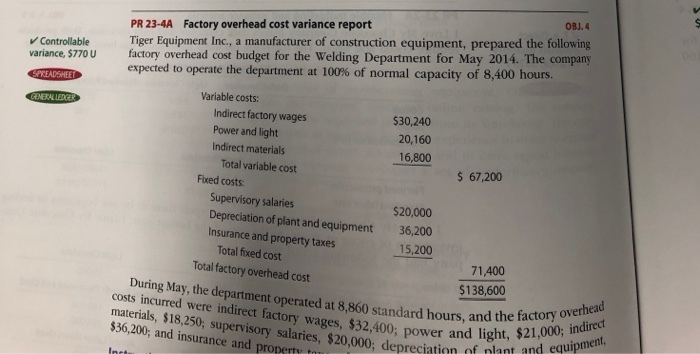

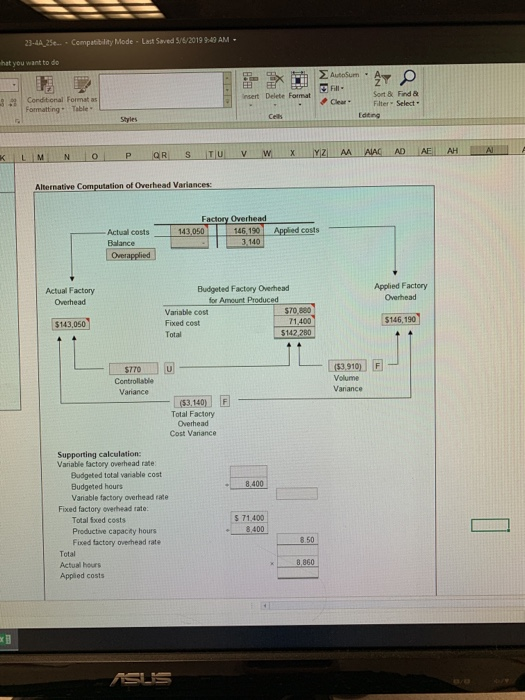

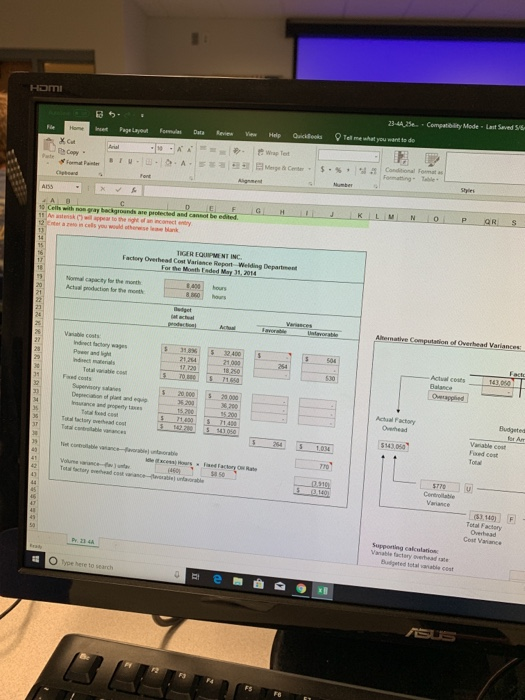

OBJ.4 PR 23-4A Factory overhead cost variance report Tiger Equipment Inc, a manufacturer of construction equipment, prepared the following Controllable variance, $770 u factor overhead cost bud get for the Welding Department for May 2014. The company expected to operate the department at 100% of normal capacity of 8,400 hours. Variable costs: 30,240 20,160 16,800 Indirect factory wages Power and light Indirect materials Total variable cost 67,200 Fixed costs Supervisory salaries Depreciation of plant and equipment Insurance and property taxes $20,000 36,200 15,200 Total fixed cost Total factory overhead cost 71,400 $138,600 During May, the department operated at 8,860 standard hours, and the facn indired ctory overhead costs incurred were indirect factory materials, $18,250; actory wages, $32,400; power and light, $21,000 250, supervisory salaries, $20,000; depreciation of nl 200, and insurance and property t nlant and equipment 3-4A25e.. Compatibilay Mode-Last Saved 5/6/2019 949AM hat you want to do AutoSurn Sort & Find & insert Delete Format | Conditional Format as Formatting Table ClearFilter Select. Ldtre Styles Alternative Computation of Overhead Variances: 146 190 L143 050 Apled costs Actual costs 3.140 Balance Applied Factory Overhead Budgeted Factory Overhead for Amount Produced Actual Factory Overhead STO,880 1,400 Variable cost Fixed cost Total $143,050 ($3.910) F $770 Volume Variance Variance ($3.140/ Total Factory Overhead Cost Vanance Supporting calculation: Variable factery overhead rate Budgeted total variable cost Budgeted hours Vanable factory overhead rate Fixed factory overhead rate: 71,400 Total fxed costs Productive capacity hours Fuxed factory overhead rate 400 8.50 Total Actual hours Applied costs 8,860 Last Seved S/5 Compatiblity Mode 3-44,25 Copy Cells with nos you would othank TIGER EQIPME NT INC Factory Overhead Cost Varience Report Welding Department For the Month Eaded May 31, 2014 Normal capacity for the month Vaniable costs ndect factory wages Pawer and ih 2 400 21 000 18 250 Actval cests Total vaniable Faxed costs 20 003 20 000 6,200 Supervisory salanes Depneciaion of plant and e Achual Factory Oehead Budgeted for Am Vaniable cost Foxed cost tal tactary sverhead cost $143 050 S14306 l untaorable 770 Centrolilable Total Factory Cost Varance Supporting calculation Vanable factary