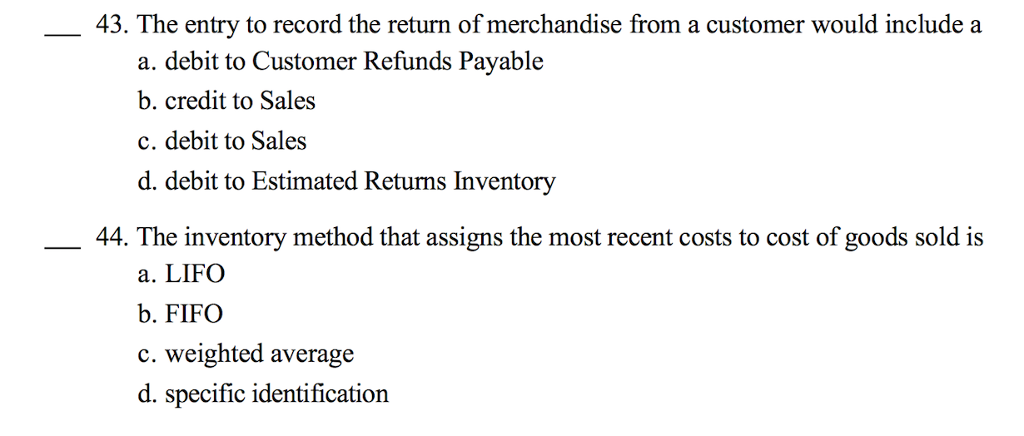

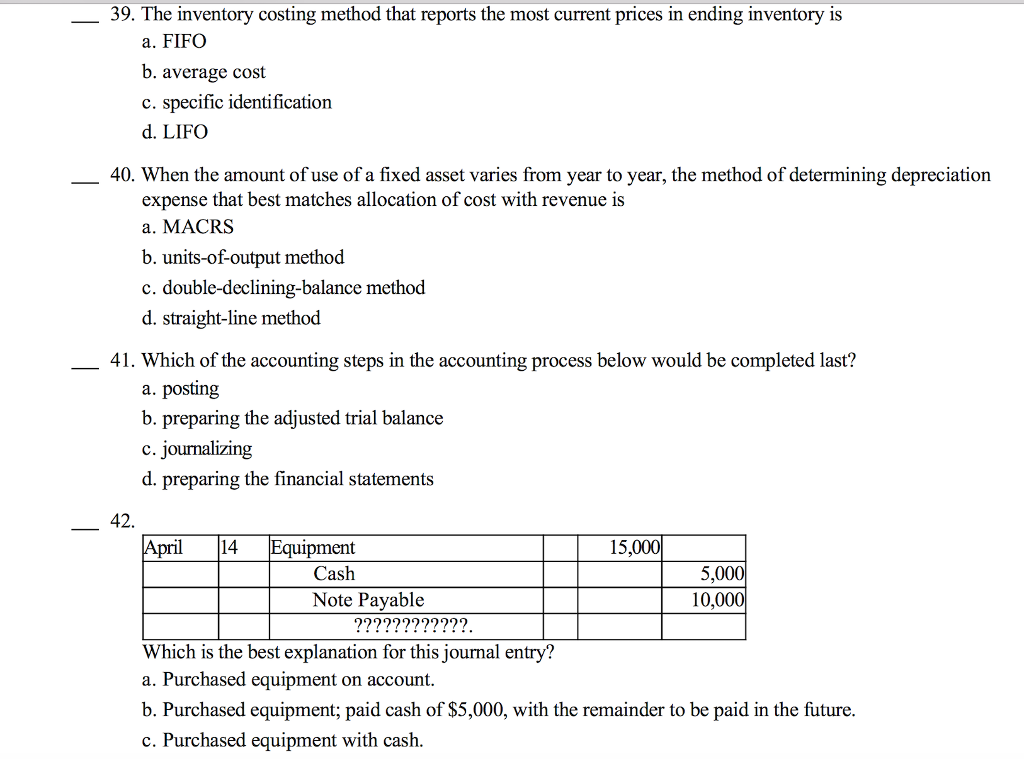

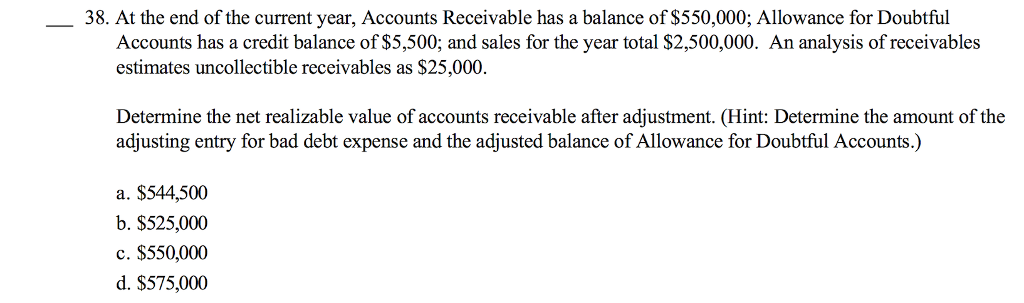

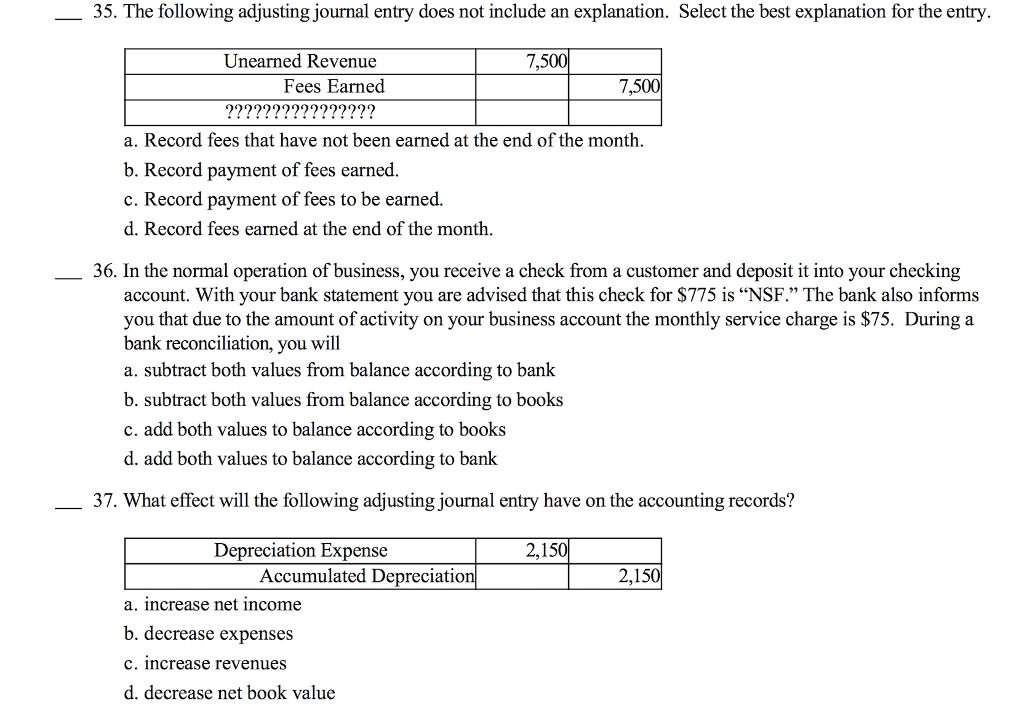

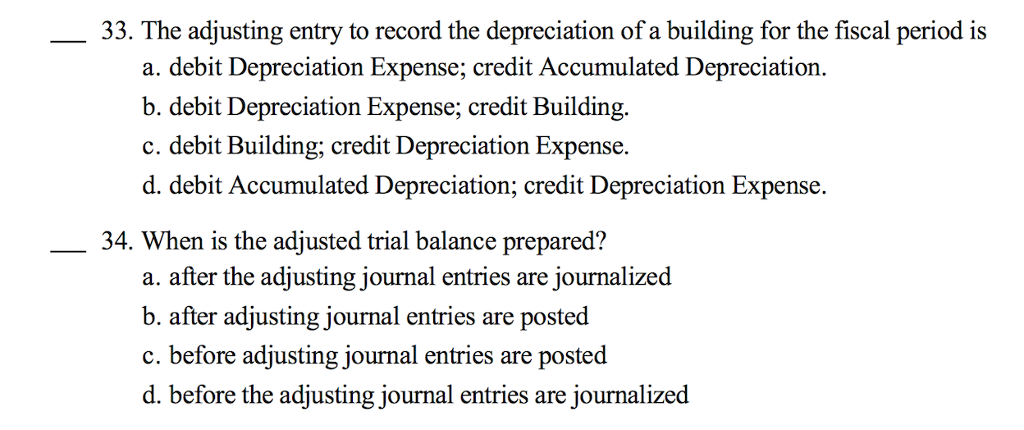

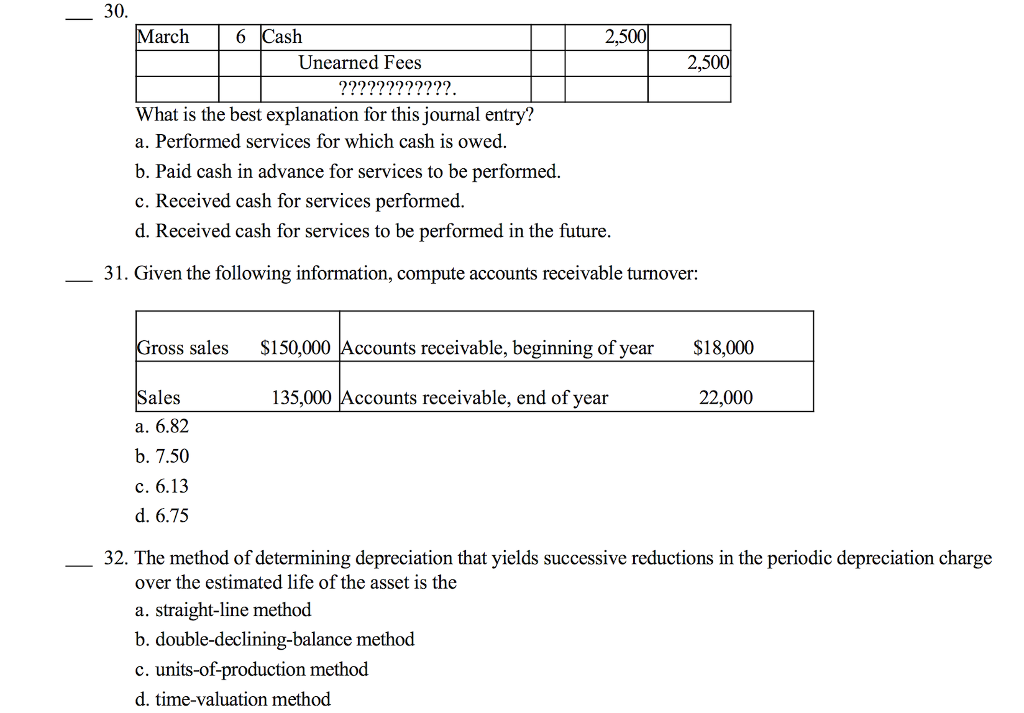

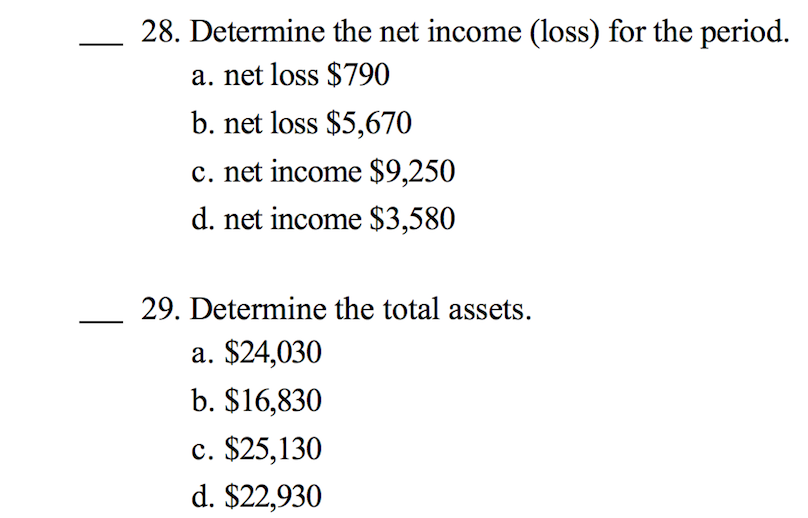

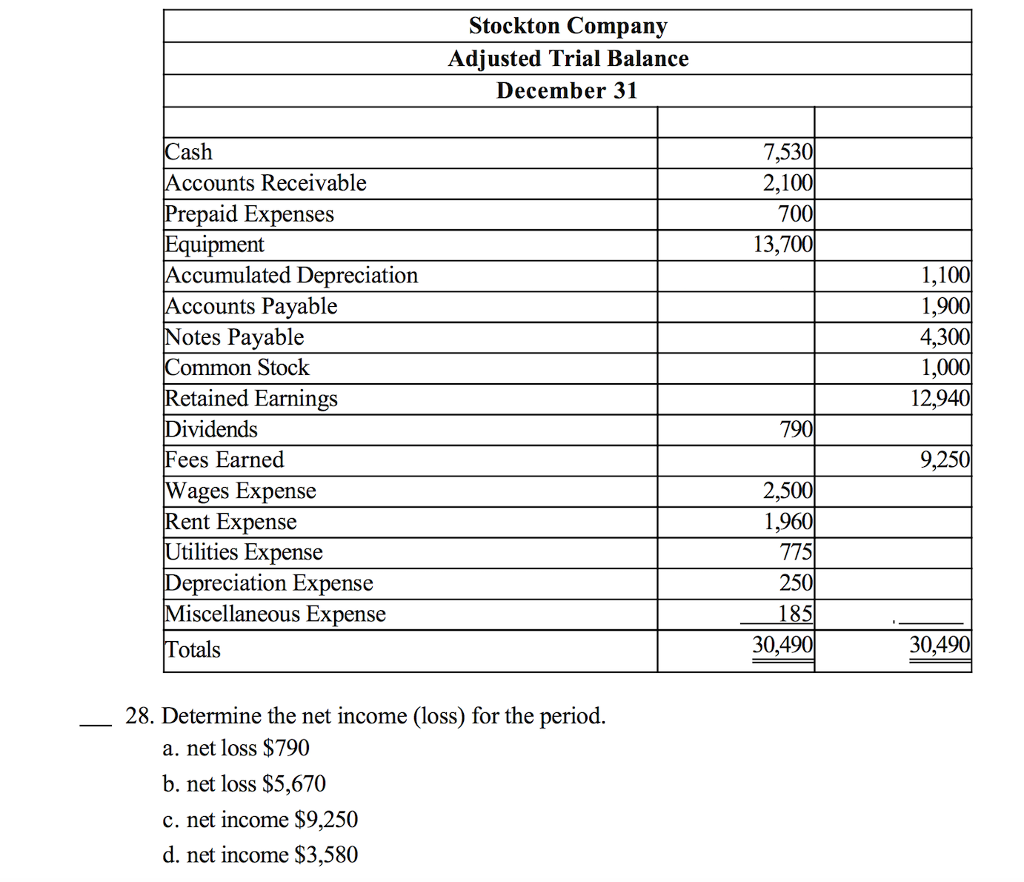

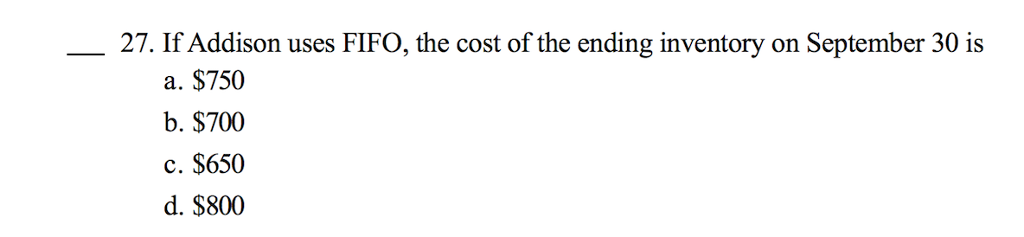

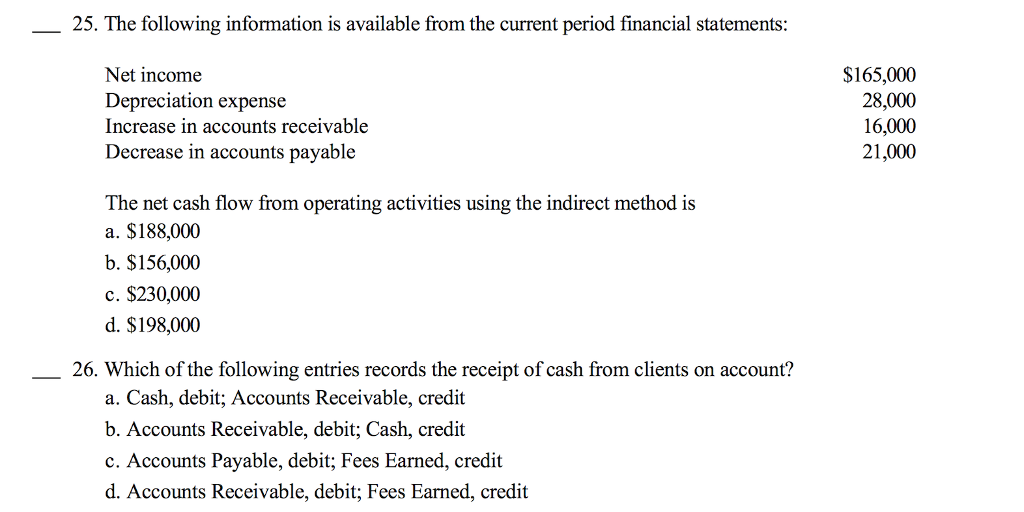

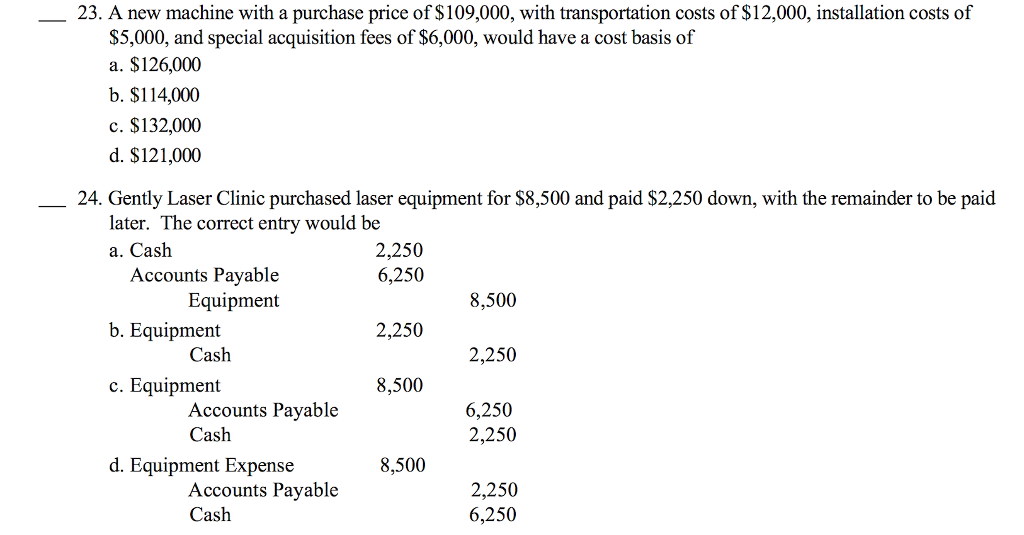

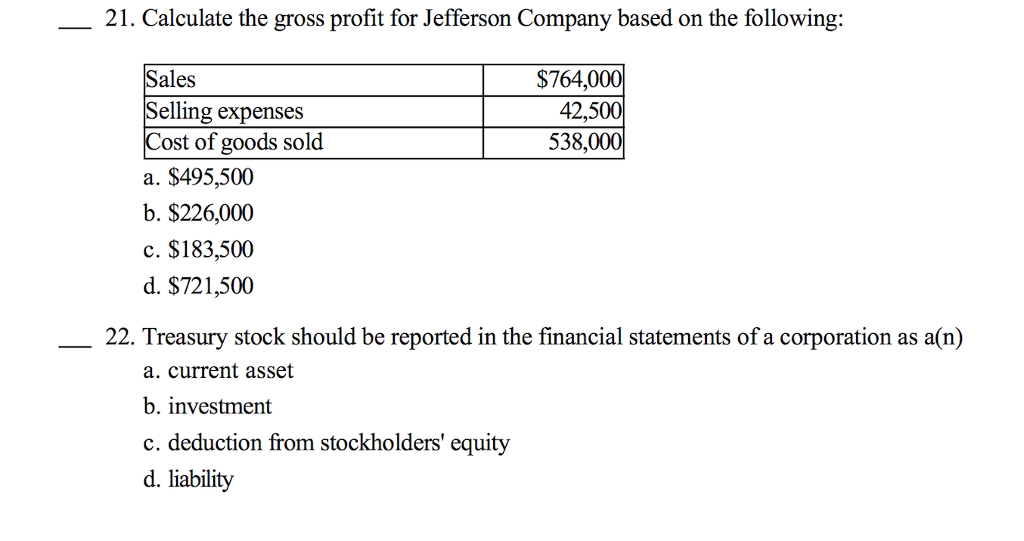

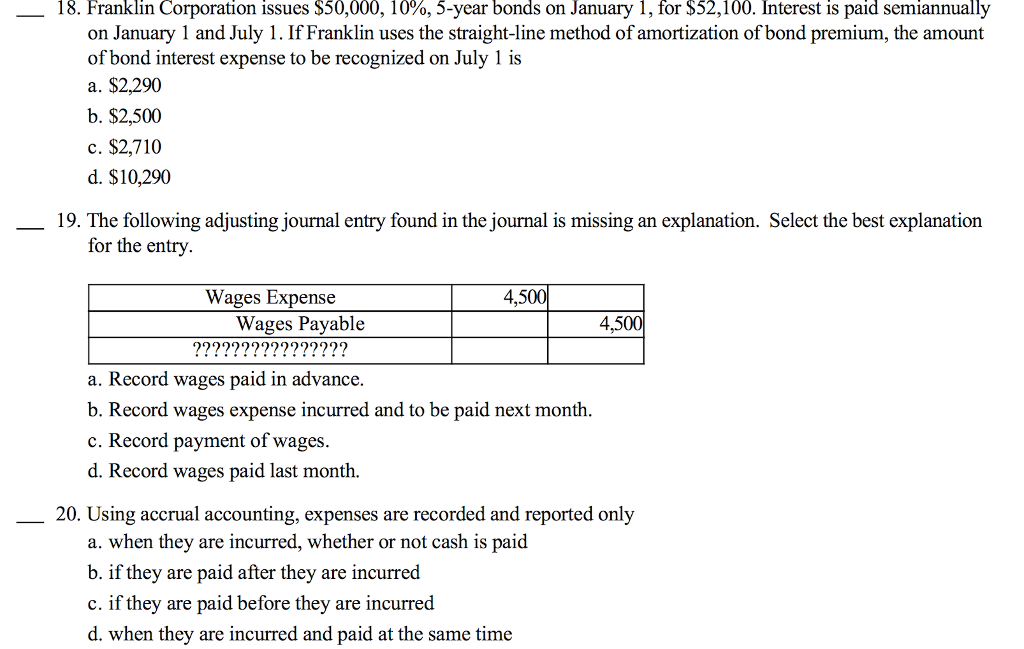

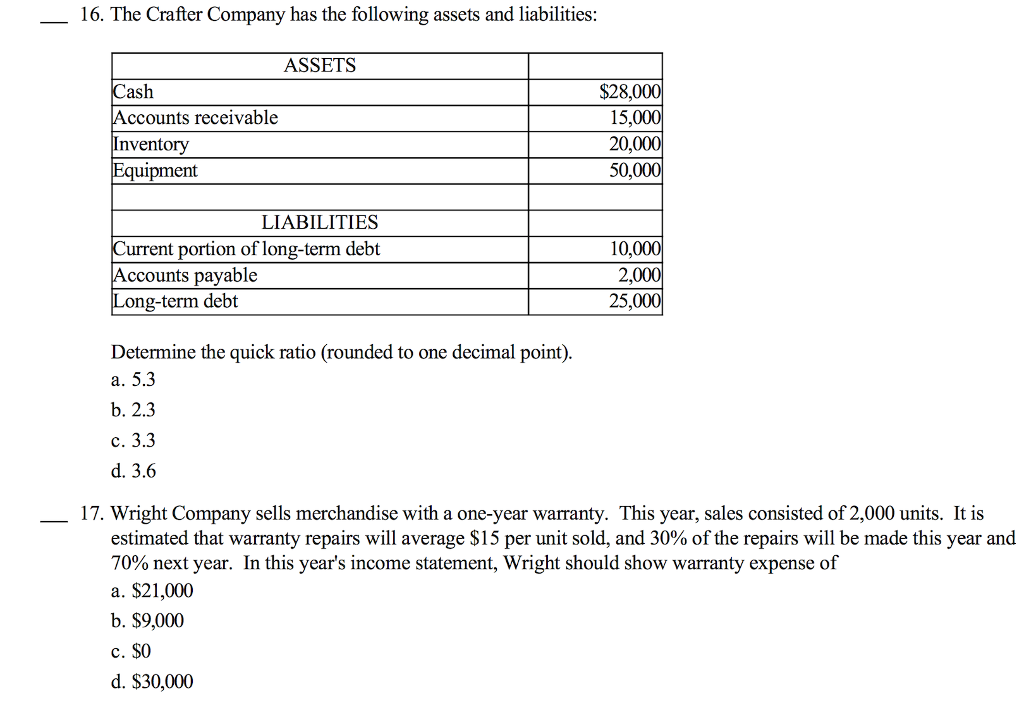

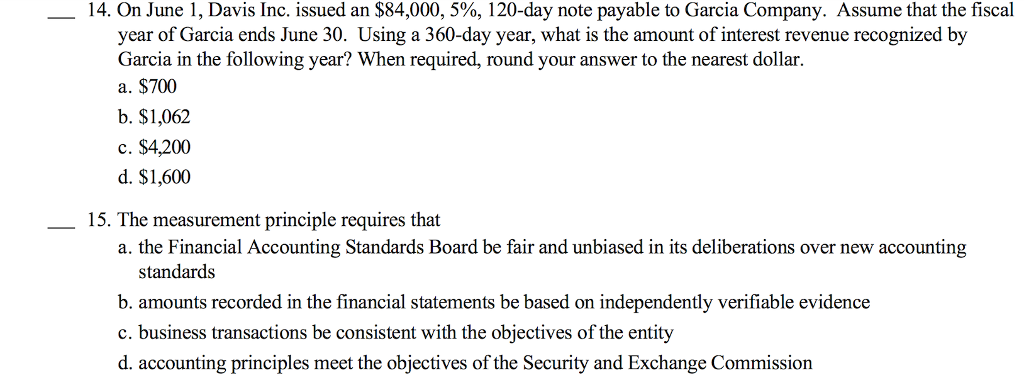

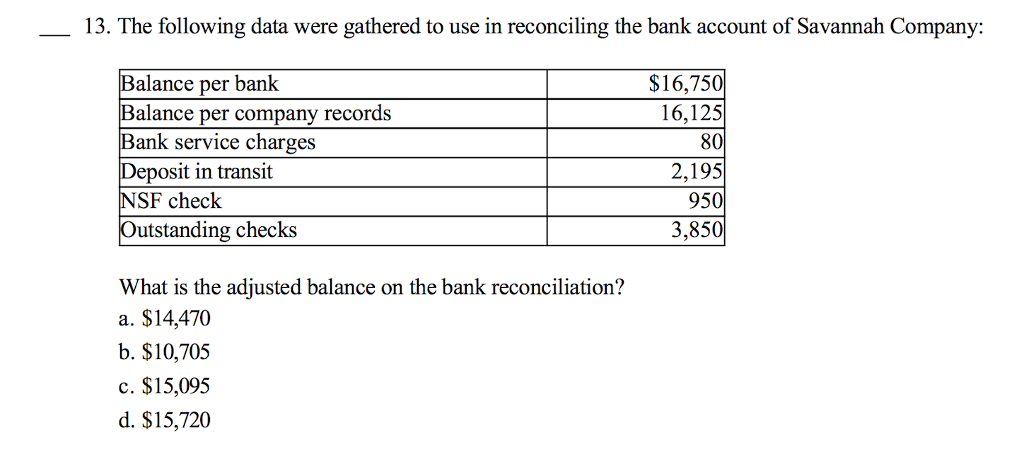

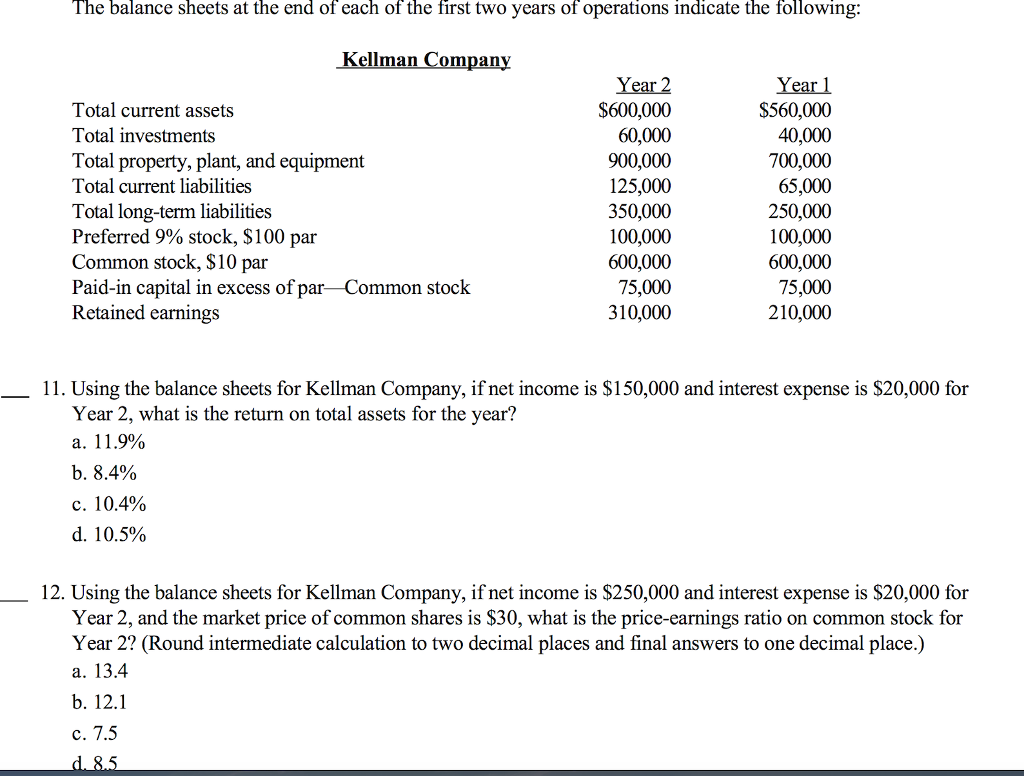

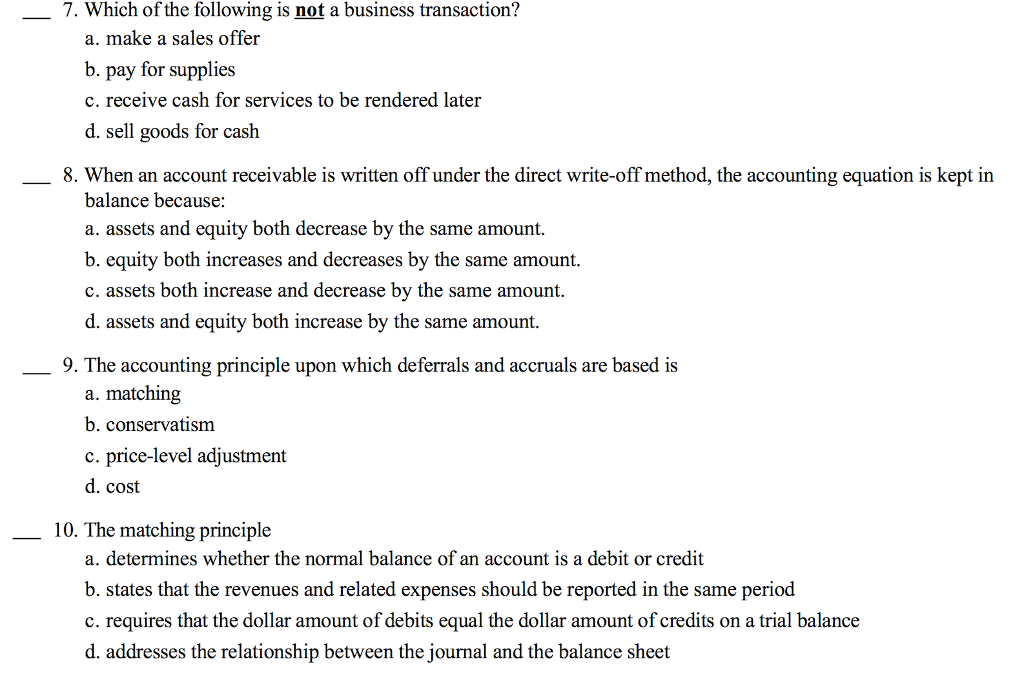

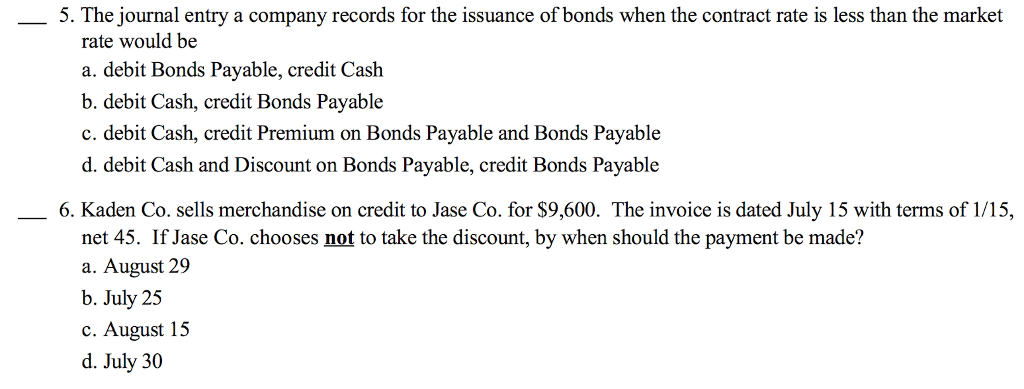

39. The inventory costing method that reports the most current prices in ending inventory is a. FIFO b. average cost c. specific identification d. LIFO 40. When the amount of use of a fixed asset varies from year to year, the method of determining depreciation expense that best matches allocation of cost with revenue is a. MACRS b. units-of-output method c. double-declining-balance method d. straight-line method 41. Which of the accounting steps in the accounting process below would be completed last? a. posting b. preparing the adjusted trial balance c. journalizing d. preparing the financial statements 42 14 uipment 15,000 Cash Note Payable 5,00 10,000 Which is the best explanation for this journal entry? a. Purchased equipment on account. b. Purchased equipment; paid cash of $5,000, with the remainder to be paid in the future c. Purchased