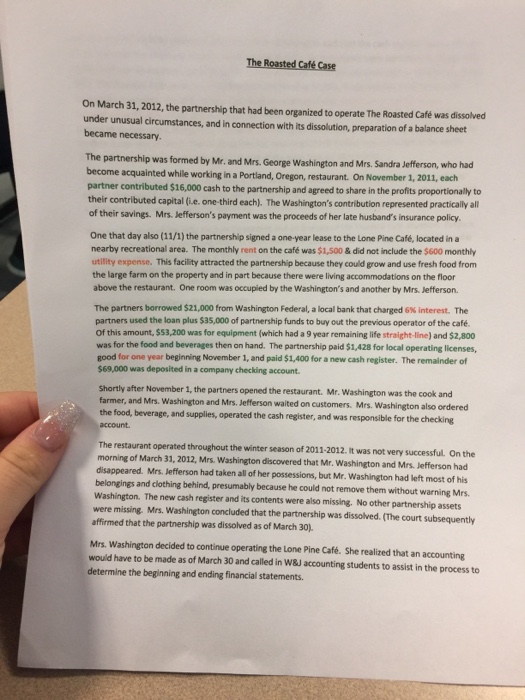

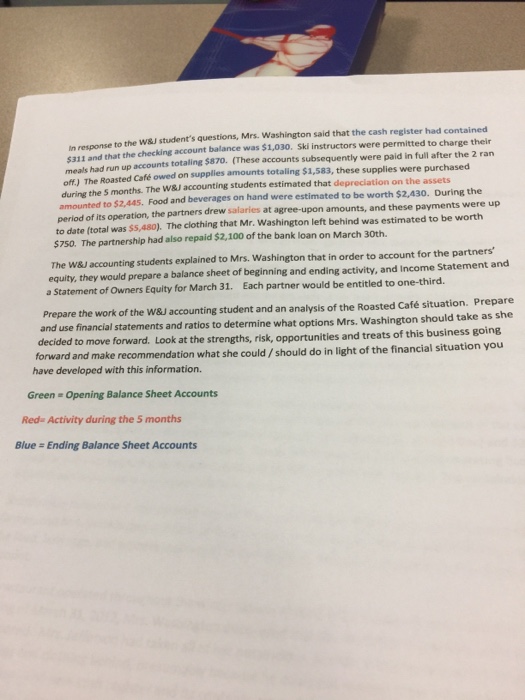

On March 31, 2012, the partnership that had been organized to operate The Roasted Caf was dissolved under unusual circumstances, and in connection with its dissolution, preparation of a balance sheet became necessary The partnership was formed by Mr. and Mrs. George Washington and Mrs. Sandra Jefferson, who had become acquainted while working in a Portland, Oregon, restaurant. On November 1, 2011,each partner contributed $16,000 cash to the partnership and agreed to share in the profits proportionally to their contributed capital (ie. one-third each). The Washington's contribution represented practicaly all of their savings. Mrs. Jefferson's payment was the proceeds of her late husband's insurance policy One that day also (11/1) the partnership signed a one-year lease to the Lone Pine Caf, located in a nearby recreational area. The monthly rent on the caf was $1,500 & did not include the $600 monthly utility expense. This facility attracted the partnership because they could grow and use fresh food from above the restaurant. One room was occupied by the Washington's and another by Mrs. Jefferson. The partners borrowed $21,000 from Washington Federal, a local bank that charged 6% interest. The the large farm on the property and in part because there were living accommodations on the floor partners used the loan plus $35,000 of partnership funds to buy out the previous operator of the caf. of this amount, $53,200 was for equipment (which had a 9 year remaining life straight-line) and $2,800 was for the food and beverages then on hand. The partnership paid $1,428 for local operating licenses, good for one year beginning November 1, and paid $1,400 for a new cash register. The remainder of $69,000 was deposited in a company checking account. shortly after November 1, the partners opened the restaurant. Mr. Washington was the cook and farmer, and Mrs. Washington and Mrs. Jefferson waited on customers. Mrs. Washington also orde the food, beverage, and supplies, operated the cash register, and was responsible for the checking account. The restaurant operated throughout the winter season of 2011-2012. It was not very successful On the disappeared. Mrs. Jefferson had taken all of her possessions, but Mr. Washington had left most of his The restaurant operated throughout the winter season of 2011 2012. t was not very successful. On the morning of March 31, 2012, Mrs. Washington discovered that Mr. Washington and Mrs. Jefferson had belongings and clothing behind, presumably because he could not remove them without warning Mrs. Washington. The new cash register and its contents were also missing. No other partnership assets were missing. Mrs. Washington concluded that the partnership was dissolved. (The court subsequently affirmed that the partnership was dissolved as of March 30) Mrs. Washington decided to continue operating the Lone Pine Caf. She realized that an accounting would have to be made as of March 30 and called in W&J accounting students to assist in the process to determine the beginning and ending financial statements