Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: All interest rates are annual interest rates with semi-annual compounding. All coupon rates are annual rates paid semi-annually. Please Show All Steps and Calculations

Note: All interest rates are annual interest rates with semi-annual compounding. All coupon rates are annual rates paid semi-annually.

Please Show All Steps and Calculations

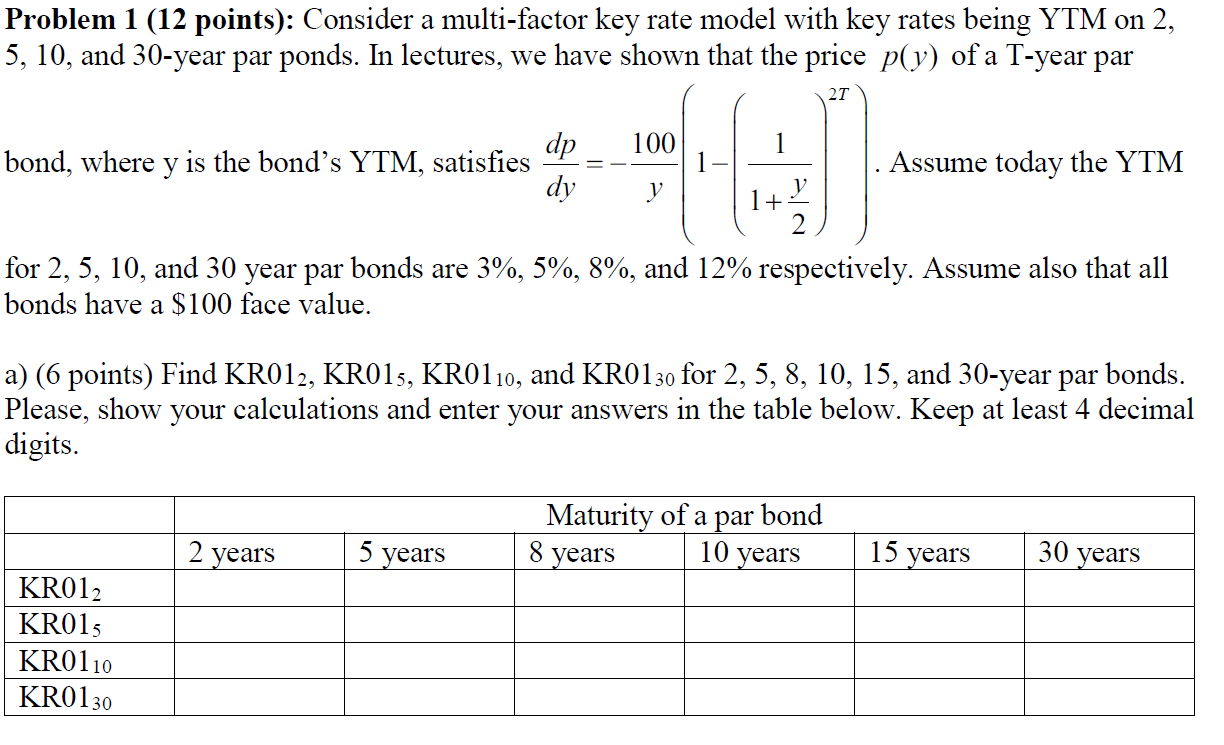

Problem 1 (12 points): Consider a multi-factor key rate model with key rates being YTM on 2, 5, 10, and 30-year par ponds. In lectures, we have shown that the price p(y) of a T-year par 21 100 dp bond, where y is the bond's YTM, satisfies dy Assume today the YTM y 1+ for 2, 5, 10, and 30 year par bonds are 3%, 5%, 8%, and 12% respectively. Assume also that all bonds have a $100 face value. a) (6 points) Find KR012, KR015, KR0110, and KR0130 for 2, 5, 8, 10, 15, and 30-year par bonds. Please, show your calculations and enter your answers in the table below. Keep at least 4 decimal digits. Maturity of a par bond 2 years 5 years 8 years 10 years 15 years 30 years KR012 KR015 KR0110 KRO130 Problem 1 (12 points): Consider a multi-factor key rate model with key rates being YTM on 2, 5, 10, and 30-year par ponds. In lectures, we have shown that the price p(y) of a T-year par 21 100 dp bond, where y is the bond's YTM, satisfies dy Assume today the YTM y 1+ for 2, 5, 10, and 30 year par bonds are 3%, 5%, 8%, and 12% respectively. Assume also that all bonds have a $100 face value. a) (6 points) Find KR012, KR015, KR0110, and KR0130 for 2, 5, 8, 10, 15, and 30-year par bonds. Please, show your calculations and enter your answers in the table below. Keep at least 4 decimal digits. Maturity of a par bond 2 years 5 years 8 years 10 years 15 years 30 years KR012 KR015 KR0110 KRO130Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started