Question

On January 1, 2024, Kroll Corporation paid $2,559,000 for 31 percent of the outstanding voting stock of Sharon, Incorporated, and appropriately applied the equity

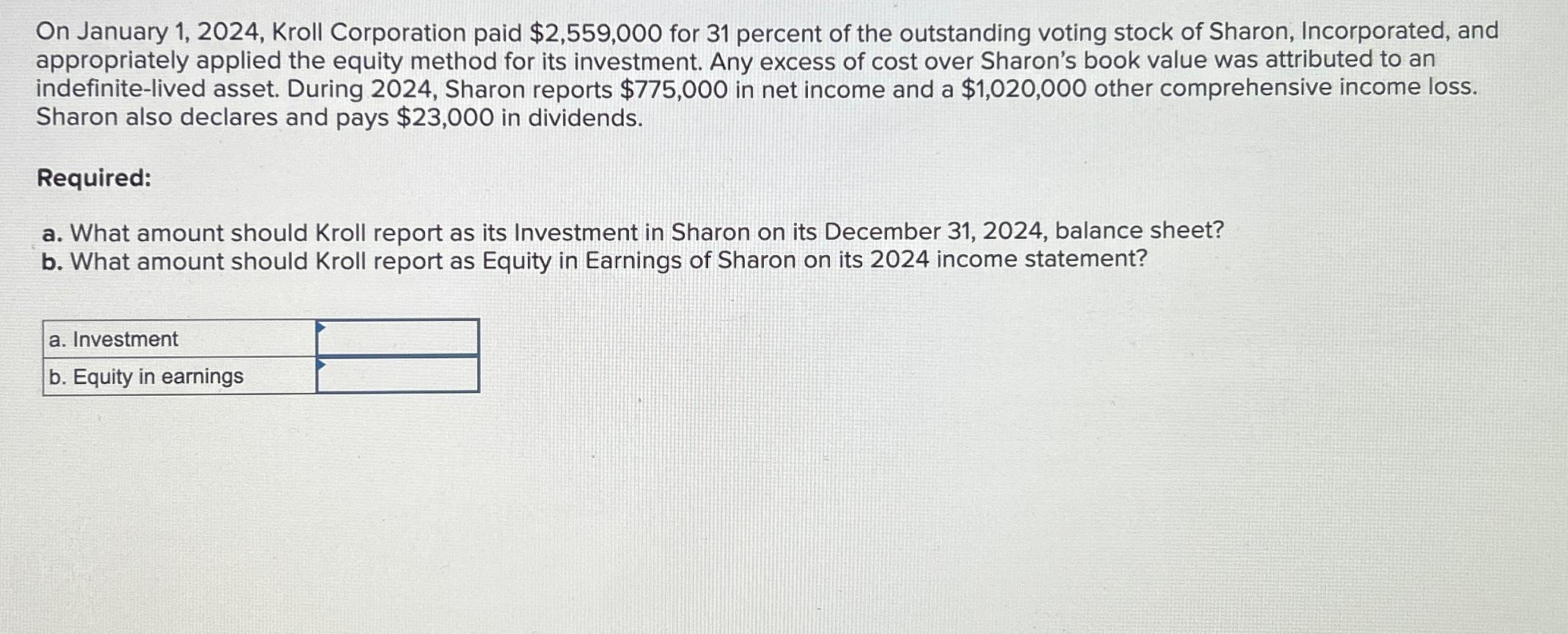

On January 1, 2024, Kroll Corporation paid $2,559,000 for 31 percent of the outstanding voting stock of Sharon, Incorporated, and appropriately applied the equity method for its investment. Any excess of cost over Sharon's book value was attributed to an indefinite-lived asset. During 2024, Sharon reports $775,000 in net income and a $1,020,000 other comprehensive income loss. Sharon also declares and pays $23,000 in dividends. Required: a. What amount should Kroll report as its Investment in Sharon on its December 31, 2024, balance sheet? b. What amount should Kroll report as Equity in Earnings of Sharon on its 2024 income statement? a. Investment b. Equity in earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER So Kroll shou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik

15th Edition

1264798482, 9781264798483

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App