Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, FRED and GEMMO formed a partnership by contributing cash of P405,000 and P270,000, respectively. On February 1. Fred contributed an additional

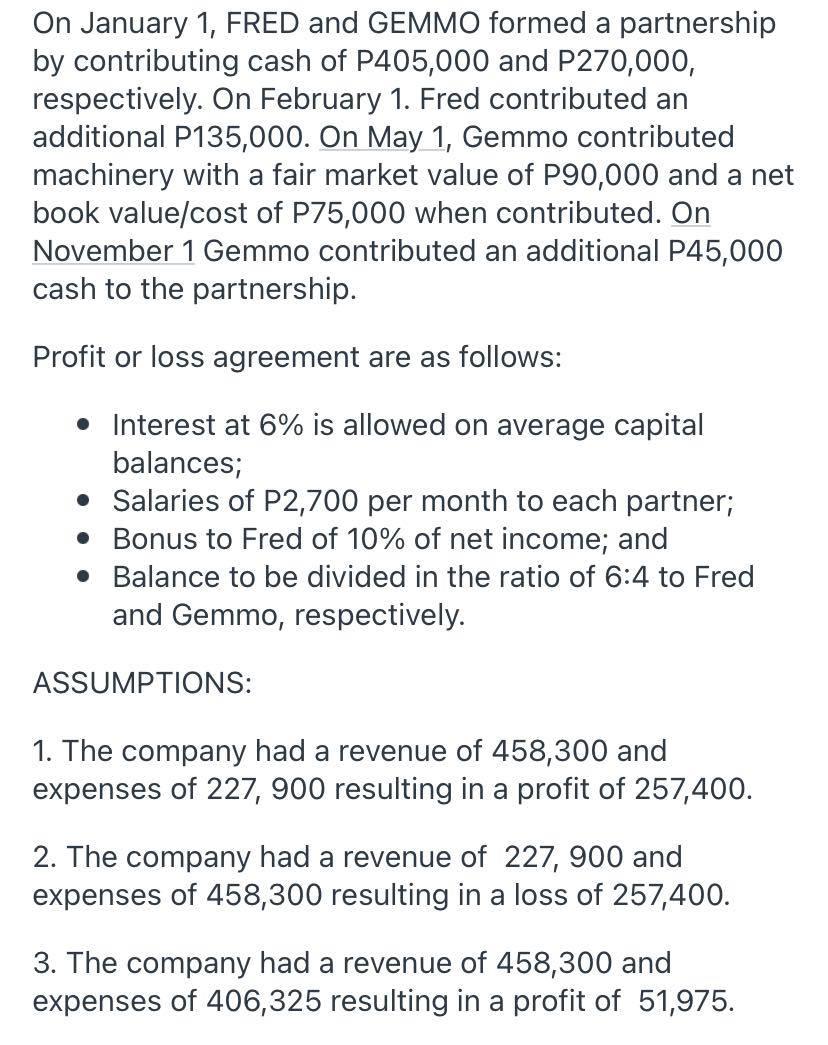

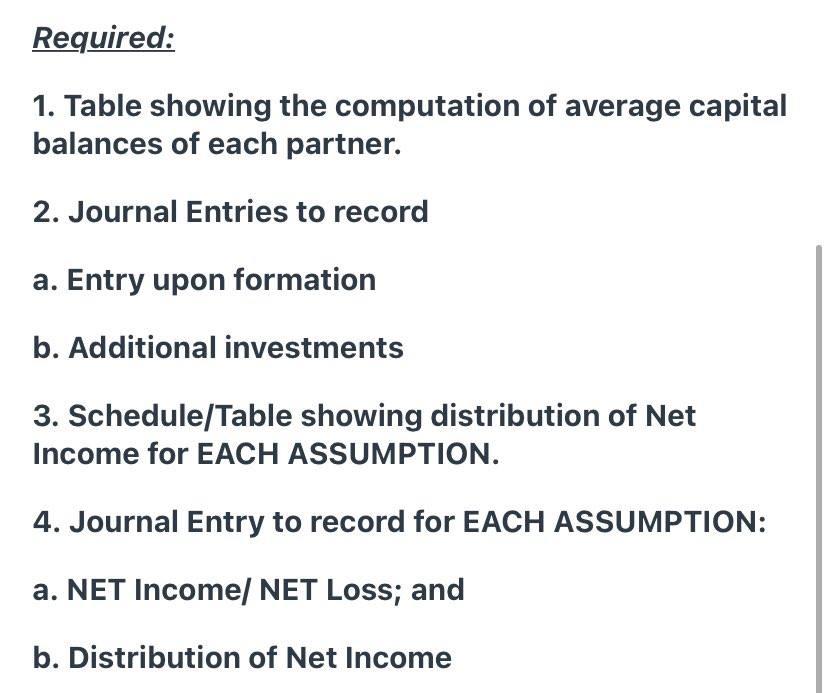

On January 1, FRED and GEMMO formed a partnership by contributing cash of P405,000 and P270,000, respectively. On February 1. Fred contributed an additional P135,000. On May 1, Gemmo contributed machinery with a fair market value of P90,000 and a net book value/cost of P75,000 when contributed. On November 1 Gemmo contributed an additional P45,000 cash to the partnership. Profit or loss agreement are as follows: Interest at 6% is allowed on average capital balances; Salaries of P2,700 per month to each partner; Bonus to Fred of 10% of net income; and Balance to be divided in the ratio of 6:4 to Fred and Gemmo, respectively. ASSUMPTIONS: 1. The company had a revenue of 458,300 and expenses of 227, 900 resulting in a profit of 257,400. 2. The company had a revenue of 227, 900 and expenses of 458,300 resulting in a loss of 257,400. 3. The company had a revenue of 458,300 and expenses of 406,325 resulting in a profit of 51,975. Required: 1. Table showing the computation of average capital balances of each partner. 2. Journal Entries to record a. Entry upon formation b. Additional investments 3. Schedule/Table showing distribution of Net Income for EACH ASSUMPTION. 4. Journal Entry to record for EACH ASSUMPTION: a. NET Income/ NET Loss; and b. Distribution of Net Income

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Table Showing Average Capital Balances FRED Average Capital is calculated based on the amount the Money was invested Divided by the Total Months In ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started