Need help with this project, not sure that I have everything labeled correctly. And need help making sure journal entries are correct.

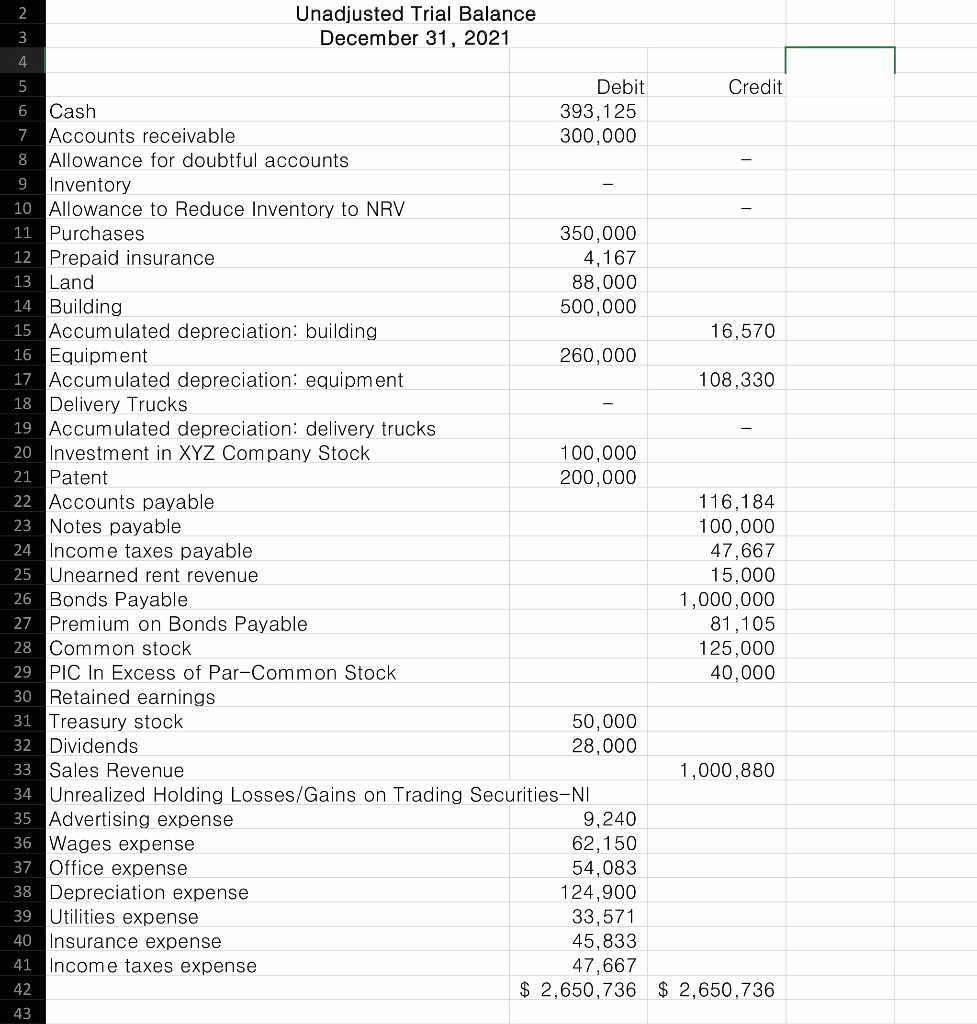

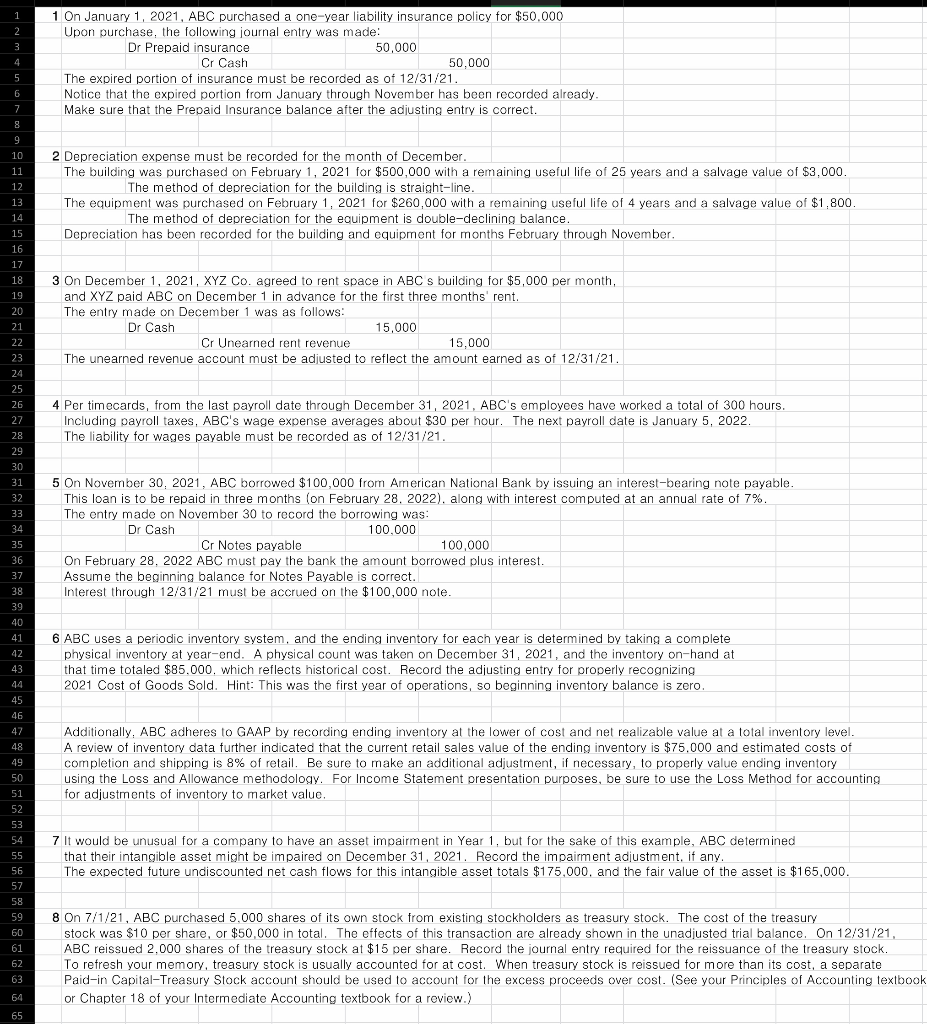

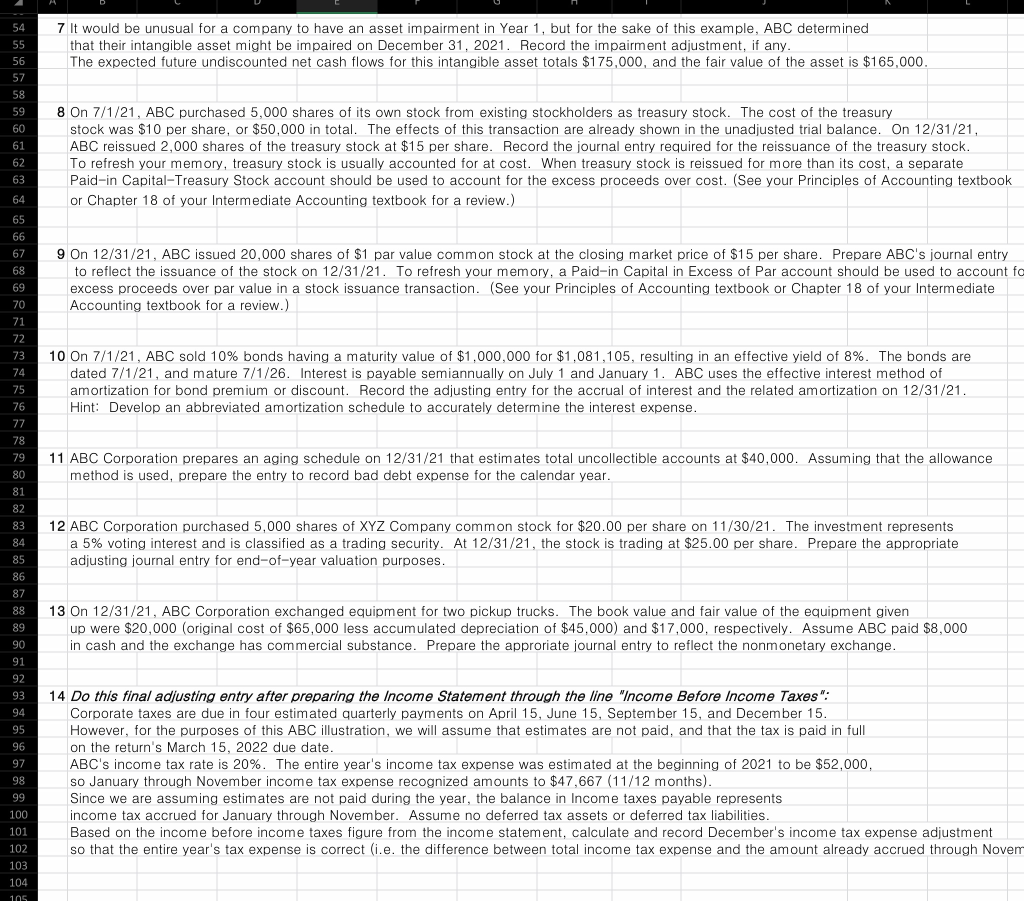

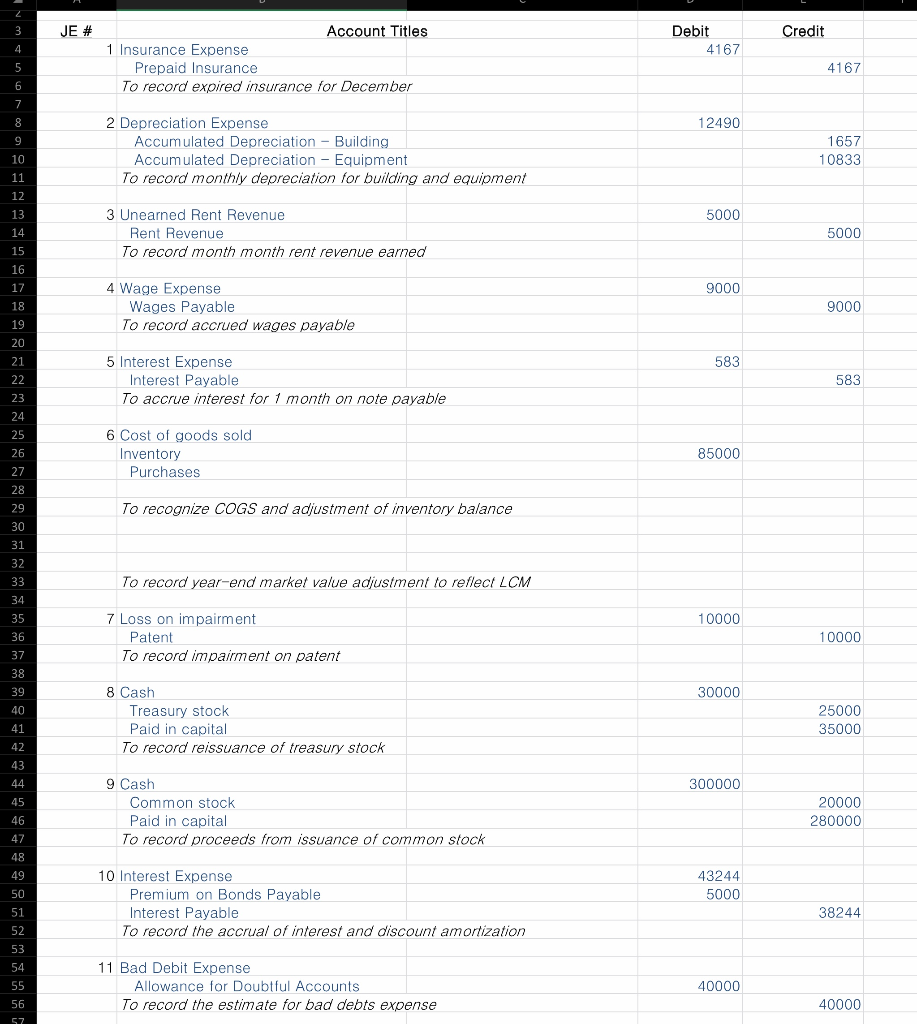

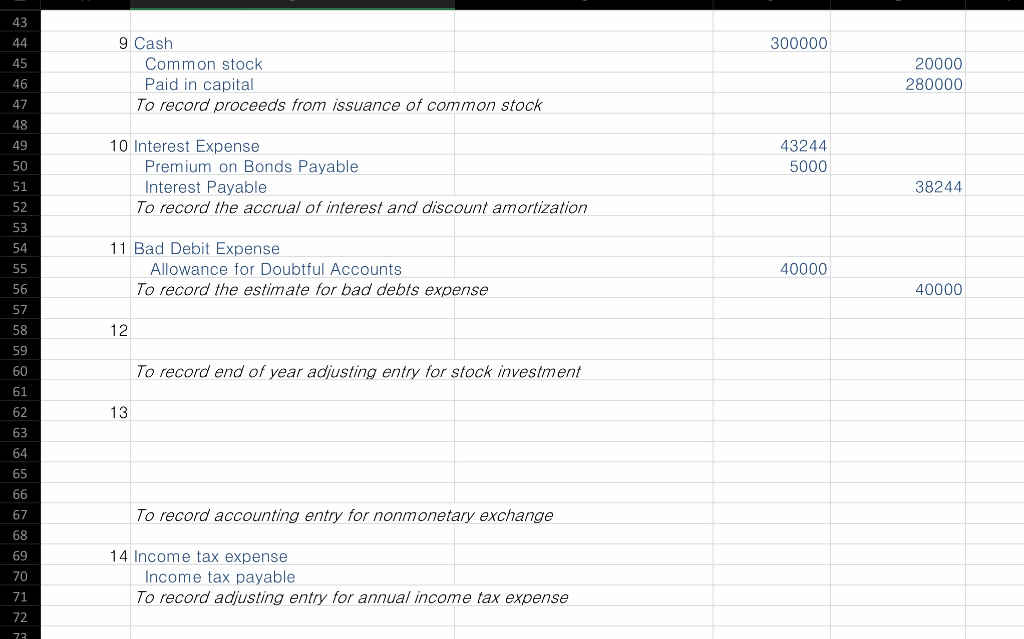

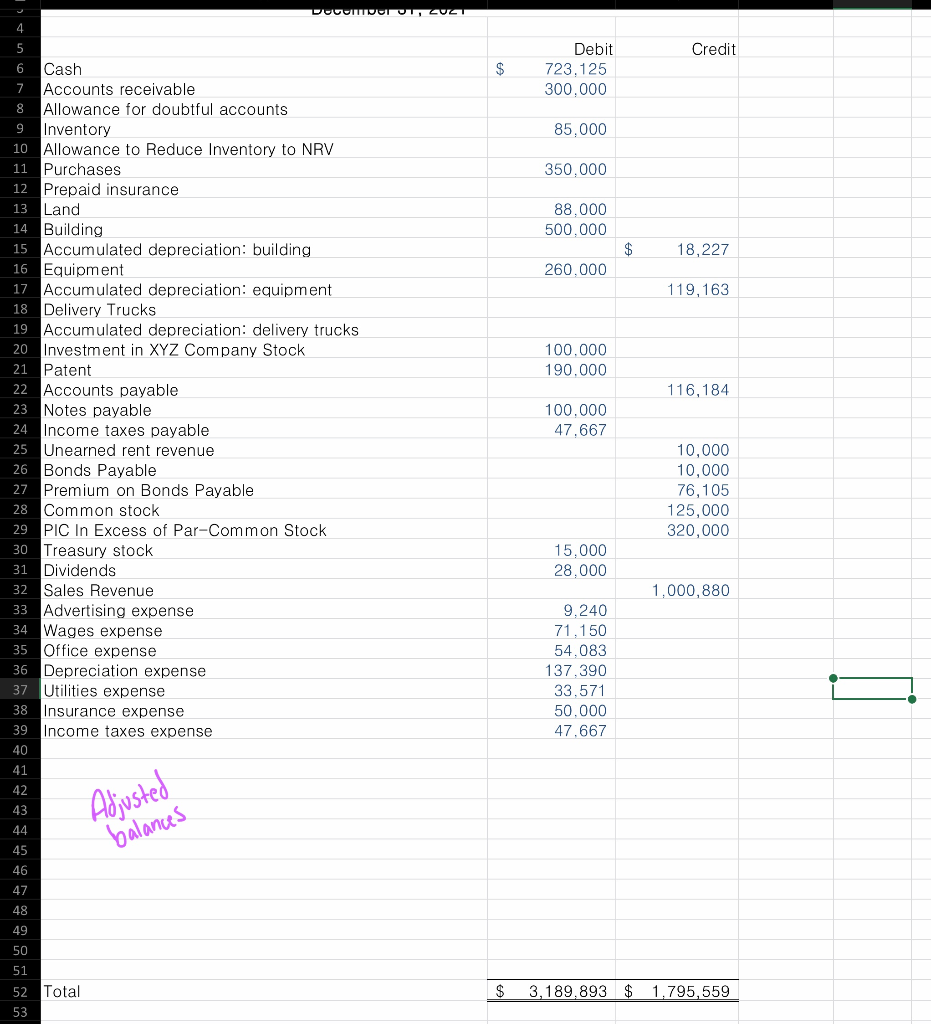

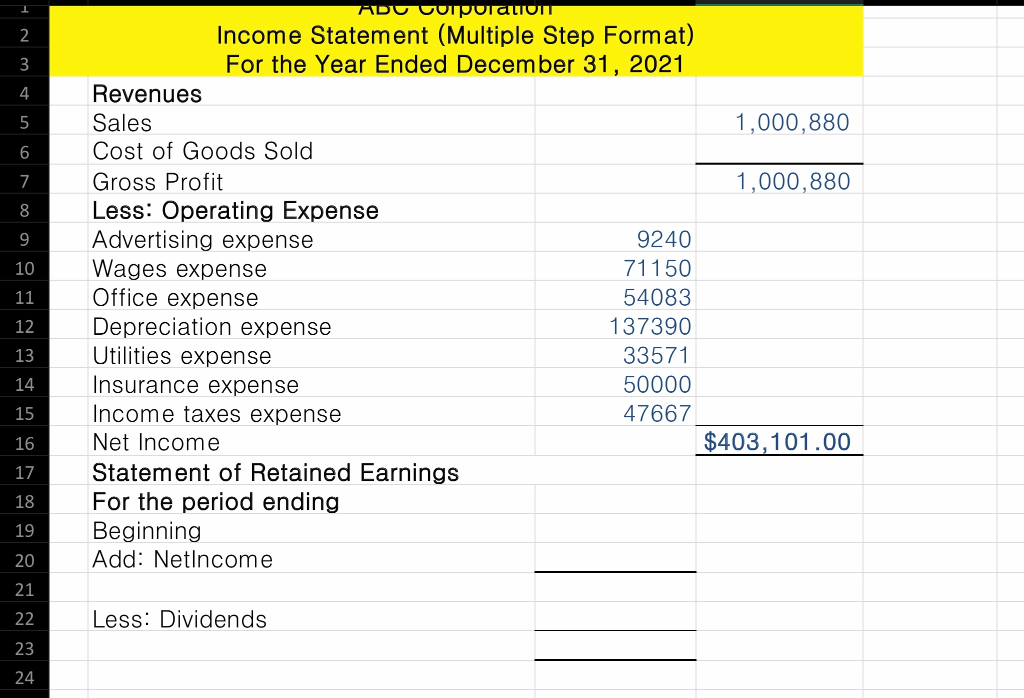

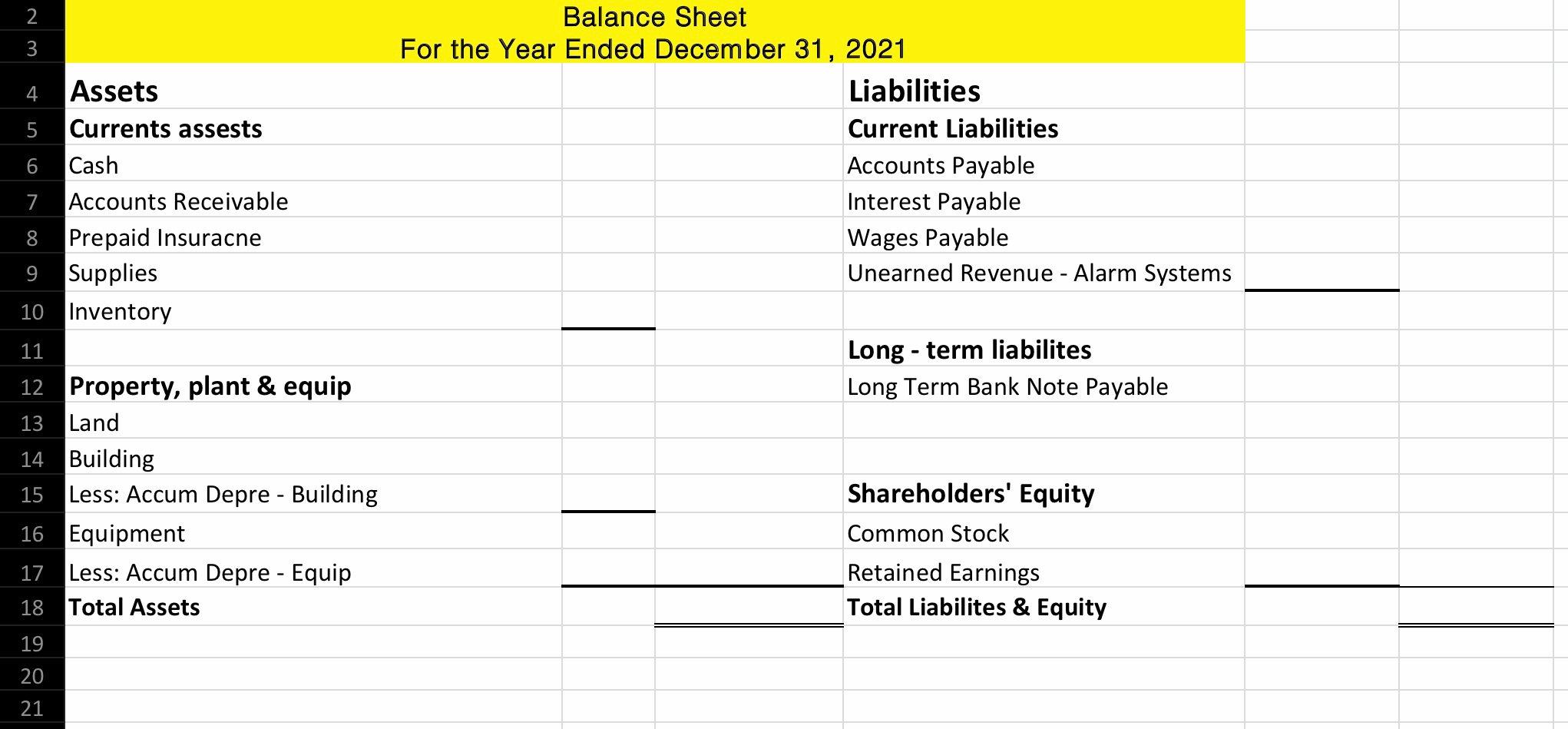

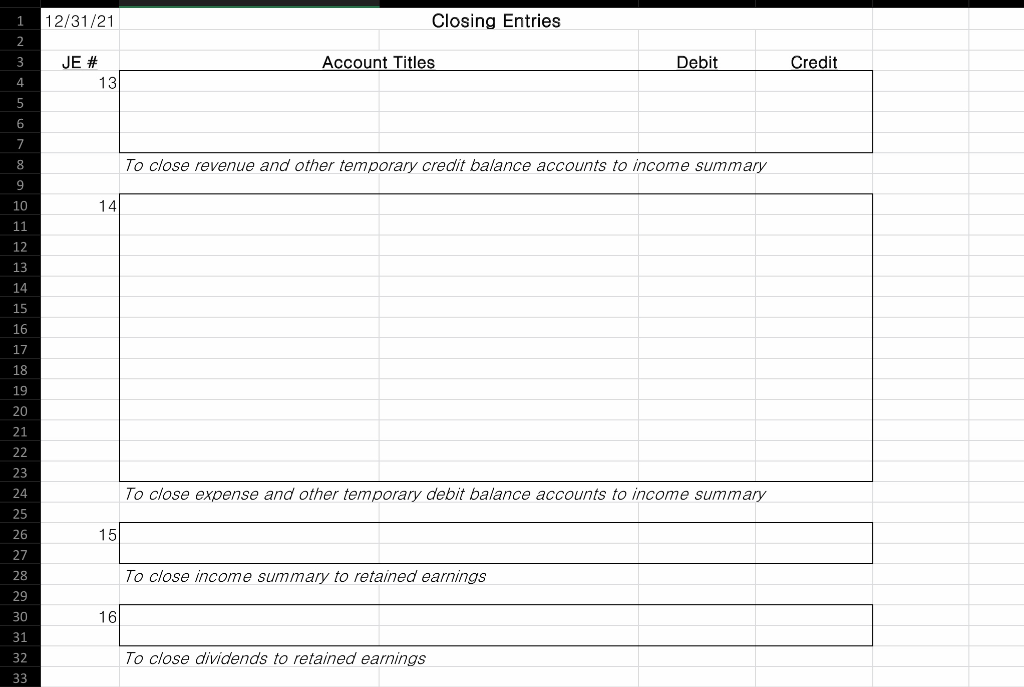

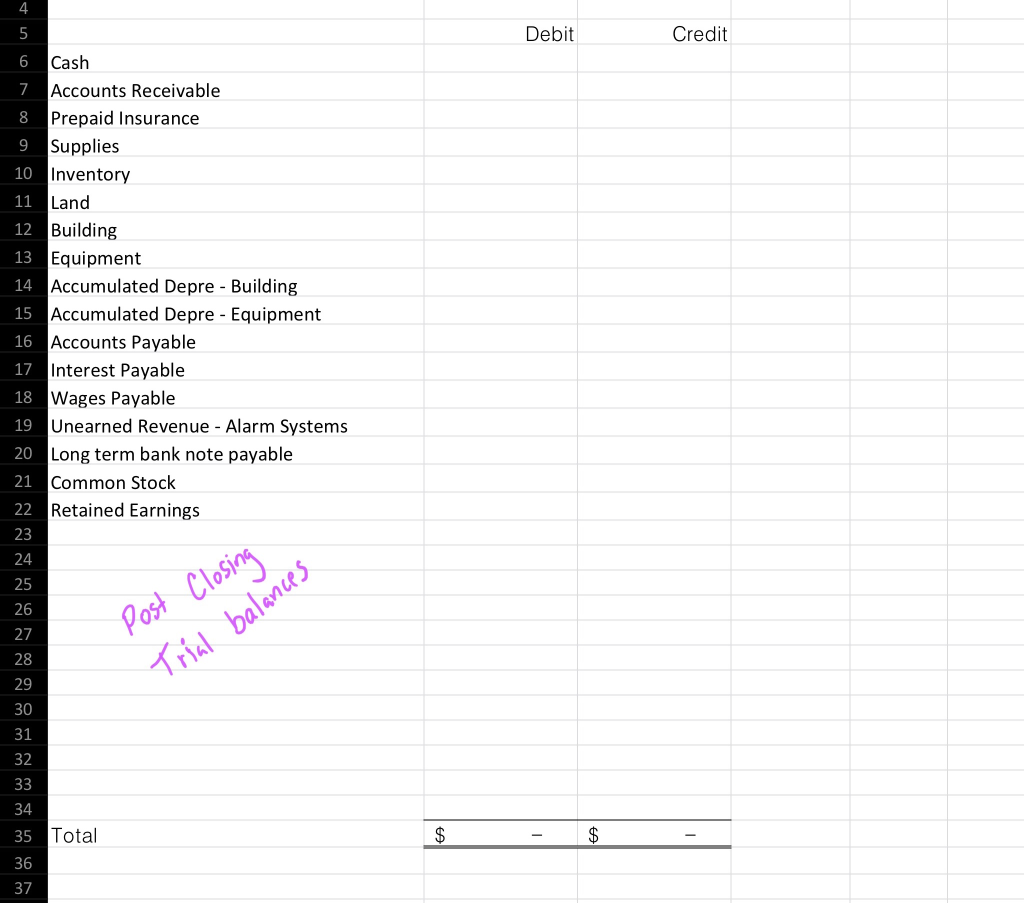

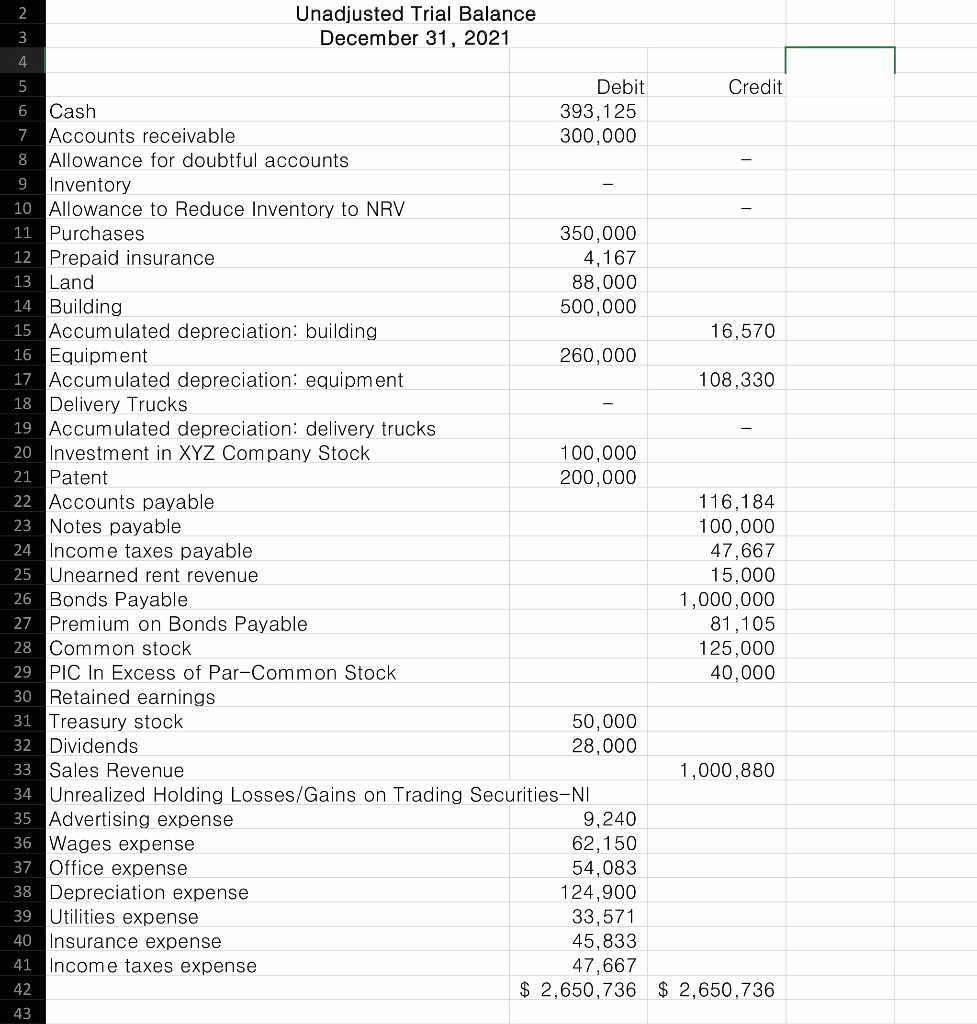

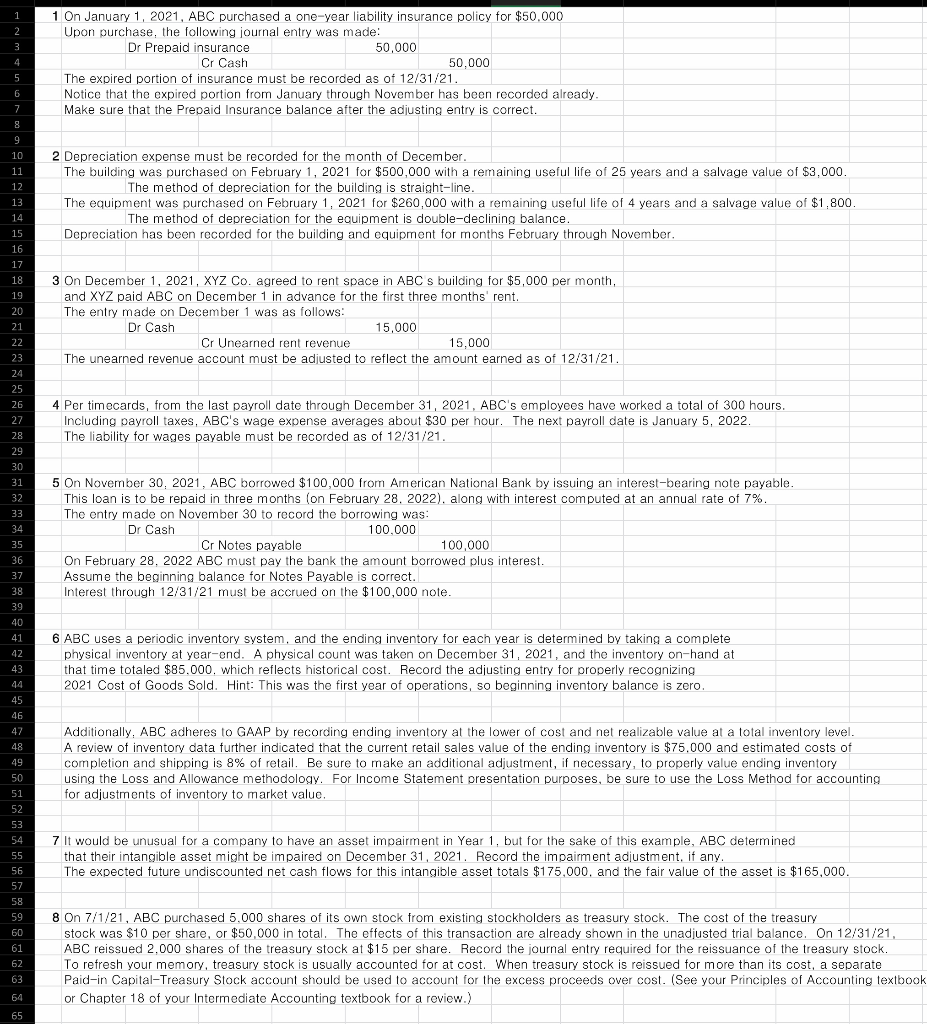

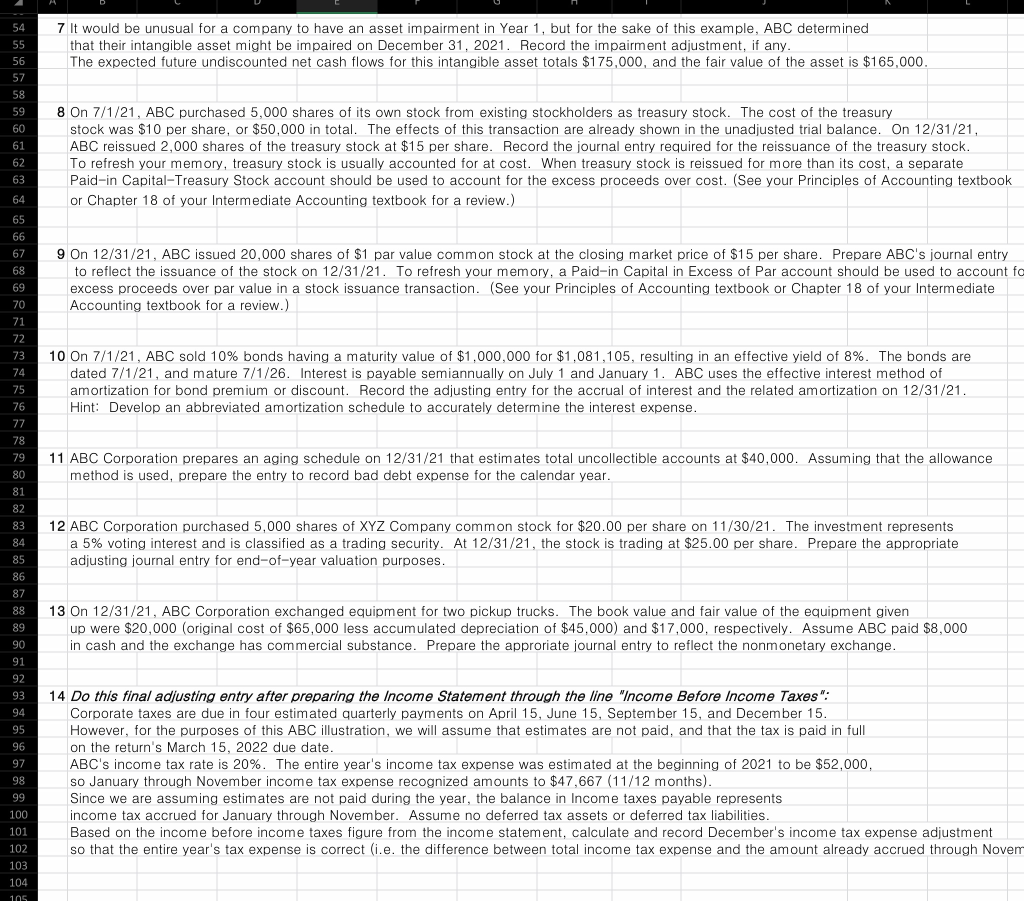

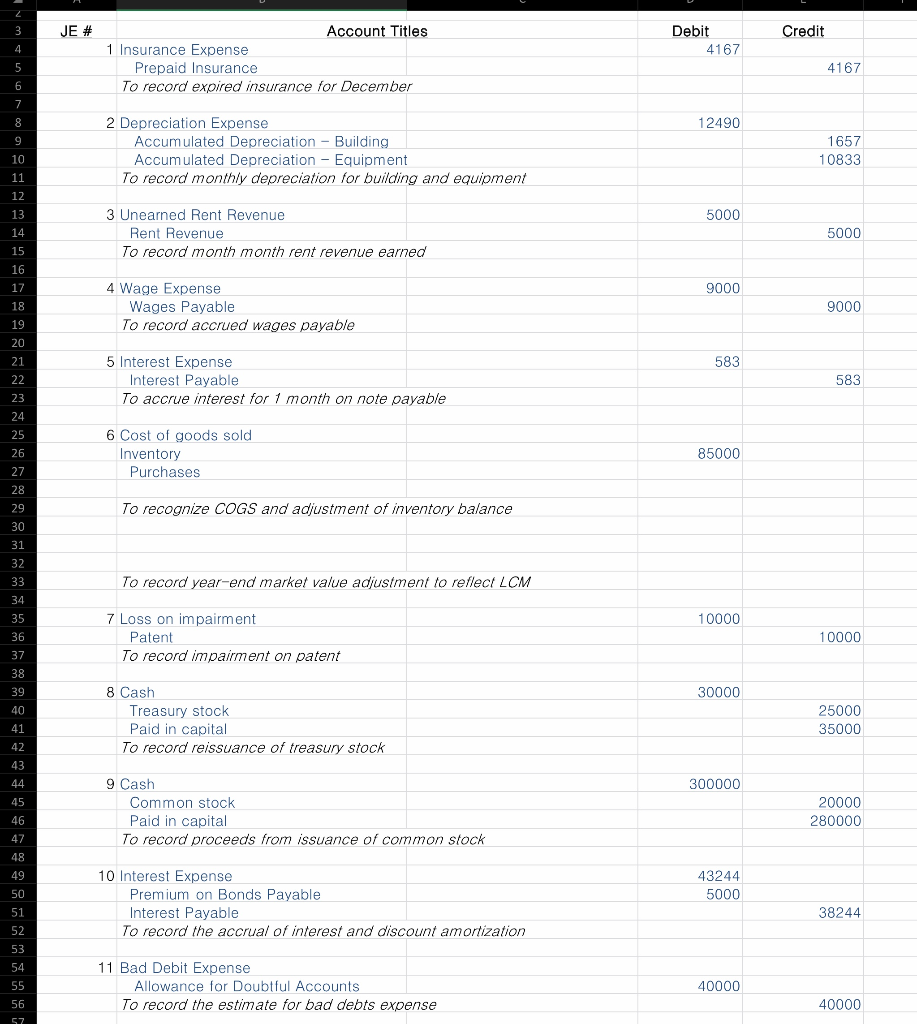

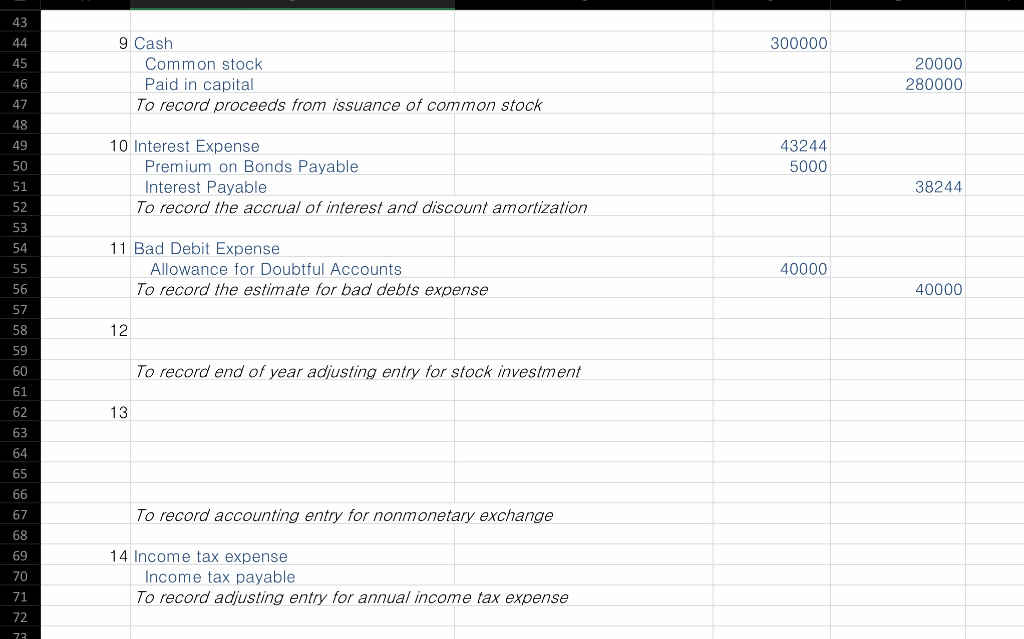

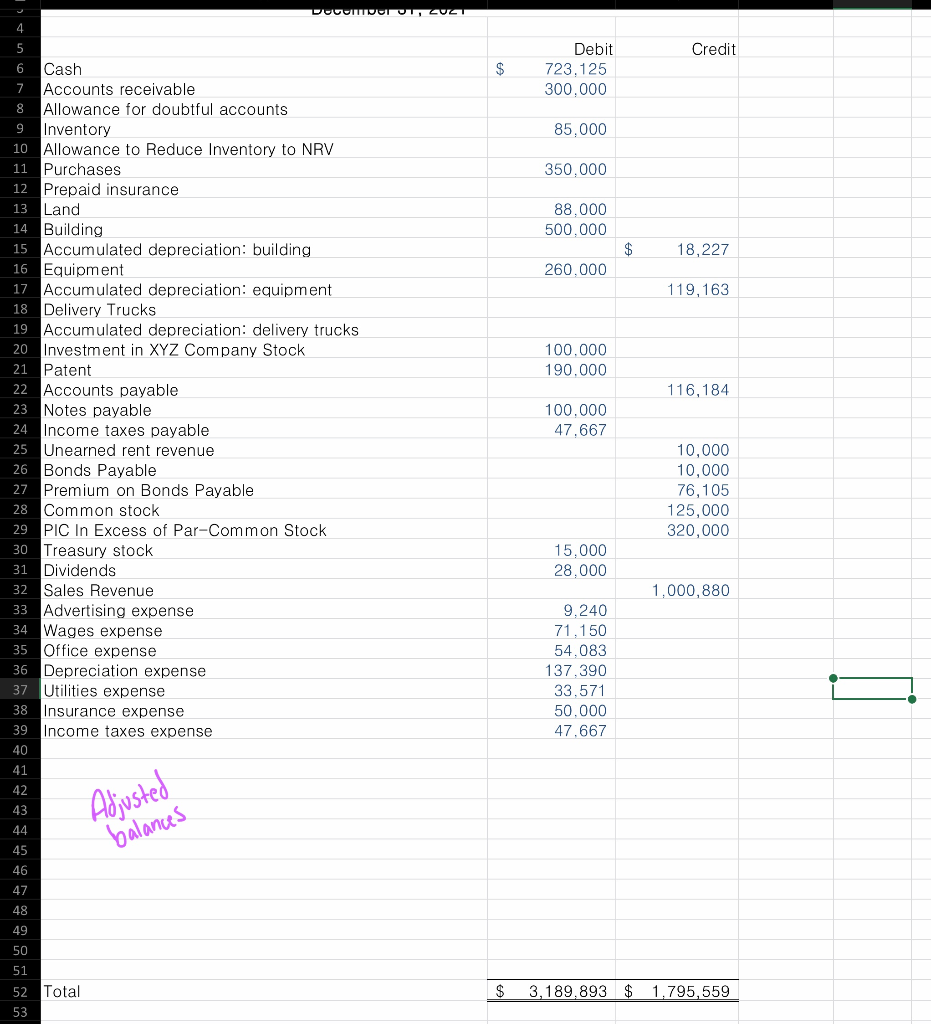

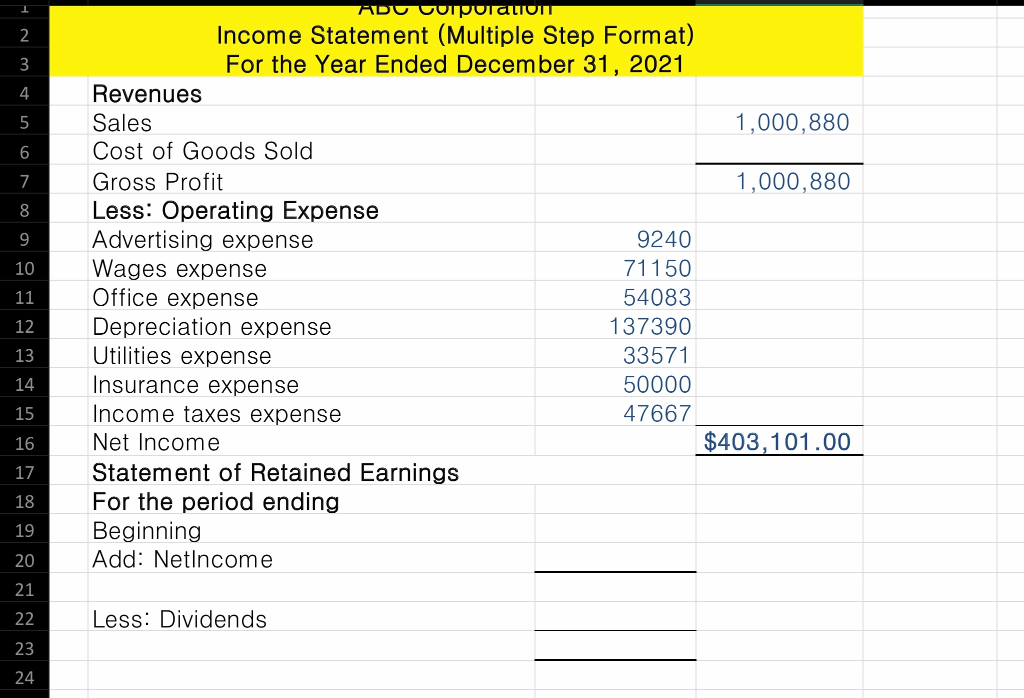

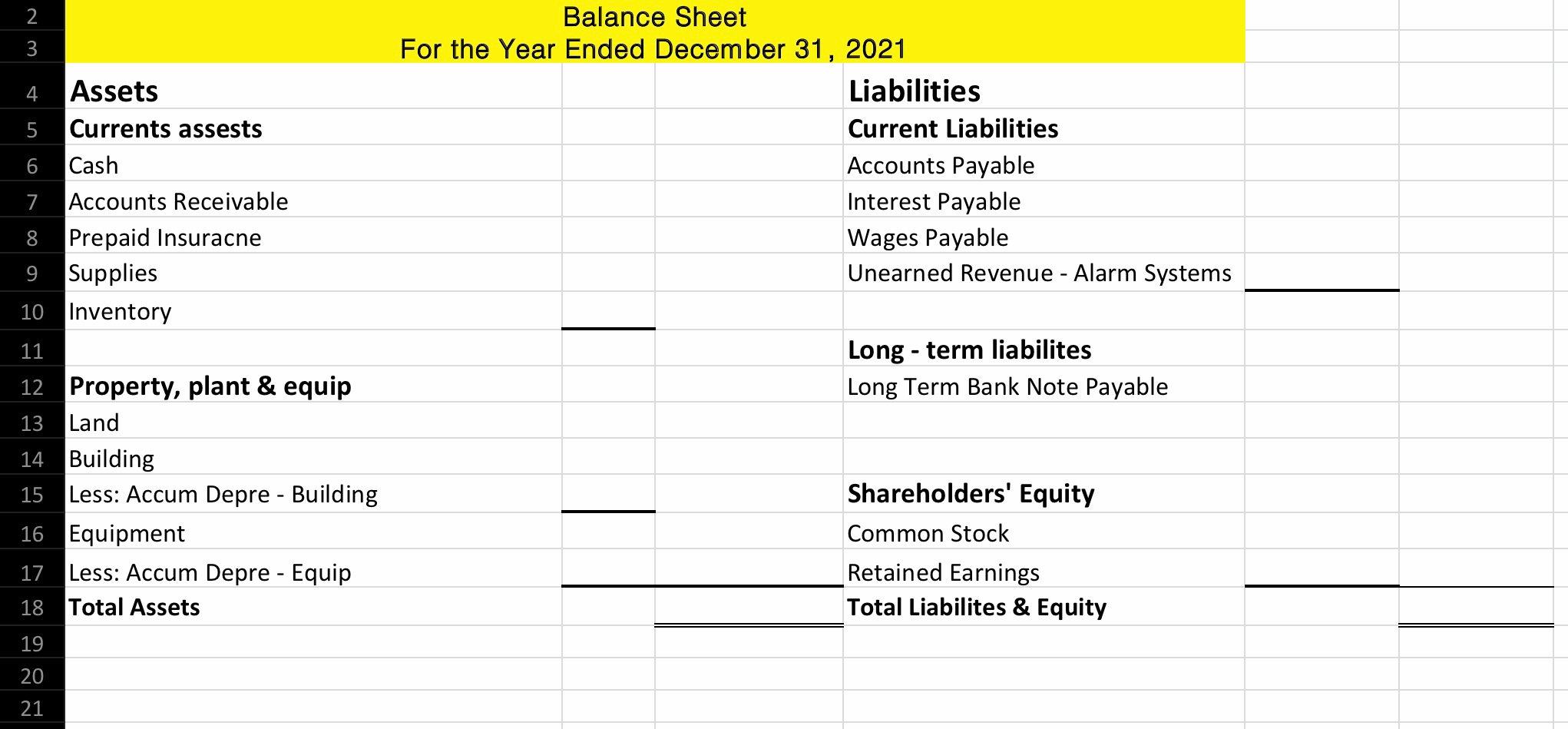

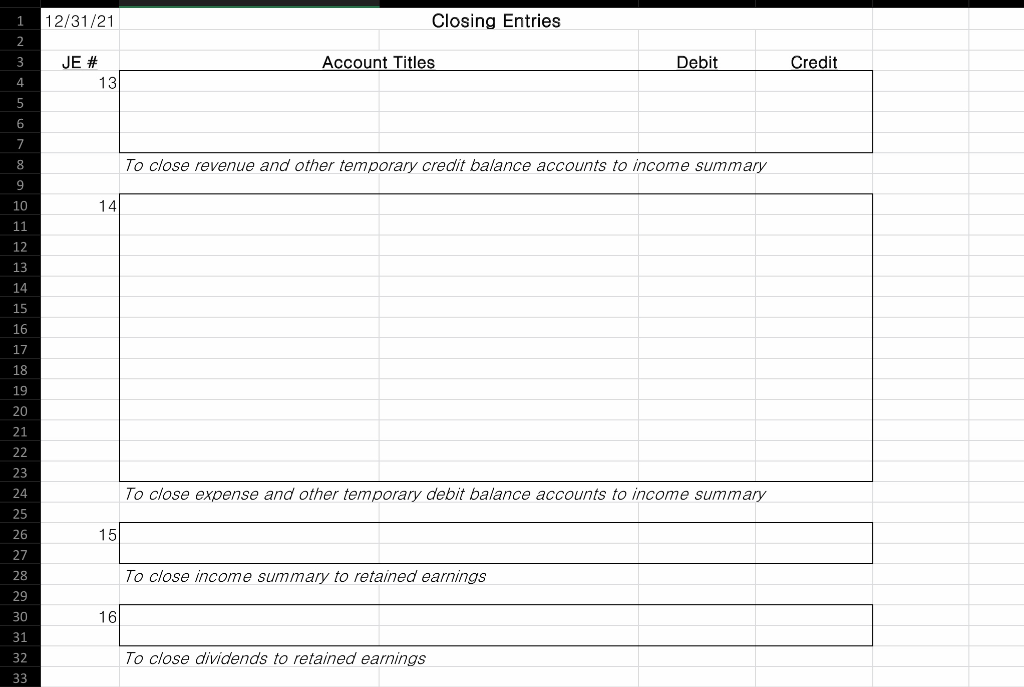

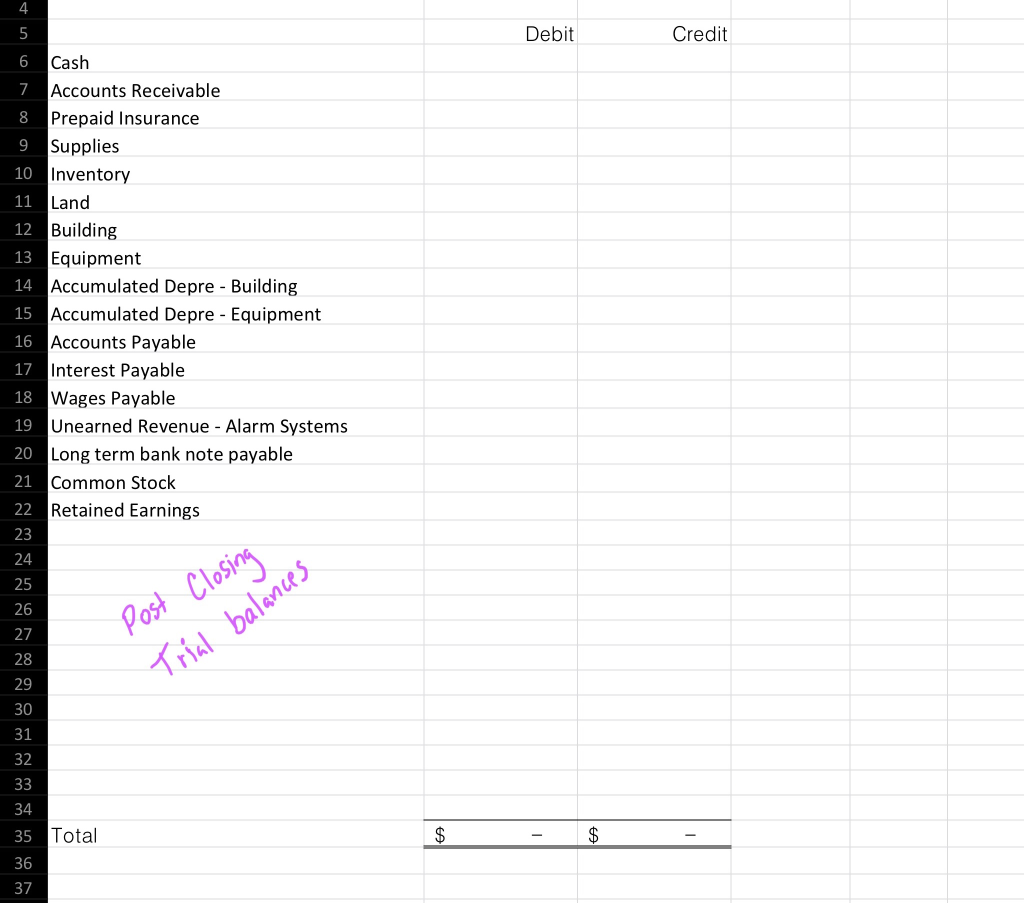

2 Unadjusted Trial Balance 3 December 31, 2021 4 5 Debit Credit 6 Cash 393,125 7 Accounts receivable 300,000 8 Allowance for doubtful accounts 9 Inventory 10 Allowance to Reduce Inventory to NRV 11 Purchases 350,000 12 Prepaid insurance 4,167 13 Land 88,000 14 Building 500,000 15 Accumulated depreciation: building 16,570 16 Equipment 260,000 17 Accumulated depreciation: equipment 108,330 18 Delivery Trucks 19 Accumulated depreciation: delivery trucks 20 Investment in XYZ Company Stock 100,000 21 Patent 200,000 22 Accounts payable 116,184 23 Notes payable 100,000 24 Income taxes payable 47,667 25 Unearned rent revenue 15,000 26 Bonds Payable 1,000,000 27 Premium on Bonds Payable 81,105 28 Common stock 125,000 29 PIC In Excess of Par-Common Stock 40,000 30 Retained earnings 31 Treasury stock 50,000 32 Dividends 28,000 33 Sales Revenue 1,000,880 34 Unrealized Holding Losses/Gains on Trading Securities-NI 35 Advertising expense 9,240 36 Wages expense 62,150 37 Office expense 54,083 38 Depreciation expense 124,900 39 Utilities expense 33,571 40 Insurance expense 45,833 Income taxes expense 47,667 42 $ 2,650,736 $ 2,650,736 43 41 1 2 3 4 1 On January 1, 2021, ABC purchased a one-year liability insurance policy for $50.000 Upon purchase, the following journal entry was made: Dr Prepaid insurance 50,000 Cr Cash 50,000 The expired portion of insurance must be recorded as of 12/31/21. Notice that the expired portion from January through November has been recorded already. Make sure that the Prepaid Insurance balance after the adjusting entry is correct. 5 6 8 9 10 11 12 13 2 Depreciation expense must be recorded for the month of December The building was purchased on February 1, 2021 for $500,000 with a remaining useful life of 25 years and a salvage value of $3,000 The method of depreciation for the building is straight-line. The equipment was purchased on February 1, 2021 for $260,000 with a remaining useful life of 4 years and a salvage value of $1,800 The method of depreciation for the equipment is double-declining balance. Depreciation has been recorded for the building and equipment for months February through November. 14 15 16 16 17 17 18 18 19 19 20 20 21 22 23 24 25 26 27 28 29 30 31 3 On December 1, 2021, XYZ Co. agreed to rent space in ABC s building for $5,000 per month, and XYZ paid ABC on December 1 in advance for the first three months' rent. The entry made on December 1 was as follows: Dr Cash 15,000 Cr Unearned rent revenue 15,000 The unearned revenue account must be adjusted to reflect the amount earned as of 12/31/21. 4 Per timecards, from the last payroll date through December 31, 2021, ABC's employees have worked a total of 300 hours. Including payroll taxes, ABC's wage expense averages about $30 per hour. The next payroll date is January 5, 2022. The liability for wages payable must be recorded as of 12/31/21 33 34. 