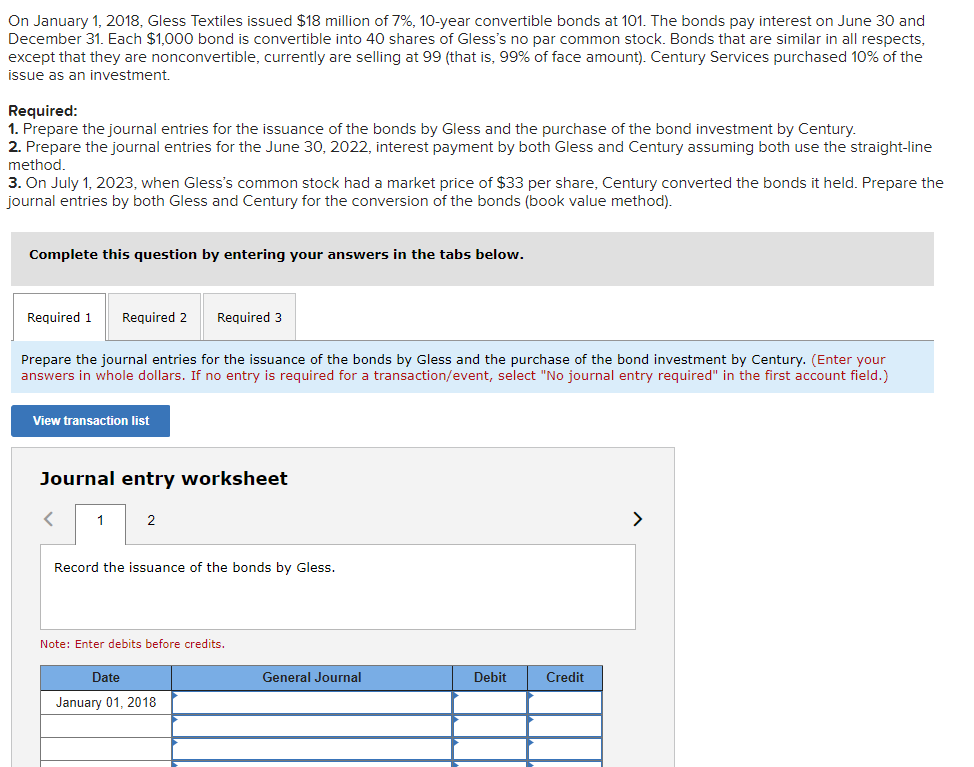

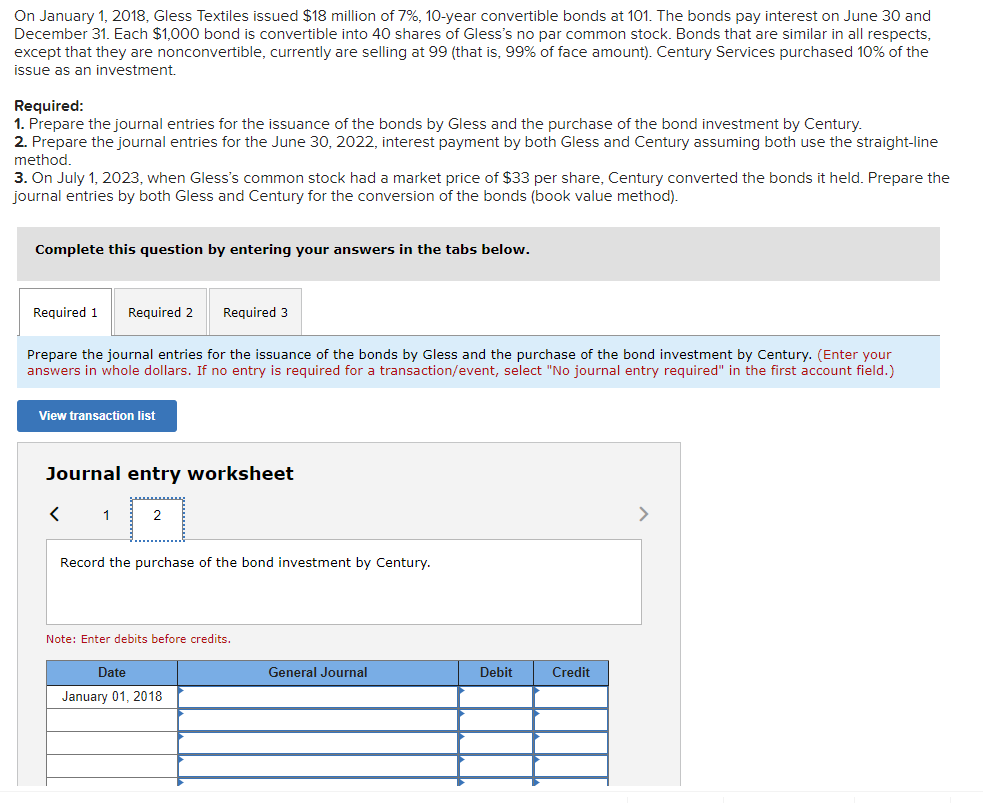

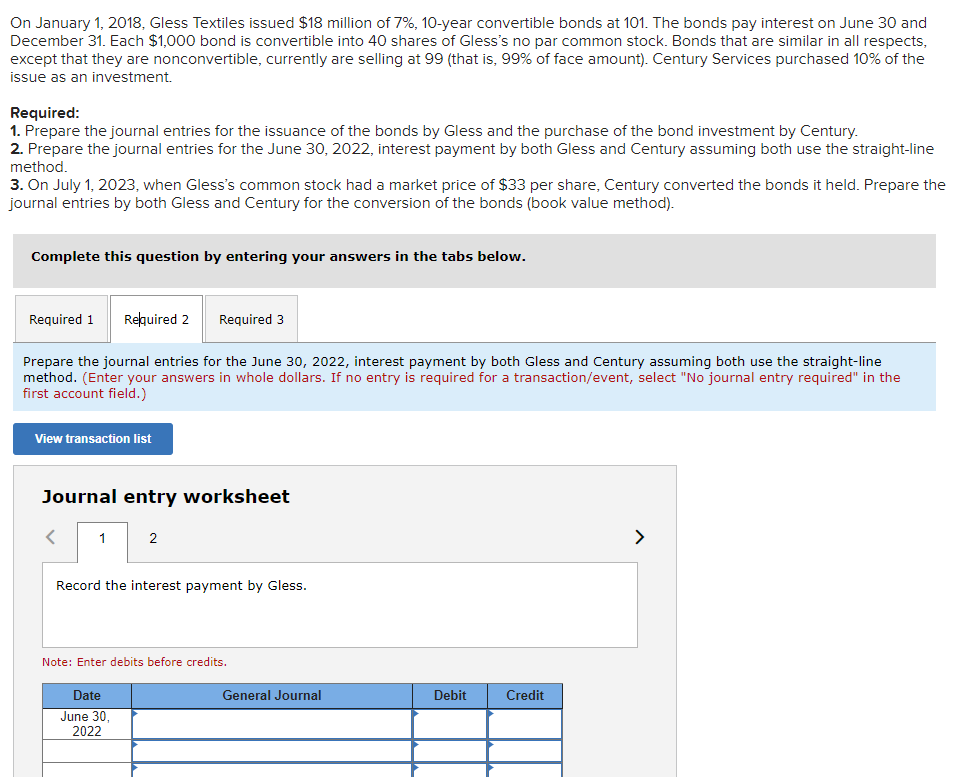

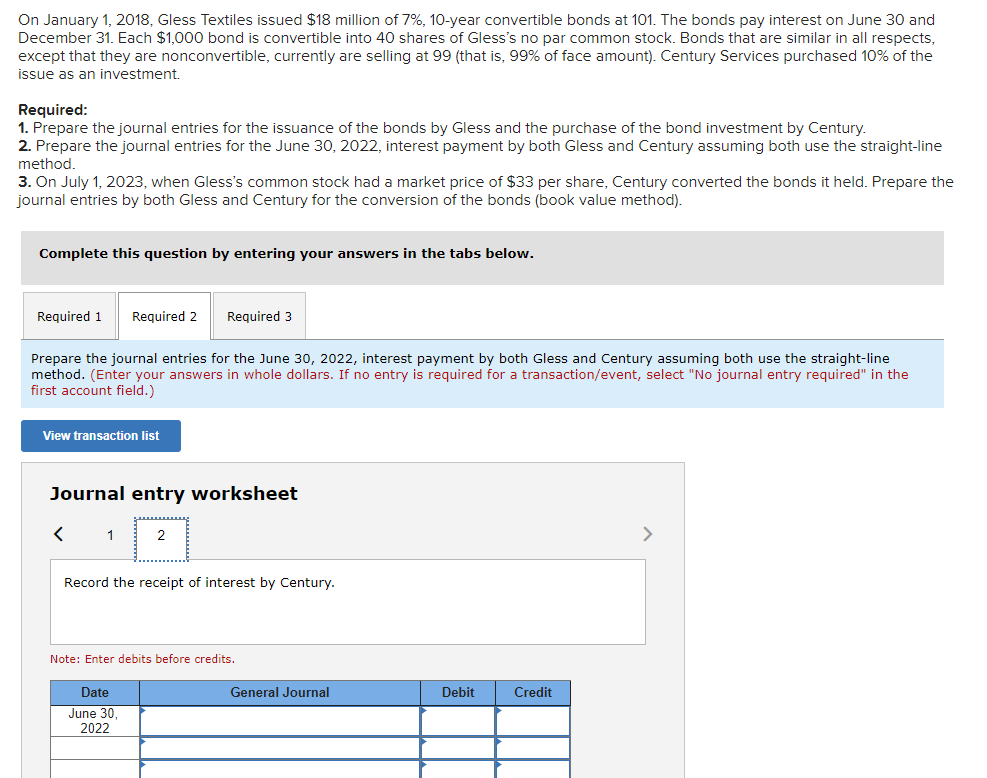

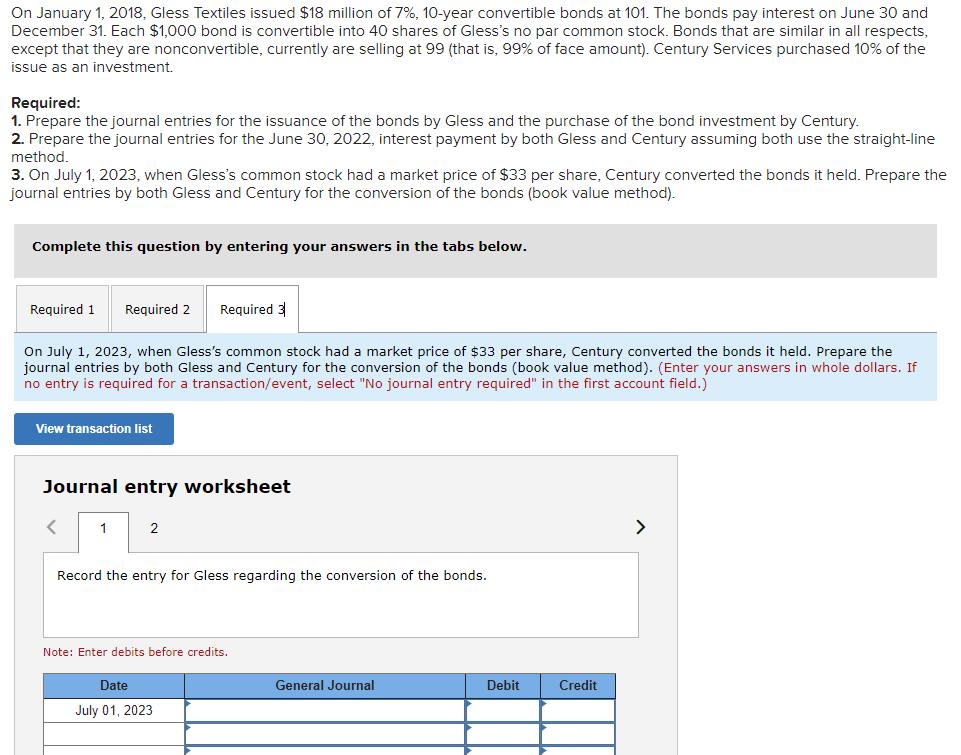

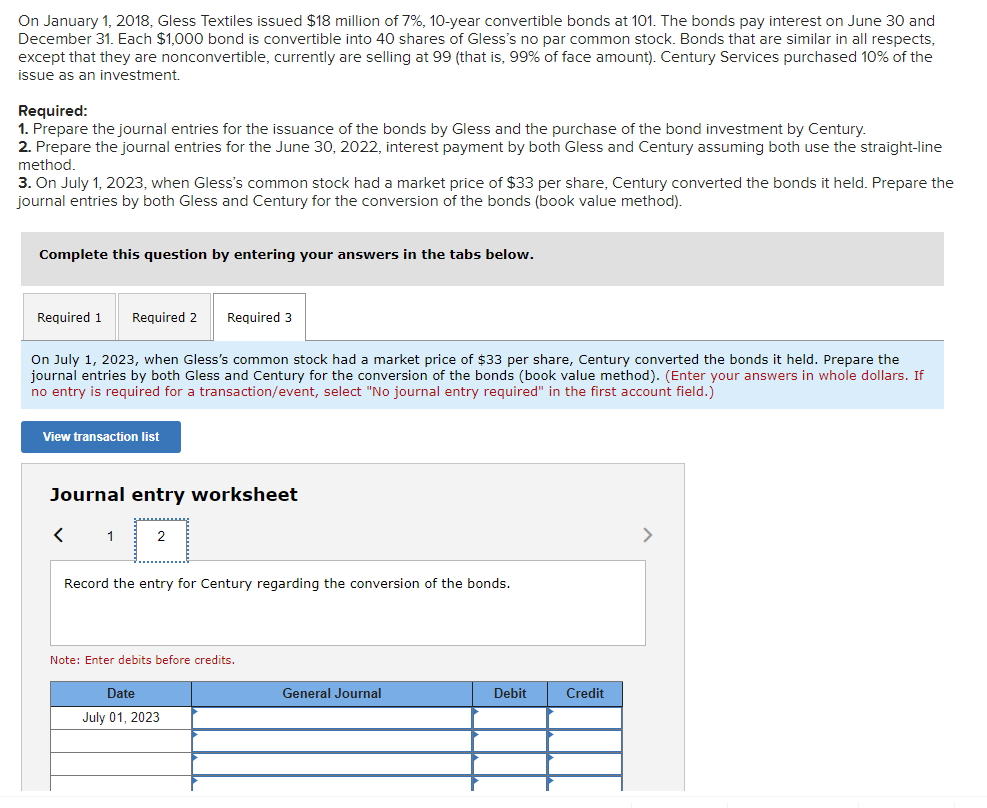

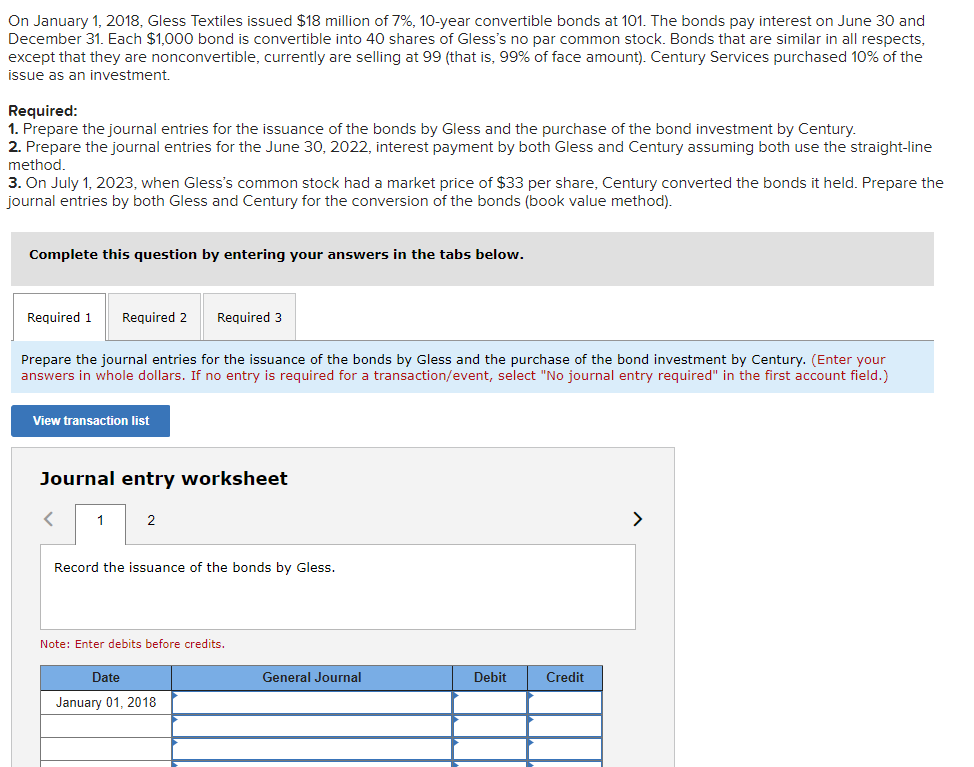

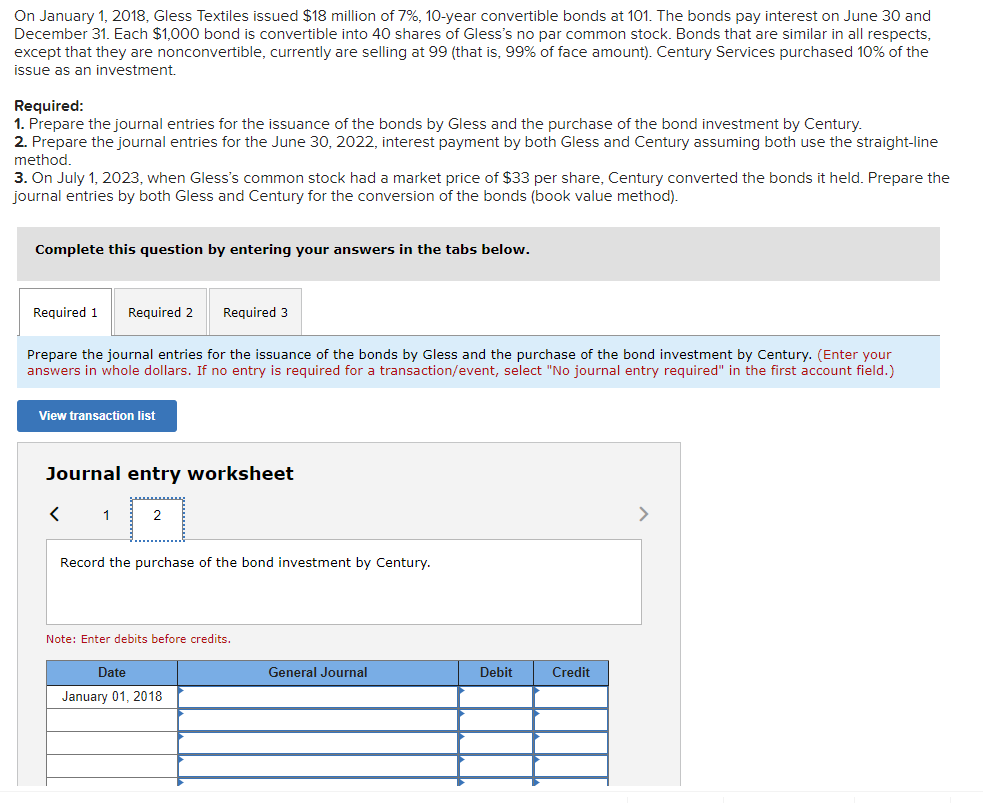

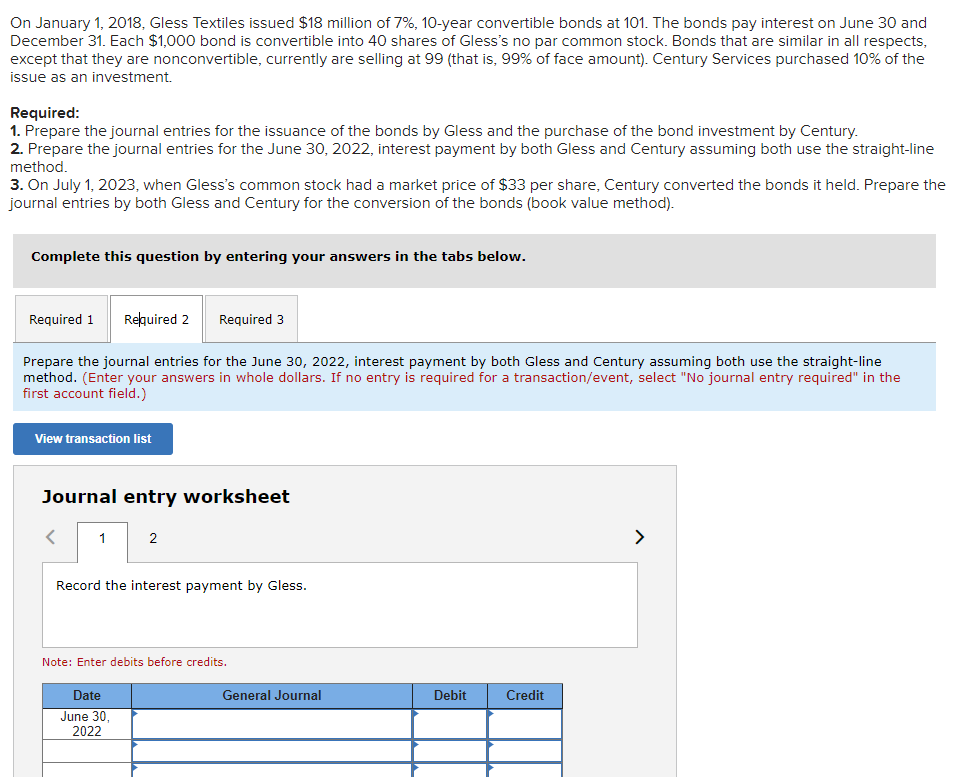

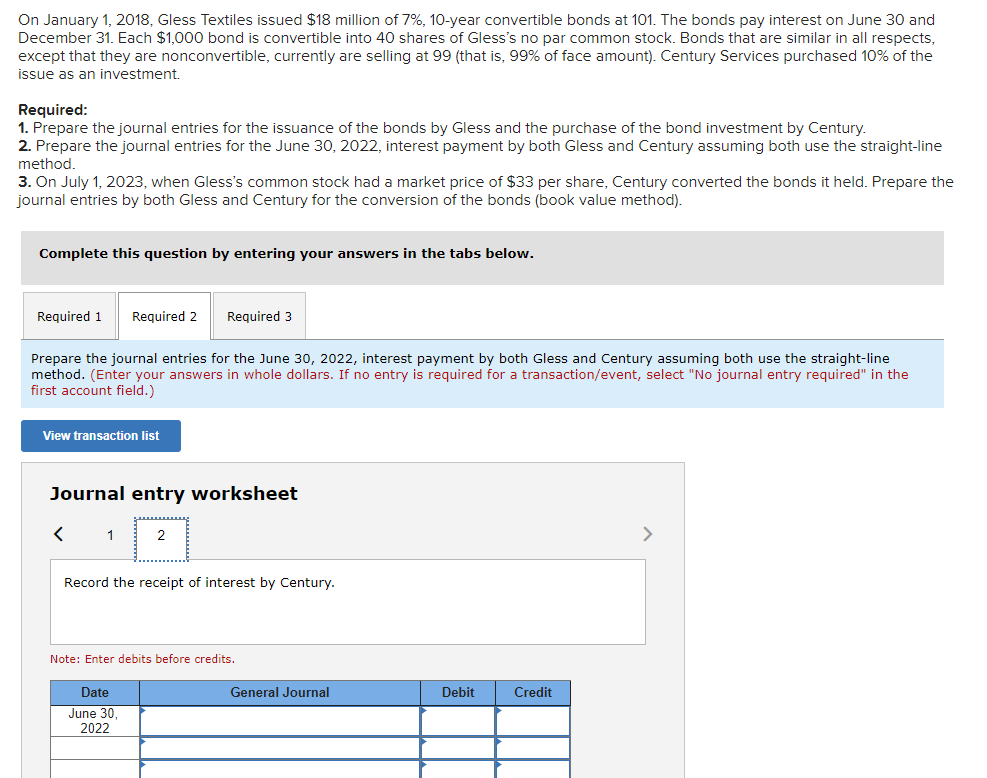

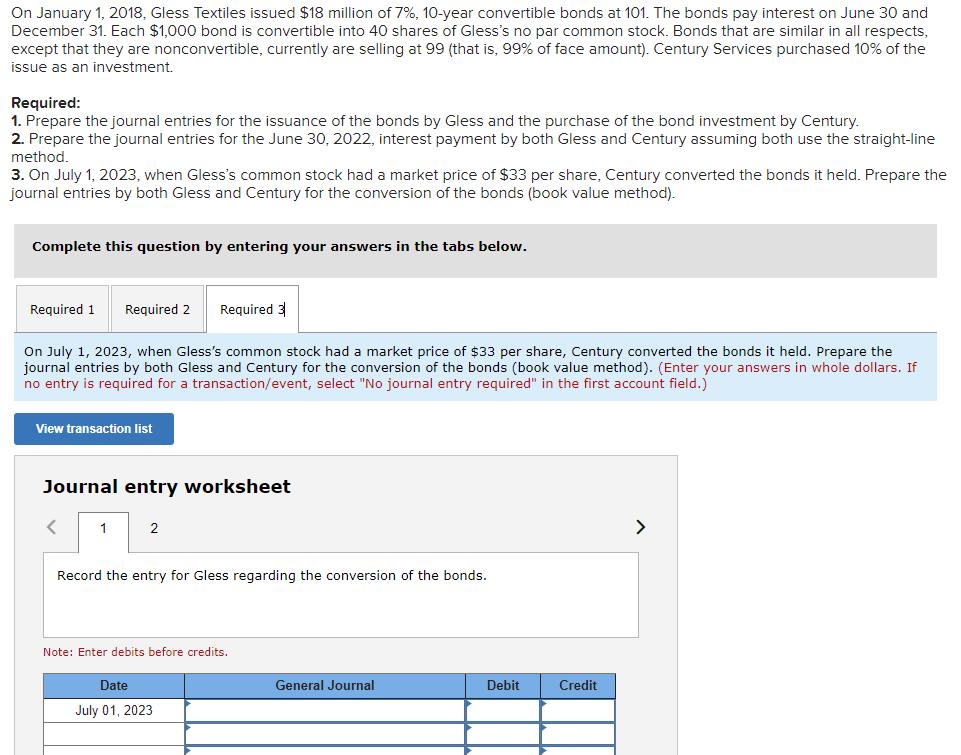

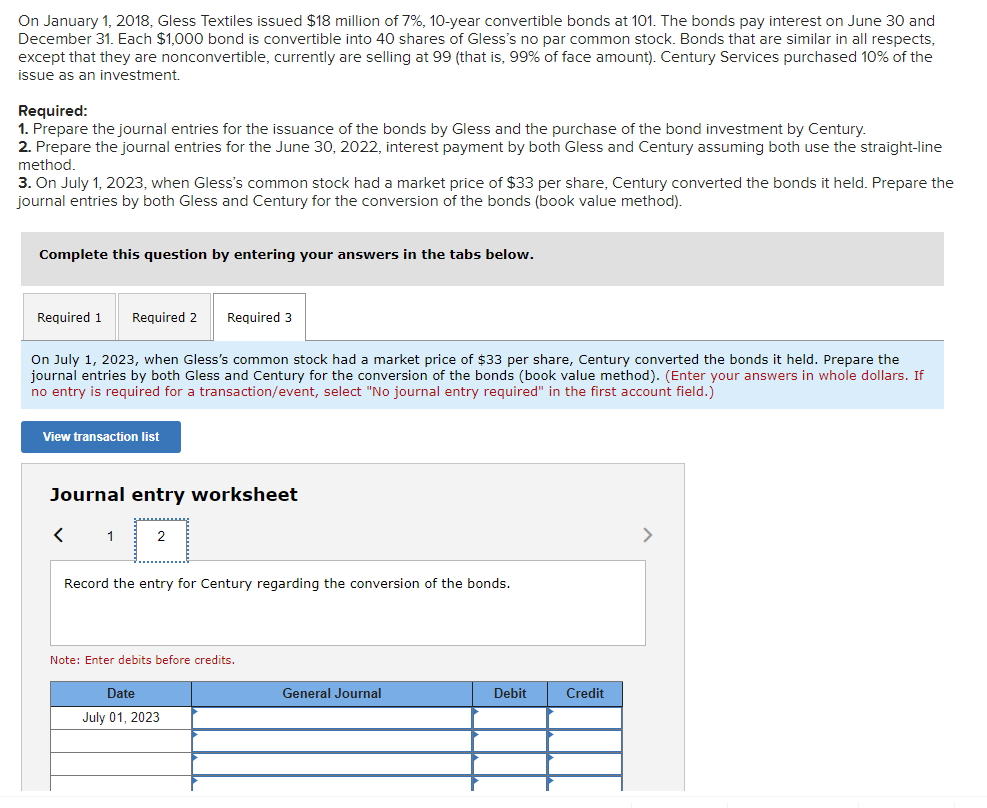

On January 1, 2018, Gless Textiles issued $18 million of 7%, 10-year convertible bonds at 101. The bonds pay interest on June 30 