equipment with cash 38. At the end of the current year, Accounts Receivable has a balance of $550,000; Allowance for Doubtful Accounts has a credit balance of $5,500; and sales for the year total $2,500,000. An analysis of receivables estimates uncollectible receivables as $25,000. Determine the net realizable value of accounts receivable after adjustment. (Hint: Determine the amount of the adjusting entry for bad debt expense and the adjusted balance of Allowance for Doubtful Accounts.) a. $544,500 b. $525,000 c. $550,000 d. $575,000 35. The following adjusting journal entry does not include an explanation. Select the best explanation for the entry. Unearned Revenue Fees Earned 7,500 7,500 a. Record fees that have not been earned at the end of the month. b. Record payment of fees earned. c. Record payment of fees to be earned. d. Record fees earned at the end of the month. 36. In the normal operation of business, you receive a check from a customer and deposit it into your checking account. With your bank statement you are advised that this check for $775 is "NSF." The bank also informs you that due to the amount of activity on your business account the monthly service charge is $75. During a bank reconciliation, you will a. subtract both values from balance according to bank b. subtract both values from balance according to books c. add both values to balance according to books d. add both values to balance according to bank 37. What effect will the following adjusting journal entry have on the accounting records? Depreciation Expense 2,150 Accumulated Depreciatio 2,150 a. increase net income b. decrease expenses