Question: Please provide introduction for the following case study 100 words Year 1 Year 2 Base Year ear $6,000,000 $6,000,000 $6,000,000 $6.000,00 Revenues Less 1,000,000 1,050,000

Please provide introduction for the following case study 100 words

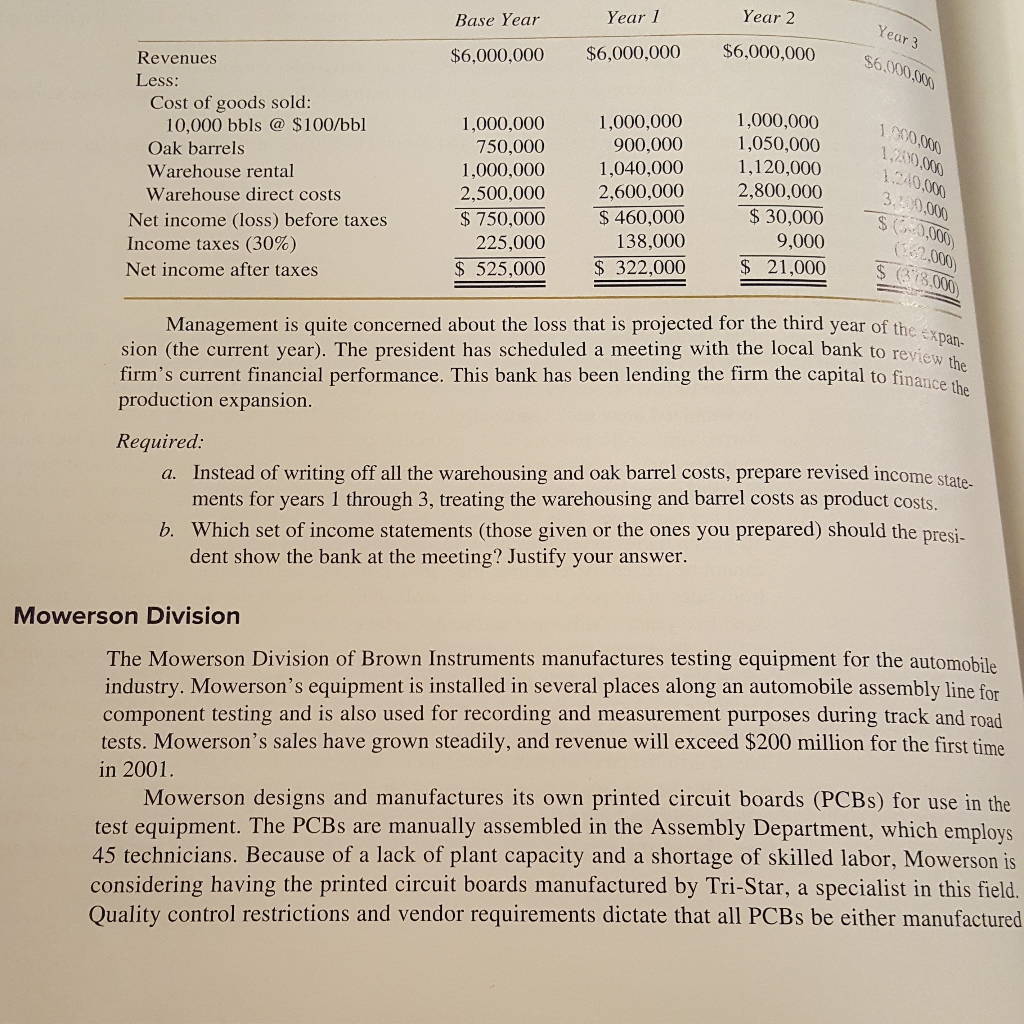

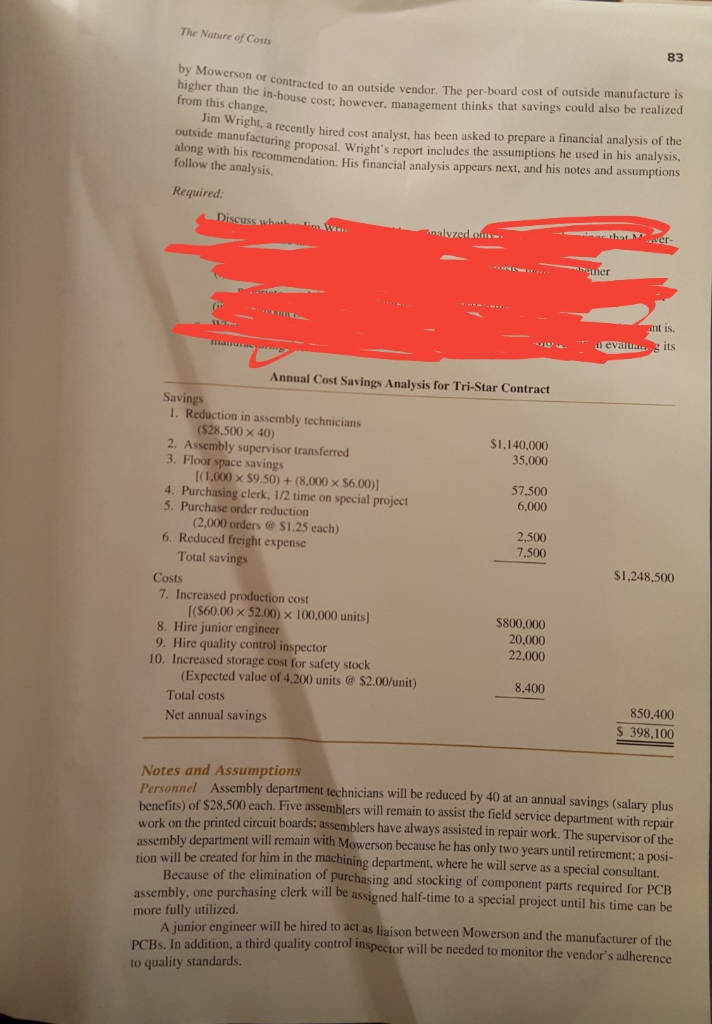

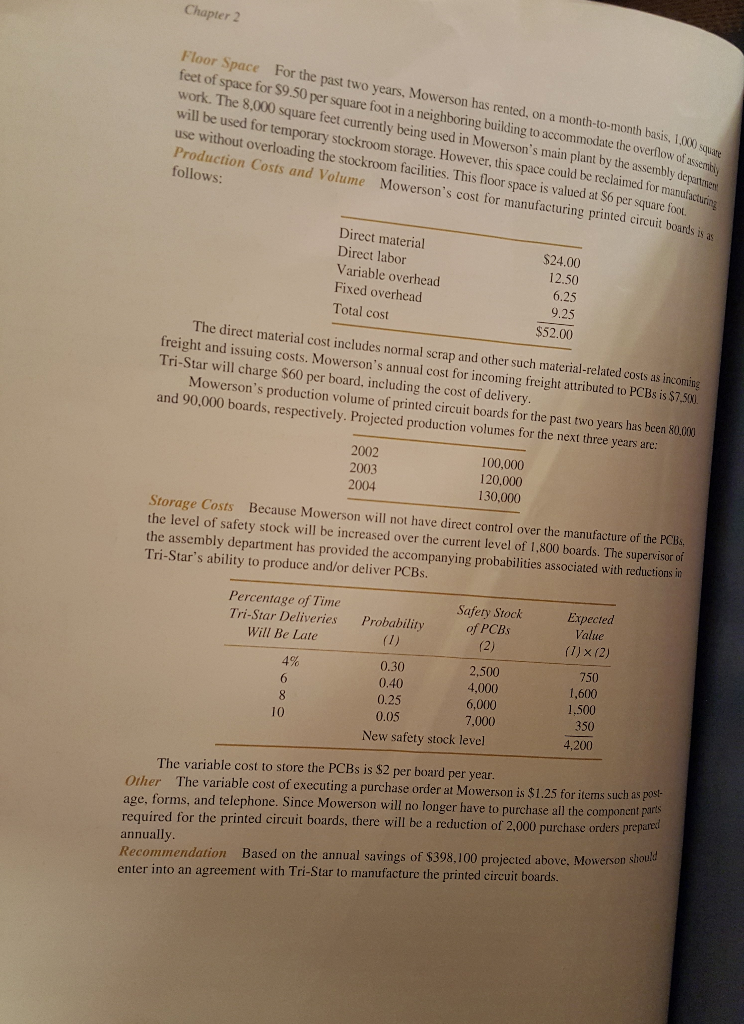

Year 1 Year 2 Base Year ear $6,000,000 $6,000,000 $6,000,000 $6.000,00 Revenues Less 1,000,000 1,050,000 1,120,000 2,800,000 $ 30,000 9,000 S 21,000 Cost of goods sold: 1,000,000 900,000 1,040,000 2,600,000 $ 460,000 138,000 1 900.000 10,000 bbls $100/bbl Oak barrels Warehouse rental Warehouse direct costs 1,000,000 750,000 1,000,000 2,500,000 750,000 225,000 1,240,000 3.200,000 5%-3,000) Net income (loss) before taxes Income taxes (30%) Net income after taxes 2,000 $ 313.000 $ 525,000 322,000 xpan- Management is quite concerned about the loss that is projected for the third year of the sion (the current year). The president has scheduled a meeting with the local bank to re firm's current financial performance. This bank has been lending the firm the capital to finan production expansion review Required a. Instead of writing off all the warehousing and oak barrel costs, prepare revised income ments for years 1 through 3, treating the warehousing and barrel costs as product costs b. Which set of income statements (those given or the ones you prepared) should the pres dent show the bank at the meeting? Justify your answer Mowerson Division The Mowerson Division of Brown Instruments manufactures testing equipment for the automobil industry. Mowerson's equipment is installed in several places along an automobile assembly line for component testing and is also used for recording and measurement purposes during track and road tests. Mowerson's sales have grown steadily, and revenue will exceed $200 million for the first time in 2001 Mowerson designs and manufactures its own printed circuit boards (PCBs) for use in the test equipment. The PCBs are manually assembled in the Assembly Department, which emplo 45 technicians. Because of a lack of plant capacity and a shortage of skilled labor, Mowerson is considering having the printed circuit boards manufactured by Tri-Star, a specialist in this field. Quality control restrictions and vendor requirements dictate that all PCBs be either manufactured The Nature of Costs 83 by Mowerso higher than the in-house cost: from this change. r contracted to an outside vendor. The per-board cost of outside manufacture is net: however, management thinks that savings could also be realized management Jim Wright, a recently hired cost analyst, has been asked to prepare a