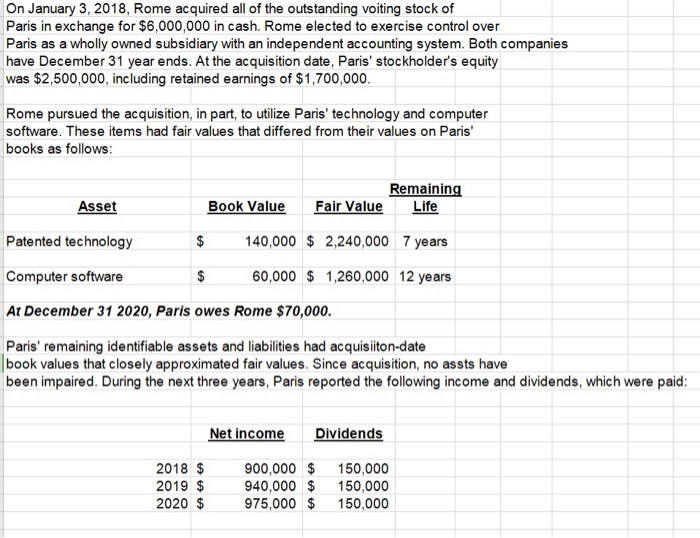

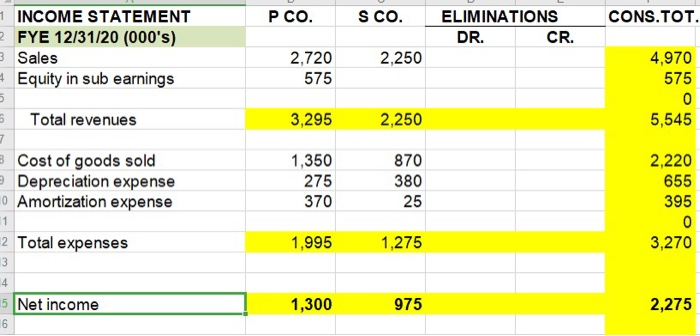

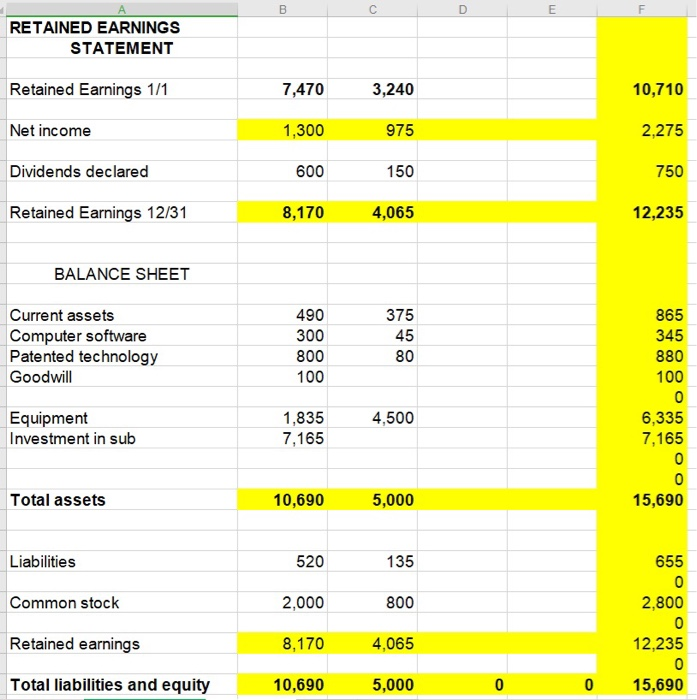

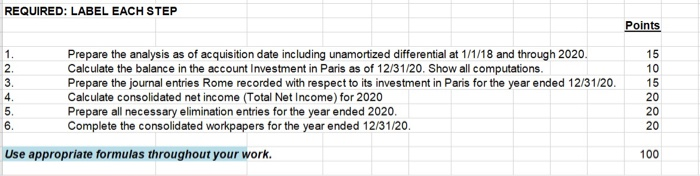

On January 3, 2018, Rome acquired all of the outstanding voiting stock of Paris in exchange for $6,000,000 in cash. Rome elected to exercise control over Paris as a wholly owned subsidiary with an independent accounting system. Both companies have December 31 year ends. At the acquisition date, Paris' stockholder's equity was $2,500,000, including retained earnings of $1,700,000. Rome pursued the acquisition, in part, to utilize Paris' technology and computer software. These items had fair values that differed from their values on Paris' books as follows: Remaining Fair Value Life Asset Book Value Patented technology $ 140,000 $ 2,240,000 7 years Computer software $ 60,000 $ 1,260,000 12 years At December 31 2020, Paris owes Rome $70,000. Paris' remaining identifiable assets and liabilities had acquisiiton-date book values that closely approximated fair values. Since acquisition, no assts have been impaired. During the next three years, Paris reported the following income and dividends, which were paid: Net income Dividends 2018 $ 2019 $ 2020 $ 900,000 $ 940,000 $ 975,000 $ 150,000 150,000 150,000 P CO. SCO. ELIMINATIONS DR. CR. CONS.TOT. 2,250 1 INCOME STATEMENT FYE 12/31/20 (000's) 3 Sales Equity in sub earnings 5 5 Total revenues 2,720 575 4,970 575 0 5,545 3,295 2,250 1,350 275 370 870 380 25 3 Cost of goods sold Depreciation expense 0 Amortization expense 11 2 Total expenses 13 4 15 Net income 16 2,220 655 395 0 3,270 1,995 1,275 1,300 975 2,275 B D E RETAINED EARNINGS STATEMENT Retained Earnings 1/1 7,470 3,240 10,710 Net income 1,300 975 2,275 Dividends declared 600 150 750 Retained Earnings 12/31 8,170 4,065 12,235 BALANCE SHEET Current assets Computer software Patented technology Goodwill 490 300 800 100 375 45 80 4,500 Equipment Investment in sub 1,835 7,165 865 345 880 100 0 6,335 7,165 0 0 15,690 Total assets 10,690 5,000 Liabilities 520 135 Common stock 2,000 800 655 0 2,800 0 12,235 0 15,690 Retained earnings 8,170 4,065 Total liabilities and equity 10,690 5,000 0 0 REQUIRED: LABEL EACH STEP Points 1. 2. 3. 4. 5. 6. Prepare the analysis as of acquisition date including unamortized differential at 1/1/18 and through 2020. Calculate the balance in the account Investment in Paris as of 12/31/20. Show all computations. Prepare the journal entries Rome recorded with respect to its investment in Paris for the year ended 12/31/20. Calculate consolidated net income (Total Net Income) for 2020 Prepare all necessary elimination entries for the year ended 2020. Complete the consolidated workpapers for the year ended 12/31/20. 15 10 15 20 20 20 Use appropriate formulas throughout your work. 100