Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview finance 4. a. b. Eastern Cement Company has a (10+last digit of your ID)% preferred stock issued outstanding, with each share having

Old MathJax webview

finance

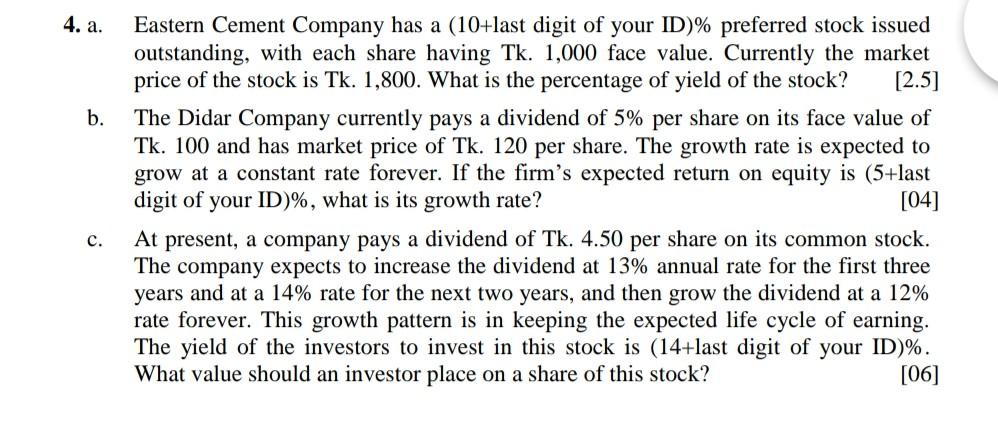

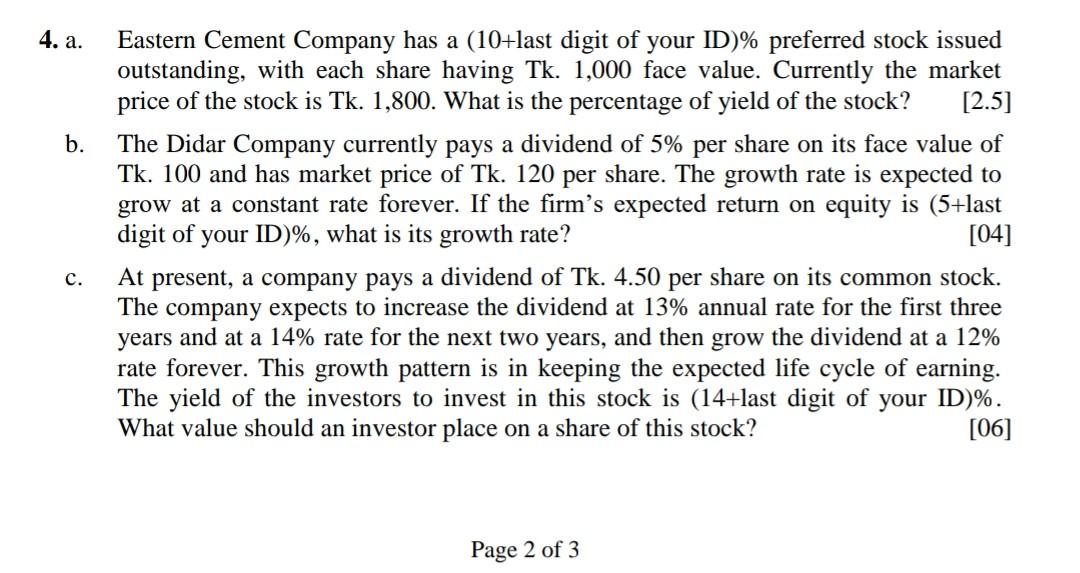

4. a. b. Eastern Cement Company has a (10+last digit of your ID)% preferred stock issued outstanding, with each share having Tk. 1,000 face value. Currently the market price of the stock is Tk. 1,800. What is the percentage of yield of the stock? [2.5] The Didar Company currently pays a dividend of 5% per share on its face value of Tk. 100 and has market price of Tk. 120 per share. The growth rate is expected to grow at a constant rate forever. If the firm's expected return on equity is (5+last digit of your ID)%, what is its growth rate? [04] At present, a company pays a dividend of Tk. 4.50 per share on its common stock. The company expects to increase the dividend at 13% annual rate for the first three years and at a 14% rate for the next two years, and then grow the dividend at a 12% rate forever. This growth pattern is in keeping the expected life cycle of earning. The yield of the investors to invest in this stock is (14+last digit of your ID)%. What value should an investor place on a share of this stock? [06] c. 4. a. b. Eastern Cement Company has a (10+last digit of your ID)% preferred stock issued outstanding, with each share having Tk. 1,000 face value. Currently the market price of the stock is Tk. 1,800. What is the percentage of yield of the stock? [2.5] The Didar Company currently pays a dividend of 5% per share on its face value of Tk. 100 and has market price of Tk. 120 per share. The growth rate is expected to grow at a constant rate forever. If the firm's expected return on equity is (5+last digit of your ID)%, what is its growth rate? [04] At present, a company pays a dividend of Tk. 4.50 per share on its common stock. The company expects to increase the dividend at 13% annual rate for the first three years and at a 14% rate for the next two years, and then grow the dividend at a 12% rate forever. This growth pattern is in keeping the expected life cycle of earning. The yield of the investors to invest in this stock is (14+last digit of your ID)%. What value should an investor place on a share of this stock? [06] c. Page 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started