Question

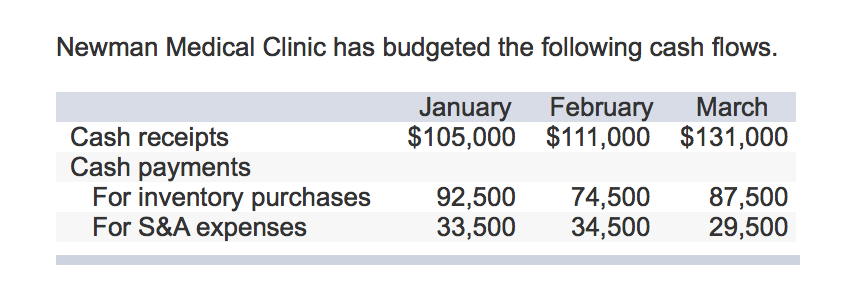

Newman Medical had a cash balance of $10,500 on January 1. The company desires to maintain a cash cushion of $10,000. Funds are assumed to

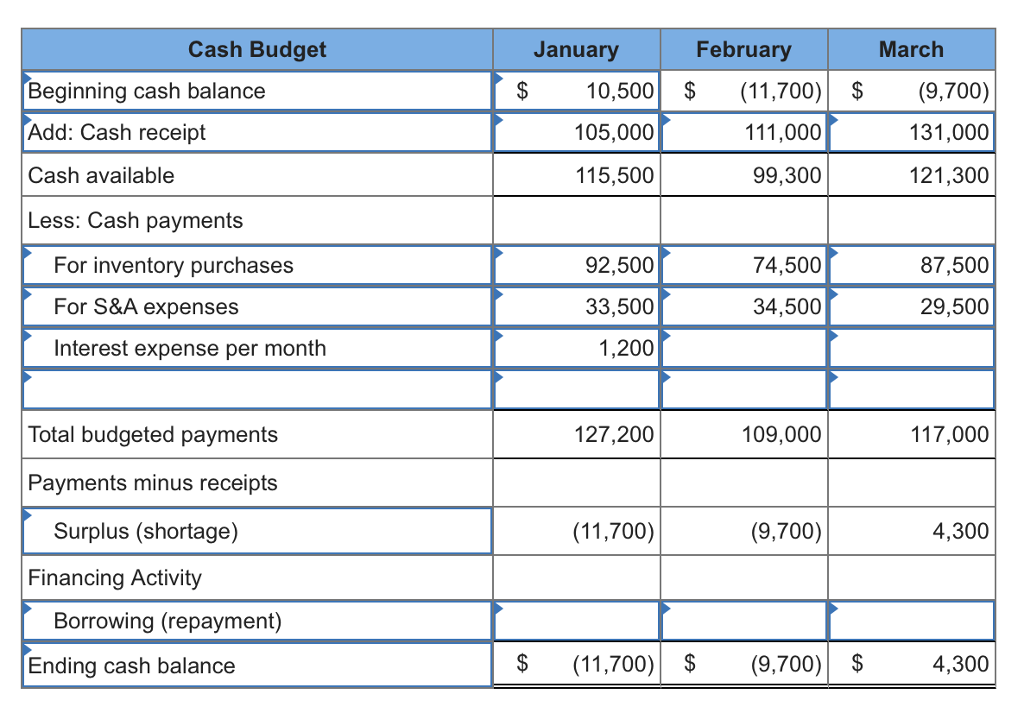

Newman Medical had a cash balance of $10,500 on January 1. The company desires to maintain a cash cushion of $10,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the interest rate is 3 percent per month. Repayments may be made in any amount available. Newman pays its vendors on the last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability account from this years quarterly results.

Newman Medical had a cash balance of $10,500 on January 1. The company desires to maintain a cash cushion of $10,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the interest rate is 3 percent per month. Repayments may be made in any amount available. Newman pays its vendors on the last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability account from this years quarterly results.  The only part I need help with is the Interest Expense per Month and the Borrowing (repayment). Can you please explain how you get these numbers? Thanks!

The only part I need help with is the Interest Expense per Month and the Borrowing (repayment). Can you please explain how you get these numbers? Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started