Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Old MathJax webview prepare an adjusted trial balance at January 31, 2021. (please send me answer quickly) can someone please answer my

Old MathJax webview

Old MathJax webview

prepare an adjusted trial balance at January 31, 2021. (please send me answer quickly)

can someone please answer my question?

leave retained earnings then just solve it this way

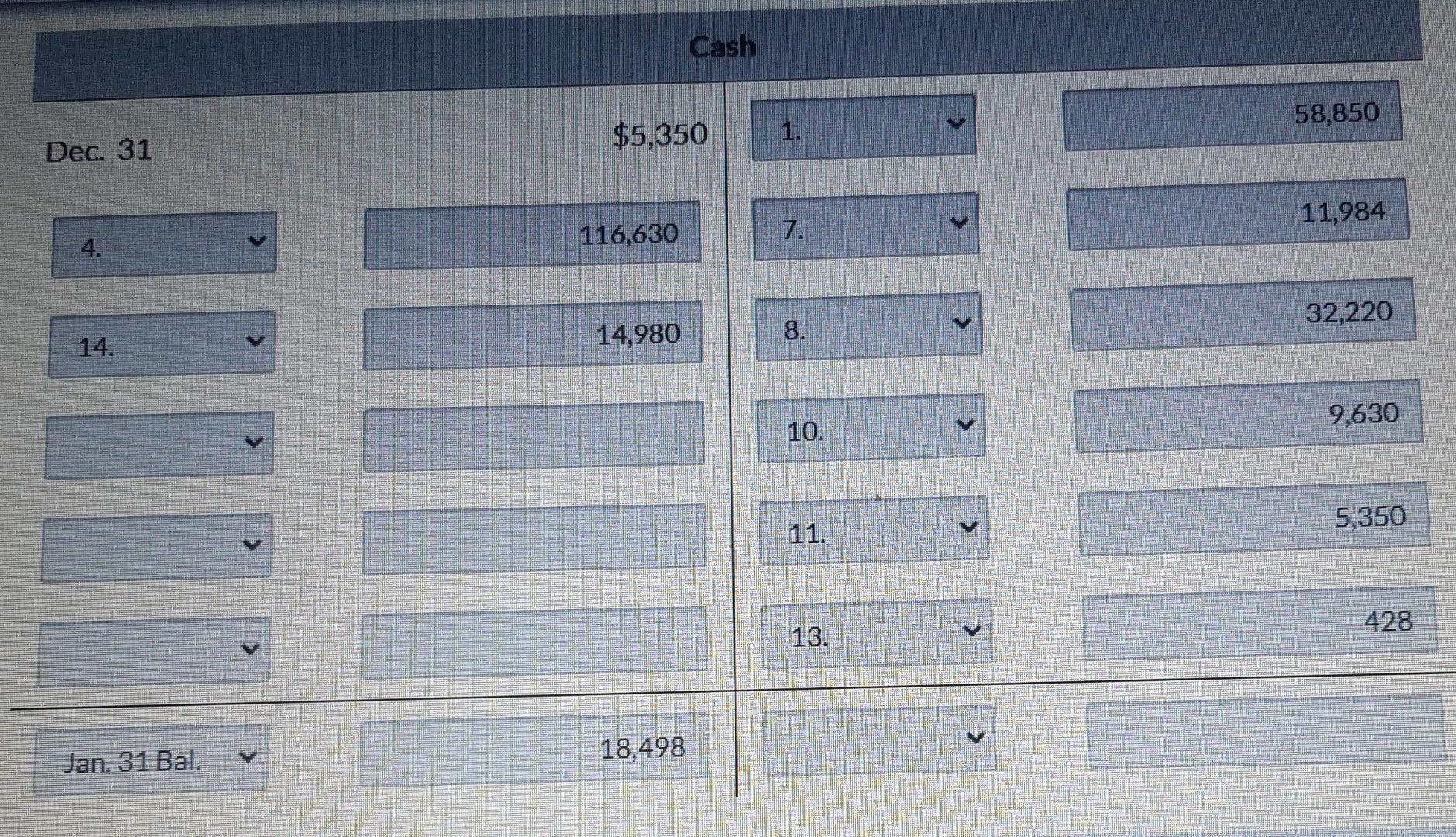

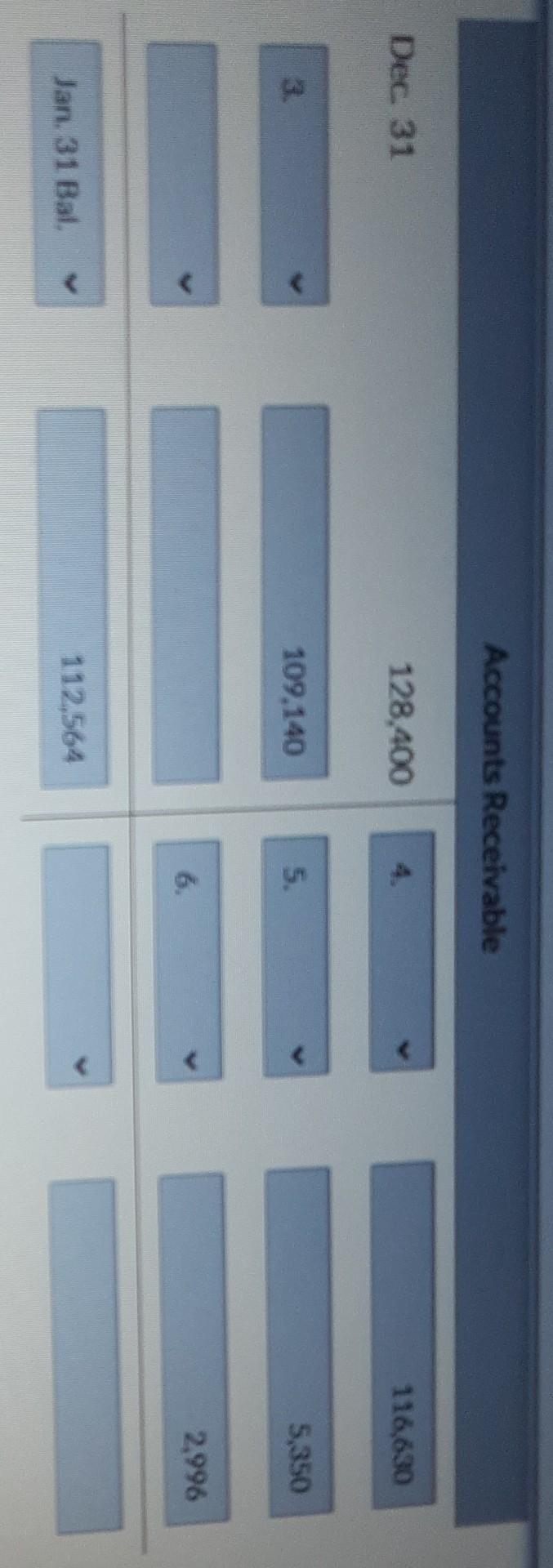