35 5 On November 30, 2021, ABC borrowed $100,000 from American National Bank by issuing an interest-bearing note payable. This loan is to be repaid in three months (on February 28. 2022), along with interest computed at an annual rate of 7%. The entry made on November 30 to record the borrowing was: Dr Cash 100.000 Cr Notes payable 100,000 On February 28, 2022 ABC must pay the bank the amount borrowed plus interest. Assume the beginning balance for Notes Payable is correct. Interest through 12/31/21 must be accrued on the $100,000 note. 6 ABC uses a periodic inventory system, and the ending inventory for each year is determined by taking a complete physical inventory at year-end. A physical count was taken on December 31, 2021, and the inventory on-hand at that time totaled $85.000, which reflects historical cost. Record the adjusting entry for properly recognizing 2021 Cost of Goods Sold. Hint: This was the first year of operations, so beginning inventory balance is zero. 36 37 38 39 40 41 42 13 43 44 45 46 45 47 * 48 * 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 Additionally, ABC adheres to GAAP by recording ending inventory at the lower of cost and net realizable value at a total inventory level. A review of inventory data further indicated that the current retail sales value of the ending inventory is $75.000 and estimated costs of completion and shipping is 8% of retail. Be sure to make an additional adjustment, if necessary, to properly value ending inventory using the Loss and Allowance methodology. For Income Statement presentation purposes, be sure to use the Loss Method for accounting for adjustments of inventory to market value. 7 It would be unusual for a company to have an asset impairment in Year 1, but for the sake of this example, ABC determined that their intangible asset might be impaired on December 31, 2021. Record the impairment adjustment, if any. The expected future undiscounted net cash flows for this intangible asset totals $175,000, and the fair value of the asset is $165,000. 8 On 7/1/21, ABC purchased 5,000 shares of its own stock from existing stockholders as treasury stock. The cost of the treasury stock was $10 per share, or $50,000 in total. The effects of this transaction are already shown in the unadjusted trial balance. On 12/31/21, ABC reissued 2.000 shares of the treasury stock at $15 per share. Record the journal entry required for the reissuance of the treasury stock. To refresh your memory, treasury stock is usually accounted for at cost. When treasury stock is reissued for more than its cost, a separate Paid-in Capital-Treasury Stock account should be used to account for the excess proceeds over cost. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review.) 64 65 7 It would be unusual for a company to have an asset impairment in Year 1, but for the sake of this example, ABC determined that their intangible asset might be impaired on December 31, 2021. Record the impairment adjustment, if any. The expected future undiscounted net cash flows for this intangible asset totals $175,000, and the fair value of the asset is $165,000 54 55 56 57 58 59 60 61 62 63 8 On 7/1/21, ABC purchased 5,000 shares of its own stock from existing stockholders as treasury stock. The cost of the treasury stock was $10 per share, or $50,000 in total. The effects of this transaction are already shown in the unadjusted trial balance. On 12/31/21, ABC reissued 2,000 shares of the treasury stock at $15 per share. Record the journal entry required for the reissuance of the treasury stock. To refresh your memory, treasury stock is usually accounted for at cost. When treasury stock is reissued for more than its cost, a separate Paid-in Capital-Treasury Stock account should be used to account for the excess proceeds over cost. