Question

Nick Andros of Streamline Company suggested that the company speculate in foreign currency as a partial hedge against its operations in the cattle market, which

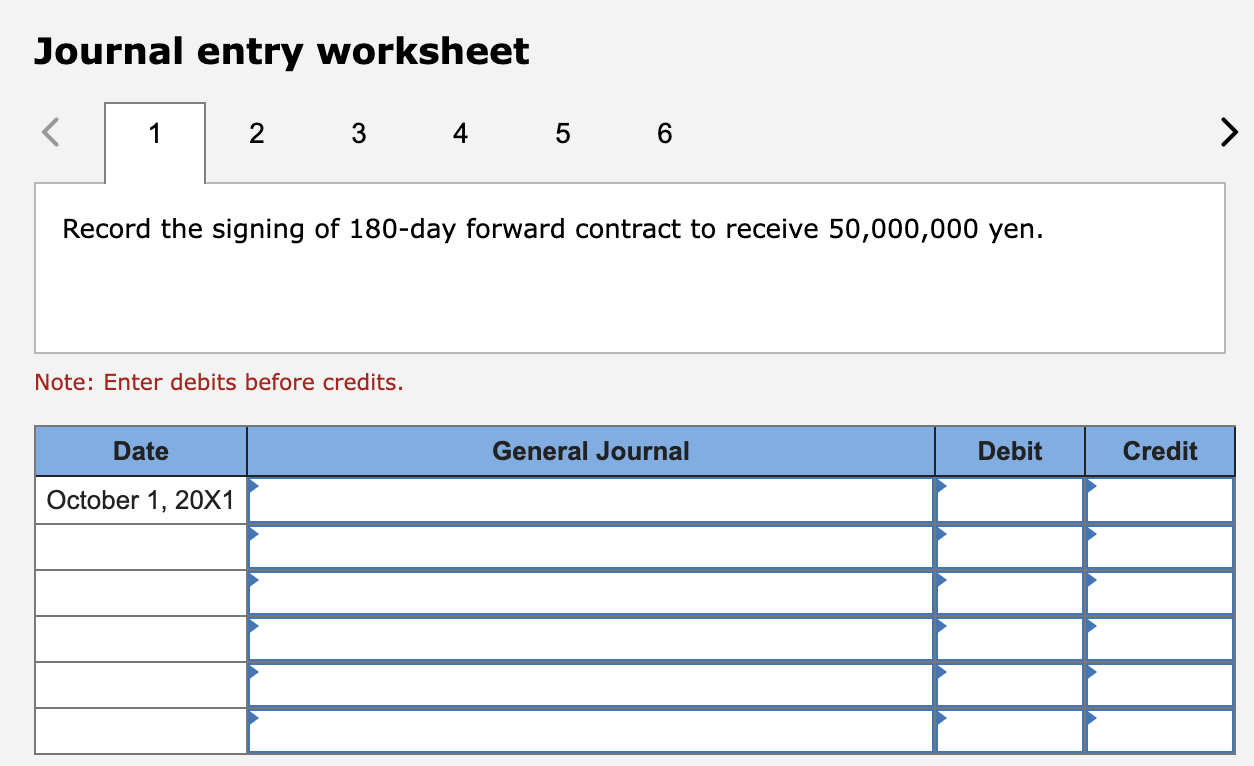

Nick Andros of Streamline Company suggested that the company speculate in foreign currency as a partial hedge against its operations in the cattle market, which fluctuates like a commodity market. On October 1, 20X1, Streamline bought a 180-day forward contract to purchase 50,000,000 yen () at a forward rate of 1 = $0.0075 when the spot rate was $0.0070. Other exchange rates were as follows:

