Answered step by step

Verified Expert Solution

Question

1 Approved Answer

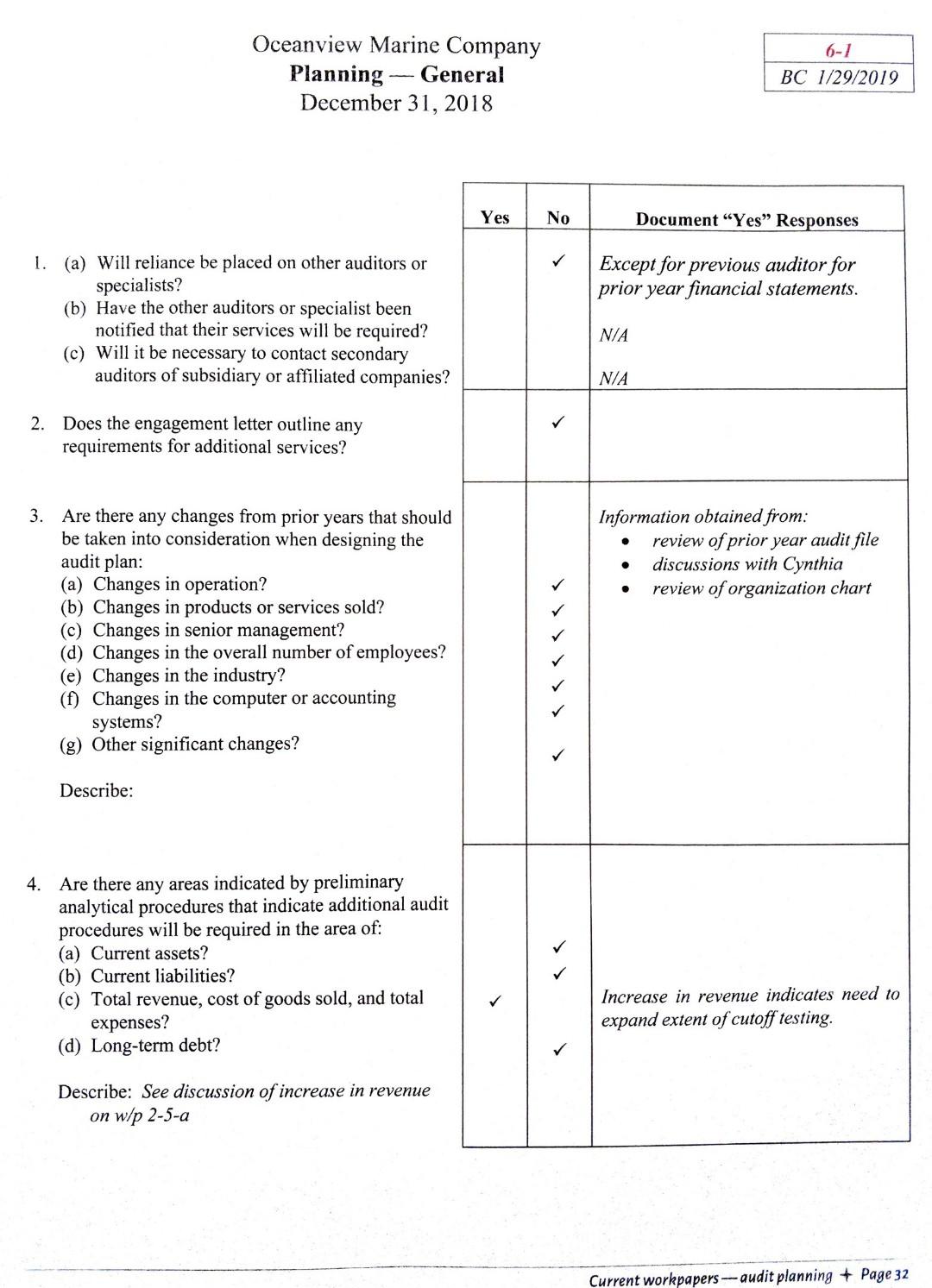

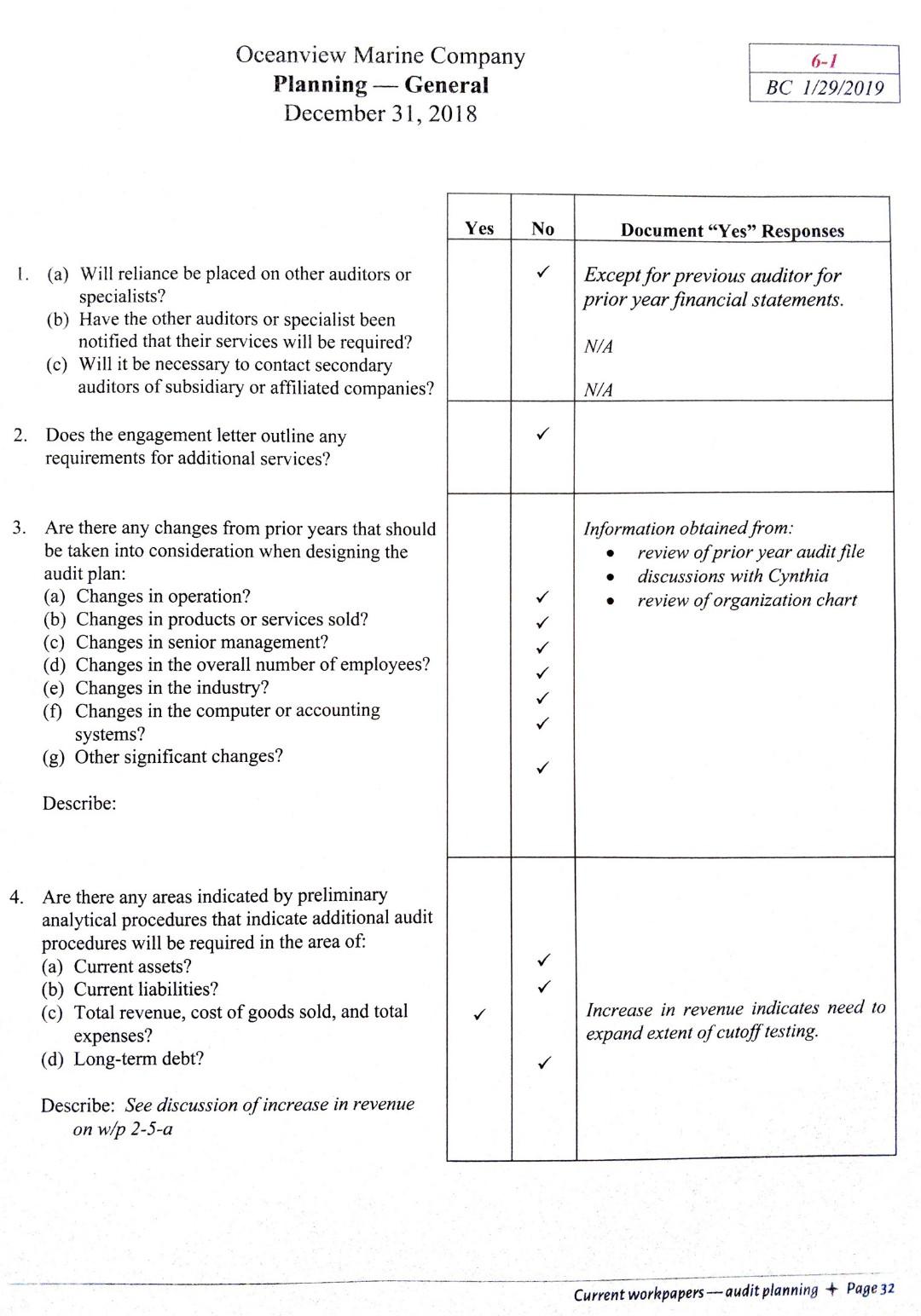

Old MathJax webview Old MathJax webview Old MathJax webview 6-1 Oceanview Marine Company Planning - General December 31, 2018 BC 1/29/2019 Yes No Document Yes