c. increase revenues d. decrease net book value 33. The adjusting entry to record the depreciation of a building for the fiscal period is a. debit Depreciation Expense; credit Accumulated Depreciation. b. debit Depreciation Expense; credit Building. c. debit Building, credit Depreciation Expense. d. debit Accumulated Depreciation; credit Depreciation Expense 34. When is the adjusted trial balance prepared? a. after the adjusting journal entries are journalized b. after adjusting journal entries are posted c. before adjusting journal entries are posted d. before the adjusting journal entries are journalized 30 arch 6 Cash 2,500 Unearned Fees What is the best explanation for this journal entry? a. Performed services for which cash is owed b. Paid cash in advance for services to be performed. c. Received cash for services performed d. Received cash for services to be performed in the future 31. Given the following information, compute accounts receivable turnover: ross sales $150,000 Accounts receivable, beginning of year $18,000 ales a. 6.82 b. 7.50 c. 6.13 d. 6.75 135,000 Accounts receivable, end of year 22,000 32. The method of determining depreciation that yields successive reductions in the periodic depreciation charge over the estimated life of the asset is the a. straight-line method b. double-declining-balance method c. units-of-production method d. time-valuation method 28. Determine the net income (loss) for the period. a. net loss $790 b. net loss $5,670 c. net income $9,250 d. net income $3,580 29. Determine the total assets a. $24,030 b. $16,830 c. $25,130 d. $22,930 Stockton Companv Adjusted Trial Balance