Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Halstead, Incorporated, purchased 76,000 shares of Sedgwick Company common stock for $1,527,000, giving Halstead 25 percent ownership and the ability to

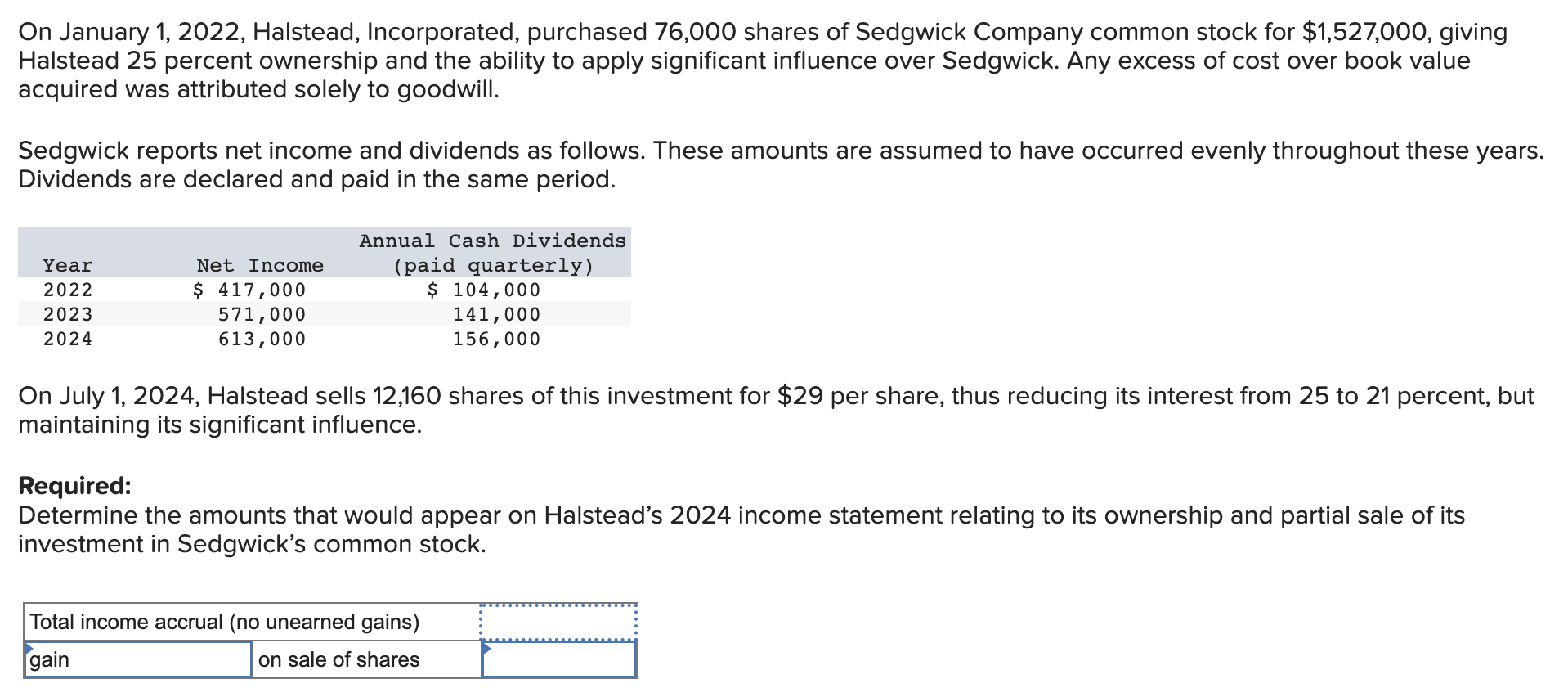

On January 1, 2022, Halstead, Incorporated, purchased 76,000 shares of Sedgwick Company common stock for $1,527,000, giving Halstead 25 percent ownership and the ability to apply significant influence over Sedgwick. Any excess of cost over book value acquired was attributed solely to goodwill. Sedgwick reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout these years Dividends are declared and paid in the same period. On July 1, 2024, Halstead sells 12,160 shares of this investment for $29 per share, thus reducing its interest from 25 to 21 percent, but maintaining its significant influence. Required: Determine the amounts that would appear on Halstead's 2024 income statement relating to its ownership and partial sale of its investment in Sedgwick's common stock

On January 1, 2022, Halstead, Incorporated, purchased 76,000 shares of Sedgwick Company common stock for $1,527,000, giving Halstead 25 percent ownership and the ability to apply significant influence over Sedgwick. Any excess of cost over book value acquired was attributed solely to goodwill. Sedgwick reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout these years Dividends are declared and paid in the same period. On July 1, 2024, Halstead sells 12,160 shares of this investment for $29 per share, thus reducing its interest from 25 to 21 percent, but maintaining its significant influence. Required: Determine the amounts that would appear on Halstead's 2024 income statement relating to its ownership and partial sale of its investment in Sedgwick's common stock Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started