On June 1, 2021, Domino Foods borrows $5 million in a floating rate term loan that rolls over every 91 days. The interest rate is

On June 1, 2021, Domino Foods borrows $5 million in a floating rate term loan that rolls over every 91 days. The interest rate is set at the current Treasury bill rate plus 0.95 percent and is payable at the end of each 91-day period. To hedge the risk that interest rates will increase, Domino sells $5 million face value 91-day Treasury bill futures at 98.5; the price reflects the current Treasury bill rate of 1.5 percent. The futures position requires a $6,000 margin deposit and qualifies as an effective hedge of a firm commitment to roll over the floating-rate loan. On August 30, 2021, the end of the 91-day period, the Treasury bill rate is 1.25 percent and the interest rate futures sell for 98.75. Domino rolls over the loan and closes its futures position. Domino is scheduled to roll the loan over again on November 29, 2021, but does not hedge during this second period. Assume that Domino is not required to pay additional cash to the broker to cover hedging losses before it closes its position.

Required

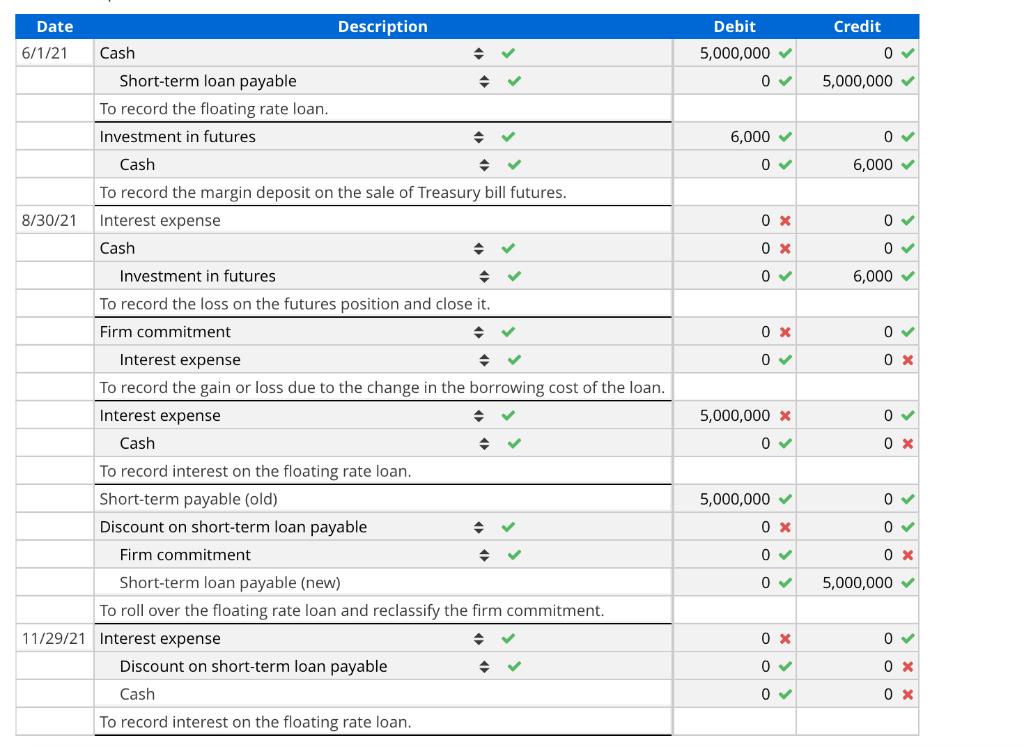

Prepare the entries necessary to record the above events. Include entries to record interest expense at the end of the first 91-day period and the second 91-day period. Income effects of the hedge are reported in interest expense.

Date Description Debit Credit 6/1/21 Cash 5,000,000 v Short-term loan payable 5,000,000 To record the floating rate loan. Investment in futures 6,000 v Cash 6,000 v To record the margin deposit on the sale of Treasury bill futures. 8/30/21 Interest expense 0 x Cash 0 x Investment in futures 6,000 v To record the loss on the futures position and close it. Firm commitment 0 x Interest expense 0 x To record the gain or loss due to the change in the borrowing cost of the loan. Interest expense 5,000,000 x Cash 0 x To record interest on the floating rate loan. Short-term payable (old) 5,000,000 v Discount on short-term loan payable 0 x Firm commitment 0 x Short-term loan payable (new) 5,000,000 v To roll over the floating rate loan and reclassify the firm commitment. 11/29/21 Interest expense 0 x Discount on short-term loan payable Cash To record interest on the floating rate loan.

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started