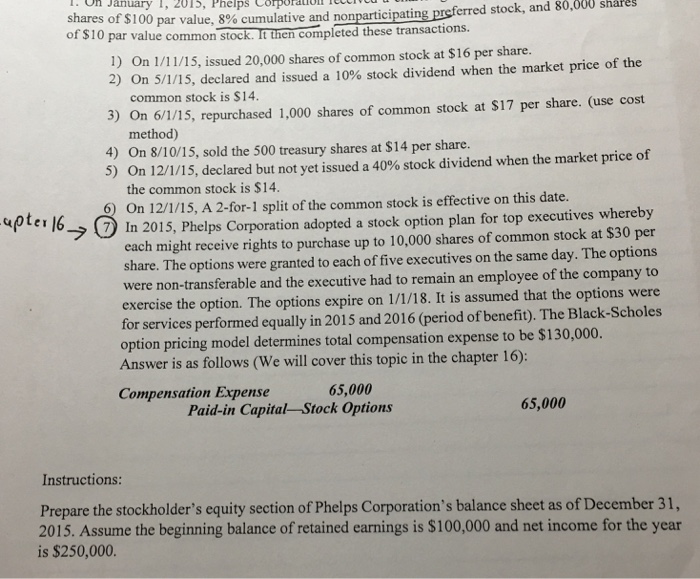

On 1/11/15, issued 20,000 shares of common stock at $16 per share. 2) On 5/1/15, declared and issued a 10% stock dividend when the market price of the common stock is $14. 3) On 6/1/15, repurchased 1,000 shares of common stock at $17 per share. (use cost method) 4) On 8/10/15, sold the 500 treasury shares at $14 per share. 5) On 12/1/15, declared but not yet issued a 40% stock dividend when the market price of the common stock is $ 14. 6) In 12/1/15, A 2-for-1 split of the common stovk is effective on this date. 7) In 2015, Phelps Corporation adopted a stock option plan for top executives whereby each might receive rights to purchase up to 10,000 shares of common stock at $30 per share. The options were granted to each of five executives on the same day. The options were non-transferable and the executive had to remain an employee of the company to exercise the option. The options expire on 1/1/18. It is assumed that the options were for services performed equally in 2015 and 2016 (period of benefit). The Black-Scholcs option pricing model determines total compensation expense to be $130,000. Answer is as follows (We will cover this topic in the chapter 16): Compensation Expense 65,000 Paid-in Capital-Stock Options 65,000 Instructions: Prepare the stockholder's equity section of Phelps Corporation's balance sheet as of December 31, 2015. Assume the beginning balance of retained earnings is $100,000 and net income for the year is $250,000. On 1/11/15, issued 20,000 shares of common stock at $16 per share. 2) On 5/1/15, declared and issued a 10% stock dividend when the market price of the common stock is $14. 3) On 6/1/15, repurchased 1,000 shares of common stock at $17 per share. (use cost method) 4) On 8/10/15, sold the 500 treasury shares at $14 per share. 5) On 12/1/15, declared but not yet issued a 40% stock dividend when the market price of the common stock is $ 14. 6) In 12/1/15, A 2-for-1 split of the common stovk is effective on this date. 7) In 2015, Phelps Corporation adopted a stock option plan for top executives whereby each might receive rights to purchase up to 10,000 shares of common stock at $30 per share. The options were granted to each of five executives on the same day. The options were non-transferable and the executive had to remain an employee of the company to exercise the option. The options expire on 1/1/18. It is assumed that the options were for services performed equally in 2015 and 2016 (period of benefit). The Black-Scholcs option pricing model determines total compensation expense to be $130,000. Answer is as follows (We will cover this topic in the chapter 16): Compensation Expense 65,000 Paid-in Capital-Stock Options 65,000 Instructions: Prepare the stockholder's equity section of Phelps Corporation's balance sheet as of December 31, 2015. Assume the beginning balance of retained earnings is $100,000 and net income for the year is $250,000