Old MathJax webview

Old MathJax webview

Old MathJax webview

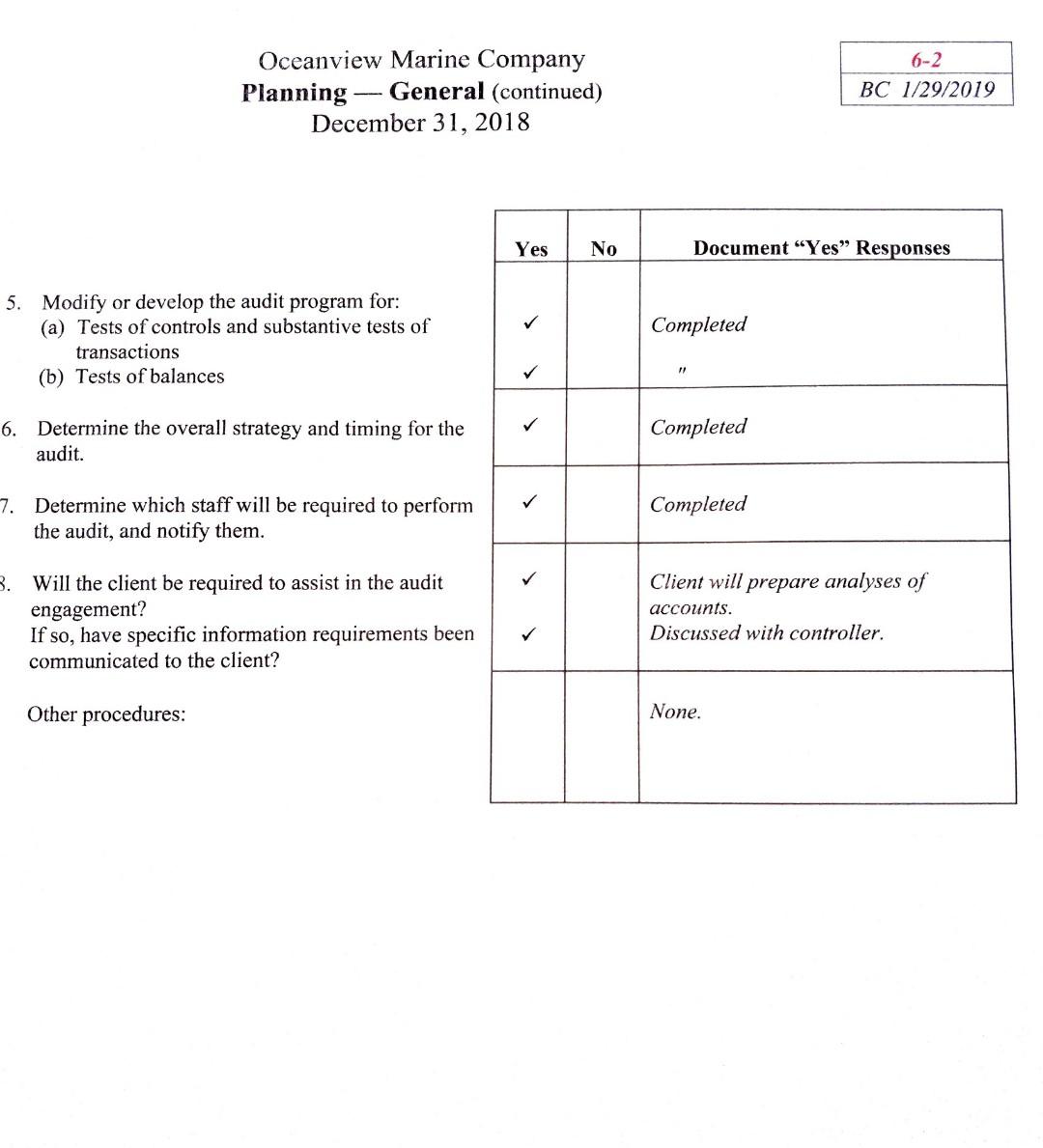

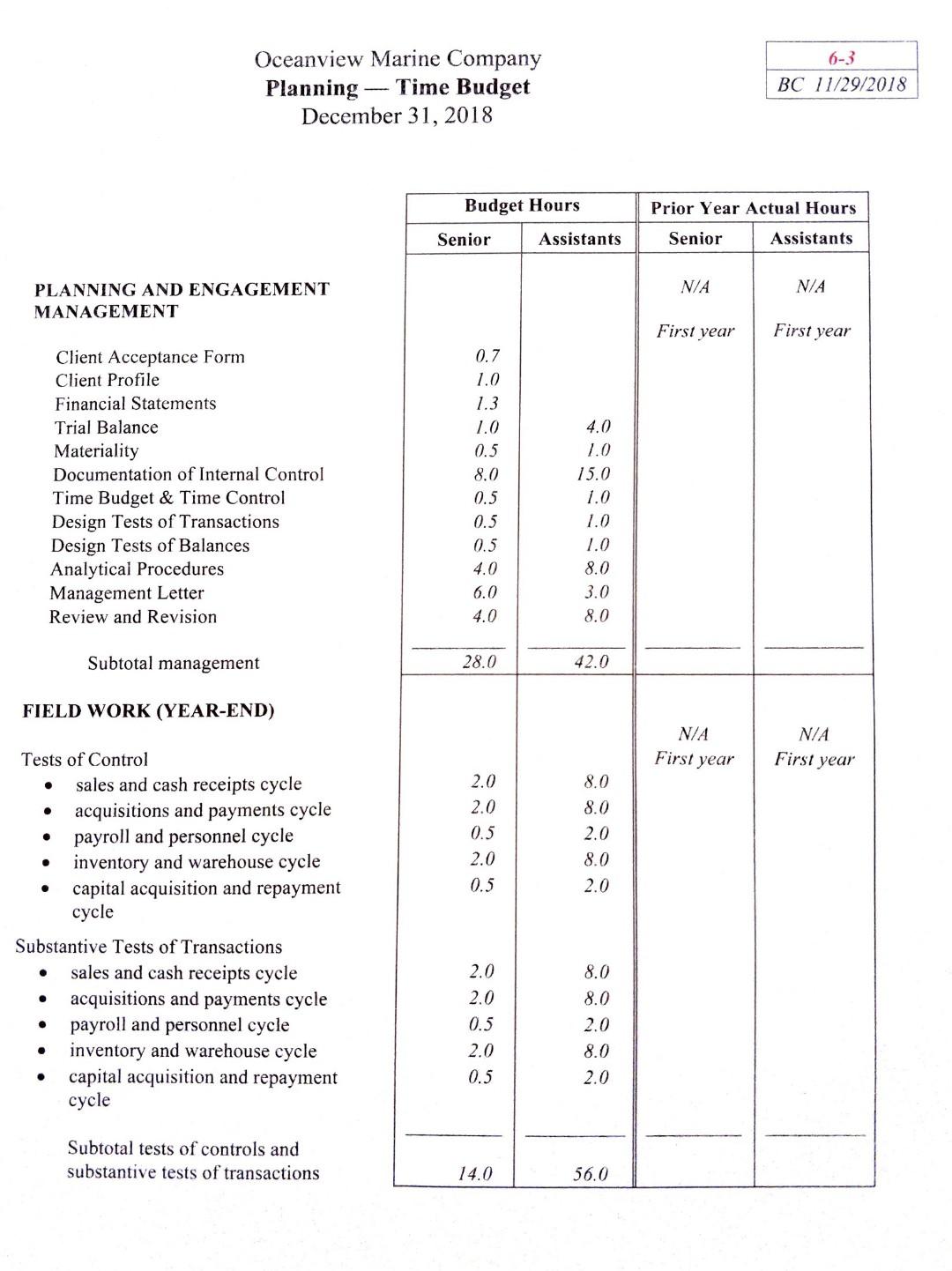

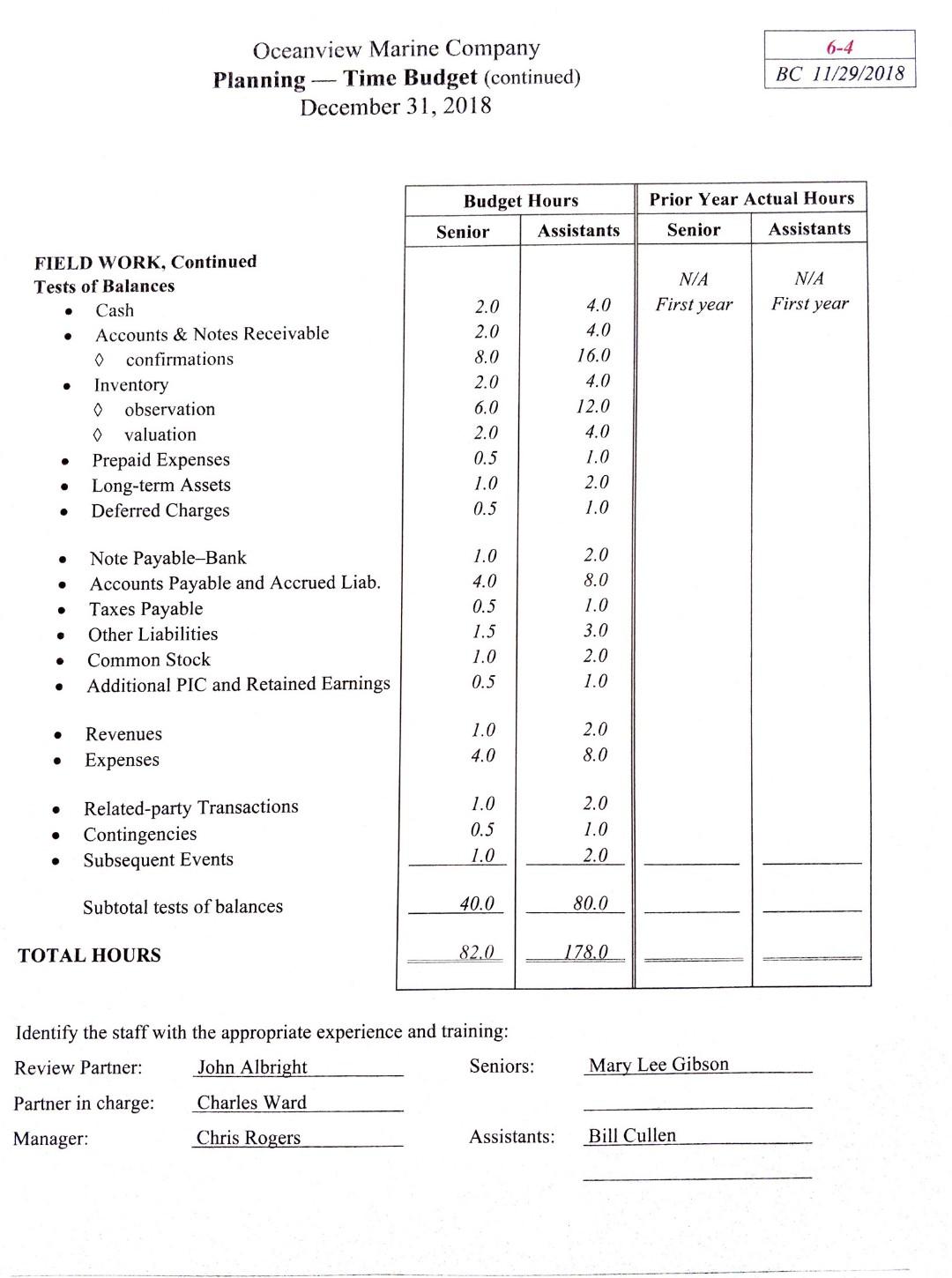

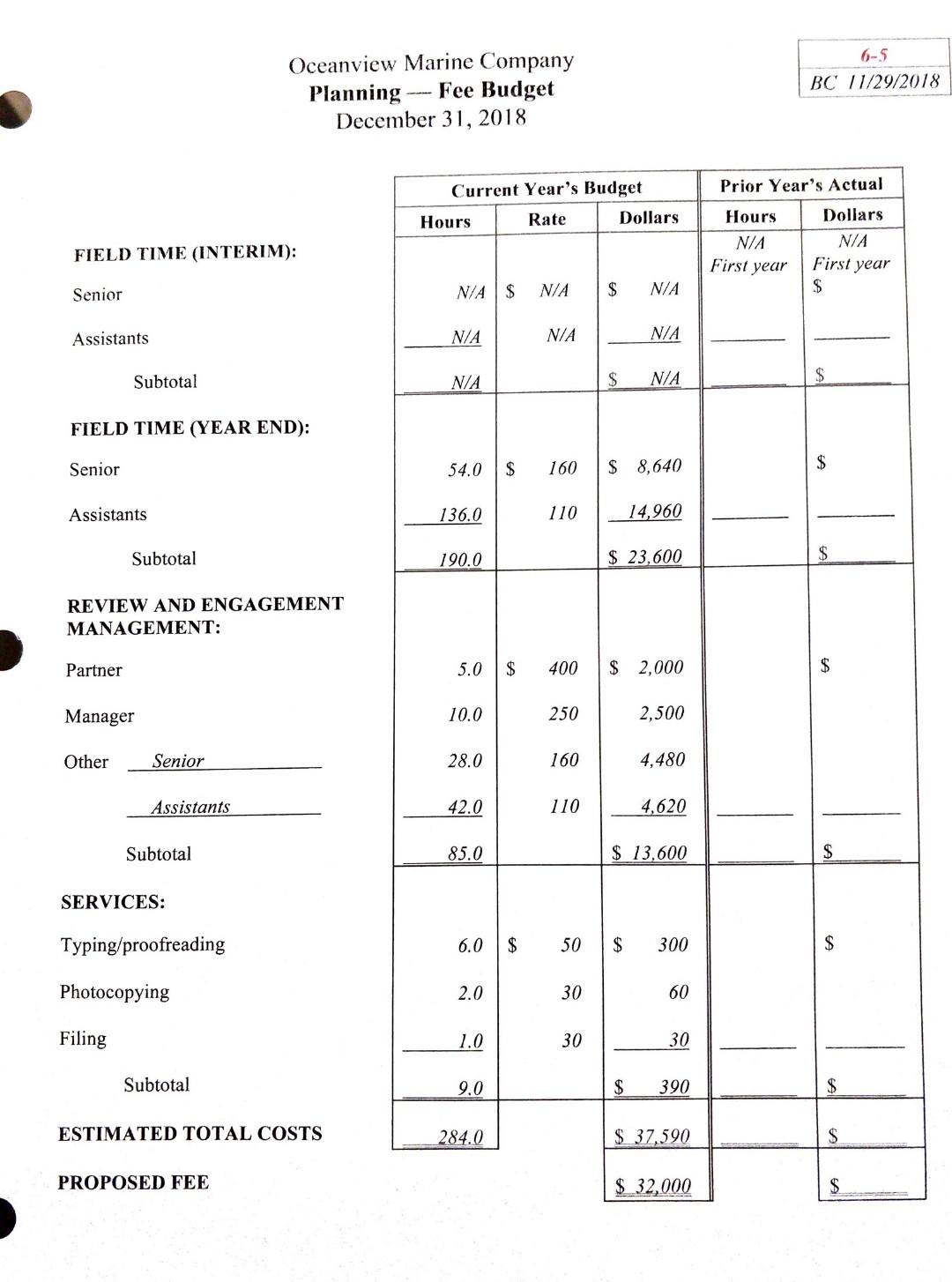

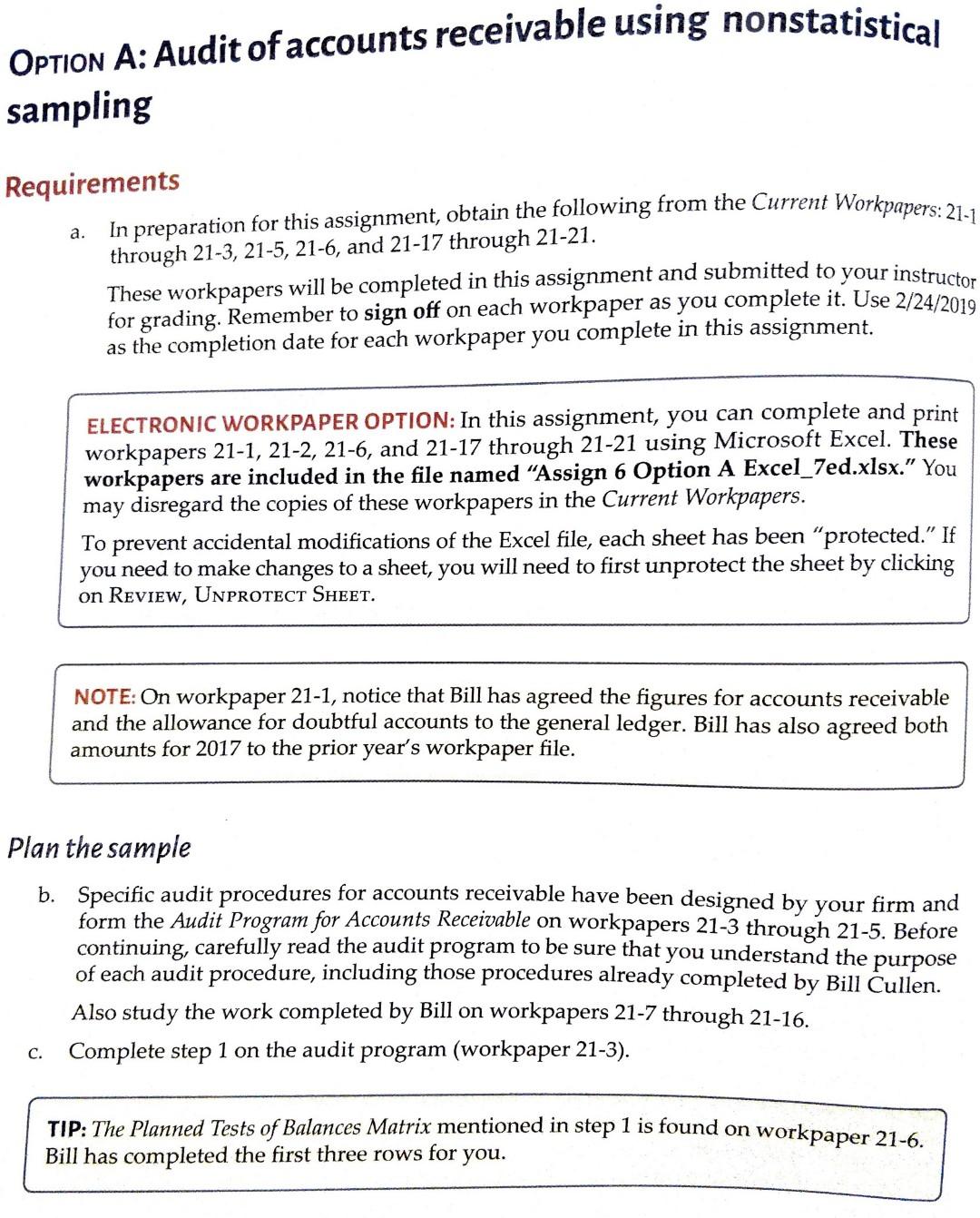

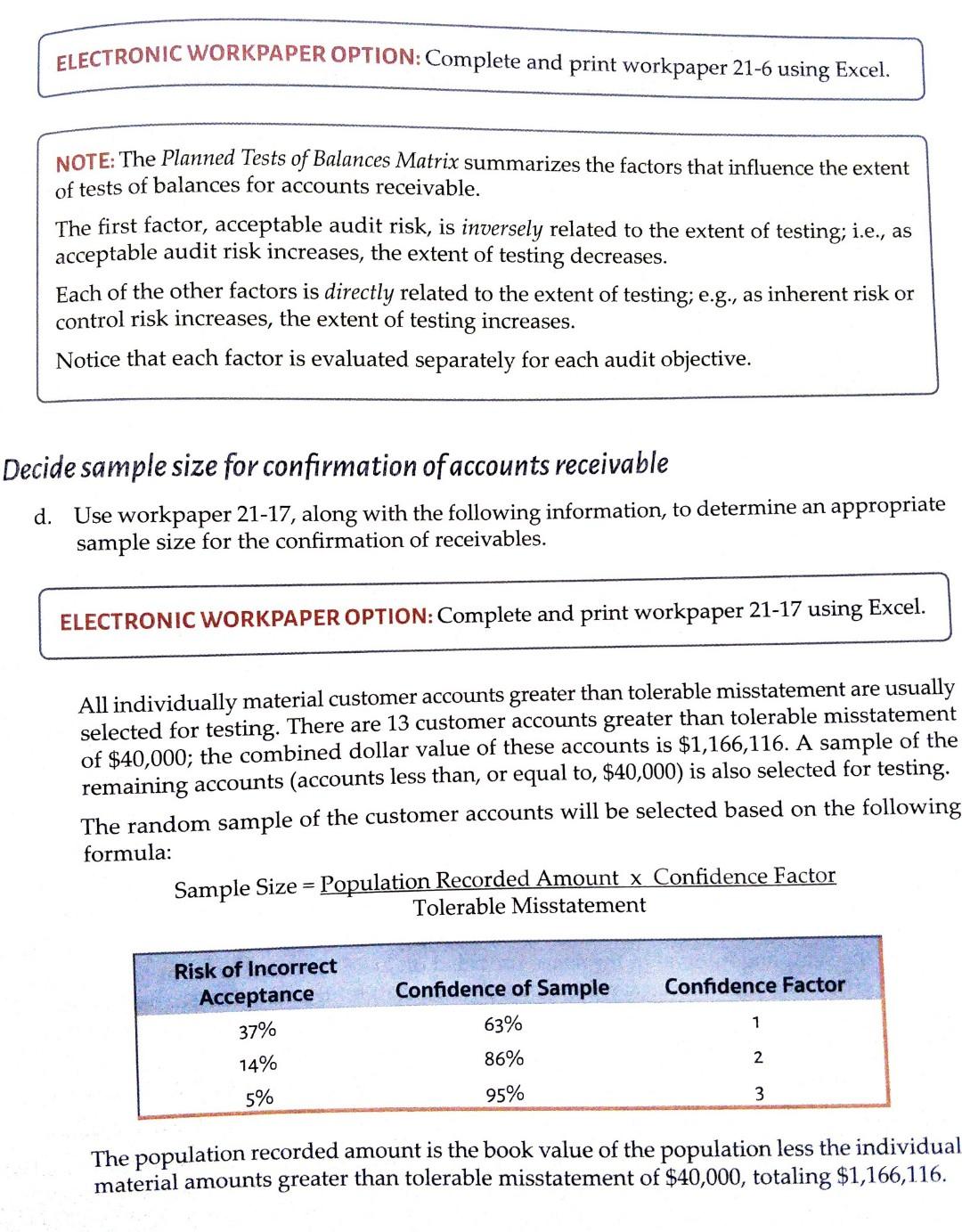

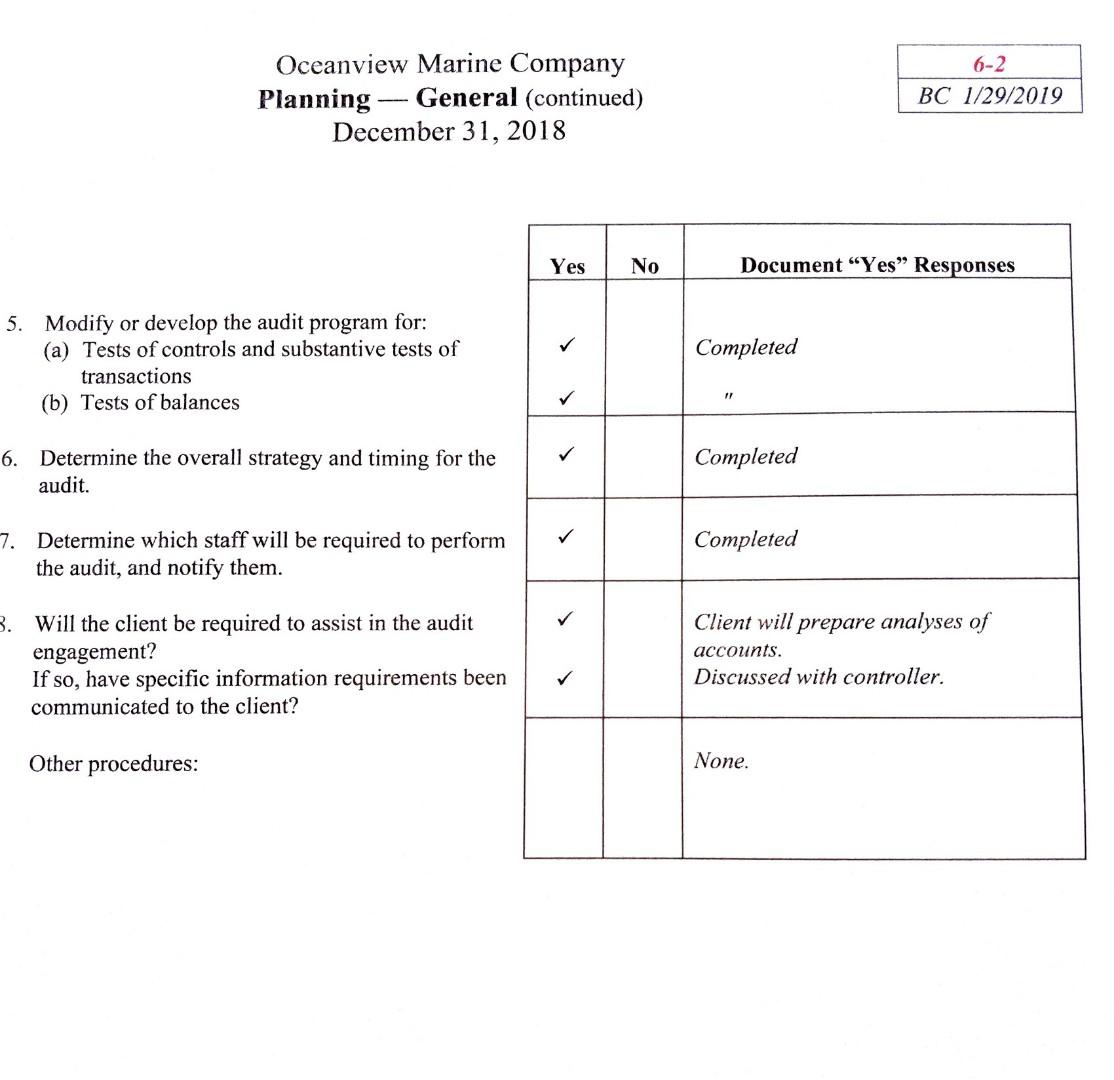

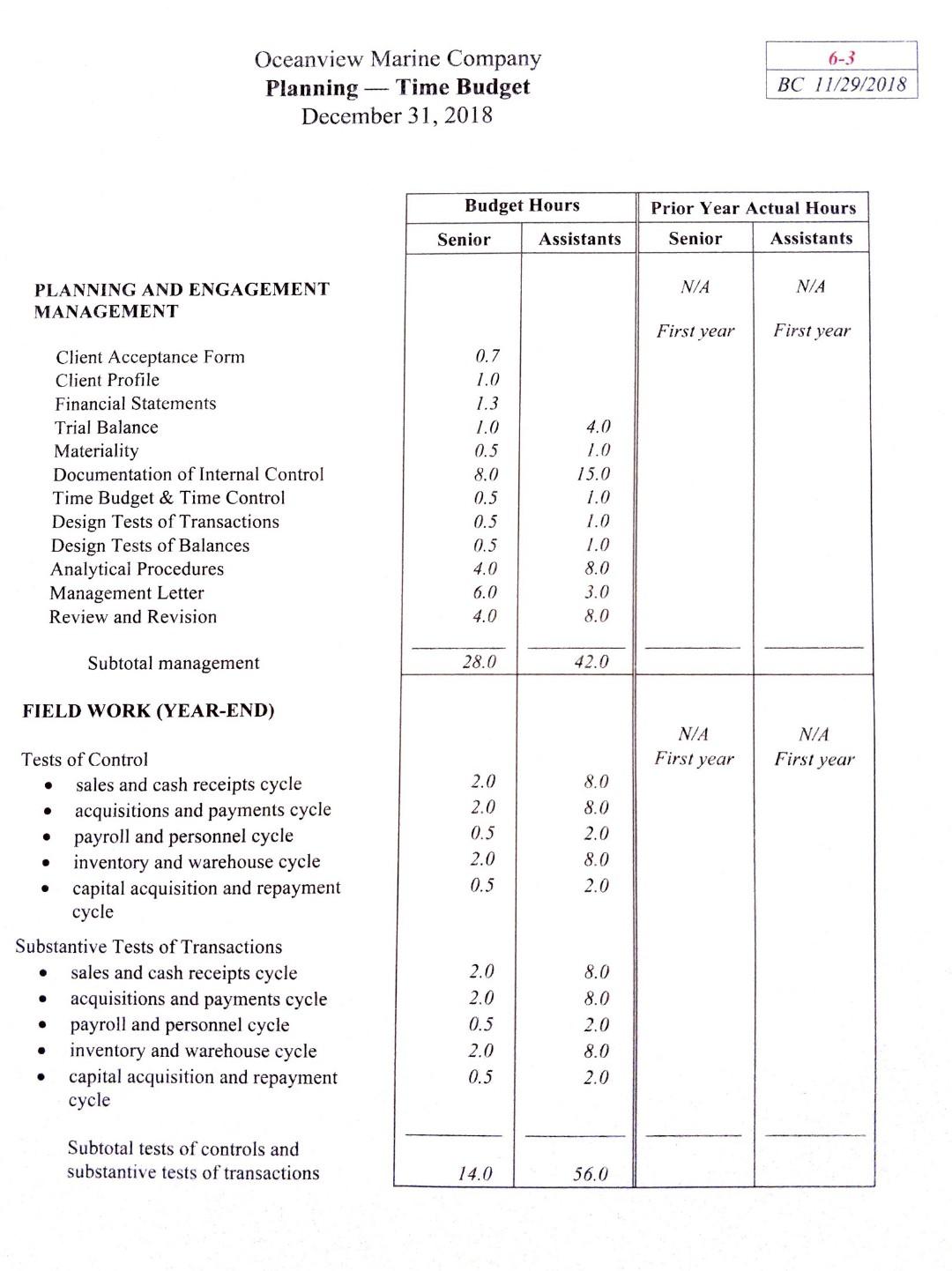

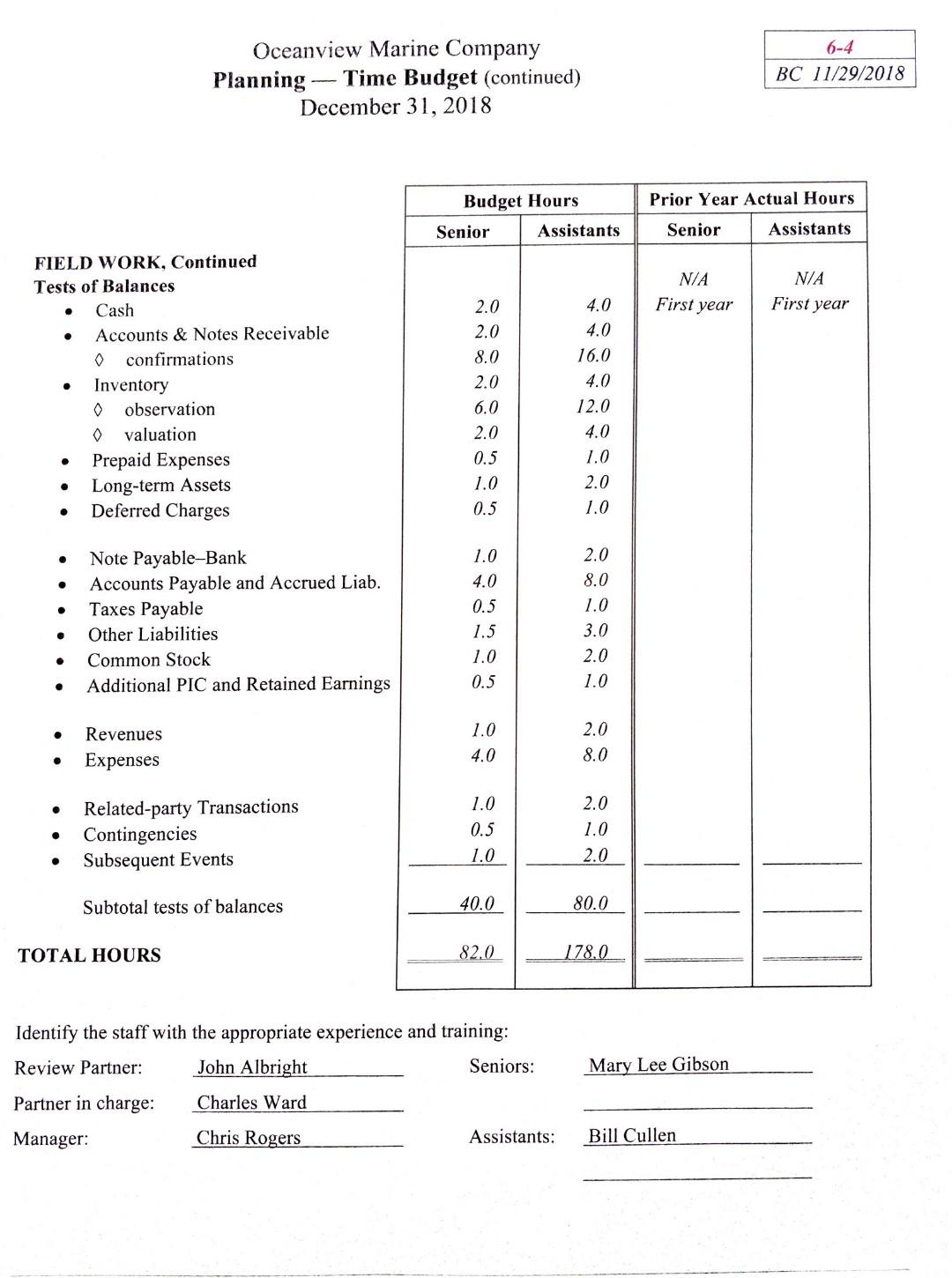

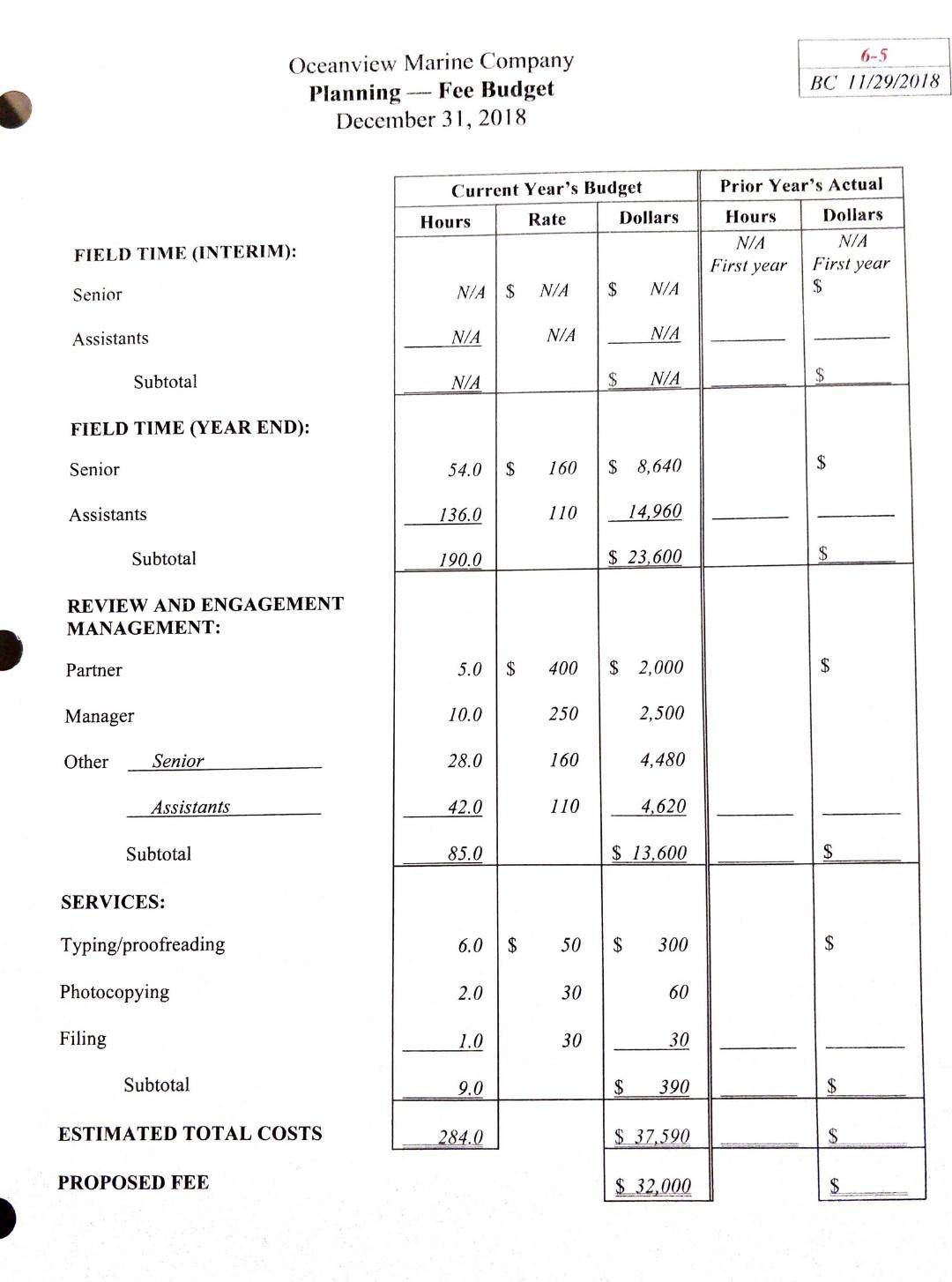

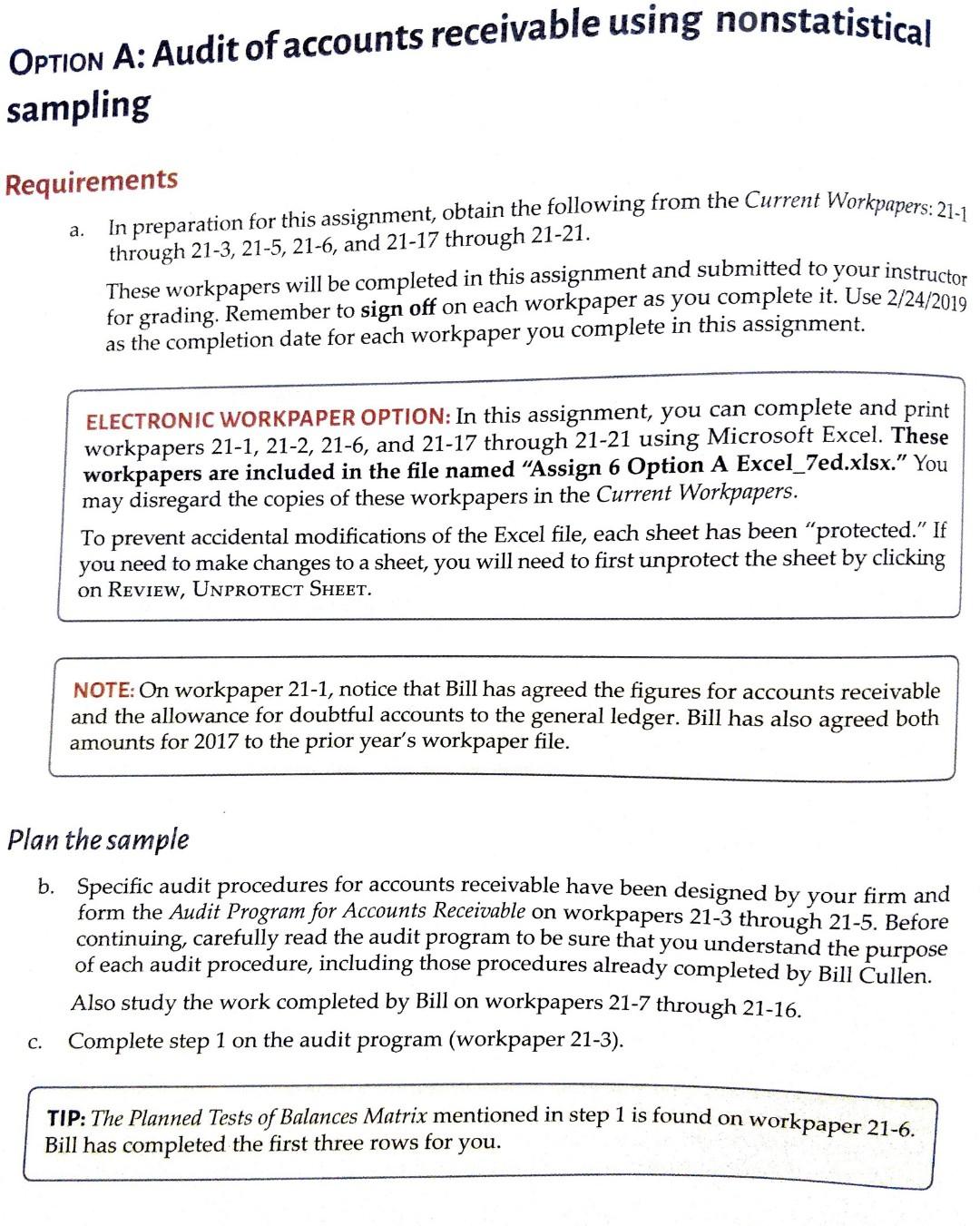

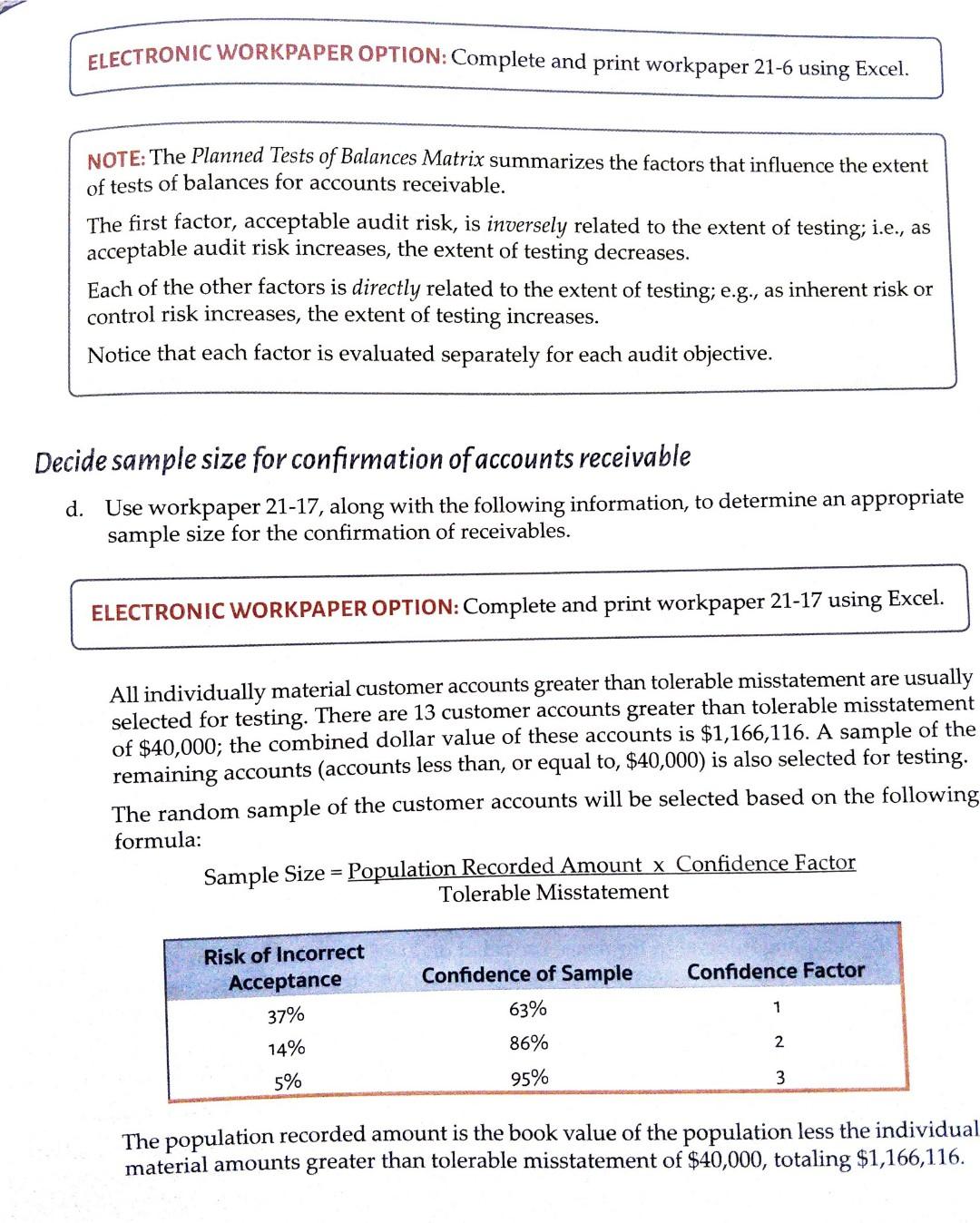

6-1 Oceanview Marine Company Planning - General December 31, 2018 BC 1/29/2019 Yes No Document Yes Responses Except for previous auditor for prior year financial statements. 1. (a) Will reliance be placed on other auditors or specialists? (b) Have the other auditors or specialist been notified that their services will be required? (c) Will it be necessary to contact secondary auditors of subsidiary or affiliated companies? N/A N/A 2. Does the engagement letter outline any requirements for additional services? Information obtained from: review of prior year audit file discussions with Cynthia review of organization chart 3. Are there any changes from prior years that should be taken into consideration when designing the audit plan: (a) Changes in operation? (b) Changes in products or services sold? (c) Changes in senior management? (d) Changes in the overall number of employees? (e) Changes in the industry? (f) Changes in the computer or accounting systems? (g) Other significant changes? Describe: 4. Are there any areas indicated by preliminary analytical procedures that indicate additional audit procedures will be required in the area of: (a) Current assets? (b) Current liabilities? (c) Total revenue, cost of goods sold, and total expenses? (d) Long-term debt? Increase in revenue indicates need to expand extent of cutoff testing. Describe: See discussion of increase in revenue on w/p 2-5-a Current workpapers --- audit planning + Page 32 6-2 Oceanview Marine Company Planning General (continued) December 31, 2018 BC 1/29/2019 Yes No Document "Yes" Responses Completed 5. Modify or develop the audit program for: (a) Tests of controls and substantive tests of transactions (b) Tests of balances Completed 6. Determine the overall strategy and timing for the audit. Completed 7. Determine which staff will be required to perform the audit, and notify them. Client will prepare analyses of accounts. 