financial analysis of the outside manufacturing proposal. Wright's report includes the assumptions he used in his analysis uring proposal. Wright's report includes the assumptions he used in his analysis, ion. His financial analysis appears next, and his notes and assumptions along with his rec follow the analysis. Required scus er IS. its Annual Cost Savings Analysis for Tri-Star Contract Savings 1. Reduction in assembly technicians (S28.500 x 40) $1,140,000 35,000 2. Assembly supervisor transferred 3. Floor space savings (1.000 S9.50) + (8,000 $6.00)] 57,500 6,000 4. Purchasing clerk, 1/2 time on special project 5. Purchase order reduction (2,000 orders@$1.25 each) 6. Reduced freight expense 2,500 7,500 Total savings $1,248,500 Costs 7. Increased production cost [(S60.00 x 52.00) x 100,000 units 8. Hire junior engineer 9. Hire quality control inspector 10. Increased storage cost for safety stock $800,000 20,000 22,000 (Expected value of 4,200 units @$2.00/unit) Total costs Net annual savings 8,400 850,400 S 398,100 Notes and Assumptions Personnel Assembly department technicians will be reduced by 40 at an annual savings (salary plus benefits) of $28,500 each. Five assemblers will remain to assist the field service department with repair work on the printed circuit boards; assemblers have always assisted in repair work. The supervisor of the assembly department will remain with Mowerson because he has only two years until retirement; a posi- tion will be created for him in the machining department, where he will serve as a special consultant. Because of the elimination of purchasing and stocking of component parts required for PCB assembly, one purchasing clerk will be assigned half-time to a special project until his time can be more fully utilized. ineer will be hired to act as liaison between Mowerson and the manufacturer of the n addition, a third quality control inspector will be needed to monitor the vendor's adherence A junior eng PCBs. I to quality standards. Chapter 2 Floor Space For the past two years, Mowerson has rented, on a month-to-month basis, 1,00 square feet of space for $9.50 per square foot in a neighboring building to accommodate the overflow of asemt work. The 8.000 square feet currently being used in Mowerson's main plant by the assembly depatmen will be used for temporary stockroom storage. However, this space could be reclaimed for manufactuni use without overloading the stockroom facilities. This floor space is valued at S6 per square foou and Volume Mowerson's cost for manufacturing printed circuit boands s a Direct material Direct labor Variable overhead Fixed overhead Total cost $24.00 12.50 6.25 9.25 52.00 The direct material cost