Question

Need the following answers for the ratios below for Starbucks company. Answers must be for the 2016 year. Please show how you got your answers

Need the following answers for the ratios below for Starbucks company. Answers must be for the 2016 year. Please show how you got your answers so I can understand how to do the problems

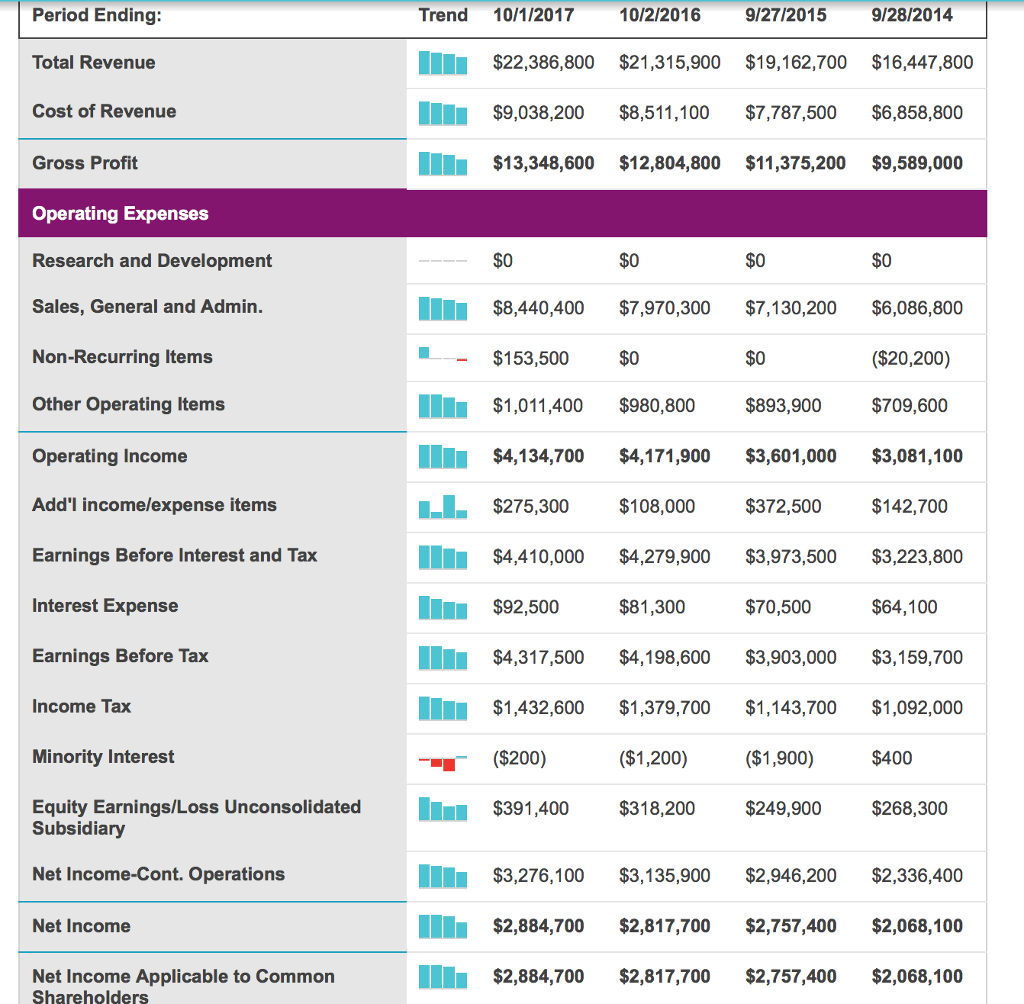

Profitability Ratios

Return on Total Assets

Return on stockholders equity

Return on common equity

Operating profit margin

Net Profit margin

Liquidity Ratios

Current Ratio

Quick Ratio

Inventory to net working capital

Leverage Ratios

Debt-to-assets

Debt-to-equity

Long-term debt-to-equity

Times-interest-earned