December 31 7,53 as ccounts Receivable repaid Expenses quipment 70 13,7 Accumulated Depreciation ccounts Pavable otes Pavable ommon Stock etained Earnings ividends ees Earned 12,9 9,250 2,5 ages Expense Rent Expense Utilities Expense 775 25 185 epreciation Expense iscellaneous Expense Totals 30,4 30,4 28. Determine the net income (loss) for the period. a. net loss $790 b. net loss $5,670 c. net income $9,250 d. net income $3,580 27. If Addison uses FIFO, the cost of the ending inventory on September 30 is a. $750 b. $700 c. $650 d. $800 25. The following information is available from the current period financial statements: Net income Depreciation expense Increase in accounts receivable Decrease in accounts payable $165,000 28,000 16,000 21,000 The net cash flow from operating activities using the indirect method is a. $188,000 b. $156,000 c. $230,000 d. $198,000 26. Which of the following entries records the receipt of cash from clients on account? a. Cash, debit; Accounts Receivable, credit b. Accounts Receivable, debit; Cash, credit c. Accounts Payable, debit; Fees Earned, credit d. Accounts Receivable, debit; Fees Earned, credit 21. Calculate the gross profit for Jefferson Company based on the following: Sales Selling expenses Cost of goods sold a. $495,500 b. $226,000 c. $183,500 d. $721,500 $764,000 42,500 538,000 22. Treasury stock should be reported in the financial statements of a corporation as a(n) a. current asset b. investment c. deduction from stockholders' equity d. liability 18. Franklin Corporation issues $50,000, 10%, 5-year bonds on January 1, for $52,100. Interest is paid semiannually on January 