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review.) 64 65 66 67 68 69 70 71 72 73 74 9 On 12/31/21, ABC issued 20,000 shares of $1 par value common stock at the closing market price of $15 per share. Prepare ABC's journal entry to reflect the issuance of the stock on 12/31/21. To refresh your memory, a Paid-in Capital in Excess of Par account should be used to account fo excess proceeds over par value in a stock issuance transaction. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review.) 10 On 7/1/21, ABC sold 10% bonds having a maturity value of $1,000,000 for $1.081,105, resulting in an effective yield of 8%. The bonds are dated 7/1/21, and mature 7/1/26. Interest is payable semiannually on July 1 and January 1. ABC uses the effective interest method of amortization for bond premium or discount. Record the adjusting entry for the accrual of interest and the related amortization on 12/31/21. Hint: Develop an abbreviated amortization schedule to accurately determine the interest expense. 75 76 77 78 79 80 81 82 83 11 ABC Corporation prepares an aging schedule on 12/31/21 that estimates total uncollectible accounts at $40,000. Assuming that the allowance method is used, prepare the entry to record bad debt expense for the calendar year. 12 ABC Corporation purchased 5,000 shares of XYZ Company common stock for $20.00 per share on 11/30/21. The investment represents a 5% voting interest and is classified as a trading security. At 12/31/21, the stock is trading at $25.00 per share. Prepare the appropriate adjusting journal entry for end-of-year valuation purposes. 13 On 12/31/21, ABC Corporation exchanged equipment for two pickup trucks. The book value and fair value of the equipment given up were $20,000 (original cost of $65,000 less accumulated depreciation of $45,000) and $17,000, respectively. Assume ABC paid $8,000 in cash and the exchange has commercial substance. Prepare the approriate journal entry to reflect the nonmonetary exchange. 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 14 Do this final adjusting entry after preparing the Income Statement through the line "Income Before Income Taxes": Corporate taxes are due in four estimated quarterly payments on April 15, June 15, September 15, and December 15. However, for the purposes of this ABC illustration, we will assume that estimates are not paid, and that the tax is paid in full on the return's March 15, 2022 due date. ABC's income tax rate is 20%. The entire year's income tax expense was estimated at the beginning of 2021 to be $52,000, so January through November income tax expense recognized amounts to $47,667 (11/12 months). Since we are assuming estimates are not paid during the year, the balance in Income taxes payable represents income tax accrued for January through November. Assume no deferred tax assets or deferred tax liabilities. Based on the income before income taxes figure from the income statement, calculate and record December's income tax expense adjustment so that the entire year's tax expense is correct (i.e. the difference between total income tax expense and the amount already accrued through Novem 100 101 102 103 104 105 JE # Credit Debit 4167 Account Titles 1 Insurance Expense Prepaid Insurance To record expired insurance for December 4167 6 8 12490 2 Depreciation Expense Accumulated Depreciation - Building Accumulated Depreciation - Equipment To record monthly depreciation for building and equipment 1657 10833 5000 3 Unearned Rent Revenue Rent Revenue To record month month rent revenue earned 5000 9000 4 Wage Expense Wages Payable To record accrued wages payable 9000 583 5 Interest Expense Interest Payable To accrue interest for 1 month on note payable 583 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 6 Cost of goods sold Inventory Purchases 85000 To recognize COGS