Answered step by step

Verified Expert Solution

Question

1 Approved Answer

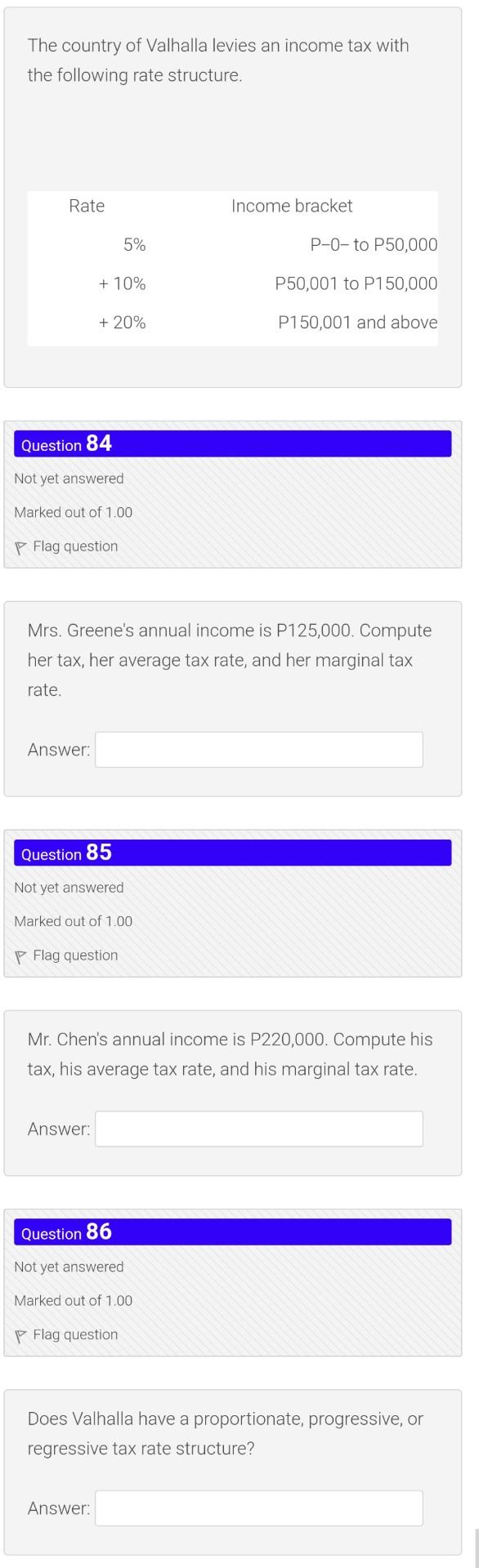

no need to explain thank you. The country of Valhalla levies an income tax with the following rate structure. Rate Income bracket 5% P-0-to P50,000

no need to explain thank you.

The country of Valhalla levies an income tax with the following rate structure. Rate Income bracket 5% P-0-to P50,000 + 10% P50,001 to P150,000 + 20% P150,001 and above Question 84 Not yet answered Marked out of 1.00 Flag question Mrs. Greene's annual income is P125,000. Compute her tax, her average tax rate, and her marginal tax rate. Answer: Question 85 Not yet answered Marked out of 1.00 P Flag question Mr. Chen's annual income is P220,000. Compute his tax, his average tax rate, and his marginal tax rate. Answer: Question 86 Not yet answered Marked out of 1.00 P Flag question Does Valhalla have a proportionate, progressive, or regressive tax rate structureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started