Answered step by step

Verified Expert Solution

Question

1 Approved Answer

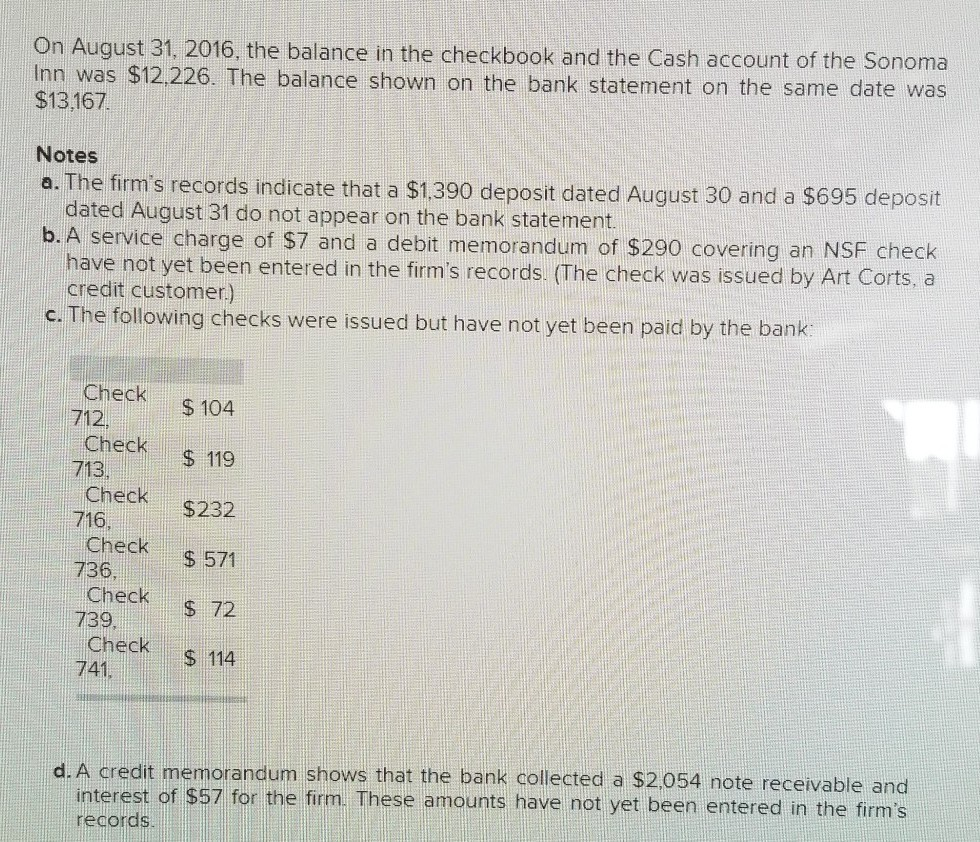

On August 31, 2016, the balance in the checkbook and the Cash account of the Sonoma Inn was $12,226. The balance shown on the bank

