NO EXPLANATION NECESSARY, just the final answer for 4 MC questions, it would help me tremendously! (thumbs up)

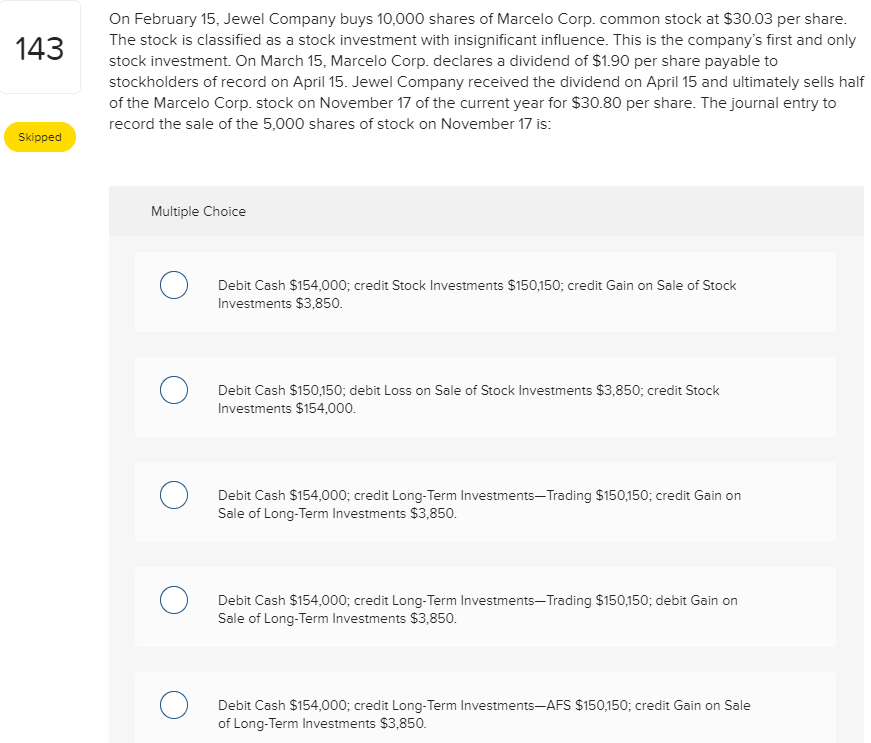

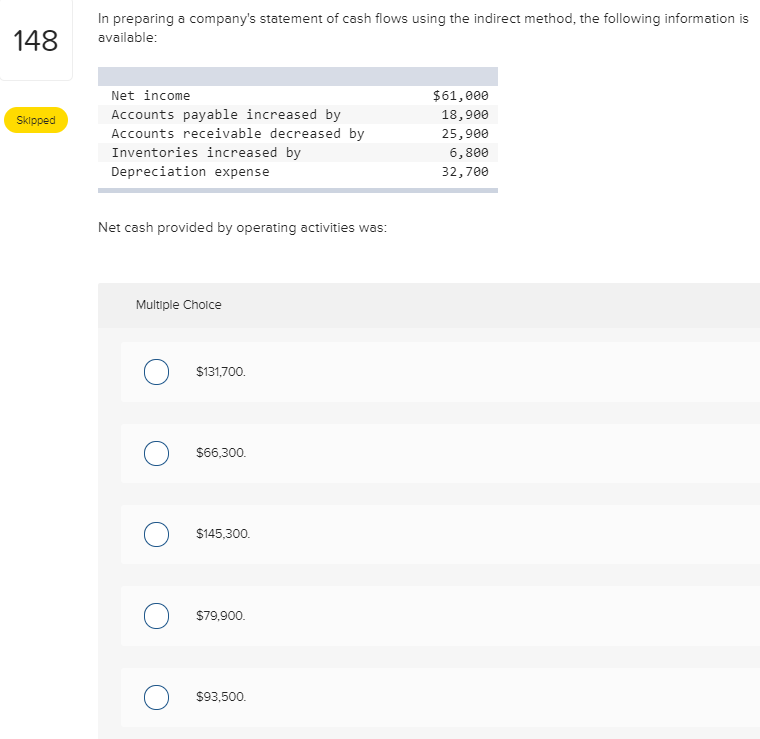

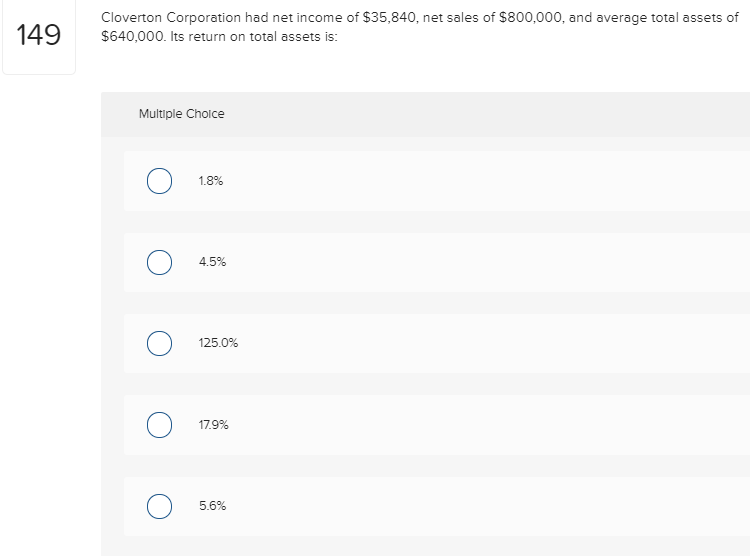

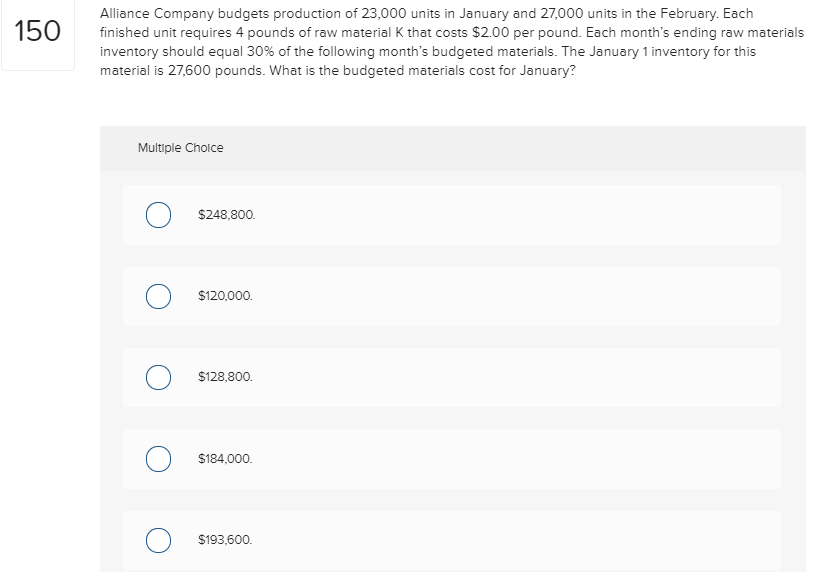

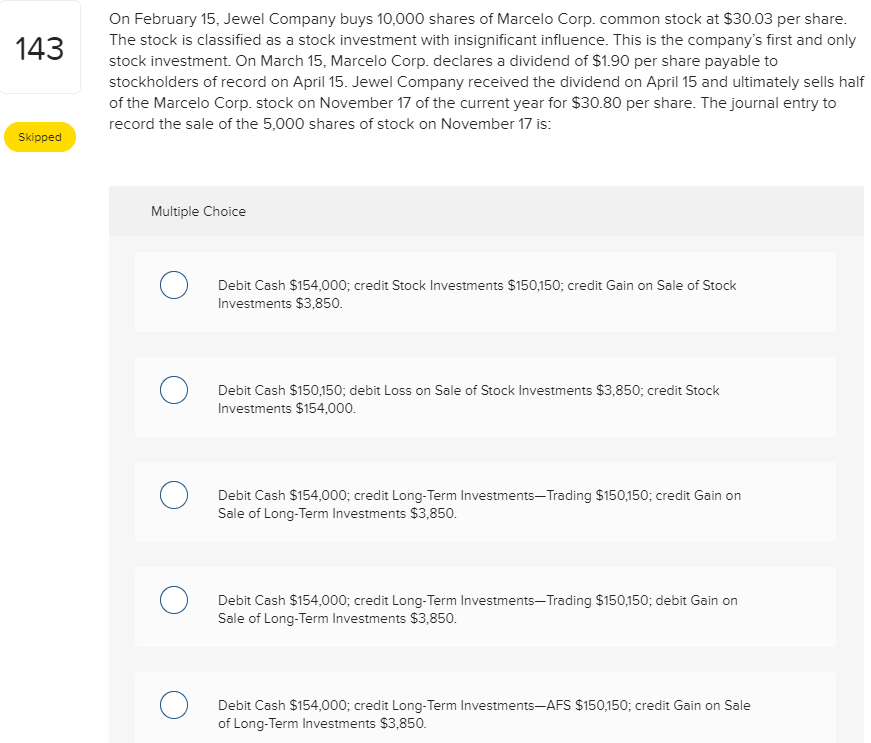

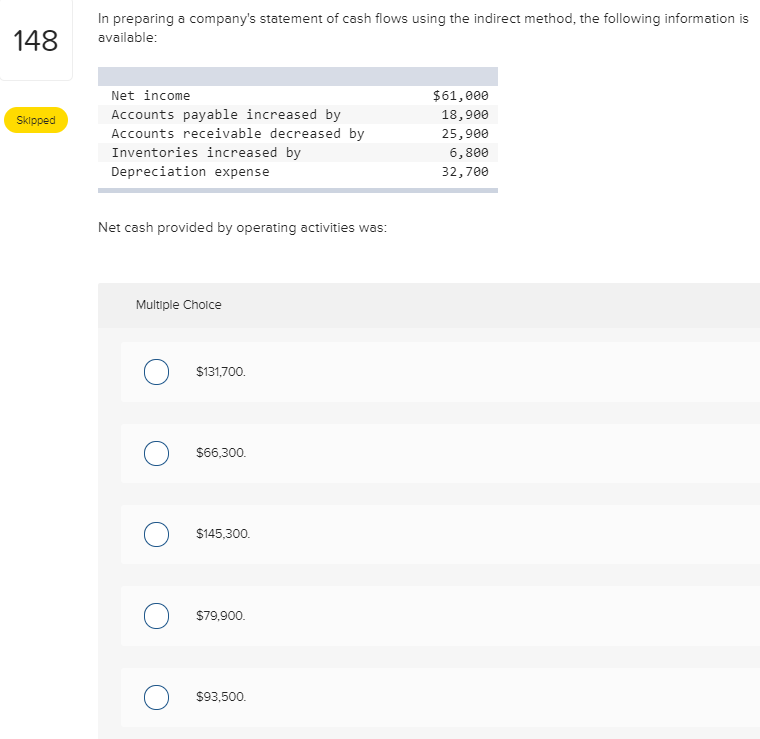

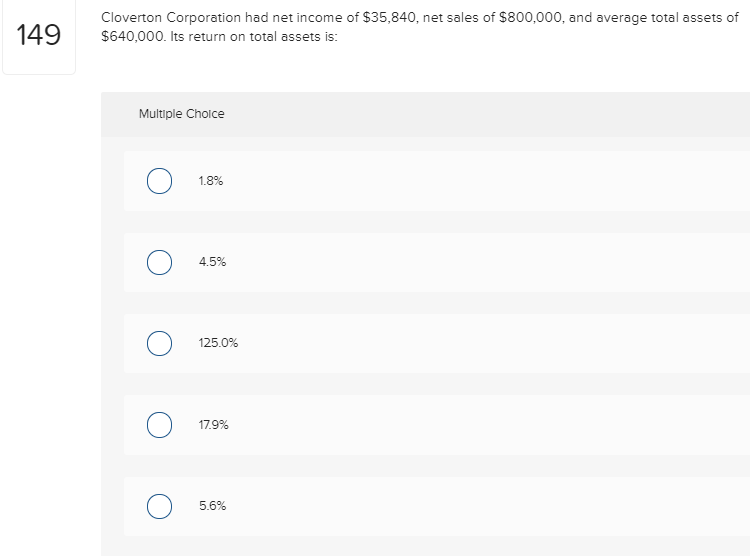

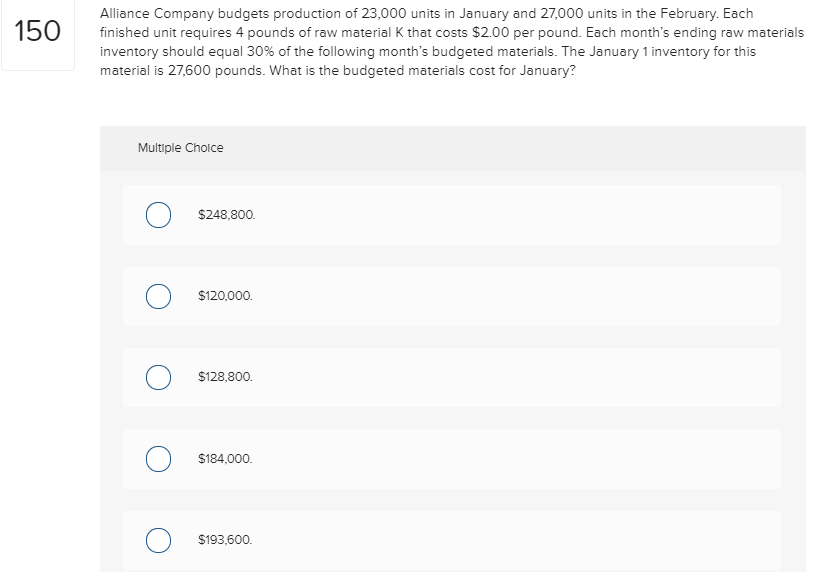

143 On February 15, Jewel Company buys 10,000 shares of Marcelo Corp. common stock at $30.03 per share. The stock is classified as a stock investment with insignificant influence. This is the company's first and only stock