Question

On January 1, Year 1, Bacco Company had a balance of $63,600 in its Delivery Equipment account. During Year 1, Bacco purchased delivery equipment that

On January 1, Year 1, Bacco Company had a balance of $63,600 in its Delivery Equipment account. During Year 1, Bacco purchased delivery equipment that cost $35,500. The balance in the Delivery Equipment account on December 31, Year 1, was $64,236. The Year 1 income statement reported a gain from the sale of equipment for $2,000. On the date of sale, accumulated depreciation on the equipment sold amounted to $14,000. Required a. Determine the original cost of the equipment that was sold during Year 1. b. Determine the amount of cash flow from the sale of delivery equipment that should be shown in the investing activities section of the Year 1 statement of cash flows.

IMPORTANT!! THIS IS ONE QUESTION WITH 3 PARTS. THE WRITTEN PART HAS DIFFERENT NUMBERS THAN IN THE PICTURE. THE PICTURE WAAS NECESSARY TO SHOW GRAPH. PLEASE ANSWER ALL

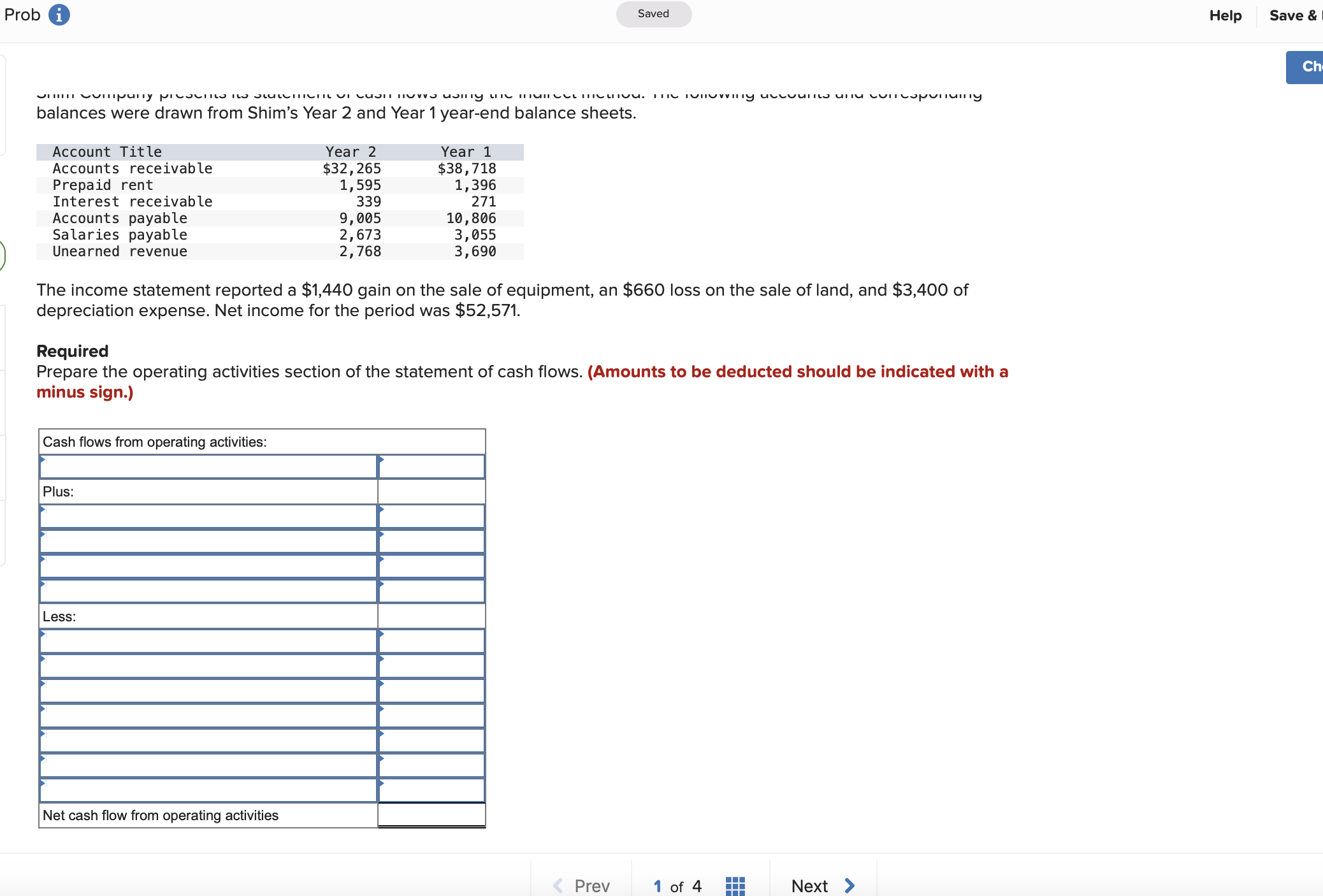

balances were drawn from Shim's Year 2 and Year 1 year-end balance sheets. The income statement reported a $1,440 gain on the sale of equipment, an $660 loss on the sale of land, and $3,400 of depreciation expense. Net income for the period was $52,571. Required Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started