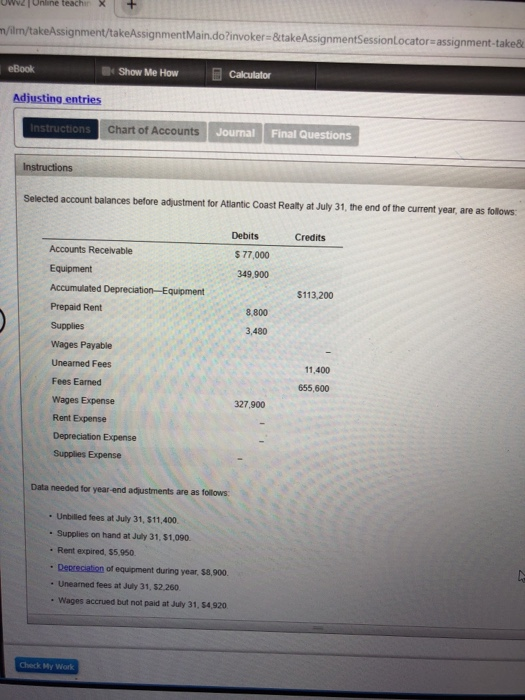

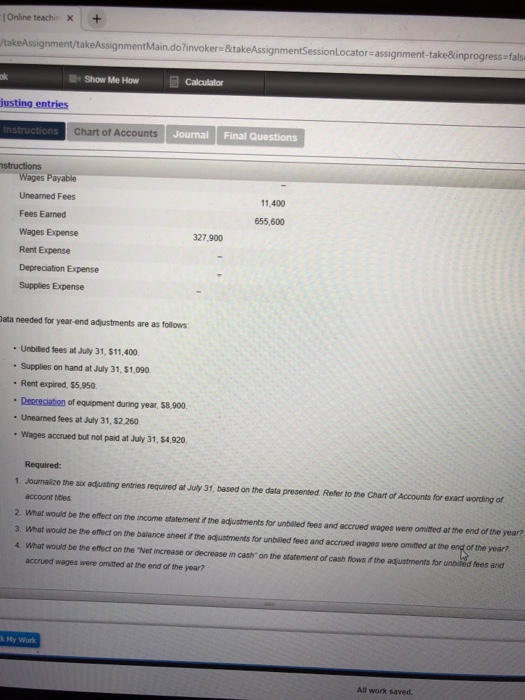

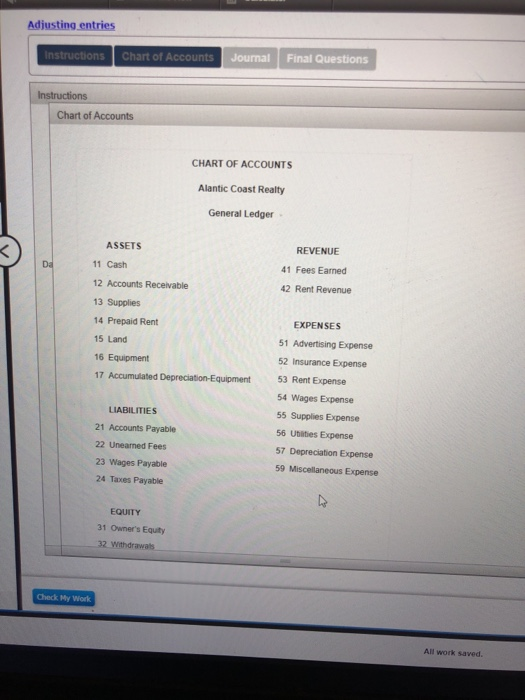

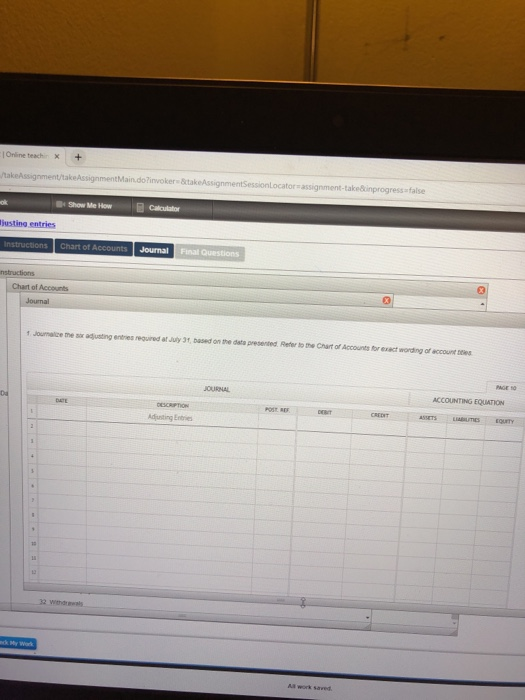

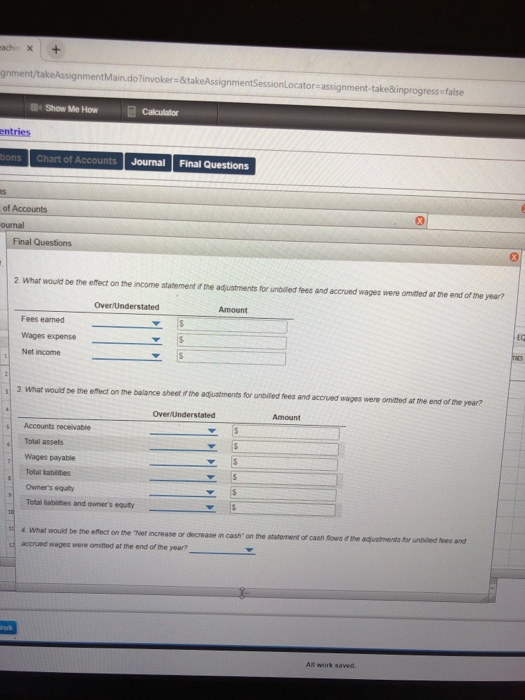

n/ilm/takeAssignment/hakeAssignmentMain.do?invoker-&takeAssignmentsessionlocator-assignment-take& eBook Show Me HowCalcutator Adjusting entries Chart of Accounts Journal Final Questions Selected account balances before adjustment for Atlantic Coast Reality at July 31, the end of the current year, are as folows Debits $ 77,000 349.900 Credits Accounts Recelvable Equipment $113,200 8.800 Prepaid Rent Supplies Wages Payable Unearned Fees Fees Earned Wages Expense Rent Expense Depreciation Expense 3,480 11,400 655,600 327,900 Supplies Expense Data needed for year-end adjustments are as follows Unbilled fees at July 31, $11,400. Supplies on hand at July 31, $1,090 . Rent expired, $5,950 . Derreciation of equipment during year, $8,900. . Unearned fees at July 31, $2.260 Wages accrued but not paid at July 31, $4,920 Check My Work I Online teachirX + -take&inprogress fals takeAssignment/takeAssignmentMain.do?invoker- &takeAssignmentSessionLocator assignment Show Me wCalculator justing entries Chart of Accounts Journal Final Questions Wages Payable Uneamed Fees Fees Earned Wages Expense Rent Expense Depreciation Expense Supplies Expense 11,400 655,600 327,900 ata needed for year-end adjustments are as follows Unbilled fees at July 31, $11,400 Supplies on hand at July 31, $1,090 - Rent expired, $5,950. Deereciation of equipment during year, $8,900 . Unearned fees at July 31, $2,.260 Wages accrued but not paid at July 31, 54,920 Required: 1. Journalize the six adjusting entries required at July 31, based on the data presented Refer to the Chart of Accounts for exact wording or account tities 2. What would be the effect on the income statement if the adjustments for unbiled fees and accrued wages were omitted at the end of the year? 3. What would be the effect on the balance sheet it the adjustments for unbilled fees and accrued