3. Will the client be required to assist in the audit engagement? If so, have specific information requirements been communicated to the client? Discussed with controller. Other procedures: None. 6-3 Oceanview Marine Company Planning - Time Budget December 31, 2018 BC 11/29/2018 Budget Hours Prior Year Actual Hours Senior Assistants Senior Assistants N/A N/A PLANNING AND ENGAGEMENT MANAGEMENT First year First year 0.7 1.0 1.3 1.0 4.0 0.5 1.0 8.0 15.0 Client Acceptance Form Client Profile Financial Statements Trial Balance Materiality Documentation of Internal Control Time Budget & Time Control Design Tests of Transactions Design Tests of Balances Analytical Procedures Management Letter Review and Revision 0.5 1.0 0.5 1.0 0.5 1.0 4.0 8.0 6.0 3.0 4.0 8.0 Subtotal management 28.0 42.0 FIELD WORK (YEAR-END) N/A N/A First year First year 2.0 8.0 2.0 . 8.0 Tests of Control sales and cash receipts cycle acquisitions and payments cycle payroll and personnel cycle inventory and warehouse cycle capital acquisition and repayment cycle 0.5 2.0 2.0 8.0 . 0.5 . 2.0 . 2.0 8.0 2.0 8.0 Substantive Tests of Transactions sales and cash receipts cycle acquisitions and payments cycle payroll and personnel cycle inventory and warehouse cycle capital acquisition and repayment cycle 0.5 2.0 . 2.0 8.0 0.5 2.0 Subtotal tests of controls and substantive tests of transactions 14.0 56.0 6-4 Oceanview Marine Company Planning -- Time Budget (continued) December 31, 2018 BC 11/29/2018 Budget Hours Prior Year Actual Hours Senior Assistants Senior Assistants FIELD WORK, Continued Tests of Balances N/A N/A 2.0 Cash 4.0 First year First year . 2.0 4.0 8.0 16.0 Accounts & Notes Receivable 0 confirmations Inventory 0 observation 2.0 4.0 . 6.0 12.0 valuation 2.0 4.0 0.5 1.0 Prepaid Expenses Long-term Assets Deferred Charges 1.0 2.0 0.5 1.0 . 1.0 2.0 . 4.0 8.0 . 0.5 1.0 Note Payable-Bank Accounts Payable and Accrued Liab. Taxes Payable Other Liabilities Common Stock Additional PIC and Retained Earnings 1.5 3.0 . 