Answered step by step

Verified Expert Solution

Question

1 Approved Answer

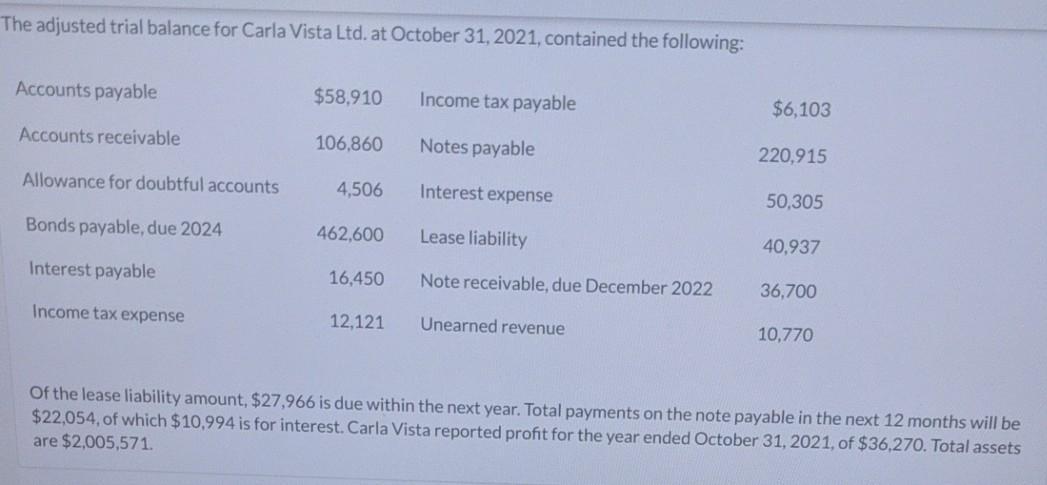

The adjusted trial balance for Carla Vista Ltd. at October 31, 2021, contained the following: Accounts payable $58,910 Income tax payable $6,103 Accounts receivable

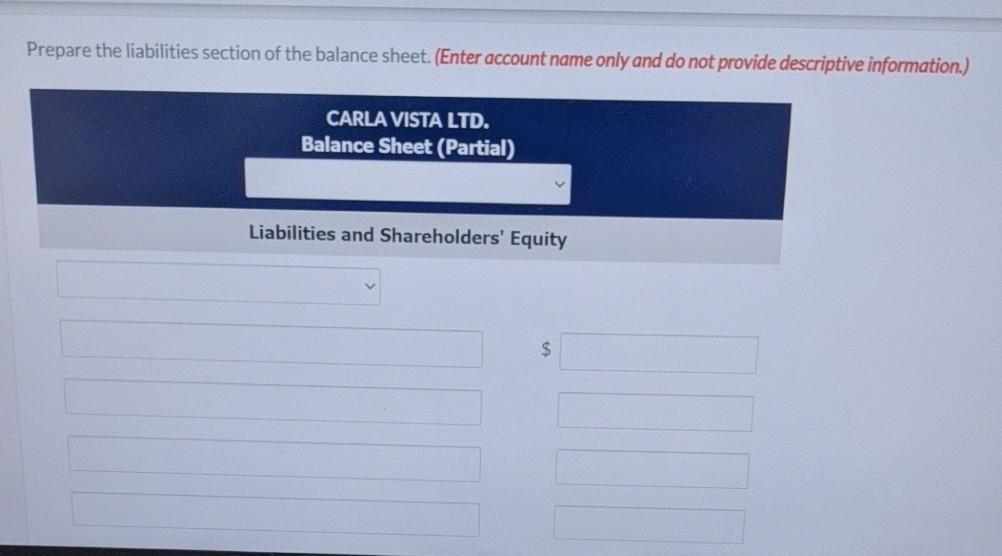

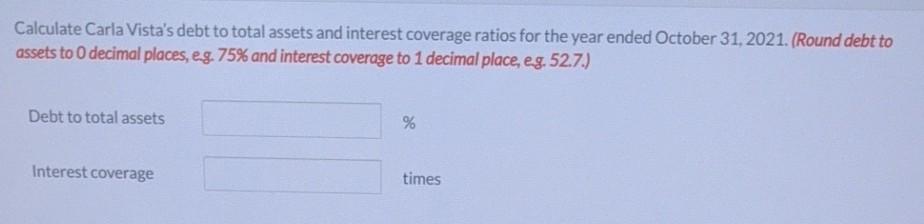

The adjusted trial balance for Carla Vista Ltd. at October 31, 2021, contained the following: Accounts payable $58,910 Income tax payable $6,103 Accounts receivable 106,860 Notes payable 220,915 Allowance for doubtful accounts 4,506 Interest expense 50,305 Bonds payable, due 2024 462,600 Lease liability 40,937 Interest payable 16,450 Note receivable, due December 2022 36,700 Income tax expense 12,121 Unearned revenue 10,770 Of the lease liability amount, $27,966 is due within the next year. Total payments on the note payable in the next 12 months will be $22,054, of which $10,994 is for interest. Carla Vista reported profit for the year ended October 31, 2021, of $36,270. Total assets are $2,005,571. Prepare the liabilities section of the balance sheet. (Enter account name only and do not provide descriptive information.) CARLA VISTA LTD. Balance Sheet (Partial) Liabilities and Shareholders' Equity %24 Calculate Carla Vista's debt to total assets and interest coverage ratios for the year ended October 31, 2021. (Round debt to assets to 0 decimal places, eg. 75% and interest coverage to 1 decimal place, eg. 52.7.) Debt to total assets Interest coverage times

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Llability means obligatlons of the buslness that It has to pay If obligatlons are to be met wlthln p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started