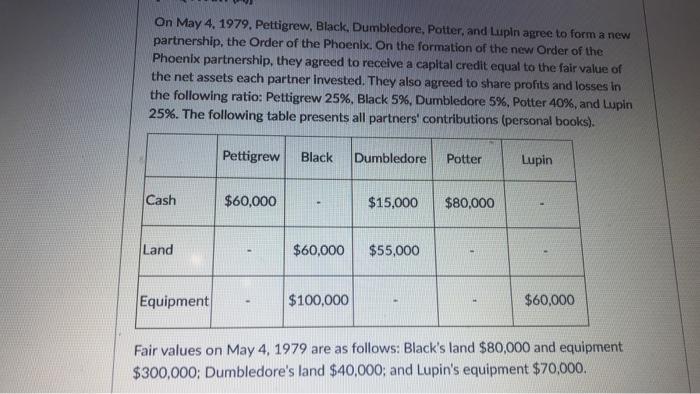

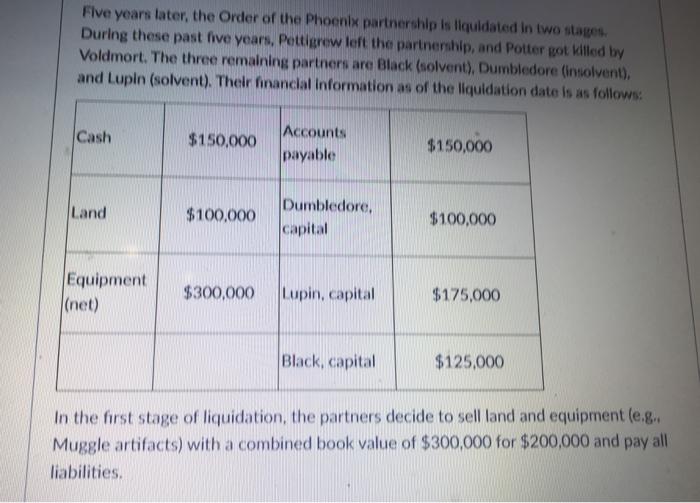

On May 4, 1979. Pettigrew, Black, Dumbledore, Potter, and Lupin agree to form a new partnership, the Order of the Phoenix. On the formation of the new Order of the Phoenix partnership, they agreed to receive a capital credit equal to the fair value of the net assets each partner invested. They also agreed to share profits and losses in the following ratio: Pettigrew 25%. Black 5%, Dumbledore 5%, Potter 40%, and Lupin 25%. The following table presents all partners' contributions (personal books). Pettigrew Black Dumbledore Potter Lupin Cash $60,000 $15,000 $80,000 Land $60,000 $55,000 Equipment $100,000 $60,000 Fair values on May 4, 1979 are as follows: Black's land $80,000 and equipment $300,000; Dumbledore's land $40,000; and Lupin's equipment $70,000. Five years later, the Order of the Phoenix partnership is liquidated in two stages During these past five years, Pettigrew left the partnership, and Potter got killed by Voldmort. The three remaining partners are Black (solvent), Dumbledore (insolvent). and Lupin (solvent). Their financial Information as of the liquidation date is as follows: Cash $150,000 Accounts payable $150,000 Land $100,000 Dumbledore, capital $100,000 Equipment (net) $300,000 Lupin, capital $175,000 Black, capital $125,000 In the first stage of liquidation, the partners decide to sell land and equipment (eg. Muggle artifacts) with a combined book value of $300,000 for $200,000 and pay all liabilities. [Required) Provide the amount and order of payments from the complete cash distribution plan. Round the final answer to the nearest dollar ($5 rounding error allowed). Maintain fractions for intermediate calculations to reduce rounding error. Show all work or order of work. On May 4, 1979. Pettigrew, Black, Dumbledore, Potter, and Lupin agree to form a new partnership, the Order of the Phoenix. On the formation of the new Order of the Phoenix partnership, they agreed to receive a capital credit equal to the fair value of the net assets each partner invested. They also agreed to share profits and losses in the following ratio: Pettigrew 25%. Black 5%, Dumbledore 5%, Potter 40%, and Lupin 25%. The following table presents all partners' contributions (personal books). Pettigrew Black Dumbledore Potter Lupin Cash $60,000 $15,000 $80,000 Land $60,000 $55,000 Equipment $100,000 $60,000 Fair values on May 4, 1979 are as follows: Black's land $80,000 and equipment $300,000; Dumbledore's land $40,000; and Lupin's equipment $70,000. Five years later, the Order of the Phoenix partnership is liquidated in two stages During these past five years, Pettigrew left the partnership, and Potter got killed by Voldmort. The three remaining partners are Black (solvent), Dumbledore (insolvent). and Lupin (solvent). Their financial Information as of the liquidation date is as follows: Cash $150,000 Accounts payable $150,000 Land $100,000 Dumbledore, capital $100,000 Equipment (net) $300,000 Lupin, capital $175,000 Black, capital $125,000 In the first stage of liquidation, the partners decide to sell land and equipment (eg. Muggle artifacts) with a combined book value of $300,000 for $200,000 and pay all liabilities. [Required) Provide the amount and order of payments from the complete cash distribution plan. Round the final answer to the nearest dollar ($5 rounding error allowed). Maintain fractions for intermediate calculations to reduce rounding error. Show all work or order of work