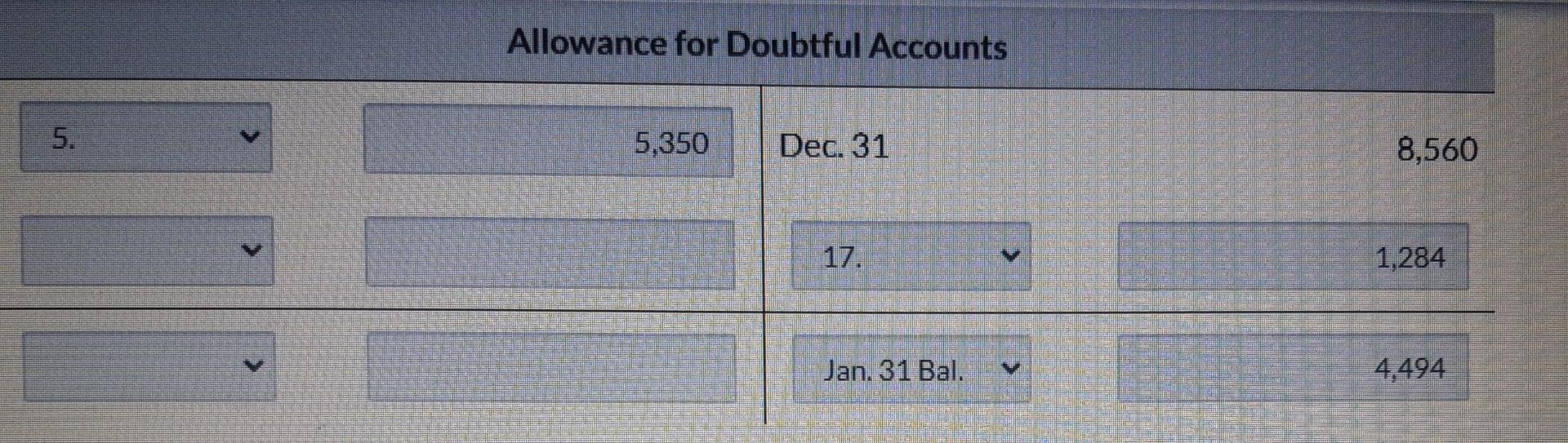

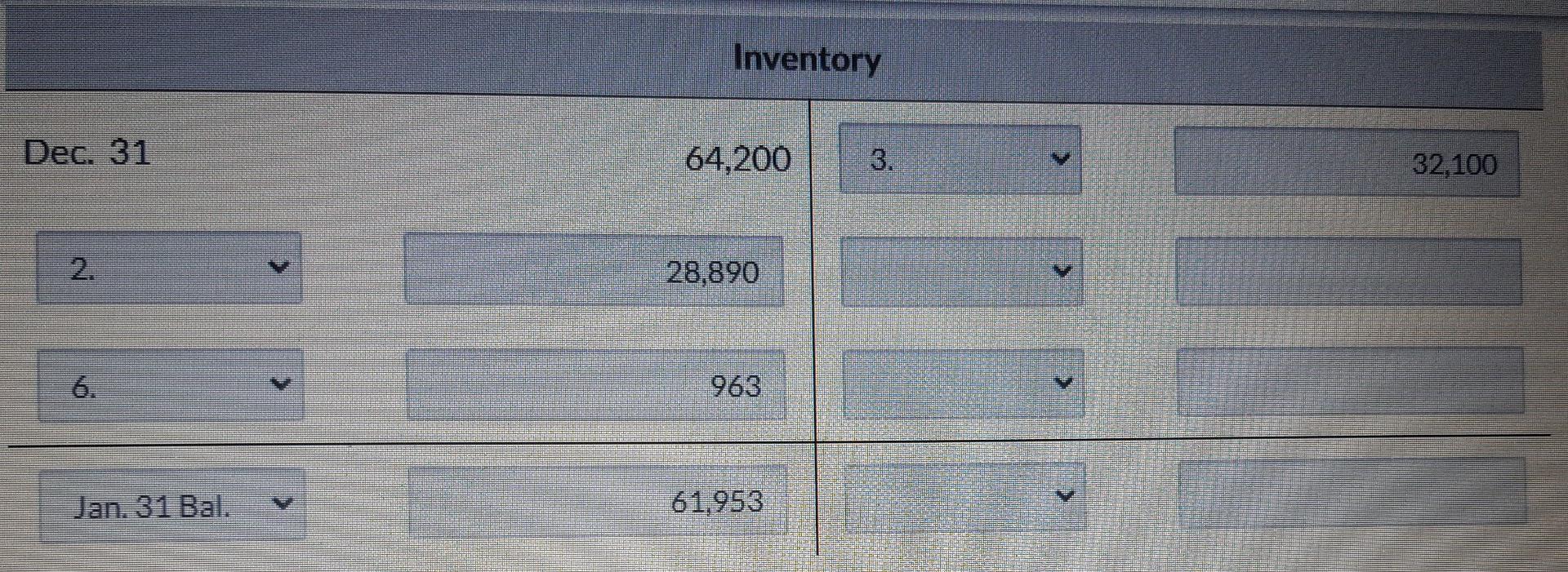

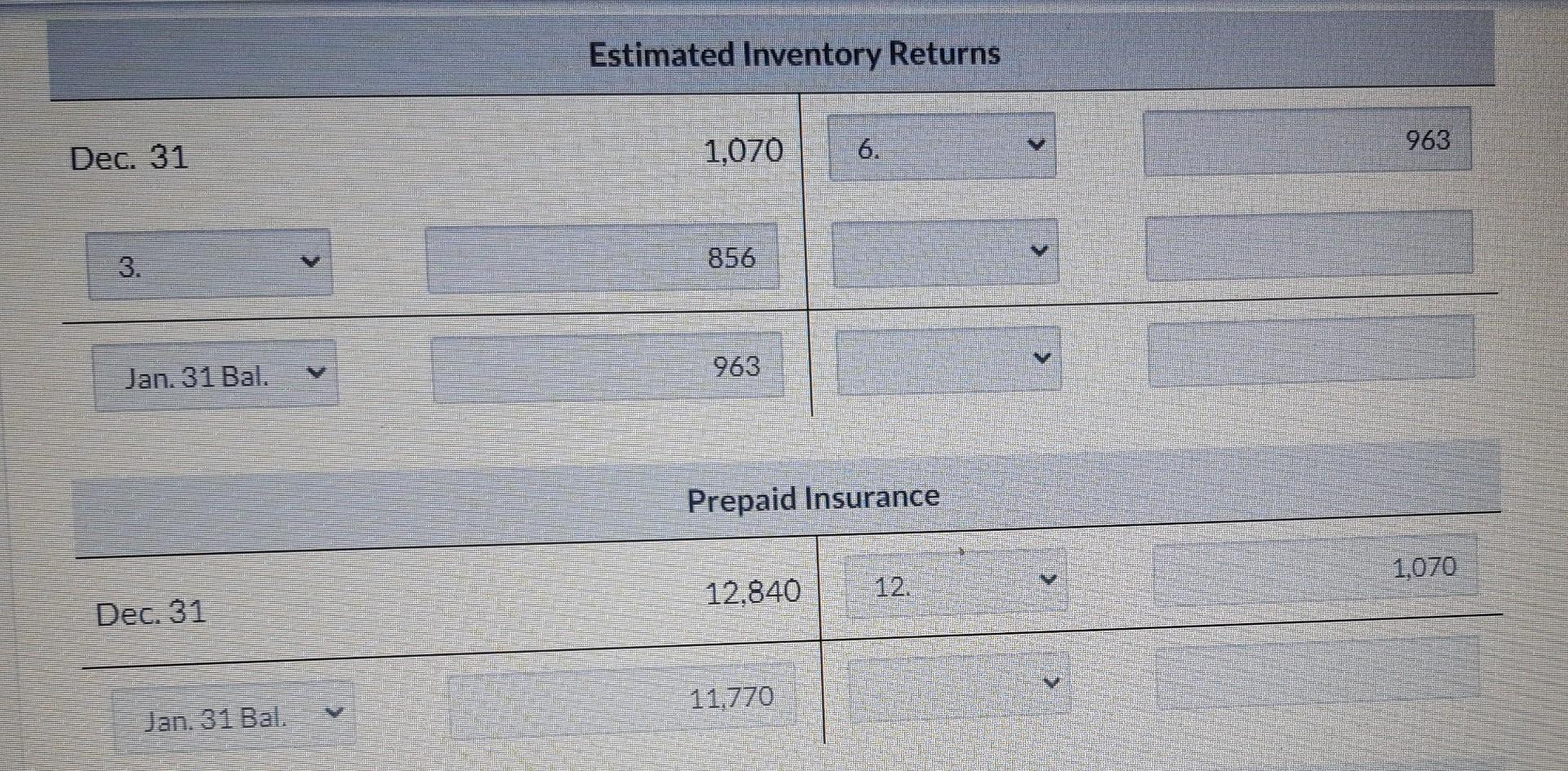

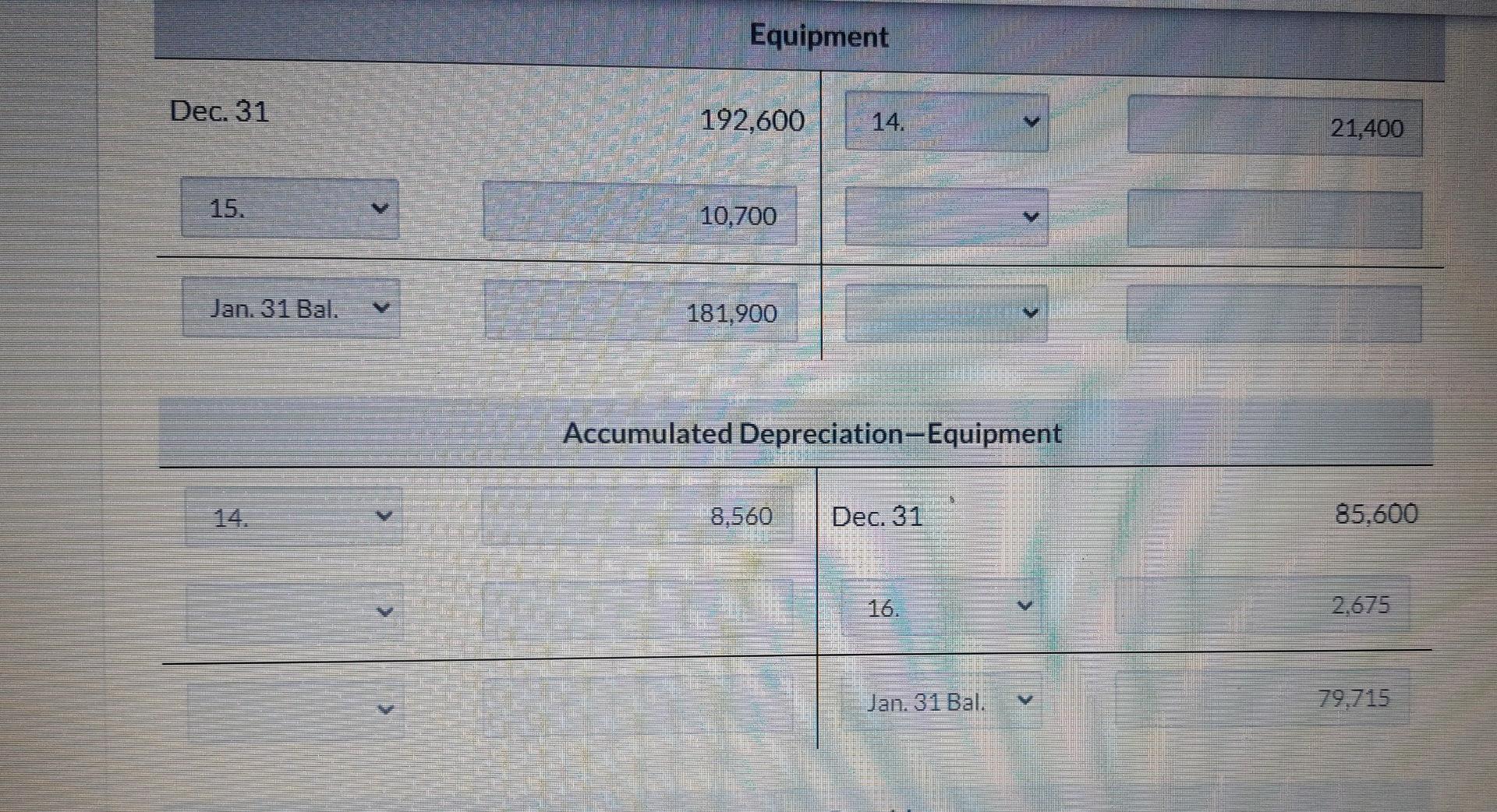

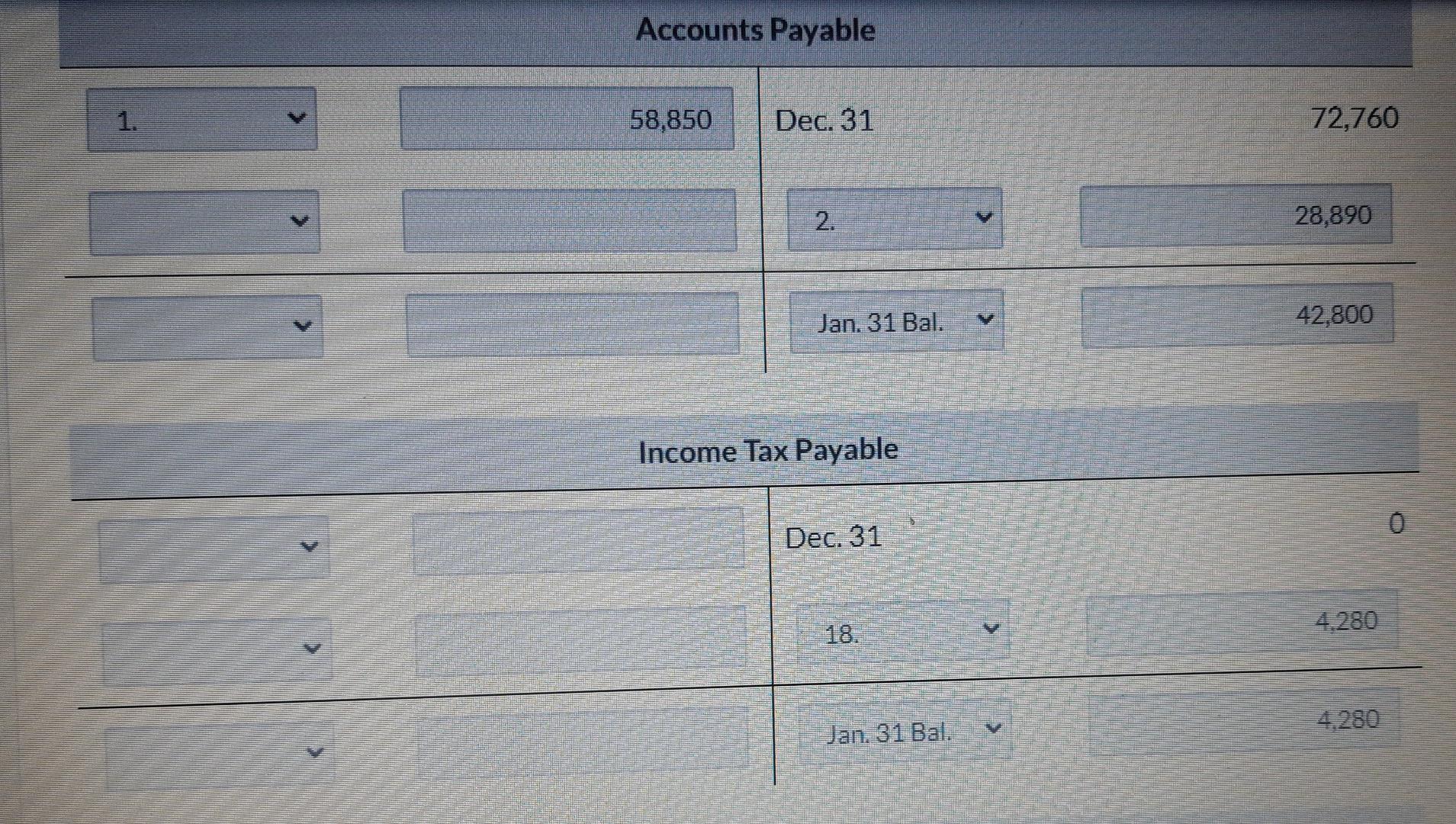

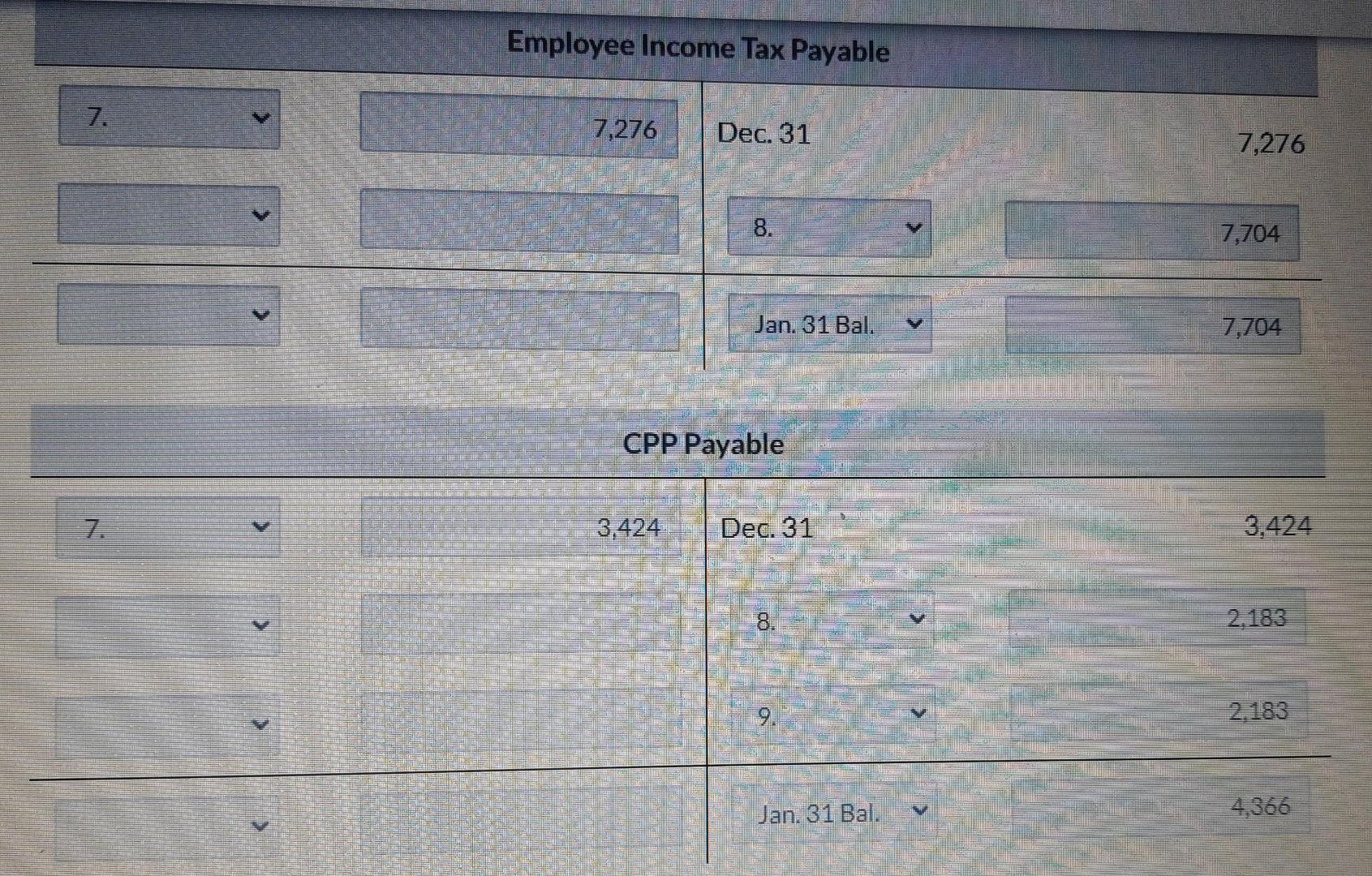

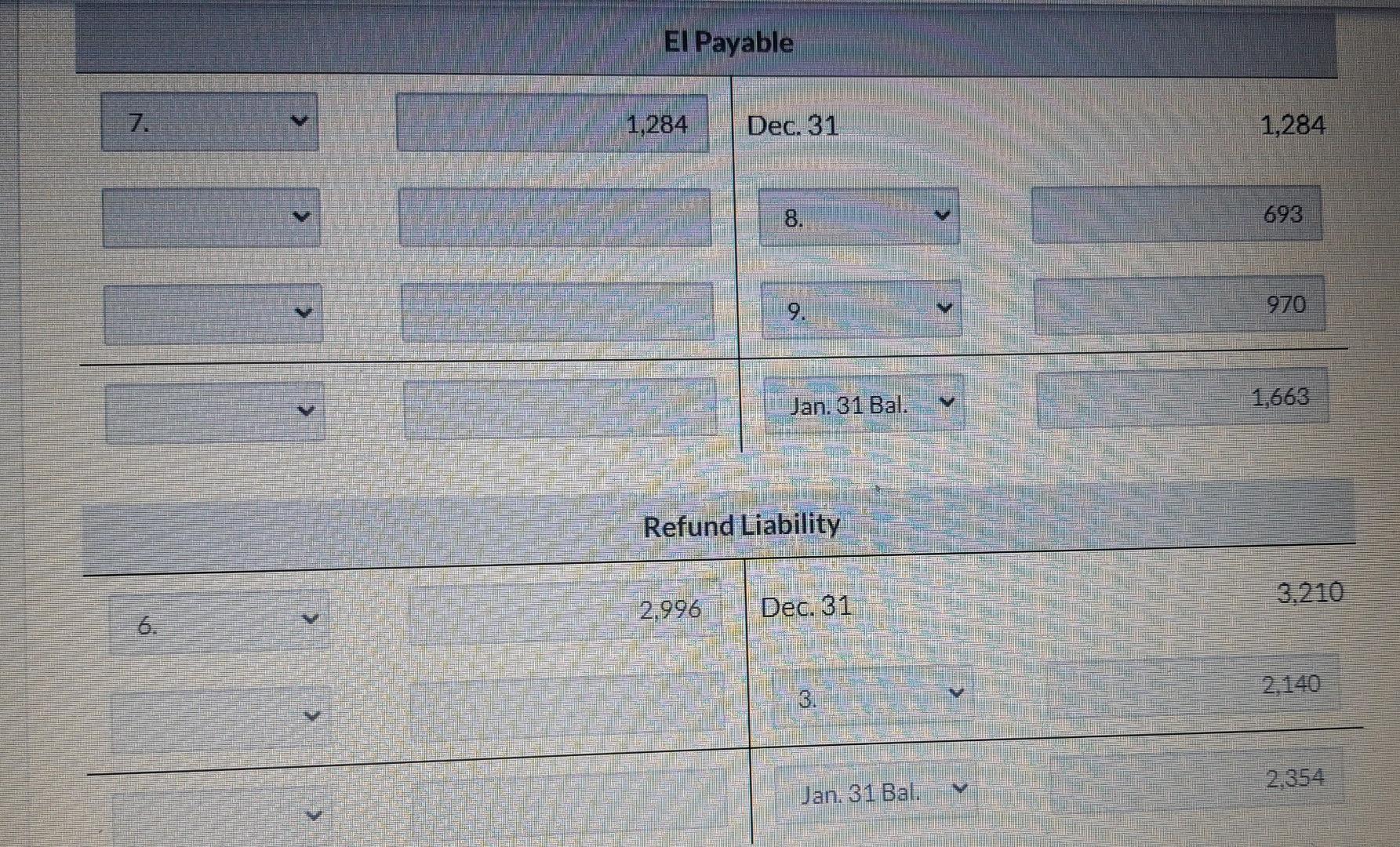

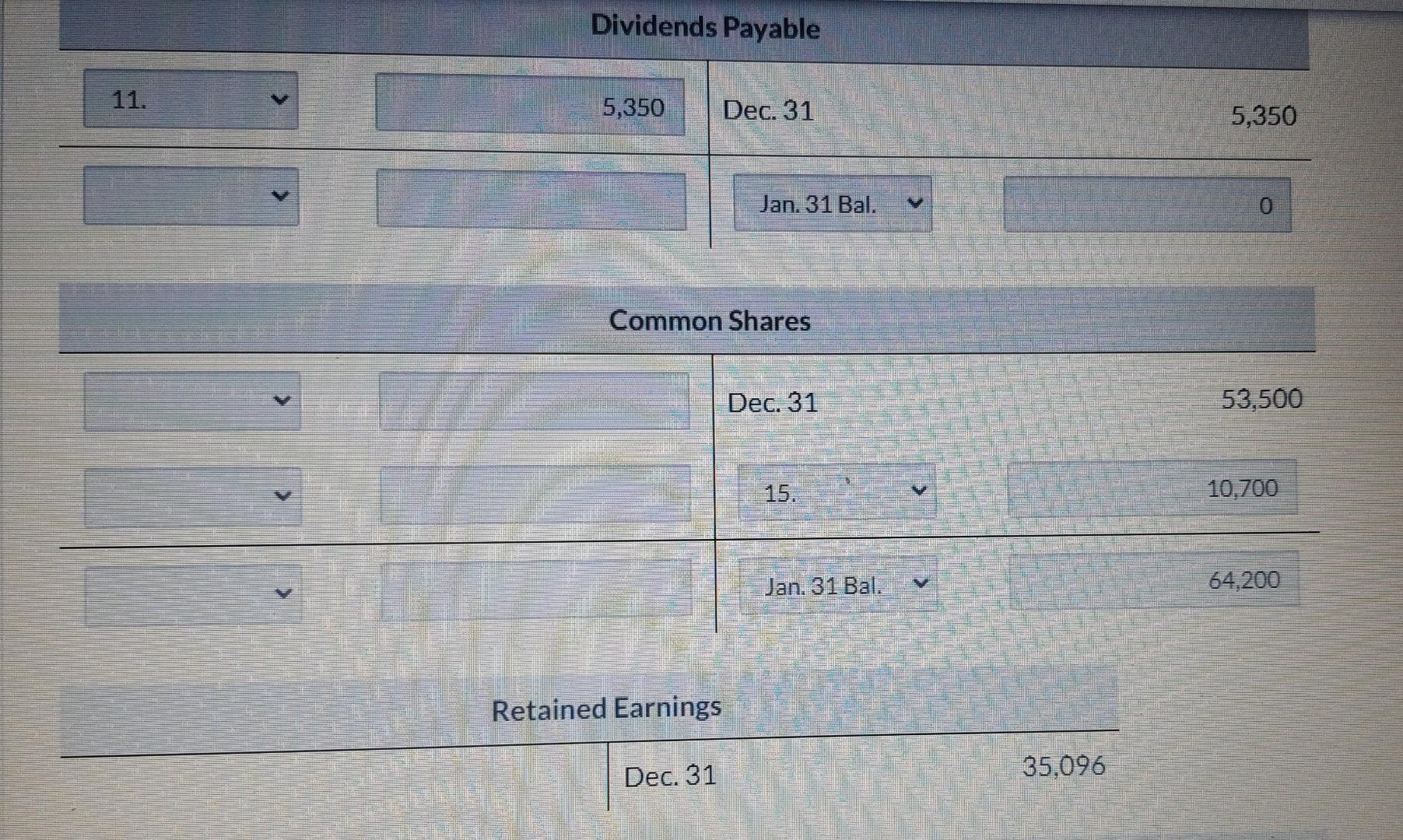

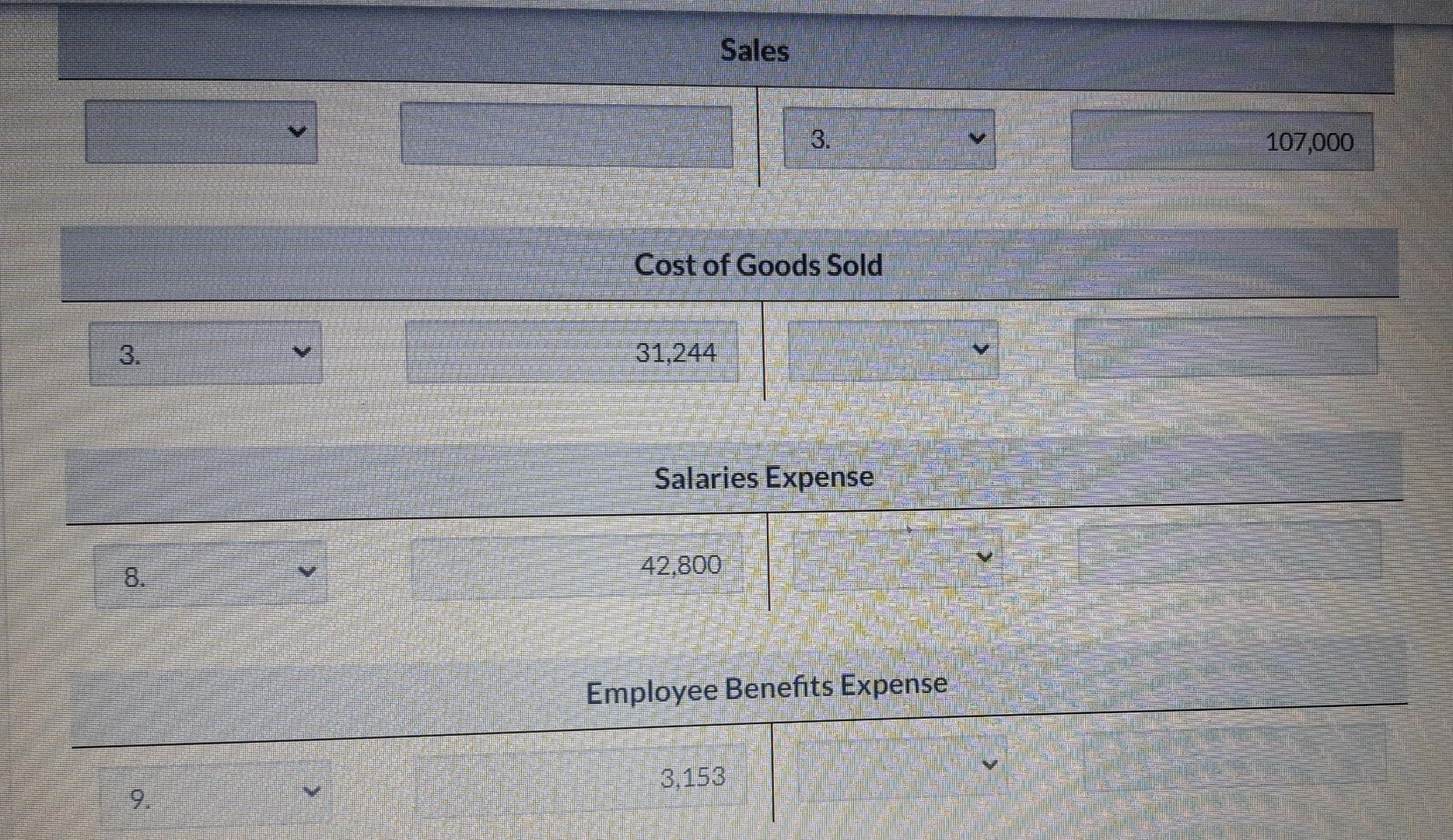

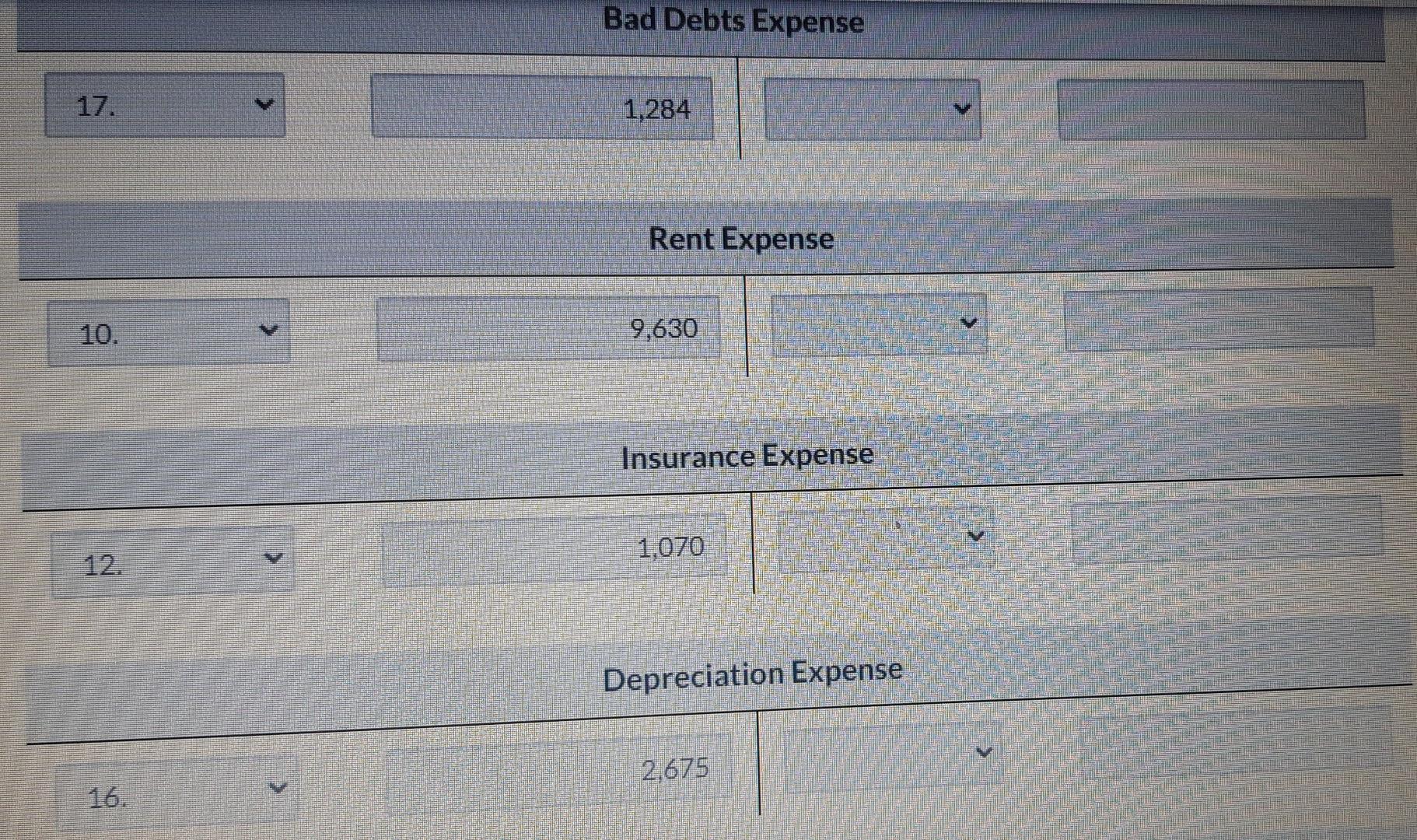

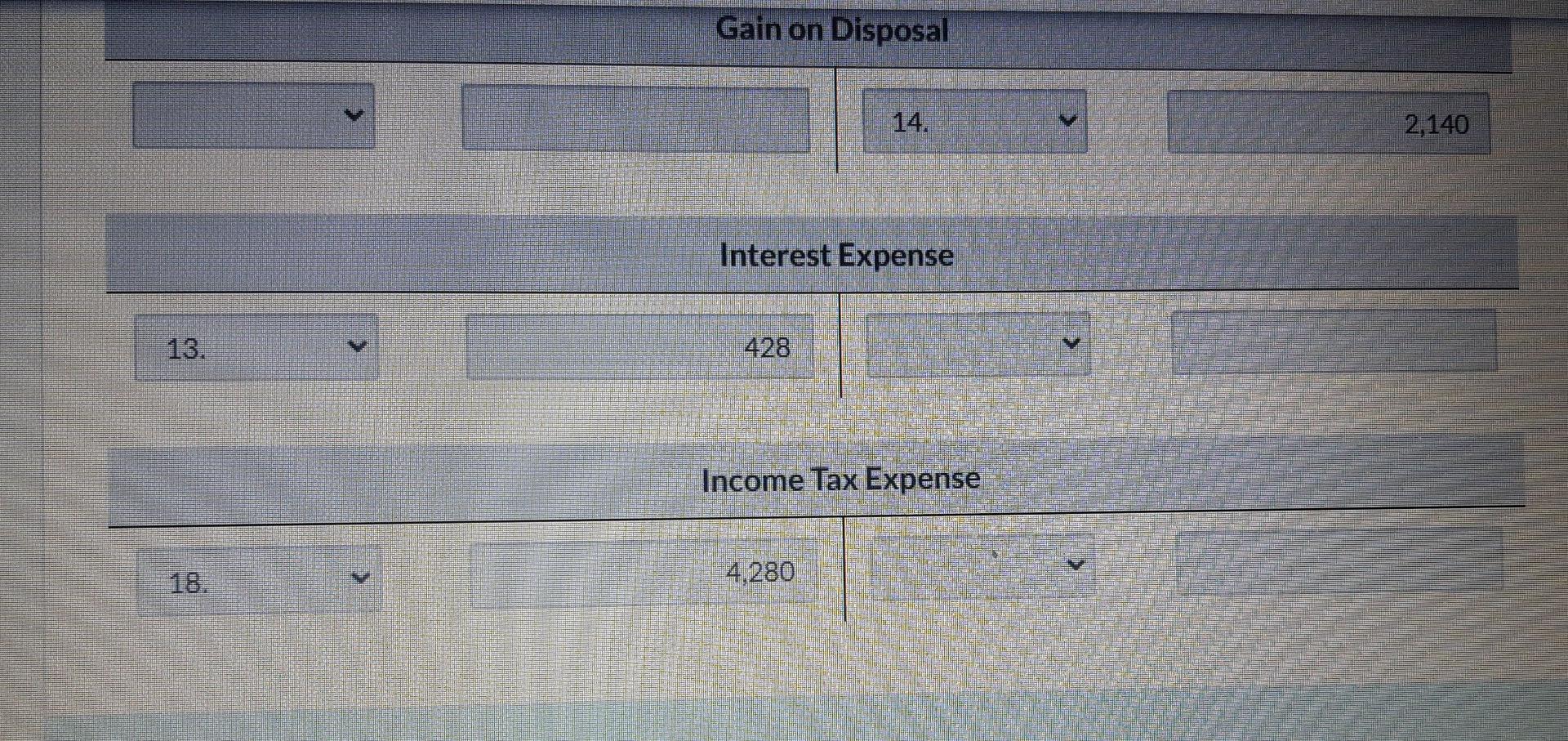

