Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 Jan 2008, Platypus Ltd acquired 75% of the shares of Wombat Ltd for $40,000. The following balances appeared in the records of

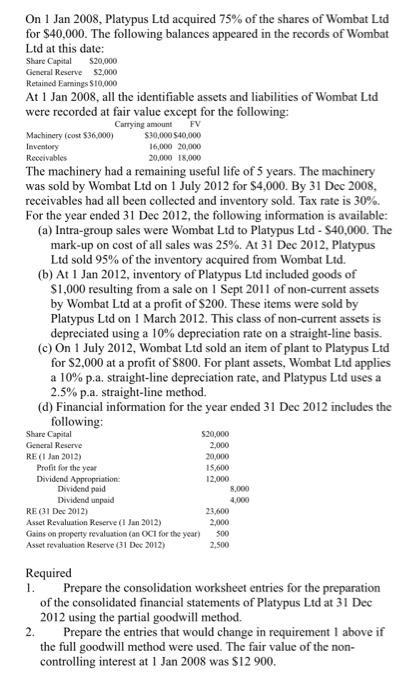

On 1 Jan 2008, Platypus Ltd acquired 75% of the shares of Wombat Ltd for $40,000. The following balances appeared in the records of Wombat Ltd at this date: $20,000 $2,000 Retained Earnings $10,000 At 1 Jan 2008, all the identifiable assets and liabilities of Wombat Ltd were recorded at fair value except for the following: Carrying amount Share Capital General Reserve FV $30,000 $40,000 16,000 20,000 20,000 18,000 The machinery had a remaining useful life of 5 years. The machinery was sold by Wombat Ltd on 1 July 2012 for $4,000. By 31 Dec 2008, receivables had all been collected and inventory sold. Tax rate is 30%. For the year ended 31 Dec 2012, the following information is available: (a) Intra-group sales were Wombat Ltd to Platypus Ltd - $40,000. The mark-up on cost of all sales was 25%. At 31 Dec 2012, Platypus Ltd sold 95% of the inventory acquired from Wombat Ltd. (b) At 1 Jan 2012, inventory of Platypus Ltd included goods of $1,000 resulting from a sale on 1 Sept 2011 of non-current assets by Wombat Ltd at a profit of $200. These items were sold by Platypus Ltd on 1 March 2012. This class of non-current assets is depreciated using a 10% depreciation rate on a straight-line basis. (c) On 1 July 2012, Wombat Ltd sold an item of plant to Platypus Ltd for $2,000 at a profit of $800. For plant assets, Wombat Ltd applies a 10% p.a. straight-line depreciation rate, and Platypus Ltd uses a 2.5% p.a. straight-line method. (d) Financial information for the year ended 31 Dec 2012 includes the following: Machinery (cost $36,000) Inventory Receivables Share Capital General Reserve RE(1 Jan 2012) Profit for the year Dividend Appropriation: Dividend paid Dividend unpaid RE (31 Dec 2012) Asset Revaluation Reserve (1 Jan 2012) Gains on property revaluation (an OCI for the year) Asset revaluation Reserve (31 Dec 2012) $20,000 2,000 20,000 15,600 12,000 8,000 4,000 23,600 2,000 500 2,500 Required 1. Prepare the consolidation worksheet entries for the preparation of the consolidated financial statements of Platypus Ltd at 31 Dec 2012 using the partial goodwill method. 2. Prepare the entries that would change in requirement 1 above if the full goodwill method were used. The fair value of the non- controlling interest at 1 Jan 2008 was $12 900.

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

This task involves preparing consolidation worksheet entries for Platypus Ltds acquisition of Wombat Ltd and calculating changes in the previously calculated goodwill if the full goodwill method were ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started