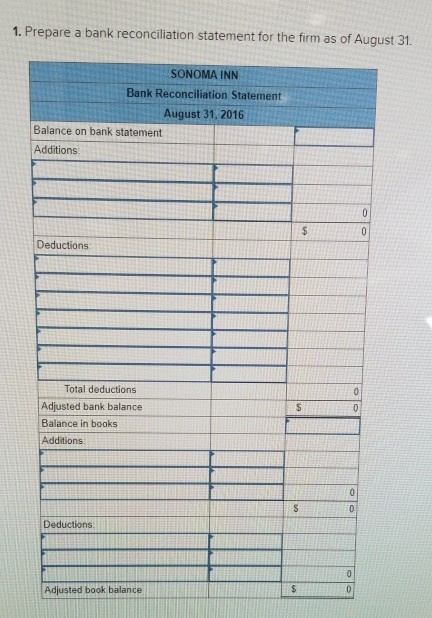

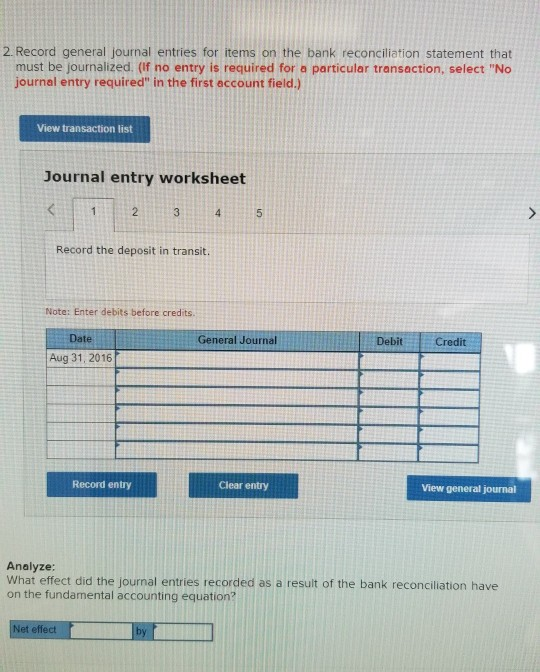

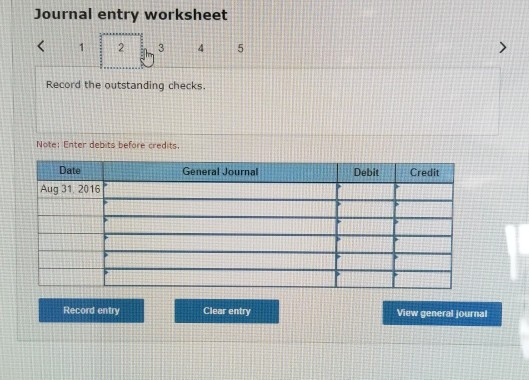

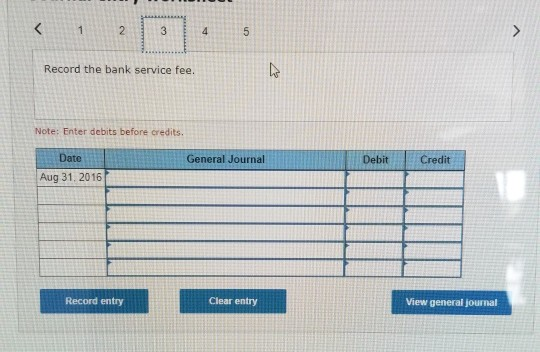

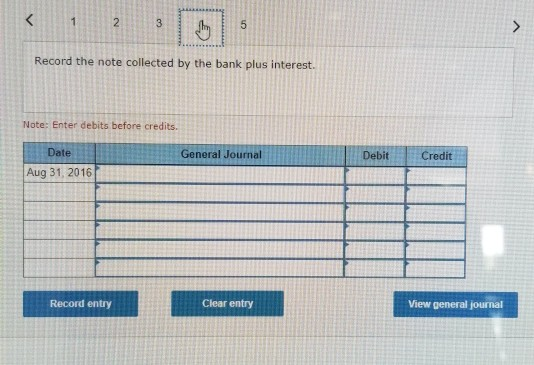

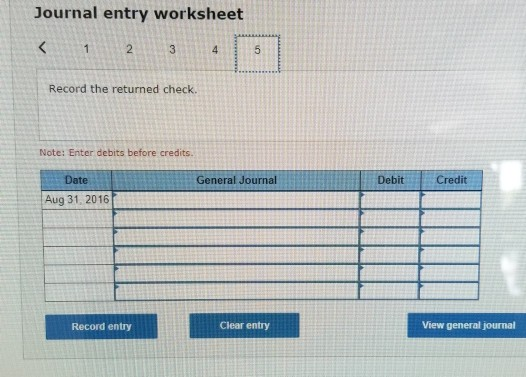

On August 31, 2016, the balance in the checkbook and the Cash account of the Sonoma Inn was $12,226. The balance shown on the bank statement on the same date was $13.167 Notes a. The firm's records indicate that a $1,390 deposit dated August 30 and a $695 deposit dated August 31 do not appear on the bank statement. b. A service charge of $7 and a debit memorandum of $290 covering an NSF check have not yet been entered in the firm's records. (The check was issued by Art Corts, a credit customer.) c. The following checks were issued but have not yet been paid by the bank $ 104 $ 119 $232 Check 712, Check 713 Check 716. Check 736 Check 739. Check 741, $ 571 $ 72 $ 114 d. A credit memorandum shows that the bank collected a $2,054 note receivable and interest of $57 for the firm. These amounts have not yet been entered in the firm's records. 1. Prepare a bank reconciliation statement for the firm as of August 31. SONOMA INN Bank Reconciliation Statement August 31, 2016 Balance on bank statement Additions 0 $ 0 Deductions 0 $ 0 Total deductions Adjusted bank balance Balance in books Additions 0 S 0 Deductions 0 Adjusted book balance $ 0 2. Record general Journal entries for items on the bank reconciliation statement that must be journalized. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the deposit in transit. Note: Enter debits before credits General Journal Debit Credit Date Aug 31, 2016 Record entry Clear entry View general journal Analyze: What effect did the journal entries recorded as a result of the bank reconciliation have on the fundamental accounting equation? Net effect Journal entry worksheet Record the outstanding checks. Note: Enter debits before credits. General Journal Debit Credit Date Aug 31 2016 Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started