Cash 58,850 $5.350 Dec. 31 11,984 116,630 7. 32,220 14. 14,980 8. 9,630 10. 5,350 428 13. 18,498 Jan. 31 Bal. Accounts Receivable Dec. 31 128.400 116,630 3 109.140 5. 5,350 6. 2,996 Jan. 31 Bal. 112.564 Allowance for Doubtful Accounts 5. 5,350 Dec. 31 8,560 1,284 Jan. 31 Bal. 4,494 Inventory Dec. 31 64,200 32,100 28,890 963 Jan. 31 Bal. 61,953 Estimated Inventory Returns Dec. 31 1,070 6. 963 856 3. Jan. 31 Bal. 963 Prepaid Insurance 1,070 12,840 12. Dec. 31 11,770 Jan. 31 Bal. Equipment Dec. 31 192,600 14. 21,400 15. 10,700 Jan. 31 Bal. 181,900 Accumulated Depreciation-Equipment 8,560 Dec. 31 85,600 16. 2.675 Jan. 31 Bal. 79.715 Accounts Payable 1. 58,850 Dec. 31 72,760 2. 28,890 Jan. 31 Bal. 42,800 Income Tax Payable 0 Dec. 31 4.280 18. 4.280 Jan. 31 Bal. Employee Income Tax Payable 7. 7,276 Dec. 31 7,276 8. 7,704 Jan. 31 Bal. 7,704 CPP Payable 3,424 Dec. 31 3.424 2.183 9. 2.183 Jan. 31 Bal. 4,366 El Payable 7. 1,284 Dec. 31 1,284 8. 693 970 Jan. 31 Bal. 1,663 Refund Liability 3.210 2,996 Dec. 31 6. 2,140 3. 