includes normal scrap and other such material-related costs as incc ning freight and issuing costs. Mowerson's annual cost for incoming freight attributed to PCBsis $7.50) Tri-Star will charge $60 per board, including the cost of delivery Mowerson's production volume of printed circuit boards for the past two years has been 80,00 and 90,000 boards, respectively. Projected production volumes for the next three years are: 2002 2003 2004 100,000 120,000 130,000 Storage Costs Because Mowerson will not have direct control over the manufacture of the PCBs, the level of safety stock will be increased over the current level of 1.800 boards. The supervisor of the assembly department has provided the accompanying probabilities associated with reductions in Tri-Star's ability to produce and/or deliver PCBs. Percentage of Time Tri-Star Deliveries Will Be Late Safety Stock of PCBs Probability Value 0.30 0.40 0.25 2,500 4,000 6,000 7,000 750 1,600 1,500 350 4,200 10 New safety stock level The variable cost to store the PCBs is $2 per board per year. Other The variable cost of executing a purchase order at Mowerson is $1.25 for ierms such as post age, forms, and telephone. Since Mowers required for the printed circuit boards, there will be a reduction of 2,000 purchase orders p annually Recommendation Based on the annual savings of $398,100 projecied above, Mowerson shoula enter into an agreement with Tri-Star to manufacture the printed circuit boards on will no longer have to purchase all the component parts Year 1 Year 2 Base Year ear $6,000,000 $6,000,000 $6,000,000 $6.000,00 Revenues Less 1,000,000 1,050,000 1,120,000 2,800,000 $ 30,000 9,000 S 21,000 Cost of goods sold: 1,000,000 900,000 1,040,000 2,600,000 $ 460,000 138,000 1 900.000 10,000 bbls $100/bbl Oak barrels Warehouse rental Warehouse direct costs 1,000,000 750,000 1,000,000 2,500,000 750,000 225,000 1,240,000 3.200,000 5%-3,000) Net income (loss) before taxes Income taxes (30%) Net income after taxes 2,000 $ 313.000 $ 525,000 322,000 xpan- Management is quite concerned about the loss that is projected for the third year of the sion (the current year). The president has scheduled a meeting with the local bank to re firm's current financial performance. This bank has been lending the firm the capital to finan production expansion review Required a. Instead of writing off all the warehousing and oak barrel costs, prepare revised income ments for years 1 through 3, treating the warehousing and barrel costs as product costs b. Which set of income statements (those given or the ones you prepared) should the pres dent show the bank at the meeting? Justify your answer Mowerson Division The Mowerson Division of Brown Instruments