and adjustment of inventory balance To record year-end market value adjustment to reflect LCM 10000 7 Loss on impairment Patent To record impairment on patent 10000 30000 8 Cash Treasury stock Paid in capital To record reissuance of treasury stock 25000 35000 41 300000 9 Cash Common stock Paid in capital To record proceeds from issuance of common stock 20000 280000 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 43244 5000 10 Interest Expense Premium on Bonds Payable Interest Payable To record the accrual of interest and discount amortization 38244 11 Bad Debit Expense Allowance for Doubtful Accounts To record the estimate for bad debts expense 40000 40000 57 43 44 300000 45 9 Cash Common stock Paid in capital To record proceeds from issuance of common stock 20000 280000 46 47 48 49 43244 5000 50 10 Interest Expense Premium on Bonds Payable Interest Payable To record the accrual of interest and discount amortization 51 38244 52 53 54 55 56 57 11 Bad Debit Expense Allowance for Doubtful Accounts To record the estimate for bad debts expense 40000 40000 58 12 59 60 To record end of year adjusting entry for stock investment 61 62 13 63 64 65 66 67 To record accounting entry for nonmonetary exchange 68 69 70 71 14 Income tax expense Income tax payable To record adjusting entry for annual income tax expense 72 73 DUUUMOUR UTILUSI 4 Credit Debit 723.125 300,000 85.000 350.000 88,000 500.000 18,227 260.000 119,163 100.000 190.000 116,184 6 Cash 7 Accounts receivable 8 Allowance for doubtful accounts 9 Inventory 10 Allowance to Reduce Inventory to NRV 11 Purchases 12 Prepaid insurance 13 Land 14 Building 15 Accumulated depreciation: building 16 Equipment 17 Accumulated depreciation: equipment 18 Delivery Trucks 19 Accumulated depreciation: delivery trucks 20 Investment in XYZ Company Stock 21 Patent 22 Accounts payable 23 Notes payable 24 Income taxes payable 25 Unearned rent revenue 26 Bonds Payable 27 Premium on Bonds Payable 28 Common stock 29 PIC In Excess of Par-Common Stock 30 Treasury stock 31 Dividends 32 Sales Revenue 33 Advertising expense 34 Wages expense 35 Office expense 36 Depreciation expense 37 Utilities expense 38 Insurance expense 39 Income taxes expense 40 100.000 47.667 10,000 10,000 76,105 125,000 320,000 15.000 28.000 1.000,880 9.240 71,150 54,083 137.390 33,571 50.000 47.667 41 42 43 Adjusted balances 44 45 46 47 48 49 50 51 52 Total 53 $ 3,189.893 $ 1,795,559 2 4 5 6 7 8 9 10 ADU Vorporation Income Statement (Multiple Step Format) For the Year Ended December 31, 2021 Revenues Sales 1,000,880 Cost of Goods Sold Gross Profit 1,000,880 Less: Operating Expense Advertising expense 9240 Wages expense 71150 Office expense 54083 Depreciation expense 137390 Utilities expense 33571 Insurance expense 50000 Income taxes expense 47667 Net Income $403,101.00 Statement of Retained Earnings For the period ending Beginning Add: Netlncome 11 12 13 14 15 16 17 18 19 20 21 22 Less: Dividends 23 24 2 3 4 Assets 5 Currents assests 6 Cash 7 Accounts Receivable 8 Prepaid Insuracne 9 Supplies 10 Inventory Balance Sheet For the Year Ended December 31, 2021 Liabilities Current Liabilities Accounts Payable Interest Payable Wages Payable Unearned Revenue - Alarm Systems 11 Long - term liabilites Long Term Bank Note Payable 12 Property, plant & equip 13 Land 14 Building 15 Less: Accum Depre - Building 16 Equipment 17. Less: Accum Depre - Equip 18 Total Assets Shareholders' Equity Common Stock Retained Earnings Total Liabilites & Equity 19 20 21 12/31/21 Closing Entries 3 Account Titles Debit Credit JE # 13 4 5 6 7 8 To close revenue and other temporary credit balance accounts to income summary 9 10 14 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 To close expense and other temporary debit balance accounts to income summary 15 27 28 To close income summary to retained earnings 