2,354 Jan. 31 Bal. . Dividends Payable 11. 5,350 Dec. 31 5,350 Jan. 31 Bal. 0 Common Shares Dec. 31 53,500 15 10,700 Jan. 31 Bal. 64.200 Retained Earnings Dec. 31 35,096 Sales 3. 107,000 Cost of Goods Sold 3. 31,244 Salaries Expense 42.800 8. Employee Benefits Expense 3,153 Bad Debts Expense 17. 1,284 Rent Expense 10. 9,630 Insurance Expense 1,070 Depreciation Expense 2,675 16. Gain on Disposal 2,140 Interest Expense 13. 428 Income Tax Expense 4,280 Cash 58,850 $5.350 Dec. 31 11,984 116,630 7. 32,220 14. 14,980 8. 9,630 10. 5,350 428 13. 18,498 Jan. 31 Bal. Accounts Receivable Dec. 31 128.400 116,630 3 109.140 5. 5,350 6. 2,996 Jan. 31 Bal. 112.564 Allowance for Doubtful Accounts 5. 5,350 Dec. 31 8,560 1,284 Jan. 31 Bal. 4,494 Inventory Dec. 31 64,200 32,100 28,890 963 Jan. 31 Bal. 61,953 Estimated Inventory Returns Dec. 31 1,070 6. 963 856 3. Jan. 31 Bal. 963 Prepaid Insurance 1,070 12,840 12. Dec. 31 11,770 Jan. 31 Bal. Equipment Dec. 31 192,600 14. 21,400 15. 