manufactures testing equipment for the automobil industry. Mowerson's equipment is installed in several places along an automobile assembly line for component testing and is also used for recording and measurement purposes during track and road tests. Mowerson's sales have grown steadily, and revenue will exceed $200 million for the first time in 2001 Mowerson designs and manufactures its own printed circuit boards (PCBs) for use in the test equipment. The PCBs are manually assembled in the Assembly Department, which emplo 45 technicians. Because of a lack of plant capacity and a shortage of skilled labor, Mowerson is considering having the printed circuit boards manufactured by Tri-Star, a specialist in this field. Quality control restrictions and vendor requirements dictate that all PCBs be either manufactured The Nature of Costs 83 by Mowerso higher than the in-house cost: from this change. r contracted to an outside vendor. The per-board cost of outside manufacture is net: however, management thinks that savings could also be realized management Jim Wright, a recently hired cost analyst, has been asked to prepare a financial analysis of the outside manufacturing proposal. Wright's report includes the assumptions he used in his analysis uring proposal. Wright's report includes the assumptions he used in his analysis, ion. His financial analysis appears next, and his notes and assumptions along with his rec follow the analysis. Required scus er IS. its Annual Cost Savings Analysis for Tri-Star Contract Savings 1. Reduction in assembly technicians (S28.500 x 40) $1,140,000 35,000 2. Assembly supervisor transferred 3. Floor space savings (1.000 S9.50) + (8,000 $6.00)] 57,500 6,000 4. Purchasing clerk, 1/2 time on special project 5. Purchase order reduction (2,000 orders@$1.25 each) 6. Reduced freight expense 2,500 7,500 Total savings $1,248,500 Costs 7. Increased production cost [(S60.00 x 52.00) x 100,000 units 8. Hire junior engineer 9. Hire quality control inspector 10. Increased storage cost for safety stock $800,000 20,000 22,000 (Expected value of 4,200 units @$2.00/unit) Total costs Net annual savings 8,400 850,400 S 398,100 Notes and Assumptions Personnel Assembly department technicians will be reduced by 40 at an annual savings (salary plus benefits) of $28,500 each. Five assemblers will remain to assist the field service department with repair work on the printed circuit boards; assemblers have always assisted in repair work. The supervisor of the assembly department will remain with Mowerson because he has only two years until retirement; a posi- tion will be created for him in the machining department, where he will serve as a special consultant. Because