1.0 2.0 0.5 1.0 Revenues 1.0 2.0 Expenses 4.0 8.0 1.0 2.0 Related-party Transactions Contingencies Subsequent Events 0.5 1.0 1.0 2.0 Subtotal tests of balances 40.0 80.0 TOTAL HOURS 82.0 178.0 Identify the staff with the appropriate experience and training: Review Partner: John Albright Seniors: Mary Lee Gibson Partner in charge: Charles Ward Manager: Chris Rogers Assistants: Bill Cullen 6-5 BC 11/29/2018 Oceanview Marine Company Planning Fee Budget December 31, 2018 Current Year's Budget Prior Year's Actual Hours Rate Dollars Hours Dollars N/A N/A FIELD TIME (INTERIM): First year First year $ Senior N/A $ N/A $ N/A Assistants N/A N/A N/A Subtotal N/A $ N/A $ FIELD TIME (YEAR END): Senior 54.0 $ 160 $ 8,640 $ Assistants 136.0 110 14,960 Subtotal 190.0 $ 23,600 REVIEW AND ENGAGEMENT MANAGEMENT: Partner 5.0 $ 400 $ 2,000 $ Manager 10.0 250 2,500 Other Senior 28.0 160 4,480 Assistants 42.0 110 4.620 Subtotal 85.0 $ 13,600 $ SERVICES: Typing/proofreading 6.0 FA $ 50 $ 300 $ Photocopying 2.0 30 60 Filing 1.0 30 30 Subtotal 9.0 $ 390 ESTIMATED TOTAL COSTS 284.0 $ 37,590 S PROPOSED FEE $ 32,000 $ OPTION A: Audit of accounts receivable using nonstatistical sampling a. Requirements In preparation for this assignment, obtain the following from the Current Workpapers: 21-1 through 21-3, 21-5, 21-6, and 21-17 through 21-21. These workpapers will be completed in this assignment and submitted to your instructor for grading. Remember to sign off on each workpaper as you complete it. Use 2/24/2019 as the completion date for each workpaper you complete in this assignment. ELECTRONIC WORKPAPER OPTION: In this assignment, you can complete and print workpapers 21-1, 21-2, 21-6, and 21-17 through 21-21 using Microsoft Excel. These workpapers are included in the file named Assign 6 Option A Excel_7ed.xlsx." You may disregard the copies of these workpapers in the Current Workpapers. To prevent accidental modifications of the Excel file, each sheet has been "protected." If you need to make changes to a sheet, you will need to first unprotect the sheet by clicking on REVIEW, UNPROTECT SHEET. NOTE: On workpaper 21-1, notice that Bill has agreed the figures for accounts receivable and the allowance for doubtful accounts to the general ledger. Bill has also agreed both amounts for 2017 to the prior year's workpaper file. Plan the sample b. Specific audit procedures for accounts receivable have been designed by your firm and form the Audit Program for Accounts Receivable on workpapers 21-3 through 21-5. Before continuing, carefully read the audit