29 30 16 31 32 To close dividends to retained earnings 33 4 5 Debit Credit 6 Cash 7 Accounts Receivable 8 Prepaid Insurance 9 Supplies 10 Inventory 11 Land 12 Building 13 Equipment 14 Accumulated Depre - Building 15 Accumulated Depre - Equipment 16 Accounts Payable 17 Interest Payable 18 Wages Payable 19 Unearned Revenue - Alarm Systems 20 Long term bank note payable 21 Common Stock 22 Retained Earnings 23 24 25 26 27 28 Post Closing Trial balances 29 30 31 32 33 34 35 Total 36 37 2 Unadjusted Trial Balance 3 December 31, 2021 4 5 Debit Credit 6 Cash 393,125 7 Accounts receivable 300,000 8 Allowance for doubtful accounts 9 Inventory 10 Allowance to Reduce Inventory to NRV 11 Purchases 350,000 12 Prepaid insurance 4,167 13 Land 88,000 14 Building 500,000 15 Accumulated depreciation: building 16,570 16 Equipment 260,000 17 Accumulated depreciation: equipment 108,330 18 Delivery Trucks 19 Accumulated depreciation: delivery trucks 20 Investment in XYZ Company Stock 100,000 21 Patent 200,000 22 Accounts payable 116,184 23 Notes payable 100,000 24 Income taxes payable 47,667 25 Unearned rent revenue 15,000 26 Bonds Payable 1,000,000 27 Premium on Bonds Payable 81,105 28 Common stock 125,000 29 PIC In Excess of Par-Common Stock 40,000 30 Retained earnings 31 Treasury stock 50,000 32 Dividends 28,000 33 Sales Revenue 1,000,880 34 Unrealized Holding Losses/Gains on Trading Securities-NI 35 Advertising expense 9,240 36 Wages expense 62,150 37 Office expense 54,083 38 Depreciation expense 124,900 39 Utilities expense 33,571 40 Insurance expense 45,833 Income taxes expense 47,667 42 $ 2,650,736 $ 2,650,736 43 41 1 2 3 4 1 On January 1, 2021, ABC purchased a one-year liability insurance policy for $50.000 Upon purchase, the following journal entry was made: Dr Prepaid insurance 50,000 Cr Cash 50,000 The expired portion of insurance must be recorded as of 12/31/21. Notice that the expired portion from January through November has been recorded already. Make sure that the Prepaid Insurance balance after the adjusting entry is correct. 5 6 8 9 10 11 12 13 2 Depreciation expense must be recorded for the month of December The building was purchased on February 1, 2021 for $500,000 with a remaining useful life of 25 years and a salvage value of $3,000 The method of depreciation for the building is straight-line. The equipment was purchased on February 1, 2021 for $260,000 with a remaining useful life of 4 years and a salvage value of $1,800 The method of depreciation for the equipment is double-declining balance. Depreciation has been recorded for the building and equipment for months February through November. 14 15 16 16 17 17 18 18 19 19 20 20 21 22 23 24 25 26 27 28 29 30 31 3 On December 1, 2021, XYZ Co. agreed to rent space in ABC s building for $5,000 per month, and XYZ paid ABC on December 1 in advance for the first three months' rent. The entry made on December 1 was as follows: Dr Cash 15,000 Cr Unearned rent revenue 15,000 The unearned revenue account must be adjusted to reflect the amount earned as of 12/31/21. 4 Per timecards, from the last payroll date through December 31, 2021, ABC's employees have worked a total of 300 hours. Including payroll taxes, ABC's wage expense averages about $30 per hour. The next payroll date is January 5, 2022. The liability for wages payable must be recorded as of 12/31/21 33 34. 35 5 On November 30, 2021, ABC borrowed $100,000 from American National Bank by issuing an interest-bearing note payable. This loan is to be repaid in three months (on February 28. 