Answered step by step

Verified Expert Solution

Question

1 Approved Answer

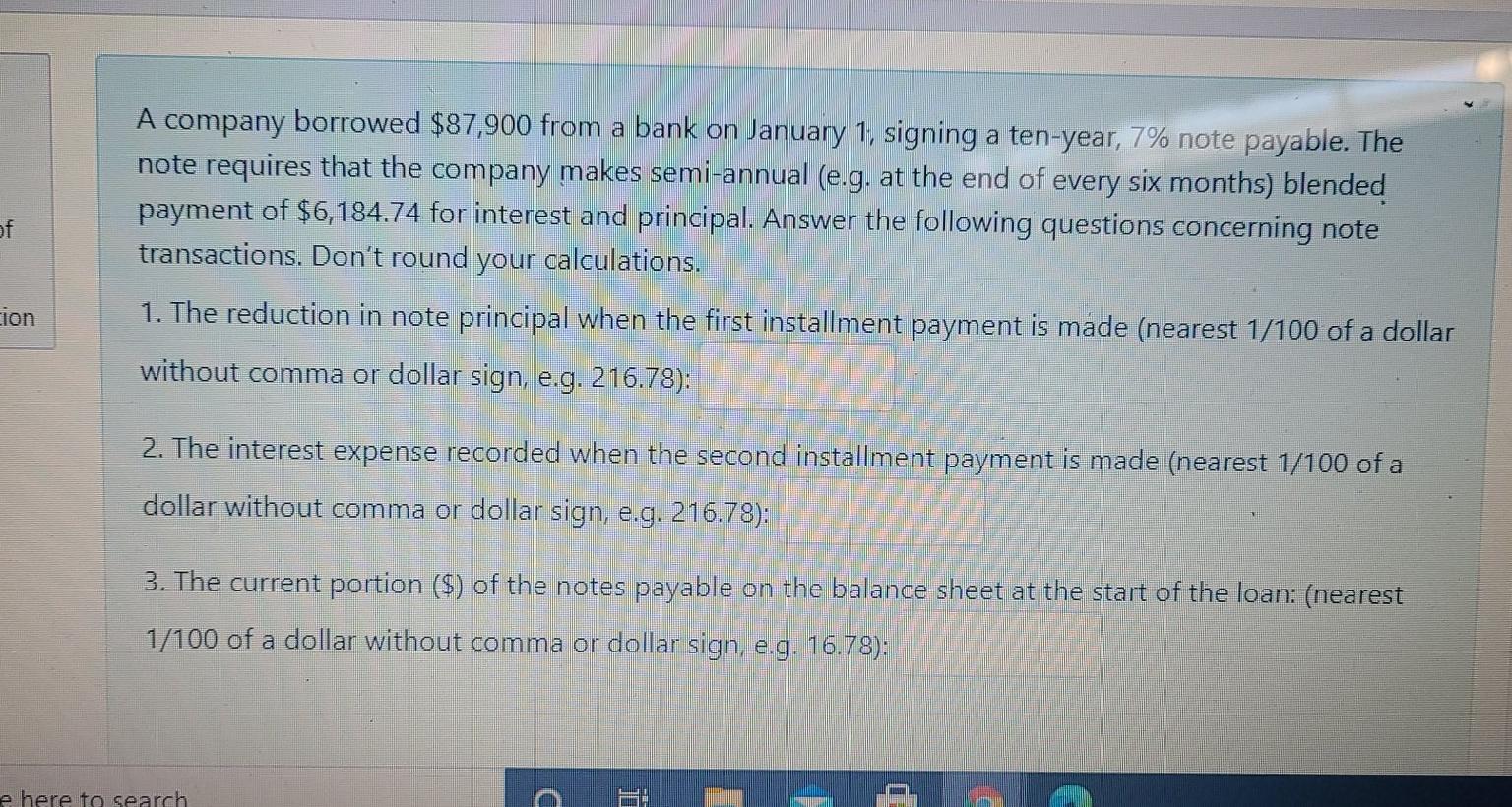

of A company borrowed $87,900 from a bank on January 1, signing a ten-year, 7% note payable. The note requires that the company makes semi-annual