and December 31. Each $1,000 bond is convertible into 40 shares of Gless's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 99% of face amount). Century Services purchased 10% of the issue as an investment. Required: 1. Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond investment by Century. 2. Prepare the journal entries for the June 30, 2022, interest payment by both Gless and Century assuming both use the straight-line method. 3. On July 1, 2023, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond investment by Century. (Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the issuance of the bonds by Gless. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018 On January 1, 2018, Gless Textiles issued $18 million of 7%, 10-year convertible bonds at 101. The bonds pay interest on June 30 and December 31. Each $1,000 bond is convertible into 40 shares of Gless's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 99% of face amount). Century Services purchased 10% of the issue as an investment. Required: 1. Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond investment by Century. 2. Prepare the journal entries for the June 30, 2022, interest payment by both Gless and Century assuming both use the straight-line method. 3. On July 1, 2023, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond investment by Century. (Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 > Record the purchase of the bond investment by Century. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018 On January 1, 2018, Gless Textiles issued $18 million of 7%, 10-year convertible bonds at 101. The bonds pay interest on June 30 and December 31. Each $1,000 bond is convertible into 40 shares of Gless's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 99% of face amount). Century Services purchased 10% of the issue as an investment Required: 1. Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond investment by Century. 2. Prepare the journal entries for the June 30, 2022, interest payment by both Gless and Century assuming both use the straight-line method. 3. On July 1, 2023, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries for the June 30, 2022, interest payment by both Gless and Century assuming both use the straight-line method. (Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the receipt of interest by Century. Note: Enter debits before credits. Date General Journal Debit Credit June 30 2022 On January 1, 2018, Gless Textiles issued $18 million of 7%, 10-year convertible