2022), along with interest computed at an annual rate of 7%. The entry made on November 30 to record the borrowing was: Dr Cash 100.000 Cr Notes payable 100,000 On February 28, 2022 ABC must pay the bank the amount borrowed plus interest. Assume the beginning balance for Notes Payable is correct. Interest through 12/31/21 must be accrued on the $100,000 note. 6 ABC uses a periodic inventory system, and the ending inventory for each year is determined by taking a complete physical inventory at year-end. A physical count was taken on December 31, 2021, and the inventory on-hand at that time totaled $85.000, which reflects historical cost. Record the adjusting entry for properly recognizing 2021 Cost of Goods Sold. Hint: This was the first year of operations, so beginning inventory balance is zero. 36 37 38 39 40 41 42 13 43 44 45 46 45 47 * 48 * 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 Additionally, ABC adheres to GAAP by recording ending inventory at the lower of cost and net realizable value at a total inventory level. A review of inventory data further indicated that the current retail sales value of the ending inventory is $75.000 and estimated costs of completion and shipping is 8% of retail. Be sure to make an additional adjustment, if necessary, to properly value ending inventory using the Loss and Allowance methodology. For Income Statement presentation purposes, be sure to use the Loss Method for accounting for adjustments of inventory to market value. 7 It would be unusual for a company to have an asset impairment in Year 1, but for the sake of this example, ABC determined that their intangible asset might be impaired on December 31, 2021. Record the impairment adjustment, if any. The expected future undiscounted net cash flows for this intangible asset totals $175,000, and the fair value of the asset is $165,000. 8 On 7/1/21, ABC purchased 5,000 shares of its own stock from existing stockholders as treasury stock. The cost of the treasury stock was $10 per share, or $50,000 in total. The effects of this transaction are already shown in the unadjusted trial balance. On 12/31/21, ABC reissued 2.000 shares of the treasury stock at $15 per share. Record the journal entry required for the reissuance of the treasury stock. To refresh your memory, treasury stock is usually accounted for at cost. When treasury stock is reissued for more than its cost, a separate Paid-in Capital-Treasury Stock account should be used to account for the excess proceeds over cost. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review.) 64 65 7 It would be unusual for a company to have an asset impairment in Year 1, but for the sake of this example, ABC determined that their intangible asset might be impaired on December 31, 2021. Record the impairment adjustment, if any. The expected future undiscounted net cash flows for this intangible asset totals $175,000, and the fair value of the asset is $165,000 54 55 56 57 58 59 60 61 62 63 8 On 7/1/21, ABC purchased 5,000 shares of its own stock from existing stockholders as treasury stock. The cost of the treasury stock was $10 per share, or $50,000 in total. The effects of this transaction are already shown in the unadjusted trial balance. On 12/31/21, ABC reissued 2,000 shares of the treasury stock at $15 per share. Record the journal entry required for the reissuance of the treasury stock. To refresh your memory, treasury stock is usually accounted for at cost. When treasury stock is reissued for more than its cost, a separate Paid-in Capital-Treasury Stock account should be used to account for the excess proceeds over cost. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review.) 64 65 66 67 68 69 70 71 72 73 74 9 On 12/31/21, ABC issued 20,000 shares of $1 par value common stock at the closing market price of $15 per share. Prepare ABC's journal entry to reflect the issuance of the stock on 12/31/21. To refresh your memory, a Paid-in Capital in Excess of Par account should be used to account fo excess proceeds over par value in a stock issuance transaction. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review.) 