program to be sure that you understand the purpose of each audit procedure, including those procedures already completed by Bill Cullen. Also study the work completed by Bill on workpapers 21-7 through 21-16. C. Complete step 1 on the audit program (workpaper 21-3). TIP: The Planned Tests of Balances Matrix mentioned in step 1 is found on workpaper 21-6. Bill has completed the first three rows for you. ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 21-6 using Excel. NOTE: The Planned Tests of Balances Matrix summarizes the factors that influence the extent of tests of balances for accounts receivable. The first factor, acceptable audit risk, is inversely related to the extent of testing; i.e., as acceptable audit risk increases, the extent of testing decreases. Each of the other factors is directly related to the extent of testing; e.g., as inherent risk or control risk increases, the extent of testing increases. Notice that each factor is evaluated separately for each audit objective. Decide sample size for confirmation of accounts receivable d. Use workpaper 21-17, along with the following information, to determine an appropriate sample size for the confirmation of receivables. ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 21-17 using Excel. All individually material customer accounts greater than tolerable misstatement are usually selected for testing. There are 13 customer accounts greater than tolerable misstatement of $40,000; the combined dollar value of these accounts is $1,166,116. A sample of the remaining accounts (accounts less than, or equal to, $40,000) is also selected for testing. The random sample of the customer accounts will be selected based on the following formula: Sample Size = Population Recorded Amount x Confidence Factor Tolerable Misstatement Risk of Incorrect Acceptance Confidence of Sample Confidence Factor 37% 63% 1 14% 86% 2 5% 95% 3 The population recorded amount is the book value of the population less the individual material amounts greater than tolerable misstatement of $40,000, totaling $1,166,116. substantive tests of transactions for the sales cycle were ADDITIONAL INFORMATION: Since (1) inherent risks for the existence and accuracy objectives are medium (see workpaper 21-6), and (2) the results of tests of controls and e generally favorable, the combined