Question

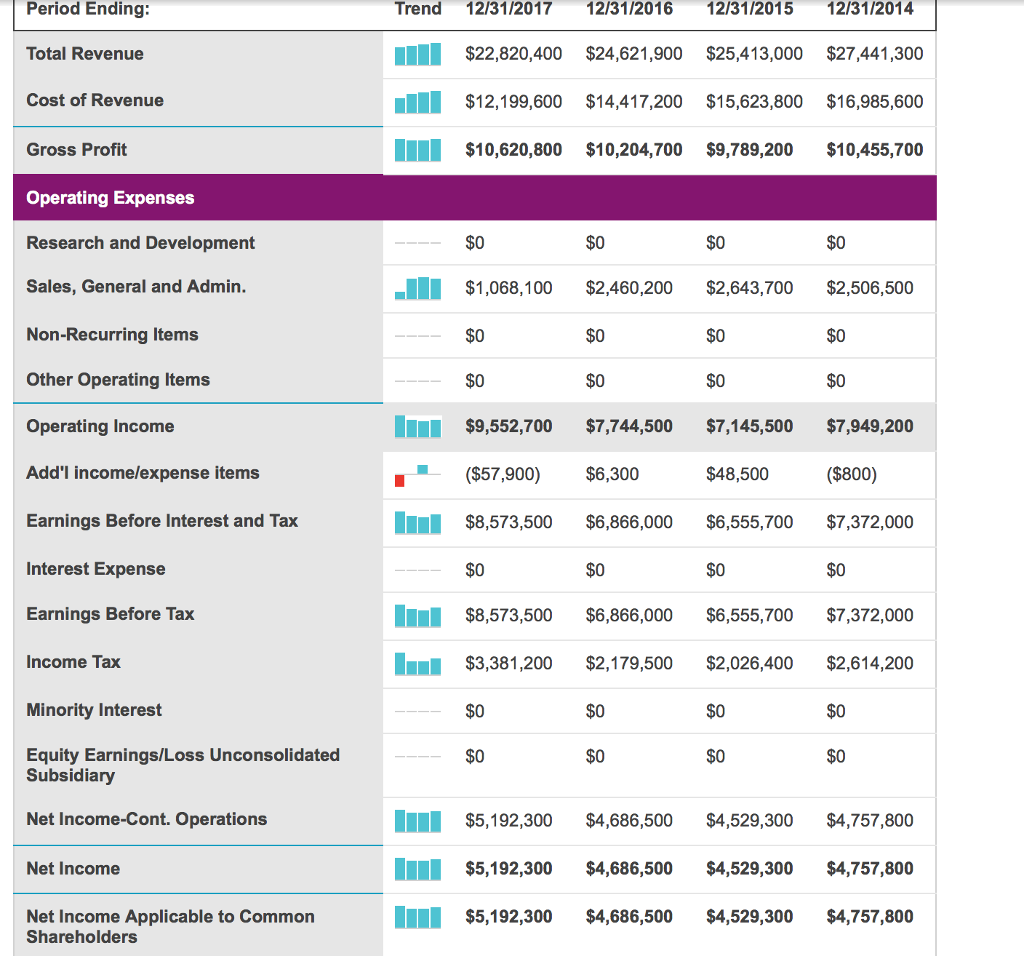

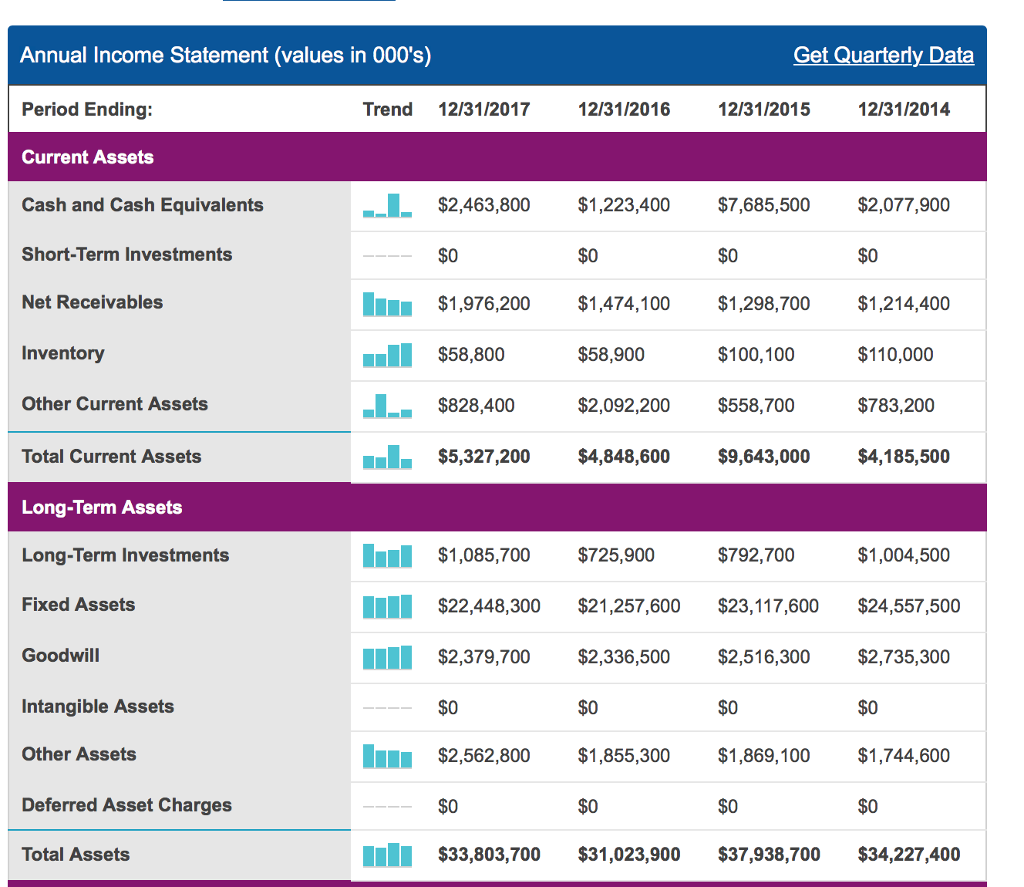

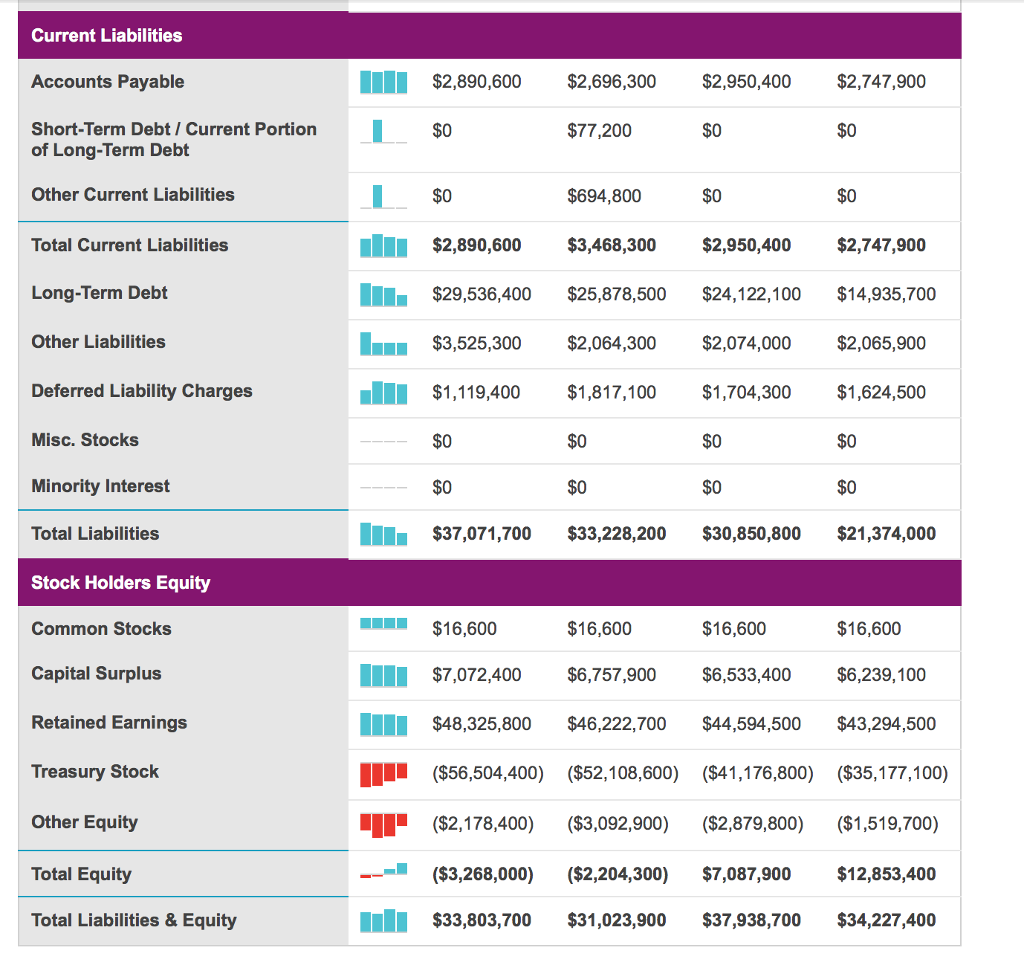

Need the following answers for the ratios below for McDonald's company. Answers must be for the 2016 year. Please show how you got your answers

Need the following answers for the ratios below for McDonald's company. Answers must be for the 2016 year. Please show how you got your answers so I can understand how to do the problems

Profitability Ratios

Return on Total Assets

Return on stockholders equity

Return on common equity

Operating profit margin

Net Profit margin

Liquidity Ratios

Current Ratio

Quick Ratio

Inventory to net working capital

Leverage Ratios

Debt-to-assets

Debt-to-equity