investment. On March 15, Marcelo Corp. declares a dividend of $1.90 per share payable to stockholders of record on April 15. Jewel Company received the dividend on April 15 and ultimately sells half of the Marcelo Corp. stock on November 17 of the current year for $30.80 per share. The journal entry to record the sale of the 5,000 shares of stock on November 17 is: Skipped Multiple Choice 0 Debit Cash $154,000; credit Stock Investments $150,150; credit Gain on Sale of Stock Investments $3,850. 0 Debit Cash $150,150; debit Loss on Sale of Stock Investments $3,850; credit Stock Investments $154,000. 0 Debit Cash $154,000; credit Long-Term Investments-Trading $150,150; credit Gain on Sale of Long-Term Investments $3,850. 0 Debit Cash $154,000; credit Long-Term Investments-Trading $150,150; debit Gain on Sale of Long-Term Investments $3,850. 0 Debit Cash $154,000; credit Long-Term Investments-AFS $150,150; credit Gain on Sale of Long-Term Investments $3,850. 148 In preparing a company's statement of cash flows using the indirect method, the following information is available: Skipped Net income Accounts payable increased by Accounts receivable decreased by Inventories increased by Depreciation expense $61,000 18,900 25,900 6,800 32,700 Net cash provided by operating activities was: Multiple Choice 0 $131,700. 0 $66,300. 0 $145,300. 0 $79,900. 0 $93,500 149 Cloverton Corporation had net income of $35,840, net sales of $800,000, and average total assets of $640,000. Its return on total assets is: Multiple Choice o o o o o 150 Alliance Company budgets production of 23,000 units in January and 27,000 units in the February. Each finished unit requires 4 pounds of raw material K that costs $2.00 per pound. Each month's ending raw materials inventory should equal 30% of the following month's budgeted materials. The January 1 inventory for this material is 27,600 pounds. What is the budgeted materials cost for January? Multiple Choice 0 $243,800. 0 $120,000. 0 $128,800. 0 $184,000. 0 O $193,600