Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory

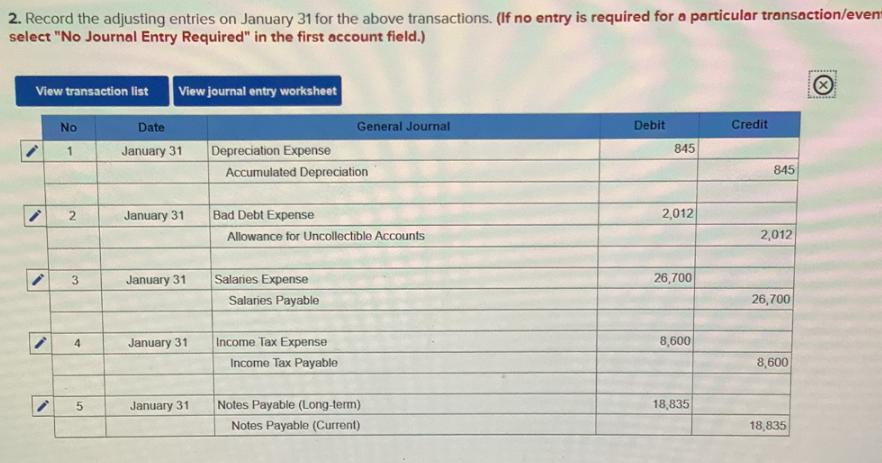

On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Buildings Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals During January 2024, the following transactions occur: January 1 January 4 Debit $ 11,800 Credit 35,200 $2,400 152,600 73,300 126,000 10,200 24,300 206,000 156,000 $ 398,900 $ 398,900 Borrow $106,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $2,049 are required at the end of each month for 60 months. Receive $31,600 from customers on accounts receivable.. January 10 Pay cash on accounts payable, $17,000. January 15 Pay cash for salaries, $29,500. January 30 Firework sales for the month total $196,200. The cost of the units sold is $115,500. January 31 Pay the first monthly installment of $2,049 related to the $106,000 borrowed on January 1. 3. Prepare an adjusted trial balance as of January 31, 2024, after updating beginning balances (above) for transactions during Januar (requirement 1) and adjusting entries at the end of January (requirement 2). (Do not round intermediate calculations.) FREEDOM FIREWORKS Adjusted Trial Balance January 31, 2024 Accounts Debit Credit 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required for a particular transaction/even select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal 1 January 31 Depreciation Expense Debit Credit 845 Accumulated Depreciation 845 2 January 31 Bad Debt Expense 2,012 Allowance for Uncollectible Accounts 2,012 3 January 31 Salaries Expense 26,700 Salaries Payable 26,700 4 January 31 Income Tax Expense Income Tax Payable 8,600 8,600 i 5 January 31 Notes Payable (Long-term) 18,835 Notes Payable (Current) 18,835

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started