Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview fin 464 bank management please ans a and b must 3. Sunshine State Bank has the following financial information for the years

Old MathJax webview

fin 464 bank management

please ans a and b must

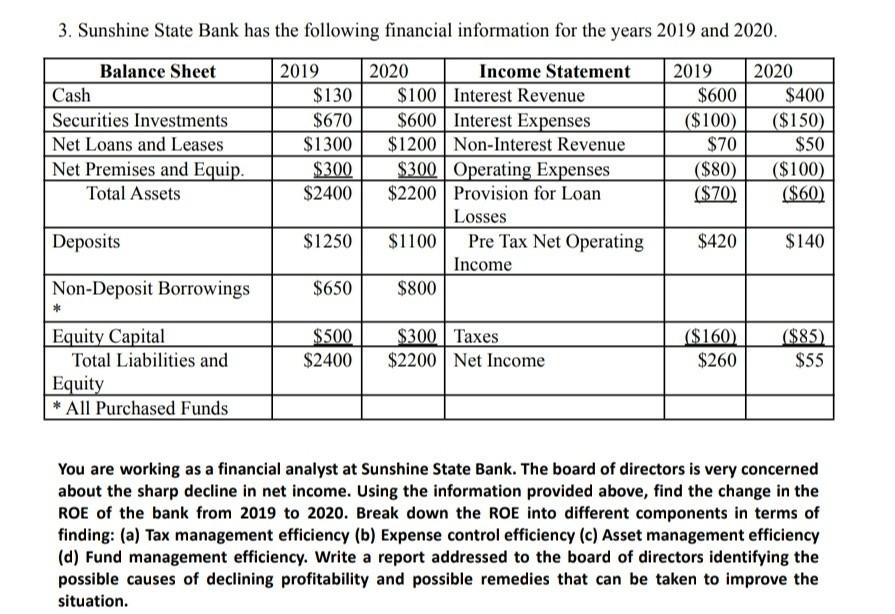

3. Sunshine State Bank has the following financial information for the years 2019 and 2020. Balance Sheet 2019 2020 Income Statement 2019 2020 Cash $130 $100 Interest Revenue $600 $400 Securities Investments $670 $600 Interest Expenses ($100) ($150) Net Loans and Leases $1300 $1200 Non-Interest Revenue $70 $50 Net Premises and Equip. $300 $300 Operating Expenses ($80) ($100) Total Assets $2400 $2200 Provision for Loan ($70) ($60) Losses Deposits $1250 $1100 Pre Tax Net Operating $420 $140 Income Non-Deposit Borrowings $650 $800 $500 $2400 $300 Taxes $2200 Net Income ($160) $260 ($85) $55 Equity Capital Total Liabilities and Equity All Purchased Funds You are working as a financial analyst at Sunshine State Bank. The board of directors is very concerned about the sharp decline in net income. Using the information provided above, find the change in the ROE of the bank from 2019 to 2020. Break down the ROE into different components in terms of finding: (a) Tax management efficiency (b) Expense control efficiency (c) Asset management efficiency (d) Fund management efficiency. Write a report addressed to the board of directors identifying the possible causes of declining profitability and possible remedies that can be taken to improve the situationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started