Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note You must show all the workings to justify your answer. No marks is given if your formula(s) working(s) is wrong but final answers is

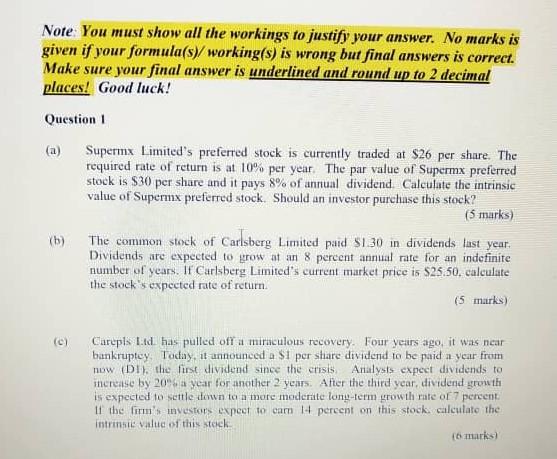

Note You must show all the workings to justify your answer. No marks is given if your formula(s) working(s) is wrong but final answers is correct. Make sure your final answer is underlined and round up to 2 decimal places! Good luck! Question 1 (a) Supermx Limited's preferred stock is currently traded at $26 per share. The required rate of return is at 10% per year. The par value of Supermx preferred stock is $30 per share and it pays 8% of annual dividend. Calculate the intrinsic value of Supermx preferred stock. Should an investor purchase this stock? (5 marks) The common stock of Carlsberg Limited paid $1.30 in dividends last year. Dividends are expected to grow at an 8 percent annual rate for an indefinite number of years. If Carlsberg Limited's current market price is $25.50, calculate the stock's expected rate of return. (5 marks) (b) (c) Carepis 1d has pulled off a miraculous recovery. Four years ago, it was near bankruptcy. Today, it announced a st per stare dividend to be paid a year from now (DI), the first dividend since the crisis Analysis expect dividends to increase by 20% a year for another 2 years. After the third year, dividend growth is expected to settle down to a more moderate long-term growth rate of 7 percent If the firm's investors expect to carn 14 percent on this stock, calculate the intre value of this stock 16 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started