1 and July 1. If Franklin uses the straight-line method of amortization of bond premium, the amount of bond interest expense to be recognized on July 1 is a. $2,290 b. $2,500 c. $2,710 d. $10,290 19. The following adjusting journal entry found in the journal is missing an explanation. Select the best explanation for the entry Wages Expense Wages Payable a. Record wages paid in advance b. Record wages expense incurred and to be paid next month c. Record payment of wages d. Record wages paid last month. 20. Using accrual accounting, expenses are recorded and reported only a. when they are incurred, whether or not cash is paid if they are paid after they are incurred c. if they are paid before they are incurred d. when they are incurred and paid at the same time 16. The Crafter Company has the following assets and liabilities: ASSETS ash ccounts receivable nventory $28, 15 20 50, uipment LIABILITIES urrent portion of long-term debt ccounts payable ong-term debt 10 25 Determine the quick ratio (rounded to one decimal point) a. 5.3 b. 2.3 d. 3.6 17. Wright Company sells merchandise with a one-year warranty. This year, sales consisted of 2,000 units. It is estimated that warranty repairs will average $15 per unit sold, and 30% of the repairs will be made this year and 70% next year. In this year's income statement, Wright should show warranty expense of a. $21,000 b. $9,000 d. $30,000 14. On June 1, Davis Inc. issued an $84,000, 500, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using a 360-day year, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. a. $700 b. $1,062 c. $4,200 d. $1,600 15. The measurement principle