Answered step by step

Verified Expert Solution

Question

1 Approved Answer

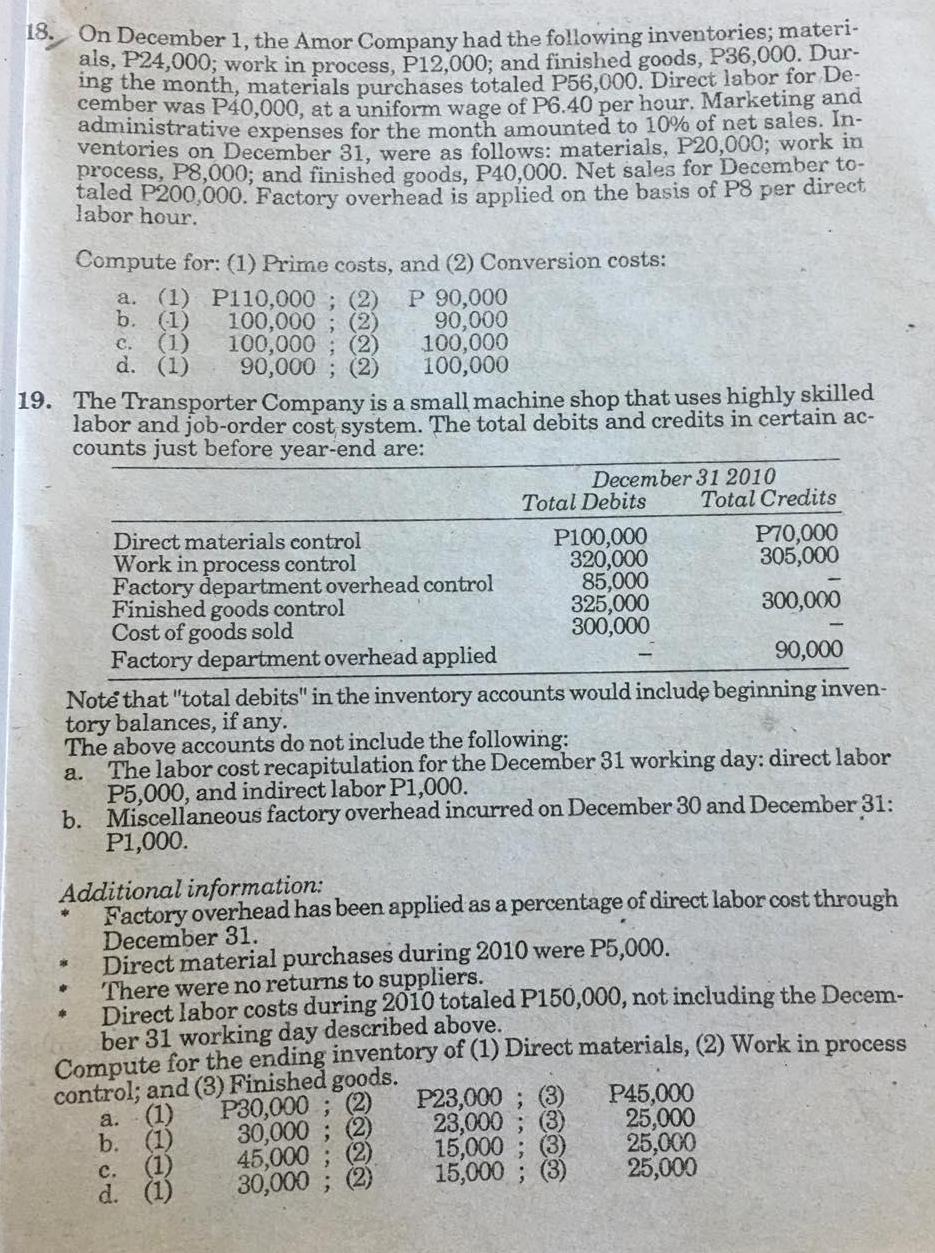

1 On December 1, the Amor Company had the following inventories; materi- ais, P24,000; work in process, P12.000; and finished goods, P36,000. Dur- ing

1 On December 1, the Amor Company had the following inventories; materi- ais, P24,000; work in process, P12.000; and finished goods, P36,000. Dur- ing the month, materials purchases totaled P56,000. Direct labor for De- cember was P40,000, at a uniform wage of P6.40 per hour. Marketing and administrative expenses for the month amounted to 10% of net sales. In- ventories on December 31, were as follows: materials, P20,000; work in process, P8,000; and finished goods, P40,000. Net sales for December to- taled P200,000. Factory overhead is applied on the basis of P8 per direct labor hour. Compute for: (1) Prime costs, and (2) Conversion costs: P 90,000 90,000 100,000 100,000 19. The Transporter Company is a small machine shop that uses highly skilled labor and job-order cost system. The total debits and credits in certain ac- a. (1) P110,000; (2) b. (1) (1) d. (1) 100,000 ; (2) 100,000 ; (2) 90,000 ; (2) C. counts just before year-end are: December 31 2010 Total Debits Total Credits Direct materials control Work in process control Factory department overhead control Finished goods control Cost of goods sold Factory department overhead applied P100,000 320,000 85,000 325,000 300,000 P70,000 305,000 300,000 90,000 Note that "total debits" in the inventory accounts would include beginning inven- tory balances, if any. The above accounts do not include the following: The labor cost recapitulation for the December 31 working day: direct labor P5,000, and indirect labor P1,000. b. Miscellaneous factory overhead incurred on December 30 and December 31: P1,000. a. Additional information: Factory overhead has been applied as a percentage of direct labor cost through December 31. Direct material purchases during 2010 were P5,000. There were no returns to suppliers. Direct labor costs during 2010 totaled P150,000, not including the Decem- ber 31 working day described above. Compute for the ending inventory of (1) Direct materials, (2) Work in process control; and (3) Finished goods. a. (1) (1) b. (1) d. (1) P30,000 ; (2) 30,000 ; (2) 45,000; 30,000 ; (2) P23,000 ; (3) 23,000 ; (3) 15,000 ; (3) 15,000 ; (3) P45,000 25,000 25,000 25,000 .

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

18 b 1 P100000 2 P90000 19 1 30000 2 23000 3 25000 EXPLANATION 1 COMPUTATION OF PRIME COST Explanation Prime cost is the sum of direct materials direc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started