Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Polka Company purchased 100% of Song Company for $500,000 which was above book value. In completing the purchase X differential

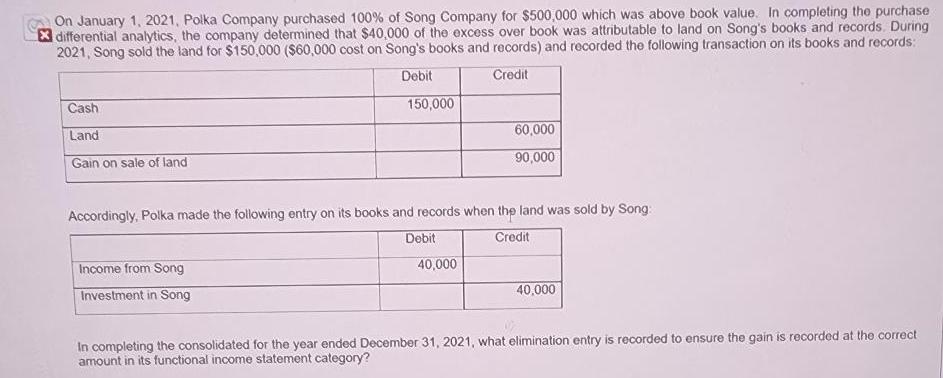

On January 1, 2021, Polka Company purchased 100% of Song Company for $500,000 which was above book value. In completing the purchase X differential analytics, the company determined that $40,000 of the excess over book was attributable to land on Song's books and records. During 2021, Song sold the land for $150,000 ($60,000 cost on Song's books and records) and recorded the following transaction on its books and records: Debit Credit Cash Land Gain on sale of land 150,000 Income from Song Investment in Song Accordingly, Polka made the following entry on its books and records when the land was sold by Song: Debit Credit 60,000 90,000 40,000 40,000 In completing the consolidated for the year ended December 31, 2021, what elimination entry is recorded to ensure the gain is recorded at the correct amount in its functional income statement category?

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Step1 Debit Credit Land 40000 Gain on sale of land 40000 Step2 Explanation Income from So...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started