Answered step by step

Verified Expert Solution

Question

1 Approved Answer

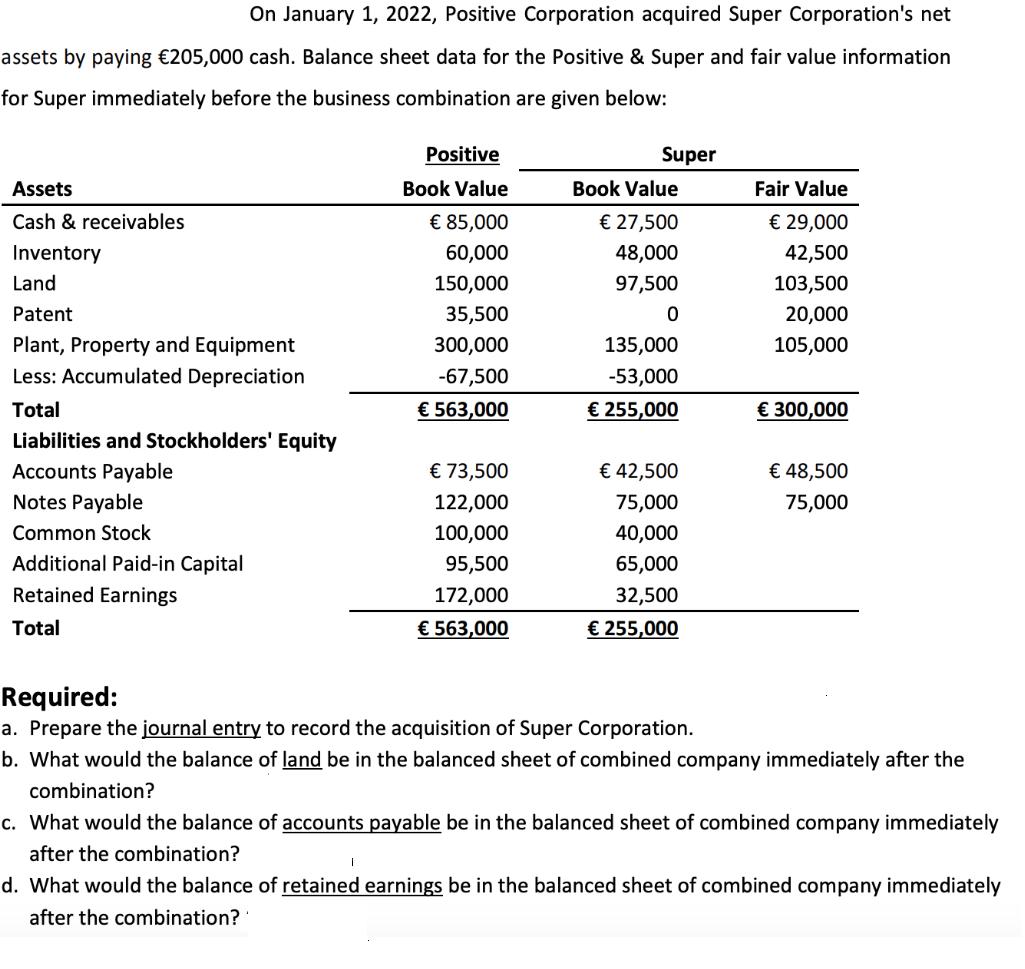

On January 1, 2022, Positive Corporation acquired Super Corporation's net assets by paying 205,000 cash. Balance sheet data for the Positive & Super and

On January 1, 2022, Positive Corporation acquired Super Corporation's net assets by paying 205,000 cash. Balance sheet data for the Positive & Super and fair value information for Super immediately before the business combination are given below: Positive Super Assets Book Value Book Value Fair Value Cash & receivables 85,000 27,500 29,000 Inventory 60,000 48,000 42,500 Land 150,000 97,500 103,500 Patent 35,500 20,000 Plant, Property and Equipment 300,000 135,000 105,000 Less: Accumulated Depreciation -67,500 -53,000 Total 563,000 255,000 300,000 Liabilities and Stockholders' Equity Accounts Payable 73,500 42,500 48,500 Notes Payable 122,000 75,000 75,000 Common Stock 100,000 40,000 Additional Paid-in Capital 95,500 65,000 Retained Earnings 172,000 32,500 Total 563,000 255,000 Required: a. Prepare the journal entry to record the acquisition of Super Corporation. b. What would the balance of land be in the balanced sheet of combined company immediately after the combination? c. What would the balance of accounts payable be in the balanced sheet of combined company immediately after the combination? d. What would the balance of retained earnings be in the balanced sheet of combined company immediately after the combination?

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

WN1 Calculation of Goodwill Identifiable Net Assets 30000048500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started