Answered step by step

Verified Expert Solution

Question

1 Approved Answer

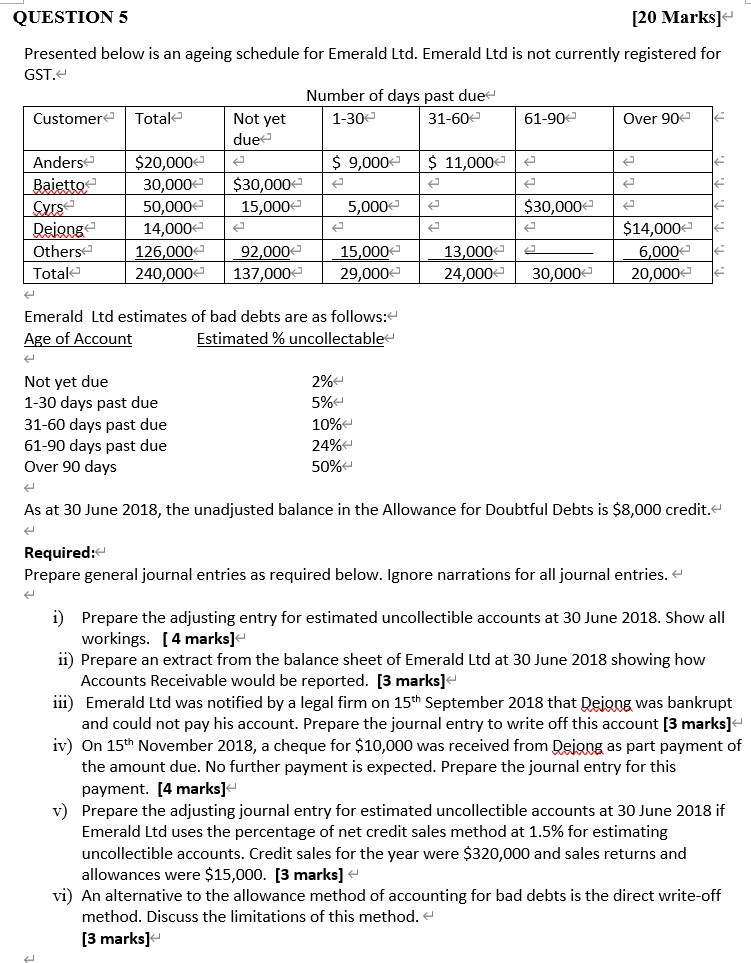

Not yet QUESTION 5 [20 Marks] Presented below is an ageing schedule for Emerald Ltd. Emerald Ltd is not currently registered for GST. Number of

Not yet QUESTION 5 [20 Marks] Presented below is an ageing schedule for Emerald Ltd. Emerald Ltd is not currently registered for GST. Number of days past due Customer Totale 1-30 31-60 61-902 Over 90 due Anderse $20,000 $ 9,000 $ 11,000 Baietto 30,000 $30,000 Cyrse 50,000 15,000 5,000 $30,000 Dejonge 14,000 $14,000 Others 126,000 92,000 15,000 13,000 6,000 Totale 240,000 137,000 29,000 24,000 30,000 20,000 Emerald Ltd estimates of bad debts are as follows: Age of Account Estimated % uncollectable Not yet due 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days 2%. 5% 10% 24% 50% As at 30 June 2018, the unadjusted balance in the Allowance for Doubtful Debts is $8,000 credit. Required: Prepare general journal entries as required below. Ignore narrations for all journal entries. i) Prepare the adjusting entry for estimated uncollectible accounts at 30 June 2018. Show all workings. (4 marks] ii) Prepare an extract from the balance sheet of Emerald Ltd at 30 June 2018 showing how Accounts Receivable would be reported. [3 marks] iii) Emerald Ltd was notified by a legal firm on 15th September 2018 that Deiong was bankrupt and could not pay his account. Prepare the journal entry to write off this account [3 marks] iv) On 15th November 2018, a cheque for $10,000 was received from Dejong as part payment of the amount due. No further payment is expected. Prepare the journal entry for this payment. [4 marks] v) Prepare the adjusting journal entry for estimated uncollectible accounts at 30 June 2018 if Emerald Ltd uses the percentage of net credit sales method at 1.5% for estimating uncollectible accounts. Credit sales for the year were $320,000 and sales returns and allowances were $15,000. [3 marks] vi) An alternative to the allowance method of accounting for bad debts is the direct write-off method. Discuss the limitations of this method. [3 marks] i), iii), iv), v) GENERAL JOURNAL IN - DATE PARTICULARS Post DEBITA CREDIT Refe k le ] ii) Balance Sheet Extract as at 30 June 2018 vi)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started