f sverhead ate Budgeted total vanable coat O Type here s Fe OBJ.4 PR 23-4A Factory overhead cost variance report Tiger Equipment Inc, a manufacturer of construction equipment, prepared the following Controllable variance, $770 u factor overhead cost bud get for the Welding Department for May 2014. The company expected to operate the department at 100% of normal capacity of 8,400 hours. Variable costs: 30,240 20,160 16,800 Indirect factory wages Power and light Indirect materials Total variable cost 67,200 Fixed costs Supervisory salaries Depreciation of plant and equipment Insurance and property taxes $20,000 36,200 15,200 Total fixed cost Total factory overhead cost 71,400 $138,600 During May, the department operated at 8,860 standard hours, and the facn indired ctory overhead costs incurred were indirect factory materials, $18,250; actory wages, $32,400; power and light, $21,000 250, supervisory salaries, $20,000; depreciation of nl 200, and insurance and property t nlant and equipment 3-4A25e.. Compatibilay Mode-Last Saved 5/6/2019 949AM hat you want to do AutoSurn Sort & Find & insert Delete Format | Conditional Format as Formatting Table ClearFilter Select. Ldtre Styles Alternative Computation of Overhead Variances: 146 190 L143 050 Apled costs Actual costs 3.140 Balance Applied Factory Overhead Budgeted Factory Overhead for Amount Produced Actual Factory Overhead STO,880 1,400 Variable cost Fixed cost Total $143,050 ($3.910) F $770 Volume Variance Variance ($3.140/ Total Factory Overhead Cost Vanance Supporting calculation: Variable factery overhead rate Budgeted total variable cost Budgeted hours Vanable factory overhead rate Fixed factory overhead rate: 71,400 Total fxed costs Productive capacity hours Fuxed factory overhead rate 400 8.50 Total Actual hours Applied costs 8,860 Last Seved S/5 Compatiblity Mode 3-44,25 Copy Cells with nos you would othank TIGER EQIPME NT INC Factory Overhead Cost Varience Report Welding Department For the Month Eaded May 31, 2014 Normal capacity for the month Vaniable costs ndect factory wages Pawer and ih 2 400 21 000 18 250 Actval cests Total vaniable Faxed costs 20 003 20 000 6,200 Supervisory salanes Depneciaion of plant and e Achual Factory Oehead Budgeted for Am Vaniable cost Foxed cost tal tactary sverhead cost $143 050 S14306 l untaorable 770 Centrolilable Total Factory Cost Varance Supporting calculation Vanable factary f sverhead ate Budgeted total vanable coat O Type here s Fe