Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 20x3, APL granted each of the 50 team leaders 2,000 share options, under which, they can elect to receive 2,000 shares

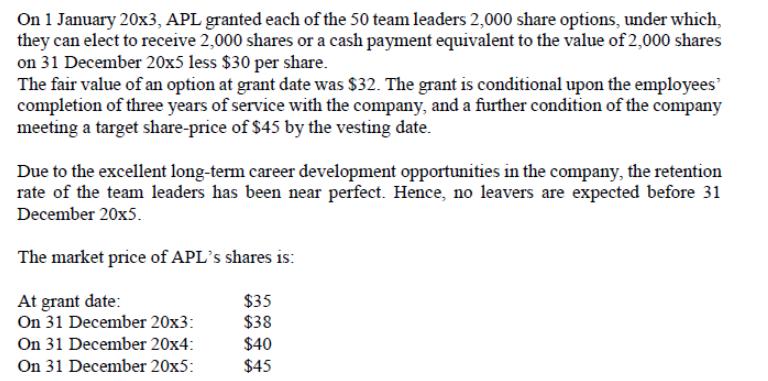

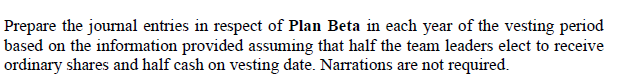

On 1 January 20x3, APL granted each of the 50 team leaders 2,000 share options, under which, they can elect to receive 2,000 shares or a cash payment equivalent to the value of 2,000 shares on 31 December 20x5 less $30 per share. The fair value of an option at grant date was $32. The grant is conditional upon the employees' completion of three years of service with the company, and a further condition of the company meeting a target share-price of $45 by the vesting date. Due to the excellent long-term career development opportunities in the company, the retention rate of the team leaders has been near perfect. Hence, no leavers are expected before 31 December 20x5. The market price of APL's shares is: At grant date: $35 On 31 December 20x3: $38 On 31 December 20x4: $40 On 31 December 20x5: $45 Prepare the journal entries in respect of Plan Beta in each year of the vesting period based on the information provided assuming that half the team leaders elect to receive ordinary shares and half cash on vesting date. Narrations are not required.

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer To prepare the journal entries for Plan Beta in each year of the vesting period we need to co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started