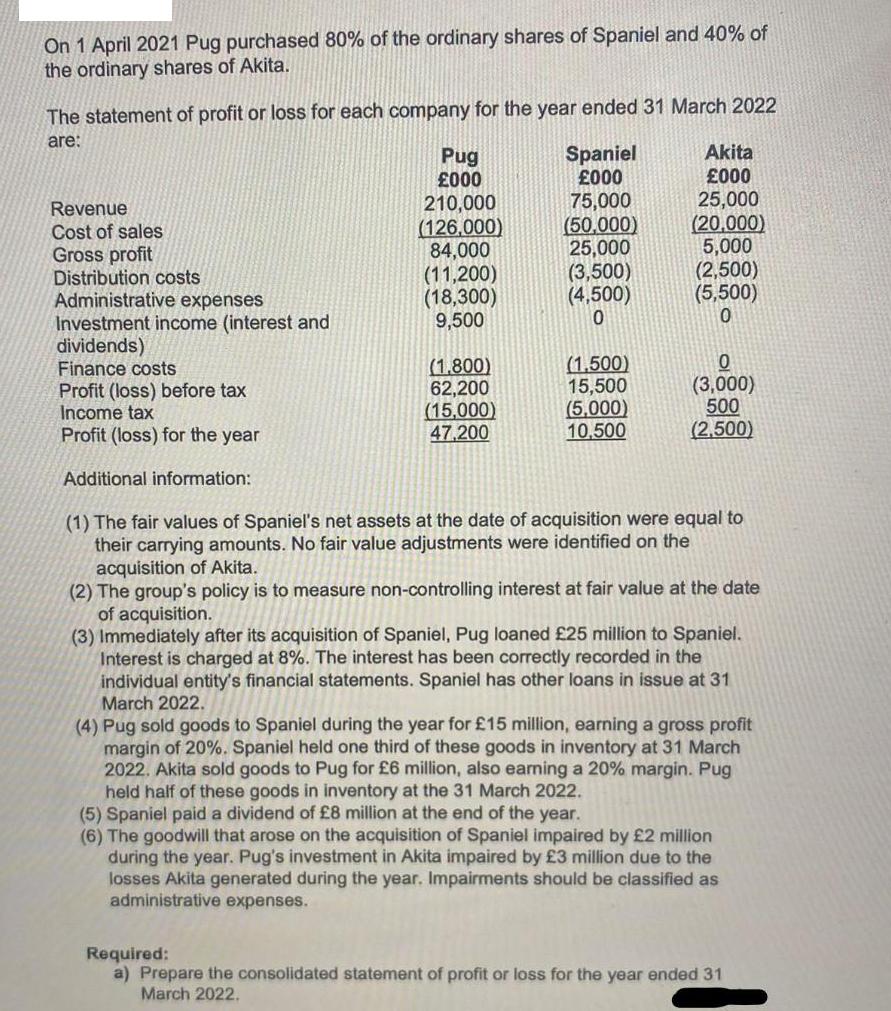

On 1 April 2021 Pug purchased 80% of the ordinary shares of Spaniel and 40% of the ordinary shares of Akita. The statement of

On 1 April 2021 Pug purchased 80% of the ordinary shares of Spaniel and 40% of the ordinary shares of Akita. The statement of profit or loss for each company for the year ended 31 March 2022 are: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment income (interest and dividends) Pug 000 210,000 (126,000) 84,000 (11,200) (18,300) 9,500 (1.800) 62,200 Spaniel 000 (15,000) 47,200 75,000 (50,000) 25,000 (3,500) (4,500) 0 (1,500) 15,500 Akita 000 25,000 (20,000) 5,000 (5,000) 10,500 (2,500) (5,500) 0 Finance costs Profit (loss) before tax Income tax Profit (loss) for the year Additional information: (1) The fair values of Spaniel's net assets at the date of acquisition were equal to their carrying amounts. No fair value adjustments were identified on the acquisition of Akita. 0 (3,000) 500 (2,500) (2) The group's policy is to measure non-controlling interest at fair value at the date of acquisition. (3) Immediately after its acquisition of Spaniel, Pug loaned 25 million to Spaniel. Interest is charged at 8%. The interest has been correctly recorded in the individual entity's financial statements. Spaniel has other loans in issue at 31 March 2022. (4) Pug sold goods to Spaniel during the year for 15 million, earning a gross profit margin of 20%. Spaniel held one third of these goods in inventory at 31 March 2022. Akita sold goods to Pug for 6 million, also earning a 20% margin. Pug held half of these goods in inventory at the 31 March 2022. (5) Spaniel paid a dividend of 8 million at the end of the year. (6) The goodwill that arose on the acquisition of Spaniel impaired by 2 million during the year. Pug's investment in Akita impaired by 3 million due to the losses Akita generated during the year. Impairments should be classified as administrative expenses. Required: a) Prepare the consolidated statement of profit or loss for the year ended 31 March 2022. b) What is a group's accounting obligations after the date of acquisition with regard to goodwill arising on a business combination? (Max 100 words) c) Explain your treatment of the goodwill impairment of Spaniel.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started