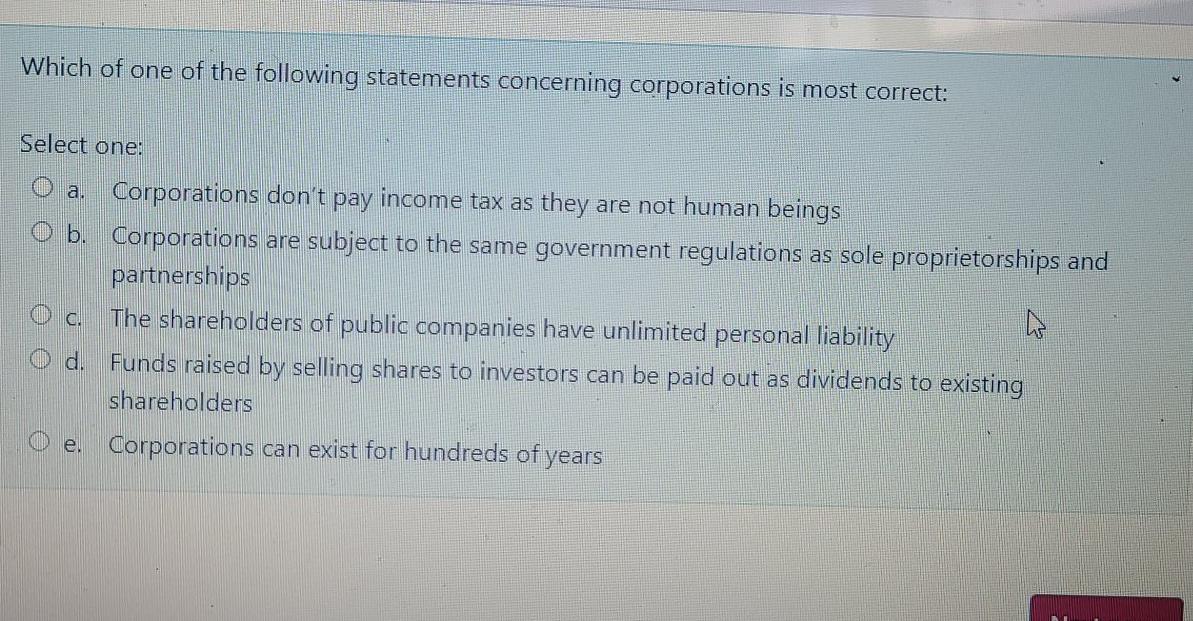

of A company borrowed $87,900 from a bank on January 1, signing a ten-year, 7% note payable. The note requires that the company makes semi-annual (e.g. at the end of every six months) blended payment of $6,184.74 for interest and principal. Answer the following questions concerning note transactions. Don't round your calculations. 1. The reduction in note principal when the first installment payment is made (nearest 1/100 of a dollar without comma or dollar sign, e.g. 216.78): cion 2. The interest expense recorded when the sec nd installment payment is made (nearest 1/100 of a dollar without comma or dollar sign, e.g. 216.78): 3. The current portion ($) of the notes payable on the balance sheet at the start of the loan: (nearest 1/100 of a dollar without comma or dollar sign, e.g. 16.78): e here to search Which of one of the following statements concerning corporations is most correct: Select one: O a. Corporations don't pay income tax as they are not human beings O b. Corporations are subject to the same government regulations as sole proprietorships and partnerships Oc. The shareholders of public companies have unlimited personal liability O d. Funds raised by selling shares to investors can be paid out as dividends to existing shareholders O e Corporations can exist for hundreds of years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started