wages were omitted at the end of the year? 4. what vould bethe enect on the "Net increase or decrease in cash-onthe statement of cash flows the adustments brunt ded fees and accrued wages were omitted at the end of the year? k My Work All work saved. Adiusting entries s Journal Final Questions Instructions Chart of Accounts CHART OF ACCOUNTS Alantic Coast Realty General Ledger REVENUE 41 Fees Earned 42 Rent Revenue ASSETS 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Rent 15 Land 16 Equipment EXPENSES 51 Advertising Expense 52 Insurance Expense 53 Rent Expense 54 Wages Expense 55 Supplies Expense 56 Ublities Expense 57 Depreciation Expense 59 Miscellaneous Expense LIABILITIES 21 Accounts Payable 22 Unearned Fees 23 Wages Payable 24 Taxes Payable EQUITY 31 Owner's Equity 32 Withdrawals Check My Work All work saved. Online teachin X+ akeAssignment/takeAssignmentMain.do?invokers &takeAssignmentSessionLocator t-take&inprogress false Show Me How justing entries Journal 03 Chart of Accounts 1 Jourmalce me sox adjusting entries required at July 3, based on the dats presented Refer to me Chant of Accounts for exact wording of account ttes OURNAL ACCOUNTING EQUATION djunting Entrie gnment takeAssignment Mando ?in oker takeAssignment essionLocator=assignment take inprogress false Show Me How Calculator entries Journal Final Questions of Accounts ournal Final Questions 2 What would be the effect on the income statement if the adjustments for unbied fees and accrued wages were omitted at the end of the year? Over/Understated Amount Fees earned Wages expense Net income 3 What would be the effect on the balance sheet ifthe adjustments for unbilted fees and accrued wages were omited at the end of the year? Over/Understated Amount s Accounts receivable Total assets Wages payable Total lablities Owner's equity Total lablnes and owner's equity 4 what would be the enect on the Net increase or decrease an cash-onthe statement of cash fows rthe adustments tr 'nbled food and accrued wages were omited at the end of the year? All work saved