Fixed charge coverage

Activity Ratios

Inventory Turnover

Fixed-assets turnover

Total assets turnover

Accounts receivables turnover

Average collecting period

Shareholders Return Ratios

Dividend yield common stock

Price-earnings ratio

Dividend payout ratio

Cash flow per share

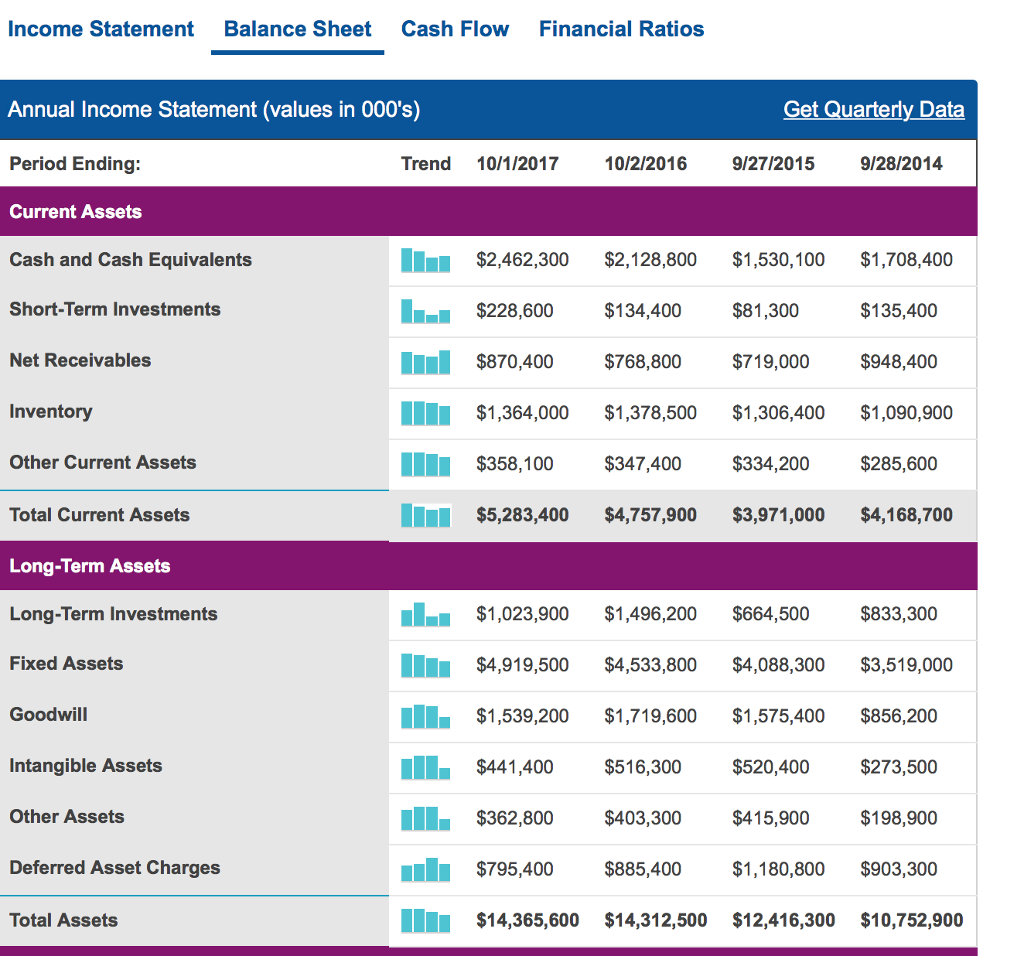

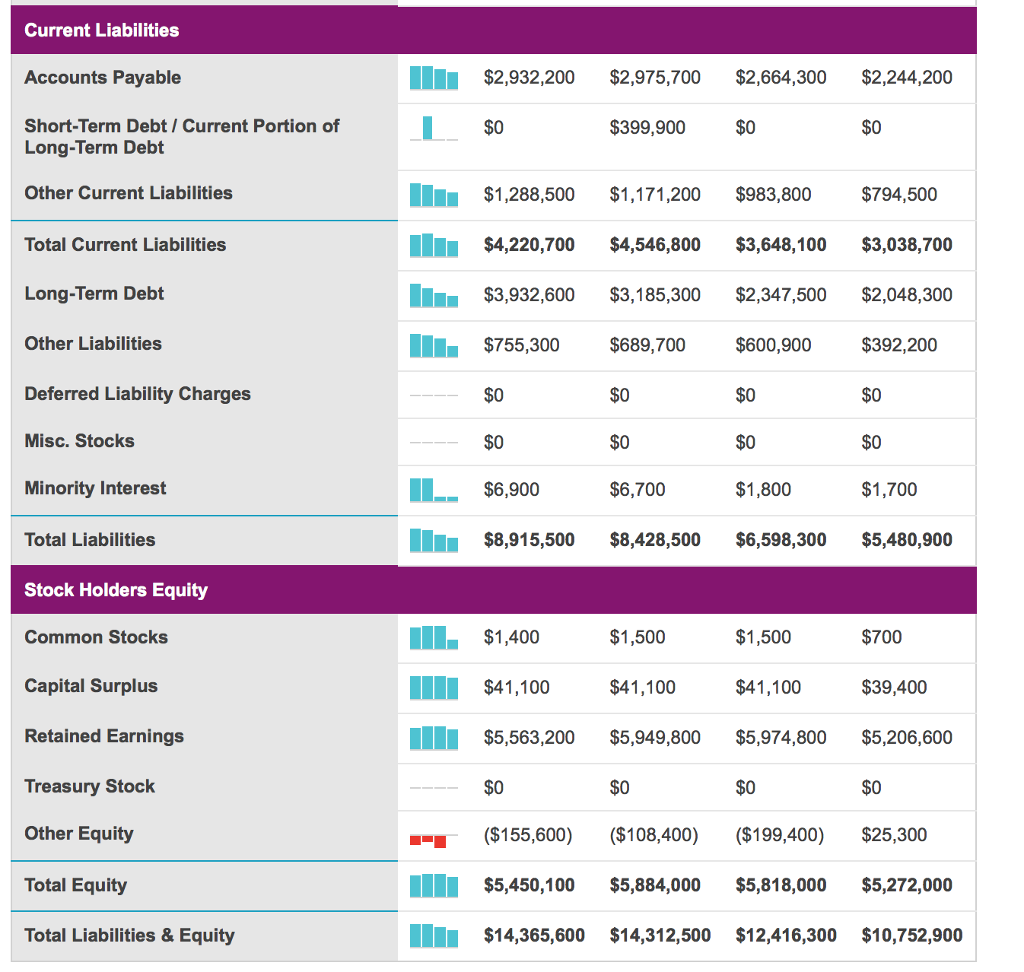

Income Statement Balance Sheet Cash Flow Financial Ratios Annual Income Statement (values in 000's) Period Ending Current Assets Cash and Cash Equivalents Short-Term Investments Net Receivables Get Quarterly Data Trend 10/1/2017 10/2/2016 9/27/2015 9/28/2014 $2,462,300 $2,128,800 $1,530,100 $1,708,400 $228,600 $134,400 $81,300 $135,400 $870,400$768,800 $719,000 $948,400 Inventory $1,364,000 $1,378,500 $1,306,400 $1,090,900 $358,100 $347,400 $334,200 Other Current Assets $285,600 Total Current Assets $5,283,400 $4,757,900 $3,971,000 $4,168,700 Long-Term ASsets Long-Term Investments Fixed Assets $1,023,900 $1,496,200 $664,500 $4,919,500 $4,533,800 $4,088,300 $3,519,000 $1,539,200 $1,719,600 $1,575,400 $856,200 $441,400 $516,300 $520,400 $273,500 $833,300 Goodwill Intangible Assets Other Assets $403,300 $415,900 $198,900 Deferred Asset Charges $795,400 $885,400$1,180,800 $903,300 Total Assets $14,365,600 $14,312,500 $12,416,300 $10,752,900Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started