Question

Nov. 26 Invested cash $20,000 to start your business, Memo 01. Nov. 30 Issued Check 101 for $2,000 to pay for rent in November and

| Nov. 26 | Invested cash $20,000 to start your business, Memo 01. |

| Nov. 30 | Issued Check 101 for $2,000 to pay for rent in November and December. |

| Dec. 1 | Issued Check 102 for $3,000 for a one-year insurance policy. |

| Dec. 1 | Purchased Inventory on account from Olivka Company with a due payment in 60 days, $2,000, Invoice 1342. |

| Dec. 2 | Purchased kitchen equipment from Cucina Inc. for $6,000 (Invoice 5431), issued Check 103 for $3,000, and agreed to pay the balance in 30 days. |

| Dec. 3 | Purchased inventory from Bevanda Company with cash payment, issued Check 104 for $3,600. |

| Dec. 4 | Issued Check 105 for $500 to pay for advertising expense. |

| Dec. 8 | Maestro Services LLC bought lunches for its employees for 1 month on credit, $2,500 net; sales tax 5%; Sales Slip 301. |

| Dec. 15 | Purchased Inventory costing $1,800 from Jolly Plus, Invoice 2341, terms 2/10, n/30, with freight charges of $100 paid by Jolly Plus and added to the invoice. |

| Dec. 20 | Issued Check 106 for partial payment to Cucina Inc. for the kitchen equipment, $1,000. |

| Dec. 24 | Issued Check 108 to pay the balance owed to Jolly Plus. |

| Dec. 27 | Received a cash payment from Maestro Services LLC to cover the liability. |

| Dec. 31 | Sales in cash for $8,300, sales tax 5%. |

| Dec. 31 | The owner's withdrawal for personal expenses $1,000, Check 109. |

Below is the information that you will use for adjusting entries:

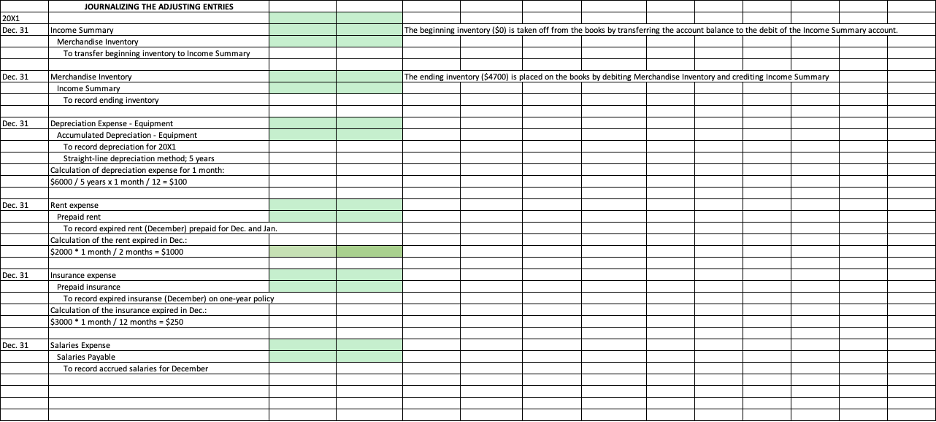

Merchandise Inventory on hand at the end of the month is $4,700. You use the periodic inventory system.

You use straight-line depreciation method. The estimated useful life of the purchased equipment is 5 years.

Make sure to record the Rent and Insurance expired in December.

You and your assistant earned $4,830 for salaries in December. The salaries expense has not been recorded because the employees will not be paid until January 10, 20X2. Ignore the payroll taxes and refer to this article to record the salaries that were accrued but not paid.

Prepare the journal entries for the above transactions.

For the template of the General Journal, refer to your textbook (Chapter 4 p. 92).

Make sure to record the date, names of debited and credited accounts, descriptions and document numbers (whenever possible) for each transaction.

Use account Purchases to record transactions associated with buying inventory. To record the transaction that took place on December 15, refer to your textbook (Chapter 8 p. 242).

Post the above transactions to the ledger accounts.

For the template of the General Ledger, refer to your textbook (Chapter 4 p. 102).

You can assign numbers to each of the accounts.

Prepare a Trial Balance.

Refer to your textbook (Chapter 5 p. 126) to learn how to prepare the trial balance.

Use the following accounts:

| 1 | Cash |

| 2 | Accounts receivable |

| 3 | Prepaid rent |

| 4 | Prepaid insurance |

| 5 | Merchandize Inventory |

| 6 | Equipment |

| 7 | Accumulated depreciation - Equipment |

| 8 | Accounts payable |

| 9 | Salaries Payable |

| 10 | Sales Tax payable |

| 11 | Capital |

| 12 | Drawing |

| 13 | Income Summary |

| 14 | Sales |

| 15 | Purchases |

| 16 | Freight in |

| 17 | Purchases discounts |

| 18 | Advertising expense |

| 19 | Salaries expense |

| 20 | Depreciation expense - equipment |

| 21 | Rent expense |

| 22 | Insurance expense |

| 23 | Totals |

Make the adjusting entries on December 31, 20X1 and journalize them.

To record accrued salaries, use the following adjusting entry: Salaries Expense is debited, Salaries Payable is credited.

You will also make adjusting entries using the accounts Merchandize Inventory and Income Summary. First, the beginning inventory is taken off from the books by transferring the account balance to the debit of the Income Summary account. Record the following entry: Income Summary is debited, and Merchandise Inventory is credited. Second, the ending inventory is placed on the books by debiting Merchandise Inventory and crediting Income Summary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started