requires that a. the Financial Accounting Standards Board be fair and unbiased in its deliberations over new accounting standards b. amounts recorded in the financial statements be based on independently verifiable evidence c. business transactions be consistent with the objectives of the entity d. accounting principles meet the objectives of the Security and Exchange Commission 13. The following data were gathered to use in reconciling the bank account of Savannah Company: $16,750 16,125 80 2,195 950 3,850 Balance per bank alance per company records ank service charges eposit in transit SF check utstanding checks What is the adjusted balance on the bank reconciliation? a. $14,470 b. $10,705 c. $15,095 d. $15,720 The balance sheets at the end of each of the first two years of operations indicate the following llman ompanv Total current assets Total investments Total property, plant, and equipment Total current liabilities Total long-term liabilities Preferred 9% stock, $100 par Common stock, $10 p Paid-in capital in excess of par Common stock Retained earnings Year 2 $600,000 60,000 900,000 125,000 350,000 100,000 600,000 75,000 310,000 Year l $560,000 40,000 700,000 65,000 250,000 100,000 600,000 75,000 210,000 11. Using the balance sheets for Kellman Company, if net income is $150,000 and interest expense is $20,000 for Year 2, what is the return on total assets for the year? a. 11.9% b. 8.4% c. 10.4% d. 10.5% 12. Using the balance sheets for Kellman Company, if net income is $250,000 and interest expense is $20,000 for Year 2, and the market price of common shares is $30, what is the price-earnings ratio on common