Answered step by step

Verified Expert Solution

Question

1 Approved Answer

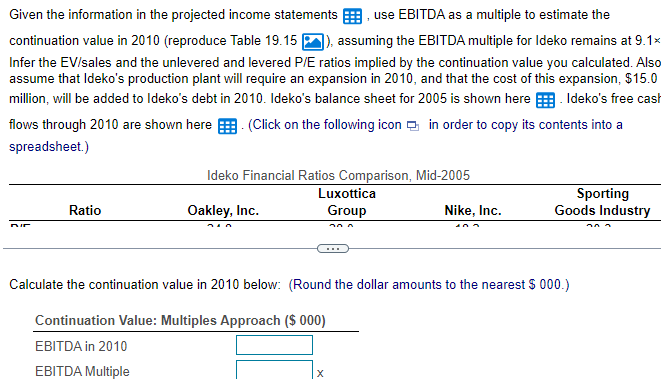

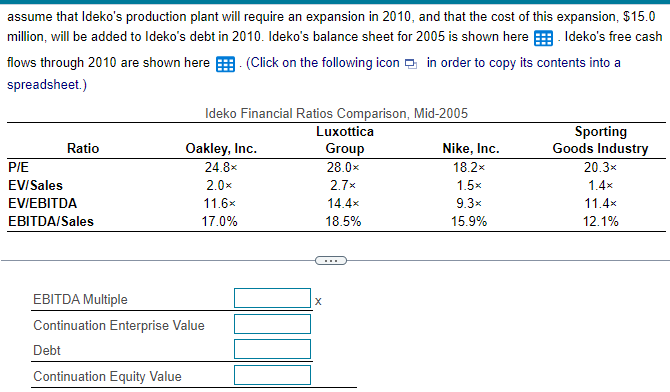

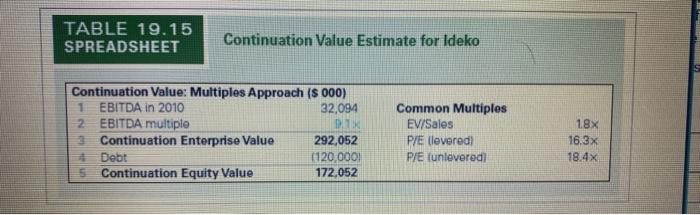

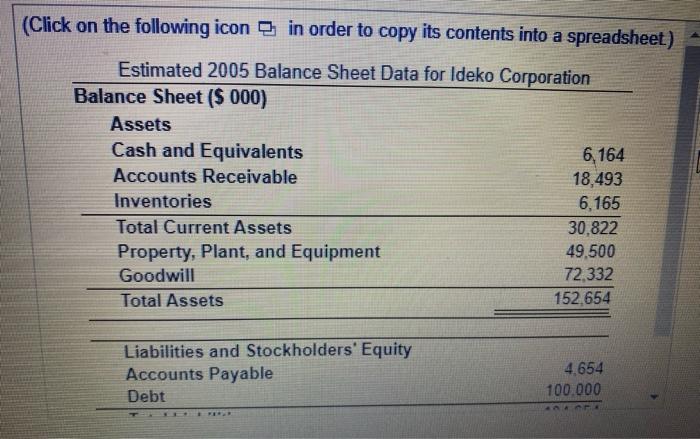

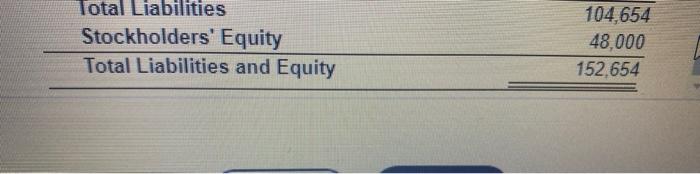

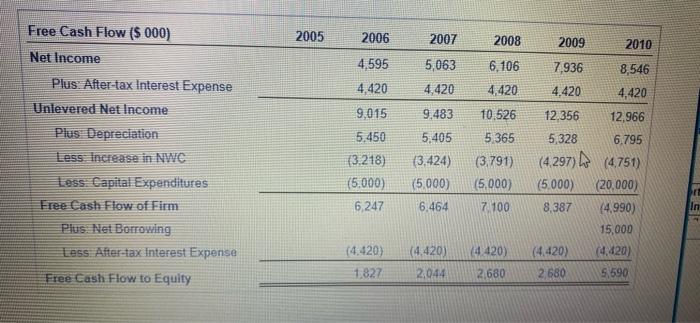

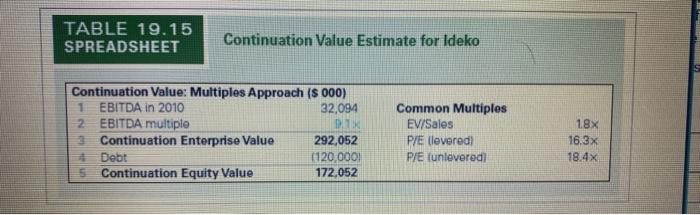

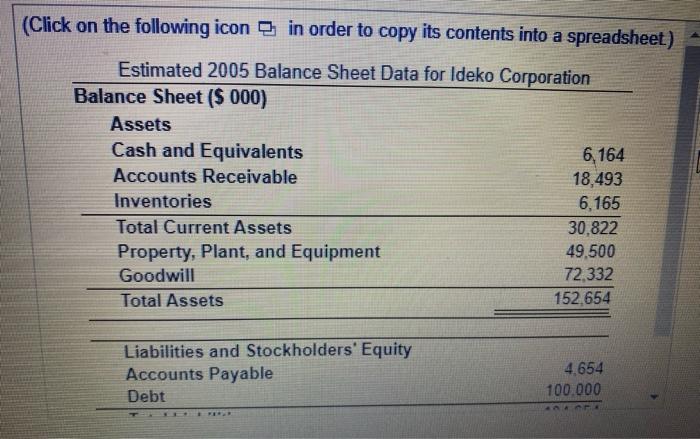

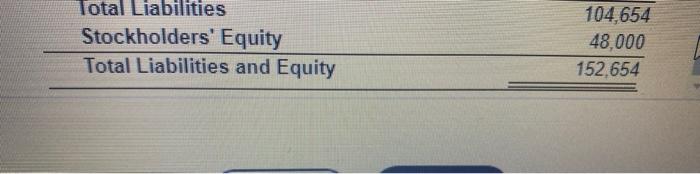

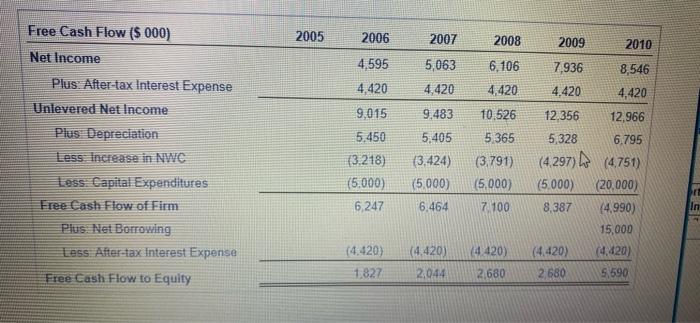

