Answered step by step

Verified Expert Solution

Question

1 Approved Answer

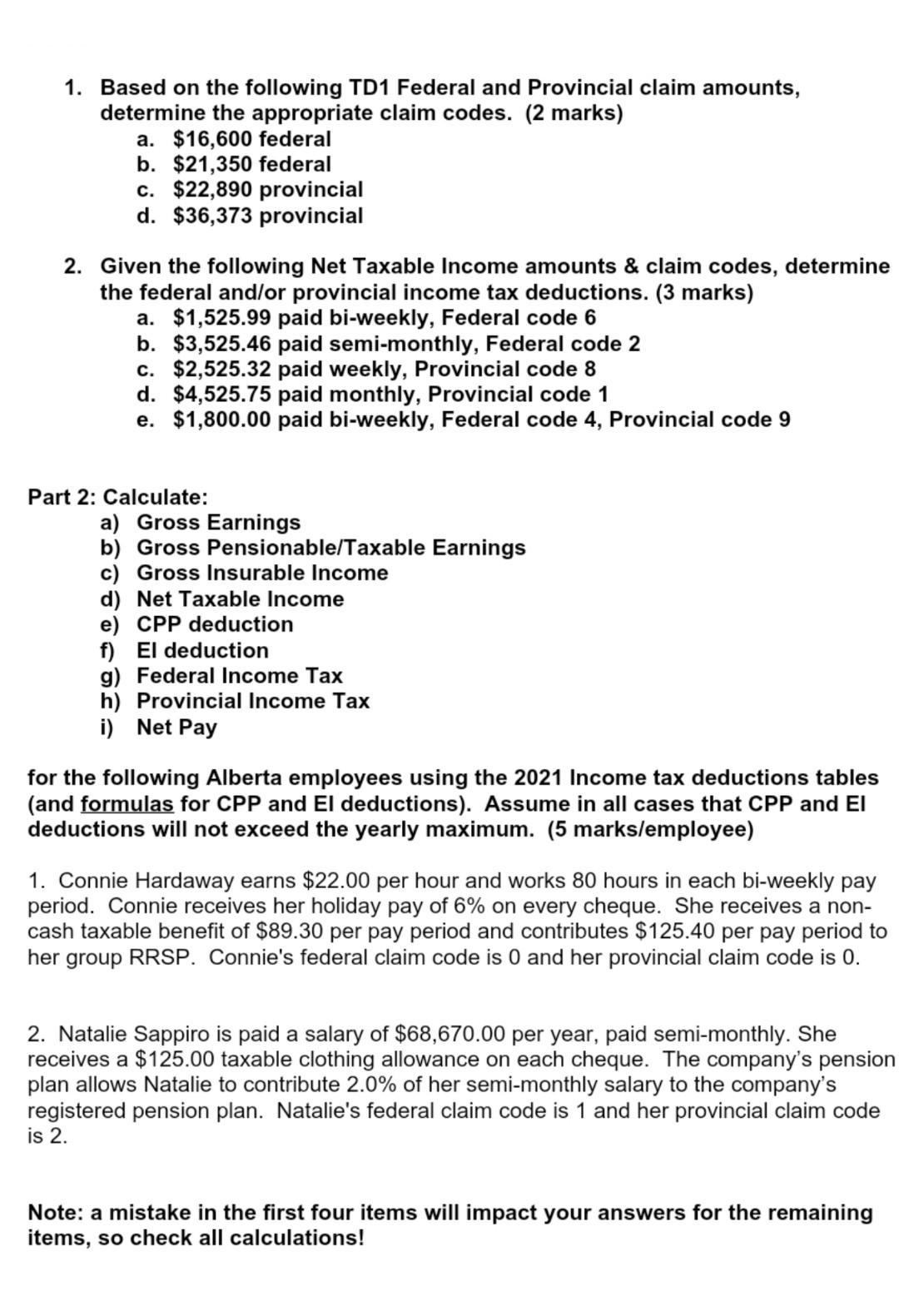

1. Based on the following TD1 Federal and Provincial claim amounts, determine the appropriate claim codes. (2 marks) a. $16,600 federal b. $21,350 federal

1. Based on the following TD1 Federal and Provincial claim amounts, determine the appropriate claim codes. (2 marks) a. $16,600 federal b. $21,350 federal c. $22,890 provincial d. $36,373 provincial 2. Given the following Net Taxable Income amounts & claim codes, determine the federal and/or provincial income tax deductions. (3 marks) a. $1,525.99 paid bi-weekly, Federal code 6 b. $3,525.46 paid semi-monthly, Federal code 2 c. $2,525.32 paid weekly, Provincial code 8 d. $4,525.75 paid monthly, Provincial code 1 e. $1,800.00 paid bi-weekly, Federal code 4, Provincial code 9 Part 2: Calculate: a) Gross Earnings b) Gross Pensionable/Taxable Earnings c) Gross Insurable Income d) Net Taxable Income e) CPP deduction f) El deduction g) Federal Income Tax h) Provincial Income Tax i) Net Pay for the following Alberta employees using the 2021 Income tax deductions tables (and formulas for CPP and El deductions). Assume in all cases that CPP and El deductions will not exceed the yearly maximum. (5 marks/employee) 1. Connie Hardaway earns $22.00 per hour and works 80 hours in each bi-weekly pay period. Connie receives her holiday pay of 6% on every cheque. She receives a non- cash taxable benefit of $89.30 per pay period and contributes $125.40 per pay period to her group RRSP. Connie's federal claim code is 0 and her provincial claim code is 0. 2. Natalie Sappiro is paid a salary of $68,670.00 per year, paid semi-monthly. She receives a $125.00 taxable clothing allowance on each cheque. The company's pension plan allows Natalie to contribute 2.0% of her semi-monthly salary to the company's registered pension plan. Natalie's federal claim code is 1 and her provincial claim code is 2. Note: a mistake in the first four items will impact your answers for the remaining items, so check all calculations!

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answers 1Appropiate cl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started