Question

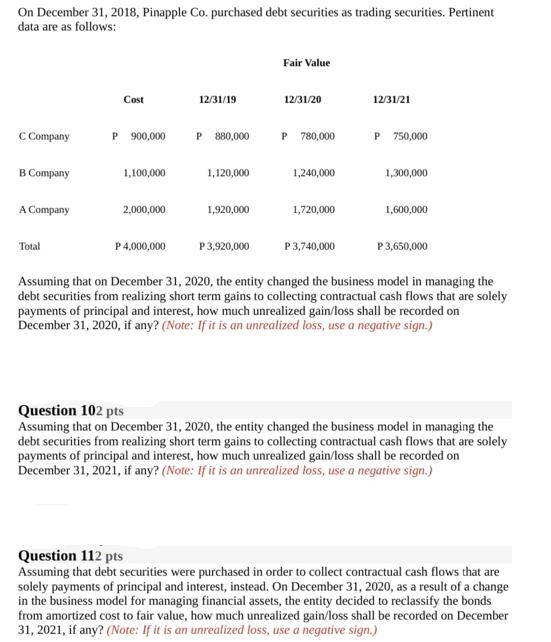

On December 31, 2018, Pinapple Co. purchased debt securities as trading securities. Pertinent data are as follows: C Company B Company A Company Total

On December 31, 2018, Pinapple Co. purchased debt securities as trading securities. Pertinent data are as follows: C Company B Company A Company Total Cost P 900,000 1,100,000 2,000,000 P 4,000,000 12/31/19 P 880,000 1,120,000 1,920,000 P 3,920,000 Fair Value 12/31/20 P 780,000 1,240,000 1,720,000 P 3,740,000 12/31/21 P 750,000 1,300,000 1,600,000 P 3,650,000 Assuming that on December 31, 2020, the entity changed the business model in managing the debt securities from realizing short term gains to collecting contractual cash flows that are solely payments of principal and interest, how much unrealized gain/loss shall be recorded on December 31, 2020, if any? (Note: If it is an unrealized loss, use a negative sign.) Question 102 pts Assuming that on December 31, 2020, the entity changed the business model in managing the debt securities from realizing short term gains to collecting contractual cash flows that are solely payments of principal and interest, how much unrealized gain/loss shall be recorded on December 31, 2021, if any? (Note: If it is an unrealized loss, use a negative sign.) Question 112 pts Assuming that debt securities were purchased in order to collect contractual cash flows that are solely payments of principal and interest, instead. On December 31, 2020, as a result of a change in the business model for managing financial assets, the entity decided to reclassify the bonds from amortized cost to fair value, how much unrealized gain/loss shall be recorded on December 31, 2021, if any? (Note: If it is an unrealized loss, use a negative sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the unrealized gainloss for each scenario we need to compare the fair value of the debt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started