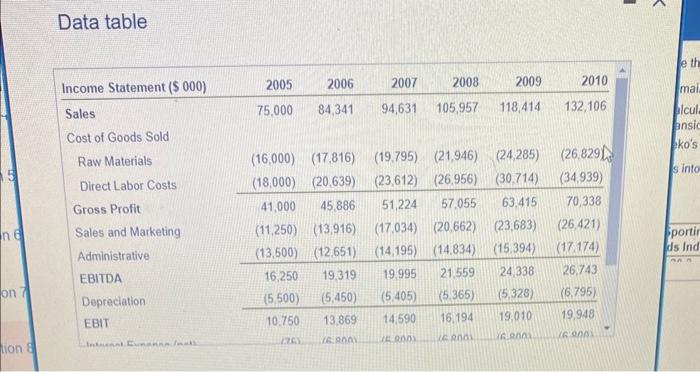

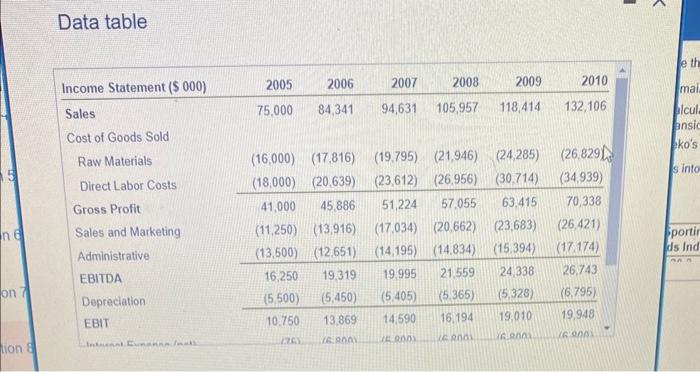

Need to answer the boxes below. The second picture is a scroll down to show everything, update: added all the charts a pictures (2&3) are

Need to answer the boxes below. The second picture is a scroll down to show everything,

update: added all the charts a pictures (2&3) are scroll down of the same table to fit everything.

income statement below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started