Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1, Year 1, a company loans cash to another company and accepts a note in return. The terms of the note are provided

On March 1, Year 1, a company loans cash to another company and accepts a note in return.

The terms of the note are provided below.

| Issue Date | March 1, Year 1 |

|---|---|

| Principal | 120,000 |

| Rate | 10% |

| Maturity Date | March 1, Year 4 |

Required:

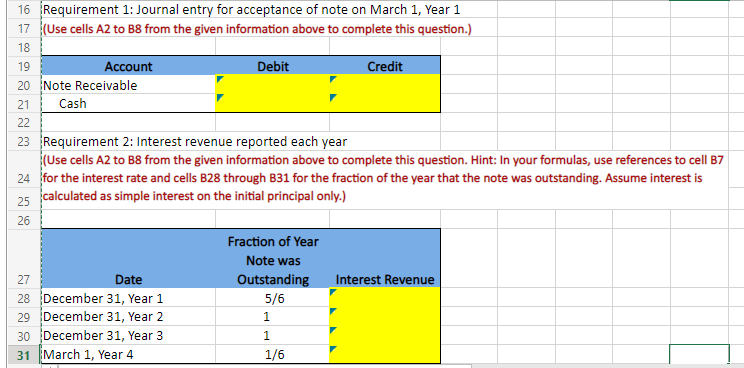

Prepare the journal entry to be made when the company makes the loan and accepts the note in return.

Calculate the interest revenue to be recorded at the end of each year the note is outstanding.

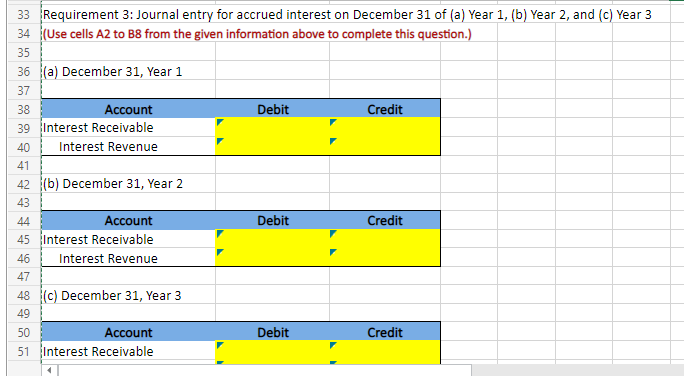

Prepare the journal entries to accrue the interest receivable for each year the note is outstanding.

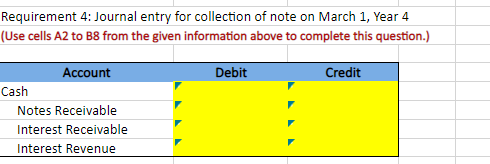

Prepare the journal entry to record receiving the cash at the note's maturity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started