| Date | Spot Rate | Forward Rate for March 31, 20X2 |

|---|---|---|

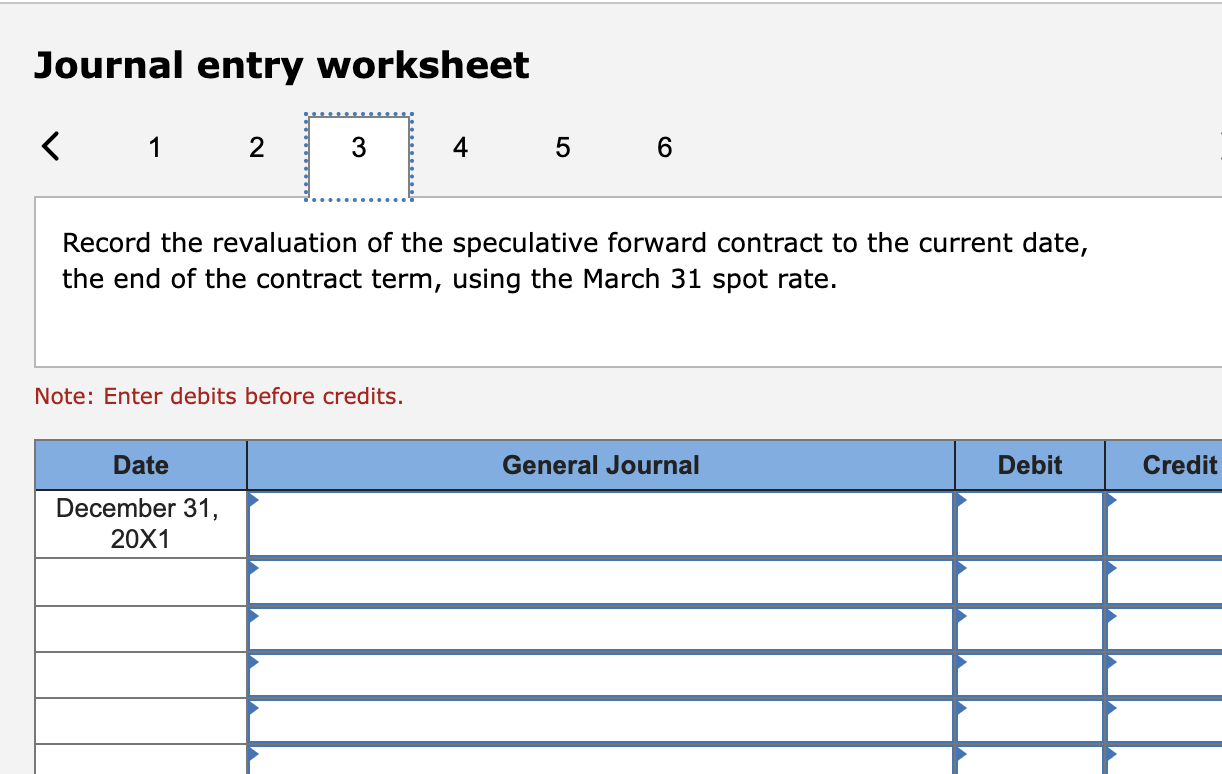

| December 31, 20X1 | $ 0.0073 | $ 0.0076 |

| March 31, 20X2 | 0.0072 |

Required:

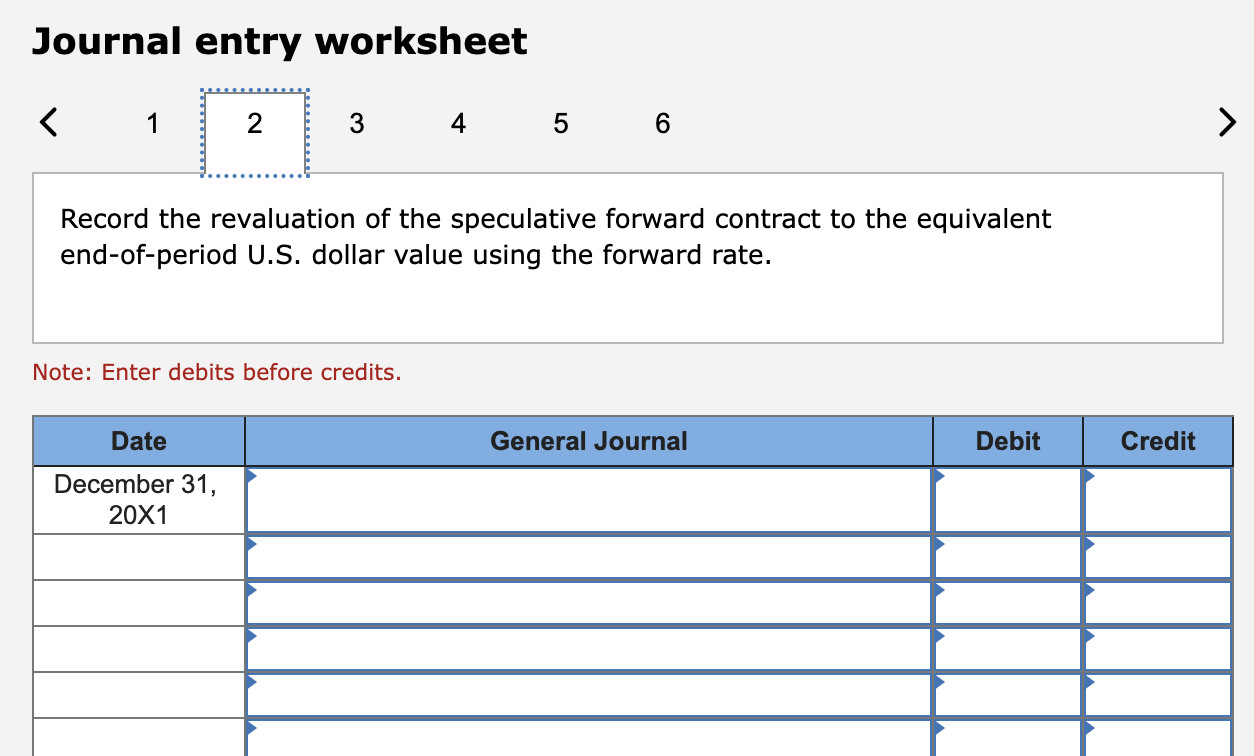

Prepare all journal entries related to Streamline Companys foreign currency speculation from October 1, 20X1, through March 31, 20X2, assuming the fiscal year ends on December 31, 20X1.

Did Streamline Company gain or lose on its purchase of the forward contract?

Did Streamline Company gain or lose on its purchase of the forward contract?