assessment of inherent and control risk is moderate. The results of substantive tests of transactions and analytical procedures were generally favorable. Based on these factors, a confidence factor of 2 was used, corresponding to a risk of incorrect acceptance of 14%. Information regarding the selection of the appropriate confidence factor is already indicated on workpaper 21-17. Assume tolerable misstatement for accounts receivable is $40,000. ELECTRONIC WORKPAPER OPTION: In cell B20 on workpaper 21-17, Bill has entered a formula to determine the sample size. You should verify that the formula is correct; make corrections if necessary. Select sample items for testing e. Independent of your answer in requirement (d), assume your sample size consists of the following: All 13 customer accounts greater than tolerable misstatement. A random sample of 35 of the remaining 73 customer accounts. . Using the year-end accounts receivable listing (workpapers 21-7 through 21-9), select the first five customer accounts from each part of the sample to be confirmed. Use workpaper 21-18 to document your selections. ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 21-18 using Excel. TIP: In selecting the sample of amounts less than tolerable misstatement, begin by calculating the sampling interval in the space provided on 21-18. The first account for each sample group and the random starting point (1st account) for the sample have been selected for you. To reduce the time demands, you are only required to select the next four items for each part of the sample. NOTE: In this assignment, systematic selection with a random start is used to select accounts The sampling interval is usually larger for companies with a large number of customers. for testing. There are many other methods of selection that would be acceptable in practice. Perform the audit procedures f. Assume that you mailed 48 confirmations and all have been returned to you from the customers. Five of the 48 customers disagreed with the client regarding the amount owed (see workpapers 21-10 through 21-14). Bill Cullen investigated the differences and wrote explanations on each of these five confirmations. After reading Bill's comments, decide whether the differences are client misstatements and should be projected to the population, or whether they are customer