10 On 7/1/21, ABC sold 10% bonds having a maturity value of $1,000,000 for $1.081,105, resulting in an effective yield of 8%. The bonds are dated 7/1/21, and mature 7/1/26. Interest is payable semiannually on July 1 and January 1. ABC uses the effective interest method of amortization for bond premium or discount. Record the adjusting entry for the accrual of interest and the related amortization on 12/31/21. Hint: Develop an abbreviated amortization schedule to accurately determine the interest expense. 75 76 77 78 79 80 81 82 83 11 ABC Corporation prepares an aging schedule on 12/31/21 that estimates total uncollectible accounts at $40,000. Assuming that the allowance method is used, prepare the entry to record bad debt expense for the calendar year. 12 ABC Corporation purchased 5,000 shares of XYZ Company common stock for $20.00 per share on 11/30/21. The investment represents a 5% voting interest and is classified as a trading security. At 12/31/21, the stock is trading at $25.00 per share. Prepare the appropriate adjusting journal entry for end-of-year valuation purposes. 13 On 12/31/21, ABC Corporation exchanged equipment for two pickup trucks. The book value and fair value of the equipment given up were $20,000 (original cost of $65,000 less accumulated depreciation of $45,000) and $17,000, respectively. Assume ABC paid $8,000 in cash and the exchange has commercial substance. Prepare the approriate journal entry to reflect the nonmonetary exchange. 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 14 Do this final adjusting entry after preparing the Income Statement through the line "Income Before Income Taxes": Corporate taxes are due in four estimated quarterly payments on April 15, June 15, September 15, and December 15. However, for the purposes of this ABC illustration, we will assume that estimates are not paid, and that the tax is paid in full on the return's March 15, 2022 due date. ABC's income tax rate is 20%. The entire year's income tax expense was estimated at the beginning of 2021 to be $52,000, so January through November income tax expense recognized amounts to $47,667 (11/12 months). Since we are assuming estimates are not paid during the year, the balance in Income taxes payable represents income tax accrued for January through November. Assume no deferred tax assets or deferred tax liabilities. Based on the income before income taxes figure from the income statement, calculate and record December's income tax expense adjustment so that the entire year's tax expense is correct (i.e. the difference between total income tax expense and the amount already accrued through Novem 100 101 102 103 104 105 JE # Credit Debit 4167 Account Titles 1 Insurance Expense Prepaid Insurance To record expired insurance for December 4167 6 8 12490 2 Depreciation Expense Accumulated Depreciation - Building Accumulated Depreciation - Equipment To record monthly depreciation for building and equipment 1657 10833 5000 3 Unearned Rent Revenue Rent Revenue To record month month rent revenue earned 5000 9000 4 Wage Expense Wages Payable To record accrued wages payable 9000 583 5 Interest Expense Interest Payable To accrue interest for 1 month on note payable 583 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 6 Cost of goods sold Inventory Purchases 85000 To recognize COGS and adjustment of inventory balance To record year-end market value adjustment to reflect LCM 10000 7 Loss on impairment Patent To record impairment on patent 10000 30000 8 Cash Treasury stock Paid in capital To record reissuance of treasury stock 25000 35000 41 300000 9 Cash Common stock Paid in capital To record proceeds from issuance of common stock 20000 280000 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 43244 5000 10 Interest Expense Premium on Bonds Payable Interest