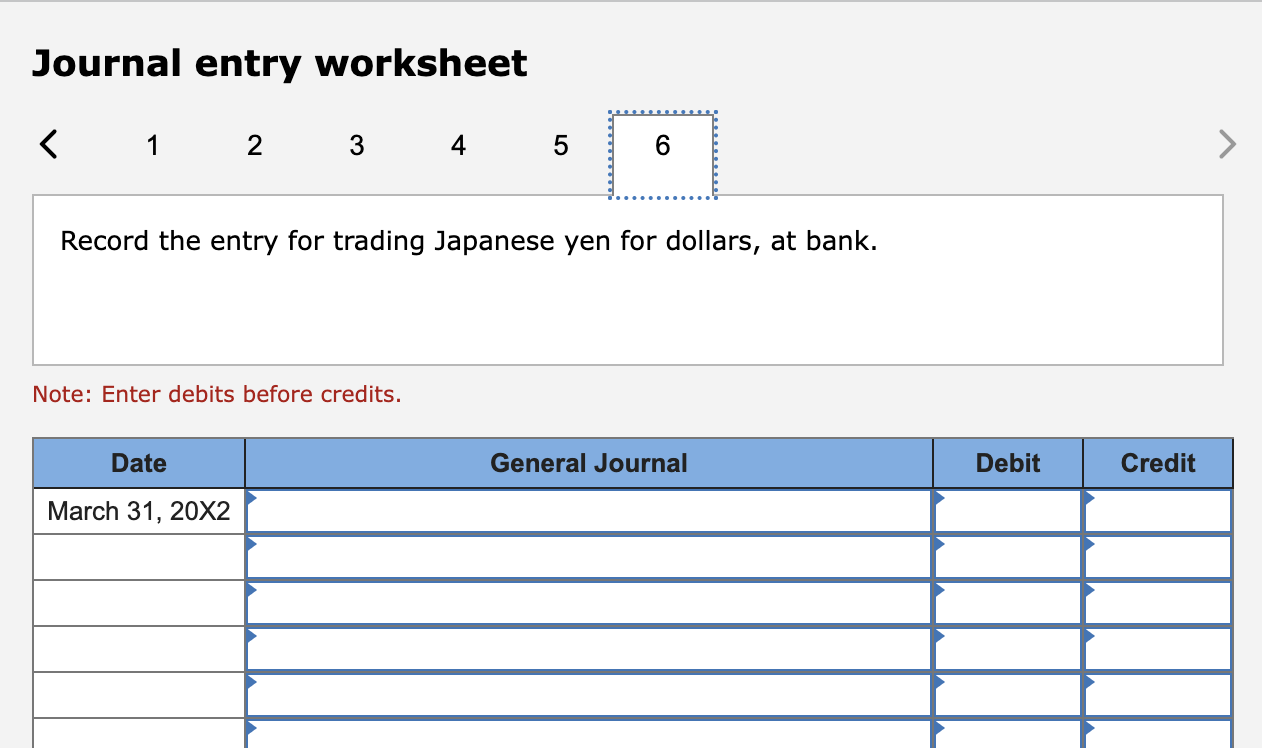

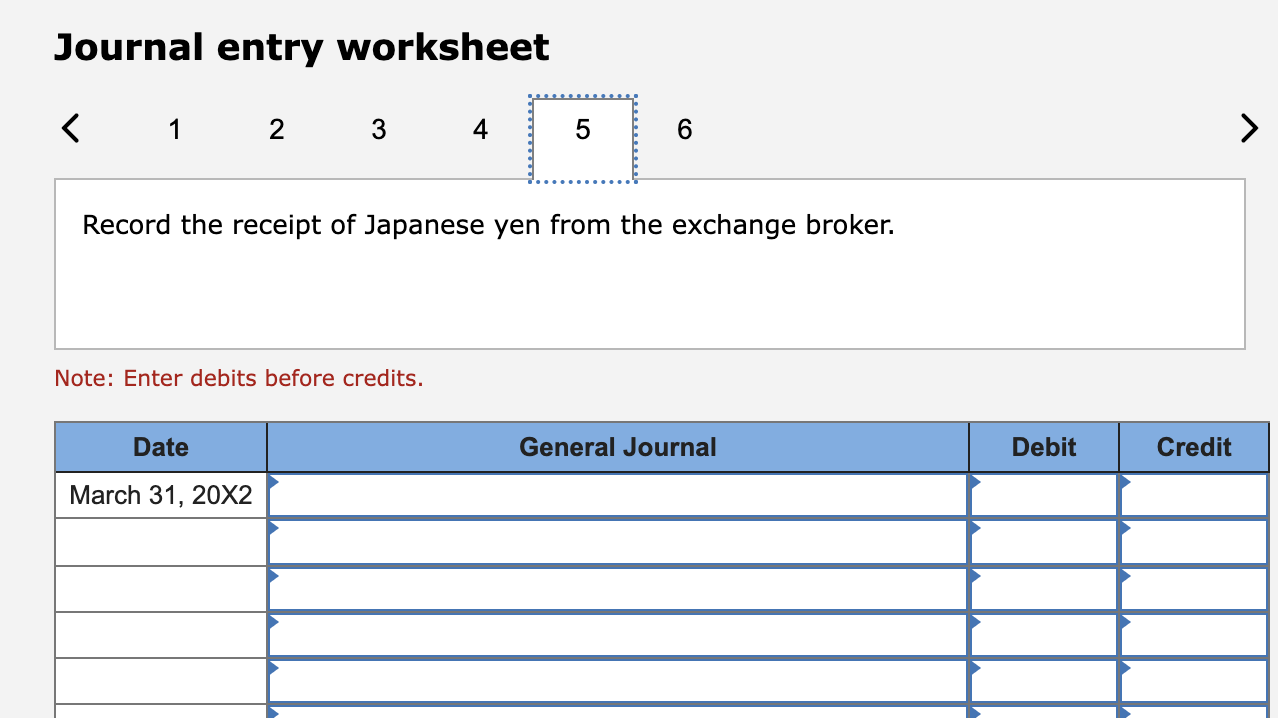

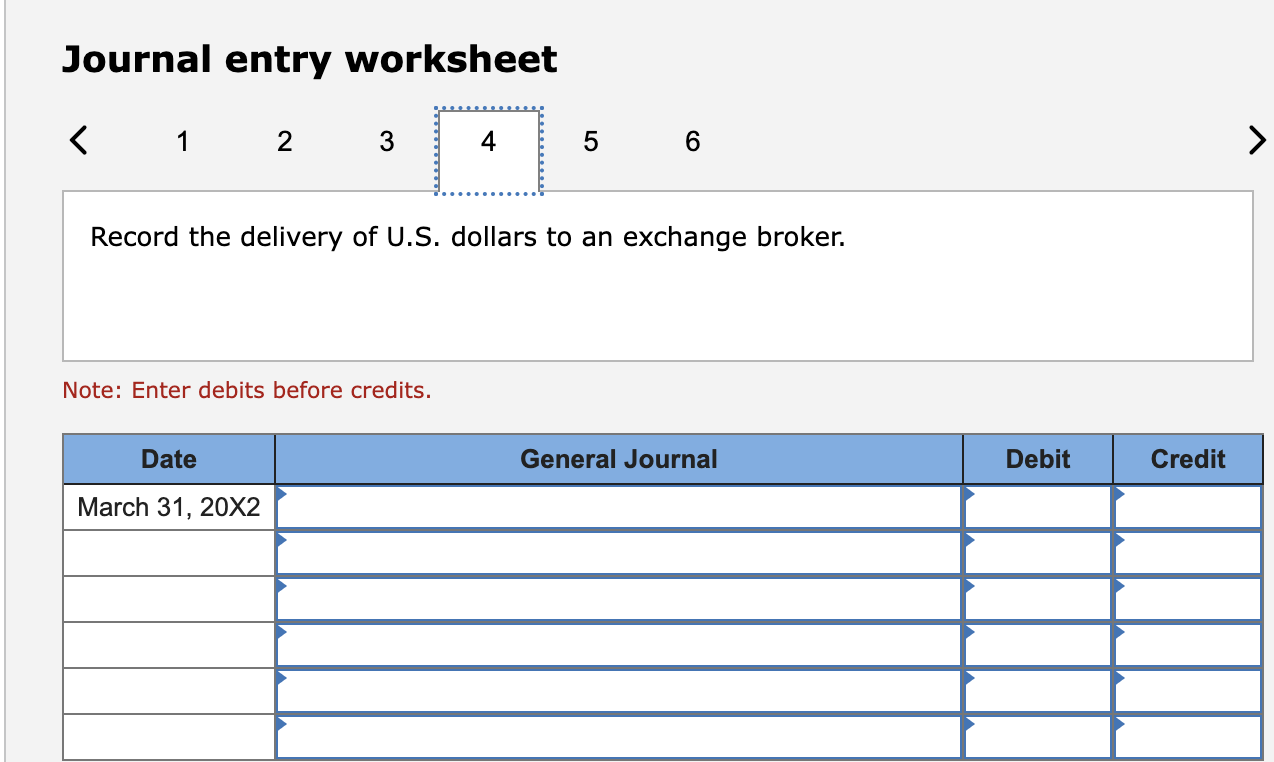

Journal entry worksheet Record the entry for trading Japanese yen for dollars, at bank. Note: Enter debits before credits. Journal entry worksheet Record the receipt of Japanese yen from the exchange broker. Note: Enter debits before credits. Journal entry worksheet Record the delivery of U.S. dollars to an exchange broker. Note: Enter debits before credits. Journal entry worksheet Record the revaluation of the speculative forward contract to the current date, the end of the contract term, using the March 31 spot rate. Note: Enter debits before credits. Journal entry worksheet Record the revaluation of the speculative forward contract to the equivalent end-of-period U.S. dollar value using the forward rate. Note: Enter debits before credits. Journal entry worksheet Record the signing of 180 -day forward contract to receive 50,000,000 yen. Note: Enter debits before credits. Journal entry worksheet Record the entry for trading Japanese yen for dollars, at bank. Note: Enter debits before credits. Journal entry worksheet Record the receipt of Japanese yen from the exchange broker. Note: Enter debits before credits. Journal entry worksheet Record the delivery of U.S. dollars to an exchange broker. Note: Enter debits before credits. Journal entry worksheet Record the revaluation of the speculative forward contract to the current date, the end of the contract term, using the March 31 spot rate. Note: Enter debits before credits. Journal entry worksheet Record the revaluation of the speculative forward contract to the equivalent end-of-period U.S. dollar value using the forward rate. Note: Enter debits before credits. Journal entry worksheet Record the signing of 180 -day forward contract to receive 50,000,000 yen. Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started