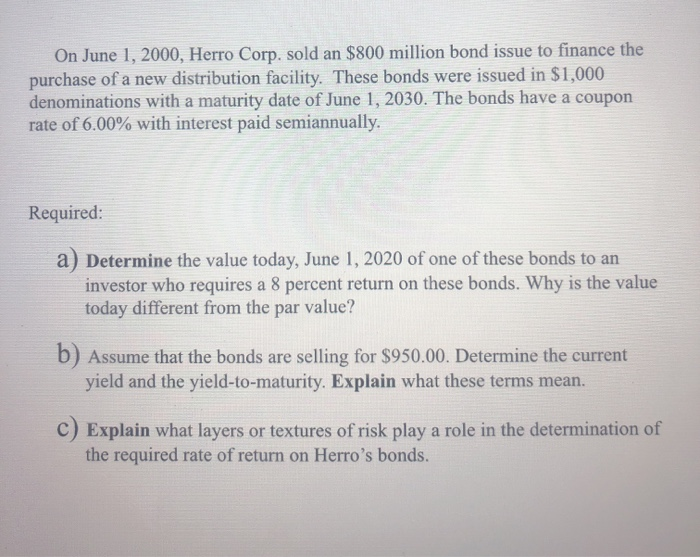

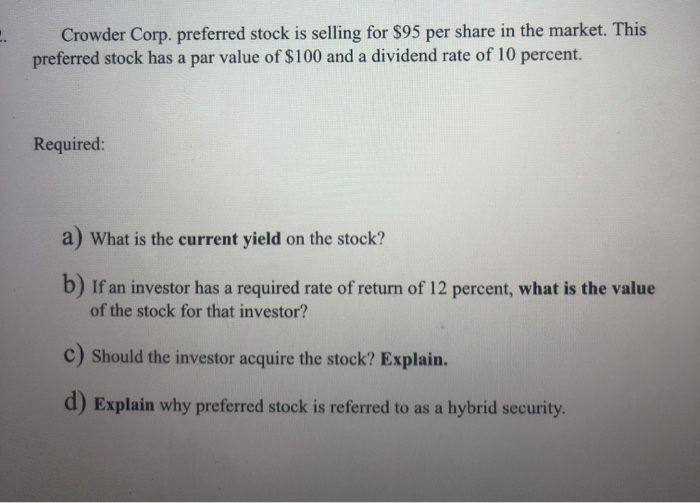

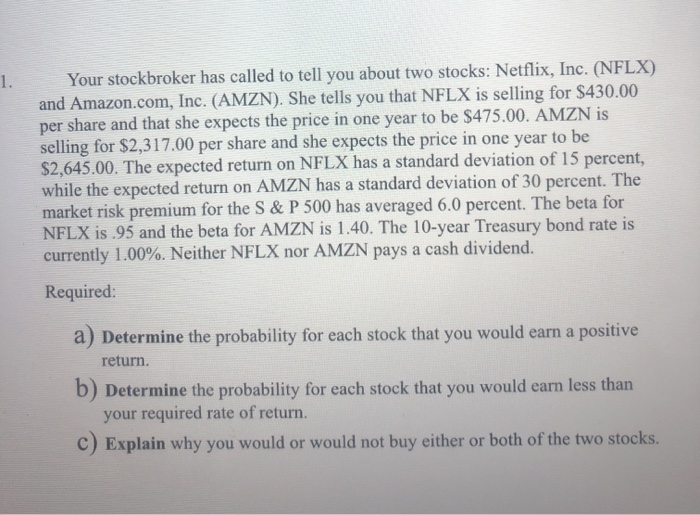

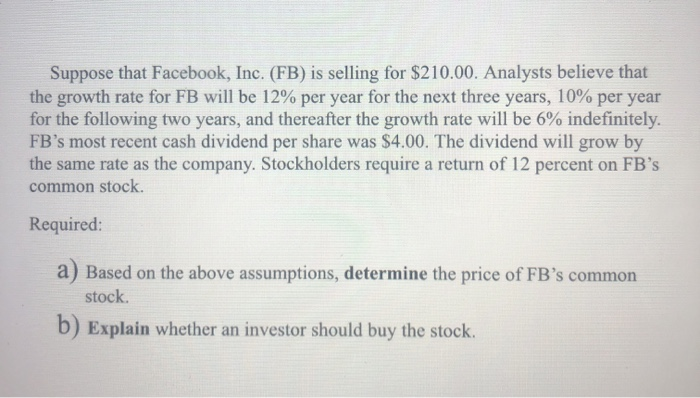

On June 1, 2000, Herro Corp. sold an $800 million bond issue to finance the purchase of a new distribution facility. These bonds were issued in $1,000 denominations with a maturity date of June 1, 2030. The bonds have a coupon rate of 6.00% with interest paid semiannually. Required: a) Determine the value today, June 1, 2020 of one of these bonds to an investor who requires a 8 percent return on these bonds. Why is the value today different from the par value? b) Assume that the bonds are selling for $950.00. Determine the current yield and the yield-to-maturity. Explain what these terms mean. C) Explain what layers or textures of risk play a role in the determination of the required rate of return on Herro's bonds. Crowder Corp. preferred stock is selling for $95 per share in the market. This preferred stock has a par value of $100 and a dividend rate of 10 percent. Required: a) What is the current yield on the stock? b) If an investor has a required rate of return of 12 percent, what is the value of the stock for that investor? C) Should the investor acquire the stock? Explain. d) Explain why preferred stock is referred to as a hybrid security. Your stockbroker has called to tell you about two stocks: Netflix, Inc. (NFLX) and Amazon.com, Inc. (AMZN). She tells you that NFLX is selling for $430.00 per share and that she expects the price in one year to be $475.00. AMZN is selling for $2,317.00 per share and she expects the price in one year to be $2,645.00. The expected return on NFLX has a standard deviation of 15 percent, while the expected return on AMZN has a standard deviation of 30 percent. The market risk premium for the S&P 500 has averaged 6.0 percent. The beta for NFLX is 95 and the beta for AMZN is 1.40. The 10-year Treasury bond rate is currently 1.00%. Neither NFLX nor AMZN pays a cash dividend. Required: a) Determine the probability for each stock that you would earn a positive return. b) Determine the probability for each stock that you would earn less than your required rate of return. C) Explain why you would or would not buy either or both of the two stocks. Suppose that Facebook, Inc. (FB) is selling for $210.00. Analysts believe that the growth rate for FB will be 12% per year for the next three years, 10% per year for the following two years, and thereafter the growth rate will be 6% indefinitely. FB's most recent cash dividend per share was $4.00. The dividend will grow by the same rate as the company. Stockholders require a return of 12 percent on FB's common stock. Required: a) Based on the above assumptions, determine the price of FB's common stock b) Explain whether an investor should buy the stock