bonds at 101. The bonds pay interest on June 30 and December 31. Each $1,000 bond is convertible into 40 shares of Gless's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 99% of face amount). Century Services purchased 10% of the issue as an investment. Required: 1. Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond investment by Century. 2. Prepare the journal entries for the June 30, 2022, interest payment by both Gless and Century assuming both use the straight-line method. 3. On July 1, 2023, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 31 On July 1, 2023, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). (Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for Gless regarding the conversion of the bonds. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2023 On January 1, 2018, Gless Textiles issued $18 million of 7%, 10-year convertible bonds at 101. The bonds pay interest on June 30 and December 31. Each $1,000 bond is convertible into 40 shares of Gless's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 99% of face amount). Century Services purchased 10% of the issue as an investment. Required: 1. Prepare the journal entries for the issuance of the bonds by Gless and the purchase of the bond investment by Century. 2. Prepare the journal entries for the June 30, 2022, interest payment by both Gless and Century assuming both use the straight-line method. 3. On July 1, 2023, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 On July 1, 2023, when Gless's common stock had a market price of $33 per share, Century converted the bonds it held. Prepare the journal entries by both Gless and Century for the conversion of the bonds (book value method). (Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for Century regarding the conversion of the bonds. Note: Enter debits before credits. General Journal Debit Credit Date July 01, 2023