of the elimination of purchasing and stocking of component parts required for PCB assembly, one purchasing clerk will be assigned half-time to a special project until his time can be more fully utilized. ineer will be hired to act as liaison between Mowerson and the manufacturer of the n addition, a third quality control inspector will be needed to monitor the vendor's adherence A junior eng PCBs. I to quality standards. Chapter 2 Floor Space For the past two years, Mowerson has rented, on a month-to-month basis, 1,00 square feet of space for $9.50 per square foot in a neighboring building to accommodate the overflow of asemt work. The 8.000 square feet currently being used in Mowerson's main plant by the assembly depatmen will be used for temporary stockroom storage. However, this space could be reclaimed for manufactuni use without overloading the stockroom facilities. This floor space is valued at S6 per square foou and Volume Mowerson's cost for manufacturing printed circuit boands s a Direct material Direct labor Variable overhead Fixed overhead Total cost $24.00 12.50 6.25 9.25 52.00 The direct material cost includes normal scrap and other such material-related costs as incc ning freight and issuing costs. Mowerson's annual cost for incoming freight attributed to PCBsis $7.50) Tri-Star will charge $60 per board, including the cost of delivery Mowerson's production volume of printed circuit boards for the past two years has been 80,00 and 90,000 boards, respectively. Projected production volumes for the next three years are: 2002 2003 2004 100,000 120,000 130,000 Storage Costs Because Mowerson will not have direct control over the manufacture of the PCBs, the level of safety stock will be increased over the current level of 1.800 boards. The supervisor of the assembly department has provided the accompanying probabilities associated with reductions in Tri-Star's ability to produce and/or deliver PCBs. Percentage of Time Tri-Star Deliveries Will Be Late Safety Stock of PCBs Probability Value 0.30 0.40 0.25 2,500 4,000 6,000 7,000 750 1,600 1,500 350 4,200 10 New safety stock level The variable cost to store the PCBs is $2 per board per year. Other The variable cost of executing a purchase order at Mowerson is $1.25 for ierms such as post age, forms, and telephone. Since Mowers required for the printed circuit boards, there will be a reduction of 2,000 purchase orders p annually Recommendation Based on the annual savings of $398,100 projecied above, Mowerson shoula enter into an agreement with Tri-Star to manufacture the printed circuit boards on will no longer have to purchase all the component parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts