Answered step by step

Verified Expert Solution

Question

1 Approved Answer

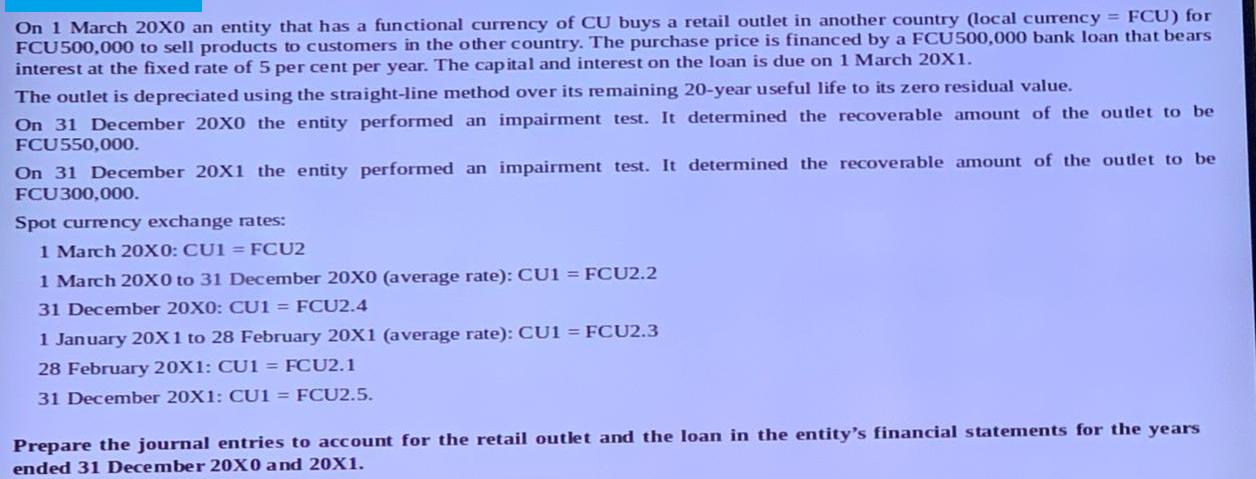

On 1 March 20X0 an entity that has a functional currency of CU buys a retail outlet in another country (local currency = FCU)

On 1 March 20X0 an entity that has a functional currency of CU buys a retail outlet in another country (local currency = FCU) for FCU500,000 to sell products to customers in the other country. The purchase price is financed by a FCU500,000 bank loan that bears interest at the fixed rate of 5 per cent per year. The capital and interest on the loan is due on 1 March 20X1. The outlet is depreciated using the straight-line method over its remaining 20-year useful life to its zero residual value. On 31 December 20X0 the entity performed an impairment test. It determined the recoverable amount of the outlet to be FCU550,000. On 31 December 20X1 the entity performed an impairment test. It determined the recoverable amount of the outlet to be FCU300,000. Spot currency exchange rates: 1 March 20X0: CUI FCU2 1 March 20X0 to 31 December 20X0 (average rate): CU1 = FCU2.2 31 December 20X0: CU1 = FCU2.4 1 January 20X1 to 28 February 20X1 (average rate): CU1 = FCU2.3 28 February 20X1: CU1 FCU2.1 31 December 20X1: CU1 = FCU2.5. Prepare the journal entries to account for the retail outlet and the loan in the entity's financial statements for the years ended 31 December 20X0 and 20X1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started