stock for Year 2? (Round intermediate calculation to two decimal places and final answers to one decimal place.) a. 13.4 b. 12.1 c. 7.5 7. Which of the following is not a business transaction? a. make a sales offer b. pay for supplies c. receive cash for services to be rendered later d. sell goods for cash 8. When an account receivable is written off under the direct write-off method, the accounting equation is kept iin balance because: a. assets and equity both decrease by the same amount. equity both increases and decreases by the same amount. c. assets both increase and decrease by the same amount. d. assets and equity both increase by the same amount 9. The accounting principle upon which deferrals and accruals are based is a. matching b. conservatism c. price-level adjustment d. cost 10. The matching principle a, determines whether the normal balance of an account is a debit or credit b. states that the revenues and related expenses should be reported in the same period c. requires that the dollar amount of debits equal the dollar amount of credits on a trial balance d. addresses the relationship between the journal and the balance sheet 5. The journal entry a company records for the issuance of bonds when the contract rate is less than the market rate would be a. debit Bonds Payable, credit Cash b. debit Cash, credit Bonds Payable c. debit Cash, credit Premium on Bonds Payable and Bonds Payable d. debit Cash and Discount on Bonds Payable, credit Bonds Payable 6. Kaden Co. sells merchandise on credit to Jase Co. for $9,600. The invoice is dated July 15 with terms of 1/15, net 45. If Jase Co. chooses not to take