misstatements or timing differences that can be disregarded. Document your decisions by completing workpaper 21-19. ELECTRONIC WORKPAPER OPTION: Complete and print workpaper 21-19 using Excel. TIPS: When completing workpaper 21-19, be sure to list each difference in the appropriate section. Recall that the first group of accounts selected for testing consists of all accounts whose book value exceeds $40,000, while a sample was selected of accounts whose book value is equal to, or less than $40,000. When calculating the net misstatement on workpaper 21-19, overstatements should be treated as positive numbers and understatements as negative numbers Evaluate the results of the tests and conclude whether accounts receivable is fairly stated g. Complete workpaper 21-20 to project misstatements to the population and calculate the allowance for sampling risk. Complete the first three of the four sections on workpaper 21-21 to document your decision regarding the acceptability of the account balance. You might want to re-read page 5 of this assignment before completing this workpaper. In the Conclusion section, indicate whether, in your opinion, accounts receivable is fairly stated or whether further testing will be necessary based on the results of your confirmations of accounts receivable. ELECTRONIC WORKPAPER OPTION: Complete and print workpapers 21-20 and 21-21 using Excel. Follow these steps: 1. workpaper 21-20, verify that the net misstatement for amounts greater than tolerable misstatement has been transferred correctly from workpaper 21-19. Also verify that the projected misstatement for the sample of items below tolerable misstatement has been calculated correctly using the formula provided on workpaper 21-20. Make any necessary corrections to the formulas. 2. Verify that the allowance for sampling risk has been calculated correctly on workpaper 21-20. Make any necessary corrections to the formulas. h. Complete the bottom section of workpaper 21-21. Refer to the Assignment 6 appendix (Assignment SIX + Page 29) for firm policy regarding the evaluation and disposition of actual and projected misstatements identified during audit testing, including description of the audit misstatement posting threshold. The posting threshold has been set at $2,000 for the Oceanview audit. Misstatements, including projected