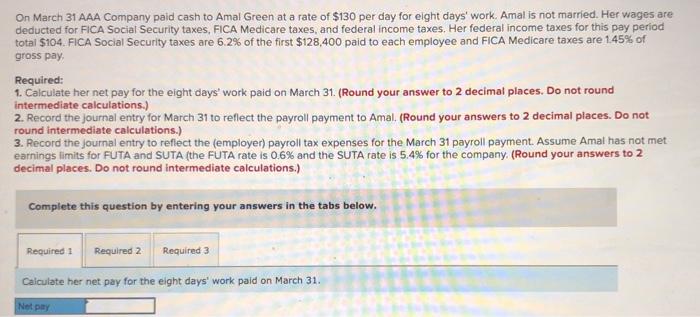

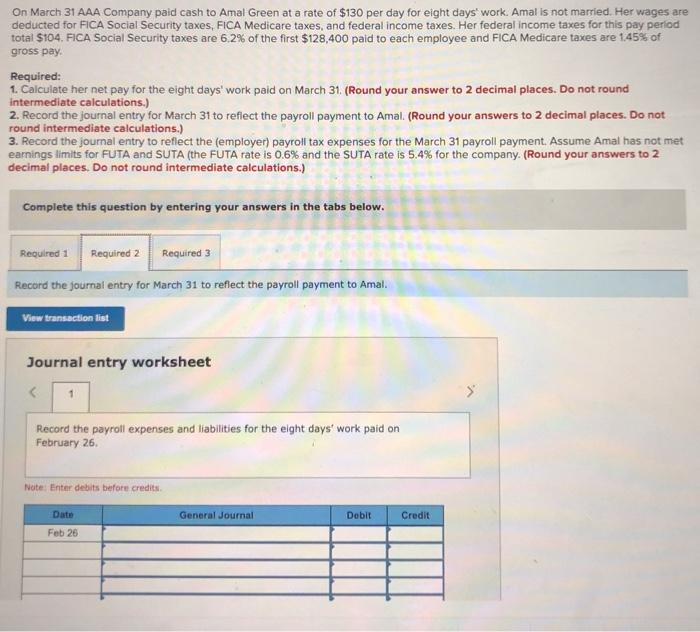

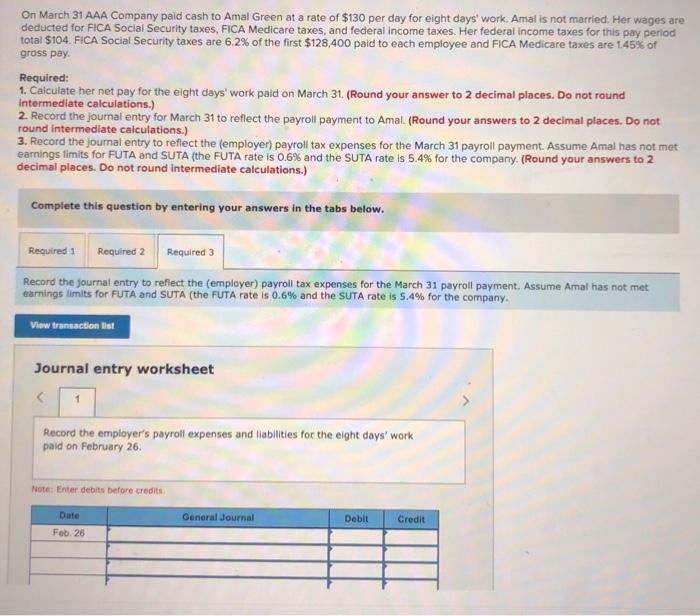

On March 31 AAA Company paid cash to Amal Green at a rate of $130 per day for eight days' work. Amal is not married. Her wages are deducted for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $104. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee and FICA Medicare taxes are 1.45% of gross pay Required: 1. Calculate her net pay for the eight days' work paid on March 31. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 2. Record the journal entry for March 31 to reflect the payroll payment to Amal (Round your answers to 2 decimal places. Do not round intermediate calculations.) 3. Record the journal entry to reflect the employer) payroll tax expenses for the March 31 payroll payment. Assume Amal has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company. (Round your answers to 2 decimal places. Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Calculate her net pay for the eight days' work paid on March 31. Netpay On March 31 AAA Company paid cash to Amal Green at a rate of $130 per day for eight days work. Amal is not married. Her wages are deducted for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $104. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee and FICA Medicare taxes are 145% of gross pay. Required: 1. Calculate her net pay for the eight days' work paid on March 31. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 2. Record the journal entry for March 31 to reflect the payroll payment to Amal (Round your answers to 2 decimal places. Do not round intermediate calculations.) 3. Record the journal entry to reflect the employer) payroll tax expenses for the March 31 payroll payment. Assume Amal has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company. (Round your answers to 2 decimal places. Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Record the journal entry for March 31 to reflect the payroll payment to Amal. View transaction list Journal entry worksheet Record the payroll expenses and liabilities for the eight days' work paid on February 26. Note: Enter debits before credits General Journal Debit Credit Date Feb 25 On March 31 AAA Company paid cash to Amal Green at a rate of $130 per day for eight days' work. Amal is not married. Her wages are deducted for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $104. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee and FICA Medicare taxes are 1.45% of gross pay Required: 1. Calculate her net pay for the eight days' work paid on March 31. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 2. Record the journal entry for March 31 to reflect the payroll payment to Amal (Round your answers to 2 decimal places. Do not round Intermediate calculations.) 3. Record the journal entry to reflect the employer) payroll tax expenses for the March 31 payroll payment. Assume Amal has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company. (Round your answers to 2 decimal places. Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Record the journal entry to reflect the employer) payroll tax expenses for the March 31 payroll payment. Assume Amal has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company. View transaction ist Journal entry worksheet Record the employer's payroll expenses and liabilities for the eight days' work paid on February 26 Note: Enter debits before credits General Journal Debit Credit Date Feb 26