10,700 Jan. 31 Bal. 181,900 Accumulated Depreciation-Equipment 8,560 Dec. 31 85,600 16. 2.675 Jan. 31 Bal. 79.715 Accounts Payable 1. 58,850 Dec. 31 72,760 2. 28,890 Jan. 31 Bal. 42,800 Income Tax Payable 0 Dec. 31 4.280 18. 4.280 Jan. 31 Bal. Employee Income Tax Payable 7. 7,276 Dec. 31 7,276 8. 7,704 Jan. 31 Bal. 7,704 CPP Payable 3,424 Dec. 31 3.424 2.183 9. 2.183 Jan. 31 Bal. 4,366 El Payable 7. 1,284 Dec. 31 1,284 8. 693 970 Jan. 31 Bal. 1,663 Refund Liability 3.210 2,996 Dec. 31 6. 2,140 3. 2,354 Jan. 31 Bal. . Dividends Payable 11. 5,350 Dec. 31 5,350 Jan. 31 Bal. 0 Common Shares Dec. 31 53,500 15 10,700 Jan. 31 Bal. 64.200 Retained Earnings Dec. 31 35,096 Sales 3. 107,000 Cost of Goods Sold 3. 31,244 Salaries Expense 42.800 8. Employee Benefits Expense 3,153 Bad Debts Expense 17. 1,284 Rent Expense 10. 9,630 Insurance Expense 1,070 Depreciation Expense 2,675 16. Gain on Disposal 2,140 Interest Expense 13. 428 Income Tax Expense 4,280Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started