Answered step by step

Verified Expert Solution

Question

1 Approved Answer

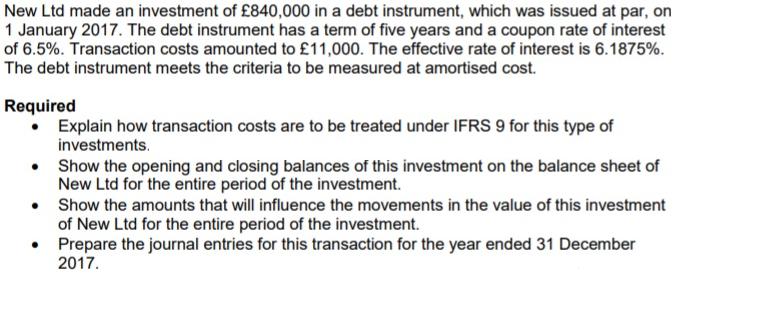

New Ltd made an investment of 840,000 in a debt instrument, which was issued at par, on 1 January 2017. The debt instrument has

New Ltd made an investment of 840,000 in a debt instrument, which was issued at par, on 1 January 2017. The debt instrument has a term of five years and a coupon rate of interest of 6.5%. Transaction costs amounted to 11,000. The effective rate of interest is 6.1875%. The debt instrument meets the criteria to be measured at amortised cost. Required Explain how transaction costs are to be treated under IFRS 9 for this type of investments. Show the opening and closing balances of this investment on the balance sheet of New Ltd for the entire period of the investment. Show the amounts that will influence the movements in the value of this investment of New Ltd for the entire period of the investment. Prepare the journal entries for this transaction for the year ended 31 December 2017.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Transaction costs are to be treated as an upfront cost and are to be deducted from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started