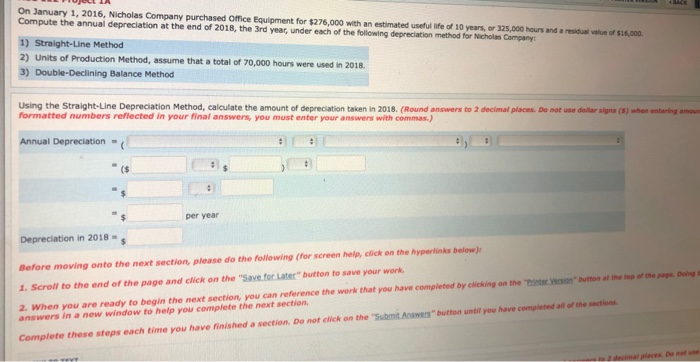

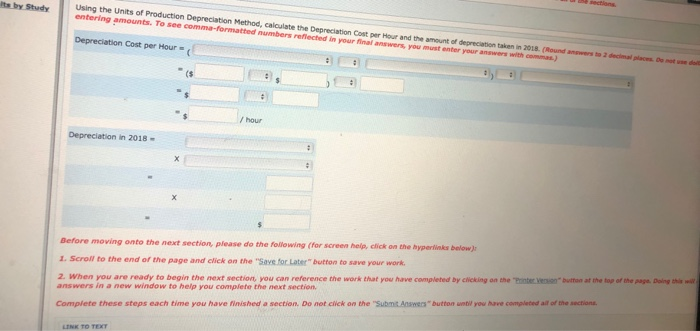

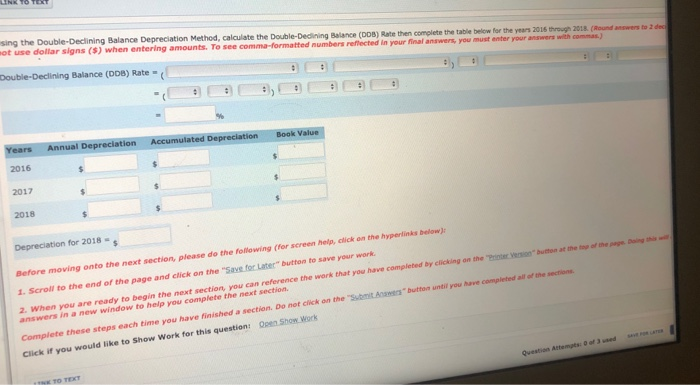

On January 1, 2016, Nicholas Company purchased Office Equipment for $276,000 with an estimated useful life of 10 years, or 325,000 hours and a Compute the annual depreciation at the end of 2018, the 3rd year, under each of the following depreciation method for Nicholas Company l l of $16,000 1) Straight-Line Method 2) Units of Production Method, assume that a total of 70,000 hours were used in 2018 3) Double-Declining Balance Method Using the Straight-Line Depreciation Method, calculate the amount of depreciation taken in 2018. (Round answers to 2 decimal places. Do not use dollar signs (5) when entering amous formatted numbers reflected in your final answers, you must enter your answers with commas.) Annual Depreciation - per year Depreciation in 2018 Before moving onto the next section, please do the following (for screen help, click on the hyperlink below) o he 1. Scroll to the end of the page and click on the "Save for Later button to save your work 2. When you are ready to begin the next section, you can reference the work that you have completed by chicing the h answers in a new window to help you complete the next section Complete these steps each time you have finished a section. Do not click on the Su n " button until you have completed all of the section It by Study Using the Units of Production Depreciation Method, calculate the Depreciation Cost per Hour and the amount of depreciation taken in 2018 (n entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with com Depreciation Cost per Hour o t ) Depreciation in 2018 - Before moving onto the next section, please do the following for screen hele, click on the hyperlink below) 1. Scroll to the end of the page and click on the "Save for Later button to save your work Doing the 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the printer Version but at the top of the answers in a new window to help you complete the next section, Complete these steps each time you have finished a section. Do not click on the "Submit Answers button to you have completed all of the sections, LINK TO TEXT LINK TO TEXT sing the Double-Declining Balance Depreciation Method, calculate the Double-Dedining Balance (DOS) Rate then complete the table below for the years 2015 through 2018. (Round answers to dec not use dollar signs (S) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with comma) Double-Declining Balance (DDB) Rate Book Value Accumulated Depreciation Years Annual Depreciation 2016 2017 2018 Depreciation for 2018 Before moving onto the next section, please do the following for screen ip, click on the hyperlink below) 1. Scroll to the end of the page and click on the "Save for Later" button to save your work 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the button at the two me ye answers in a new window to help you complete the next section Complete these steps each time you have finished a section. Do not click on the "Submit " buttoventil you have completed all of the section Click if you would like to Show Work for this question: Open Show of 3 Question Attempts