Question

On January 2, 2020, the Jing Company received its charter. It issued all of its authorized 6,000 shares of no-par preferred stock at $106 per

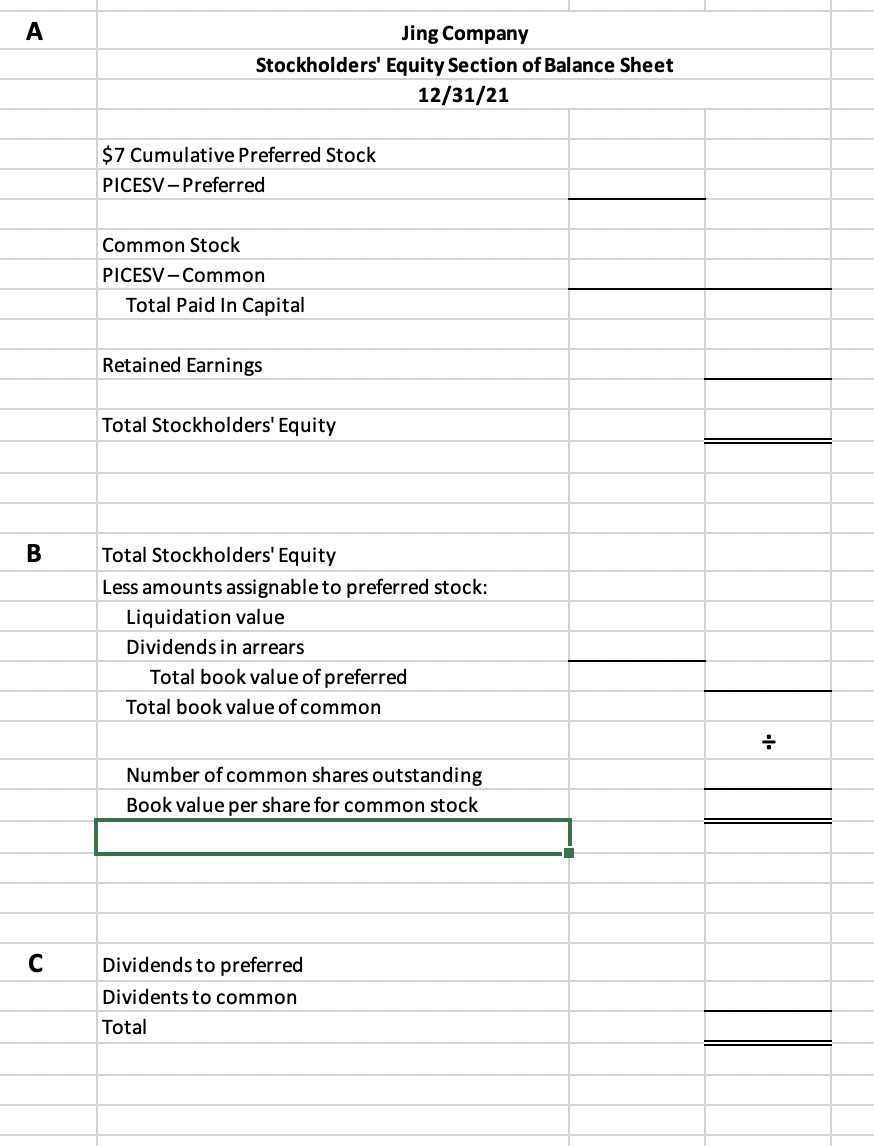

On January 2, 2020, the Jing Company received its charter. It issued all of its authorized 6,000 shares of no-par preferred stock at $106 per share and all of its 12,000 authorized shares of no-par common stock at $42 per share. The preferred stock has a stated value of $60 per share, is entitled to a basic cumulative annual dividend of $7 per share, is callable at $110 beginning in 2022, and is entitled to $100 per share plus cumulative dividends in the event of liquidation. The common stock has a stated value of $11 per share. On December 31, 2021, the end of the second year of operations, retained earnings were $140,000. No dividends have been declared on paid on either class of stock up to December 31, 2021. Required: A. Prepare the stockholders' equity section of the Jing Company's December 31, 2021 balance sheet. B. Compute the book value of each share of common stock as of December 31, 2021. C. If $90,000 of dividends were declared as of December 31, 2021, compute the amount that would go to each class of stock.

On January 2, 2020, the Jing Company received its charter. It issued all of its authorized 6,000 shares of no-par preferred stock at $106 per share and all of its 12,000 authorized shares of no-par common stock at $42 per share. The preferred stock has a stated value of $60 per share, is entitled to a basic cumulative annual dividend of $7 per share, is callable at $110 beginning in 2022, and is entitled to $100 per share plus cumulative dividends in the event of liquidation. The common stock has a stated value of $11 per share. On December 31, 2021, the end of the second year of operations, retained earnings were $140,000. No dividends have been declared on paid on either class of stock up to December 31, 2021. Required: A. Prepare the stockholders' equity section of the Jing Company's December 31, 2021 balance sheet. B. Compute the book value of each share of common stock as of December 31, 2021. C. If $90,000 of dividends were declared as of December 31, 2021, compute the amount that would go to each class of stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started