Payable To record the accrual of interest and discount amortization 38244 11 Bad Debit Expense Allowance for Doubtful Accounts To record the estimate for bad debts expense 40000 40000 57 43 44 300000 45 9 Cash Common stock Paid in capital To record proceeds from issuance of common stock 20000 280000 46 47 48 49 43244 5000 50 10 Interest Expense Premium on Bonds Payable Interest Payable To record the accrual of interest and discount amortization 51 38244 52 53 54 55 56 57 11 Bad Debit Expense Allowance for Doubtful Accounts To record the estimate for bad debts expense 40000 40000 58 12 59 60 To record end of year adjusting entry for stock investment 61 62 13 63 64 65 66 67 To record accounting entry for nonmonetary exchange 68 69 70 71 14 Income tax expense Income tax payable To record adjusting entry for annual income tax expense 72 73 DUUUMOUR UTILUSI 4 Credit Debit 723.125 300,000 85.000 350.000 88,000 500.000 18,227 260.000 119,163 100.000 190.000 116,184 6 Cash 7 Accounts receivable 8 Allowance for doubtful accounts 9 Inventory 10 Allowance to Reduce Inventory to NRV 11 Purchases 12 Prepaid insurance 13 Land 14 Building 15 Accumulated depreciation: building 16 Equipment 17 Accumulated depreciation: equipment 18 Delivery Trucks 19 Accumulated depreciation: delivery trucks 20 Investment in XYZ Company Stock 21 Patent 22 Accounts payable 23 Notes payable 24 Income taxes payable 25 Unearned rent revenue 26 Bonds Payable 27 Premium on Bonds Payable 28 Common stock 29 PIC In Excess of Par-Common Stock 30 Treasury stock 31 Dividends 32 Sales Revenue 33 Advertising expense 34 Wages expense 35 Office expense 36 Depreciation expense 37 Utilities expense 38 Insurance expense 39 Income taxes expense 40 100.000 47.667 10,000 10,000 76,105 125,000 320,000 15.000 28.000 1.000,880 9.240 71,150 54,083 137.390 33,571 50.000 47.667 41 42 43 Adjusted balances 44 45 46 47 48 49 50 51 52 Total 53 $ 3,189.893 $ 1,795,559 2 4 5 6 7 8 9 10 ADU Vorporation Income Statement (Multiple Step Format) For the Year Ended December 31, 2021 Revenues Sales 1,000,880 Cost of Goods Sold Gross Profit 1,000,880 Less: Operating Expense Advertising expense 9240 Wages expense 71150 Office expense 54083 Depreciation expense 137390 Utilities expense 33571 Insurance expense 50000 Income taxes expense 47667 Net Income $403,101.00 Statement of Retained Earnings For the period ending Beginning Add: Netlncome 11 12 13 14 15 16 17 18 19 20 21 22 Less: Dividends 23 24 2 3 4 Assets 5 Currents assests 6 Cash 7 Accounts Receivable 8 Prepaid Insuracne 9 Supplies 10 Inventory Balance Sheet For the Year Ended December 31, 2021 Liabilities Current Liabilities Accounts Payable Interest Payable Wages Payable Unearned Revenue - Alarm Systems 11 Long - term liabilites Long Term Bank Note Payable 12 Property, plant & equip 13 Land 14 Building 15 Less: Accum Depre - Building 16 Equipment 17. Less: Accum Depre - Equip 18 Total Assets Shareholders' Equity Common Stock Retained Earnings Total Liabilites & Equity 19 20 21 12/31/21 Closing Entries 3 Account Titles Debit Credit JE # 13 4 5 6 7 8 To close revenue and other temporary credit balance accounts to income summary 9 10 14 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 To close expense and other temporary debit balance accounts to income summary 15 27 28 To close income summary to retained earnings 29 30 16 31 32 To close dividends to retained earnings 33 4 5 Debit Credit 6 Cash 7 Accounts Receivable 8 Prepaid Insurance 9 Supplies 10 Inventory 11 Land 12 Building 13 Equipment 14 Accumulated Depre - Building 15 Accumulated Depre - Equipment 16 Accounts Payable 17 Interest Payable 18 Wages Payable 19 Unearned Revenue - Alarm Systems 20 Long term bank note payable 21 Common Stock 22 Retained Earnings 23 24 25 26 27 28 Post Closing Trial balances 29 30 31 32 33 34 35 Total 36 37