the discount, by when should the payment be made? a. August 29 b. July 25 c. August 15 d. July 30 T. WnICl ol tuie ToIowing entres records Lhe acquisition Ol Olllce supplies On account! a. Office Supplies, debit; Accounts Payable, credit b. Office Supplies, debit; Cash, credit c. Accounts Receivable, debit; Office Supplies, credit d. Cash, debit; Office Supplies, credit 2. Hall Company sells merchandise with a one-year warranty. In the current year, sales consisted of 4,500 units. It is estimated that warranty repairs will average $10 per unit sold, and 30% of the repairs will be made in the current year and 70% in the next year. In the current year's income statement, Hall should show warranty expense of a. $31,500 b. $45,000 c. $13,500 d. $0 3. Which of the following accounts will be closed to the retained earnings account at the end of the fiscal year? a. Rent Expense b. Fees Earned c. Depreciation Expense d. Income Summary 4. Allowance for Doubtful Accounts has a debit balance of S600 at the end of the year (before adjustment), and an analysis of accounts in the customers ledger indicates uncollectible receivables of $13,000. Which of the following entries records the proper adjusting entry for bad debt expense? a. debit Bad Debt Expense, $600; credit Allowance for Doubtful Accounts, $600 b. debit Allowance for Doubtful Accounts, $600; credit Bad Debt Expense, $600 c. debit Bad Debt Expense, $13,600; credit Allowance for Doubtful Accounts, $13,600 d. debit Bad Debt Expense, $12.400: credit Allowance for Doubtful Accounts, $12,400

Need help with these questions. Thank you!

Need help with these questions. Thank you!