misstatements, below this amount are considered trivial and do not need to be accumulated. Amounts greater than misstatements to determine if the aggregate amount of unadjusted misstatements is the audit misstatement threshold should be included on the summary of uncorrected material. The projected misstatement should be reduced by the amount of adjusting entries, if any, to accounts receivable (do not include the adjusting journal entry to the allowance for doubtful accounts prepared by Bill Cullen). Carry forward any unadjusted projected misstatement greater than the posting threshold to the Summary of Uncorrected Misstatements (workpaper 90-1). TIP: The Identified Misstatement column on workpaper 90-1 includes the amount of any misstatements identified in your testing on workpaper 21-19 that have not been adjusted by the client. Your remaining unadjusted projected misstatement on workpaper 21-21 should be entered in the Likely Aggregate Misstatement, Current Assets, and Income Before Taxes columns on workpaper 90-1. At the conclusion of the audit, the Summary of Uncorrected Misstatements will be reviewed and compared to materiality to decide if further adjusting entries are required to reduce the misstatements to an acceptable level. i. Assume the client agrees with the adjusting journal entry(ies) proposed on workpape 21-2. . Write the net effect (on accounts receivable and the allowance for doubtfu accounts) of the entry(ies) in the Net Adjustments column on the account receivable leadsheet (workpaper 21-1), and write the new account balance in the 2018 Adjusted Balance column on the leadsheet. Note that Bill has already posted the adjustment to the allowance for doubtful accounts and cross-referenced the balance to workpaper 21-15. You should complete the extensions on the leadsheet and cross-reference the balance for Account 1100 - accounts receivable. Th entry(ies), including the effect on accounts other than accounts receivable, will be posted to the trial balance in Assignment 10. ELECTRONIC WORKPAPER OPTION: Complete and print workpapers 21-1 and 21-2 using Excel. Complete the conclusion section, step 22, on workpaper 21-5. workpapers completed in this assignment, using 5, 21-6, and 21-17 through 21-21. a workpaper 21-3 by writing your initials in the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started