Long-term debt-to-equity

Times-interest-earned

Fixed charge coverage

Activity Ratios

Inventory Turnover

Fixed-assets turnover

Total assets turnover

Accounts receivables turnover

Average collecting period

Shareholders Return Ratios

Dividend yield common stock

Price-earnings ratio

Dividend payout ratio

Cash flow per share

Period Ending Trend 12/31/2017 12/31/2016 12/31/2015 12/31/2014 $22,820,400 $24,621,900 $25,413,000 $27,441,300 $12,199,600 $14,417,200 $15,623,800 $16,985,600 $10,620,800 $10,204,700 $9,789,200 $10,455,700 Total Revenue Cost of Revenue Gross Profit Operating Expenses Research and Development Sales, General and Admin. Non-Recurring Items Other Operating Items Operating Income Add'l income/expense items Earnings Before Interest and Tax Interest Expense Earnings Before Tax $0 $0 $0 $0 $1,068,100 $2,460,200 $2,643,700 $2,506,500 $0 $0 $0 $0 $0 $0 $0 $9,552,700 $7,744,500 $7,145,500 $7,949,200 ($57,900) S6,300 $48,500 ($800) $8,573,500 $6,866,000 $6,555,700 $7,372,000 $0 $0 $0 $0 $8,573,500 $6,866,000 $6,555,700 $7,372,000 $3,381,200 $2,179,500 $2,026,400 $2,614,200 Incone Tax Minority Interest $0 $0 $0 $0 Equity Earnings/Loss Unconsolidated $0 $0 $0 $0 Subsidiary Net Income-Cont. Operations Net Income Net Income Applicable to Common $5,192,300 $4,686,500 $4,529,300 $4,757,800 $5,192,300 $4,686,500 $4,529,300 $4,757,800 $5,192,300 $4,686,500 $4,529,300 $4,757,800 ShareholdersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started