Question

During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: 2022 understated by

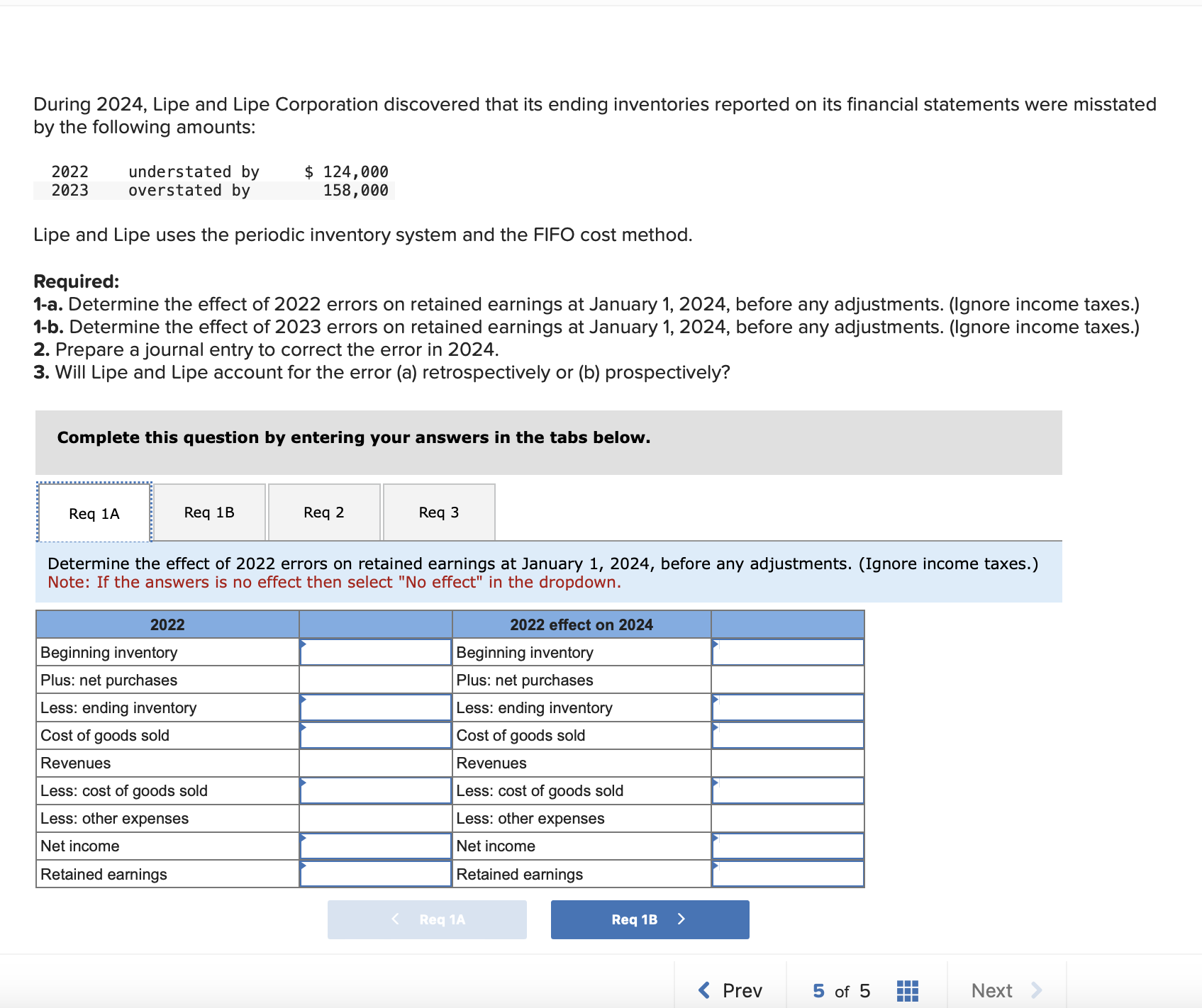

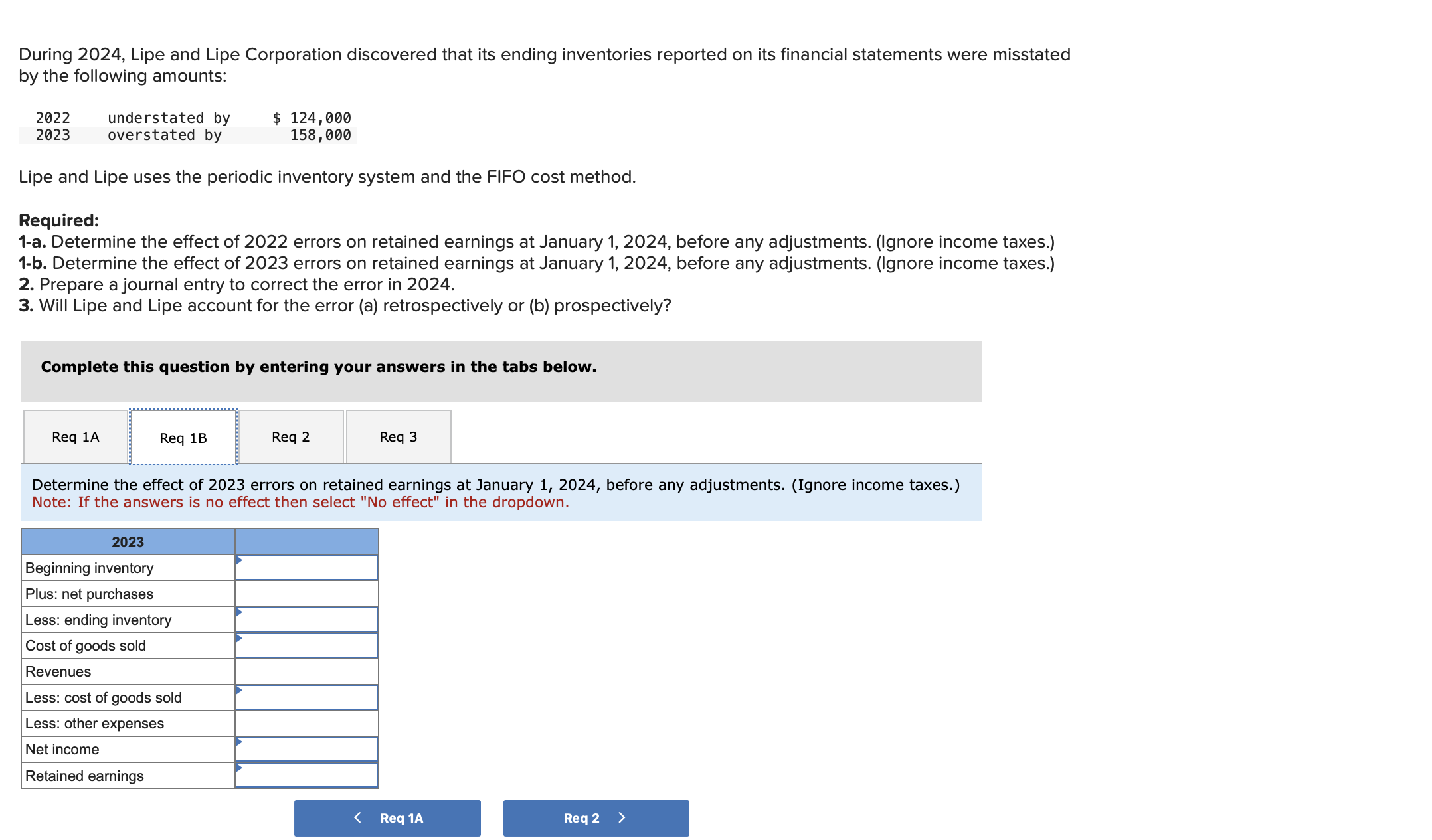

During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts:

During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts:

| 2022 | understated by | $ 124,000 |

|---|---|---|

| 2023 | overstated by | 158,000 |

Lipe and Lipe uses the periodic inventory system and the FIFO cost method.

Required:

1-a. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.)

1-b. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.)

2. Prepare a journal entry to correct the error in 2024.

3. Will Lipe and Lipe account for the error (a) retrospectively or (b) prospectively?

During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: Lipe and Lipe uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2024. 3. Will Lipe and Lipe account for the error (a) retrospectively or (b) prospectively? Complete this question by entering your answers in the tabs below. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) Note: If the answers is no effect then select "No effect" in the dropdown. During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: Lipe and Lipe uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2024. 3. Will Lipe and Lipe account for the error (a) retrospectively or (b) prospectively? Complete this question by entering your answers in the tabs below. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) Note: If the answers is no effect then select "No effect" in the dropdown

During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: Lipe and Lipe uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2024. 3. Will Lipe and Lipe account for the error (a) retrospectively or (b) prospectively? Complete this question by entering your answers in the tabs below. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) Note: If the answers is no effect then select "No effect" in the dropdown. During 2024, Lipe and Lipe Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: Lipe and Lipe uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2022 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2024. 3. Will Lipe and Lipe account for the error (a) retrospectively or (b) prospectively? Complete this question by entering your answers in the tabs below. Determine the effect of 2023 errors on retained earnings at January 1, 2024, before any adjustments. (Ignore income taxes.) Note: If the answers is no effect then select "No effect" in the dropdown Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started